Get the free Tax Organizer For 2023 Income Tax Return

Get, Create, Make and Sign tax organizer for 2023

Editing tax organizer for 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer for 2023

How to fill out tax organizer for 2023

Who needs tax organizer for 2023?

Tax organizer for 2023 form: Your essential guide to stress-free tax preparation

Understanding the importance of a tax organizer

A tax organizer is an indispensable tool designed to streamline the tax preparation process for individuals and businesses. It serves as a comprehensive checklist and collection point for all relevant financial documents, income records, and deductions, ensuring nothing is overlooked as tax season approaches. In the context of the 2023 tax year, utilizing a tax organizer is more important than ever due to frequent updates in tax regulations and evolving financial circumstances.

The benefits of using a tax organizer for the 2023 tax year cannot be overstated. It simplifies the collection of necessary paperwork, limits the likelihood of errors in your tax return, and can even reduce the stress typically associated with tax season. Ultimately, a procedure that encourages meticulous documentation can aid in identifying potential deductions or credits that taxpayers might not otherwise consider.

Freelancers, small businesses, and families are prime candidates for leveraging a tax organizer. Freelancers often juggle multiple income streams and require a structured way to document them. Small businesses must keep track of various expenses, while families benefit from the holistic view of their financial situation, including household deductions related to children’s education, medical expenses, and more.

Overview of 2023 tax forms

For the 2023 tax year, several key forms will be essential for filing. Understanding these forms and their purposes is crucial for efficient tax preparation. Here are the main tax forms associated with individual and business tax filings:

Tax laws have seen adjustments and updates that may affect your tax return. As an example, the standard deduction continues to rise, allowing taxpayers to claim more without itemizing. It's vital to stay informed about these changes as they could significantly impact your tax filings.

Features of the pdfFiller tax organizer

The pdfFiller tax organizer boasts features that facilitate streamlined tax preparation. Its seamless integration with existing tax forms ensures that users can easily access and utilize their tax documentation without experiencing compatibility issues.

Being a cloud-based platform, pdfFiller allows users to access their documents from any device, making it highly flexible and convenient. Whether you're working from home, on the go, or at a partner's office, your tax documents are at your fingertips.

Collaboration features further enhance the experience, allowing team members and financial advisors to work together in real-time. The interactive tools incorporated into the organizer assist users in filling out forms correctly and managing their tax documents effectively.

Step-by-step guide to using the tax organizer for 2023

To get started with your tax organizer on pdfFiller, simply navigate to the website and locate the tax organizer template. Utilizing the search functionality can expedite this process, allowing you to jump straight to the form you need. Once you open the organizer, familiarize yourself with the user interface which is designed for ease of navigation.

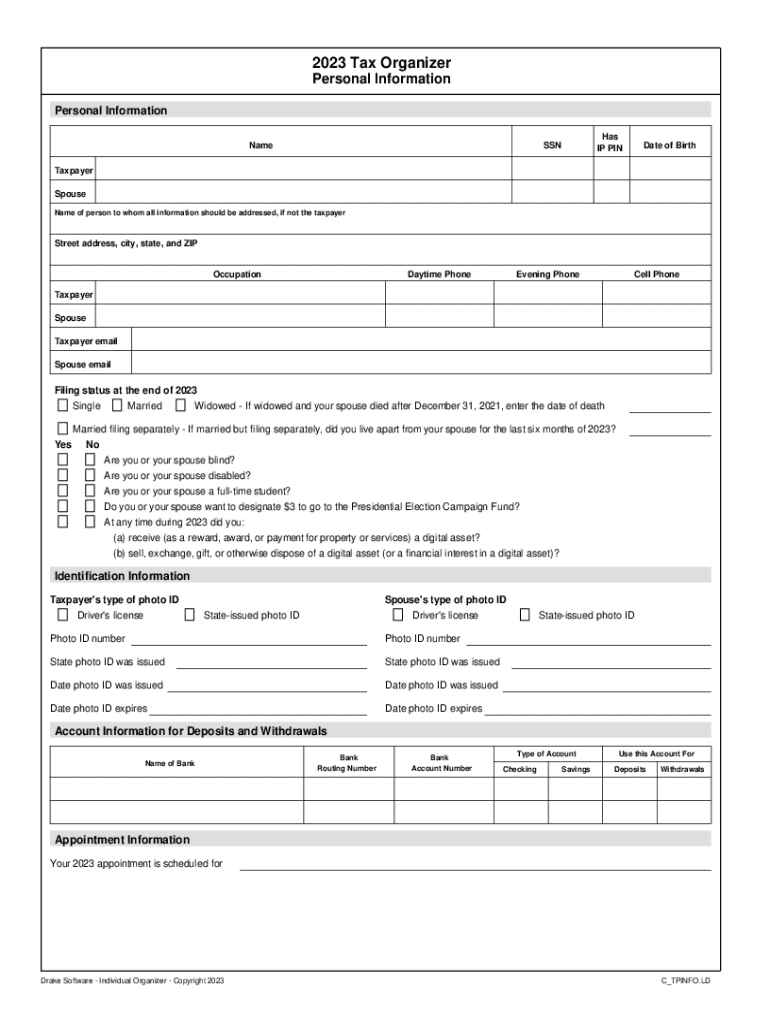

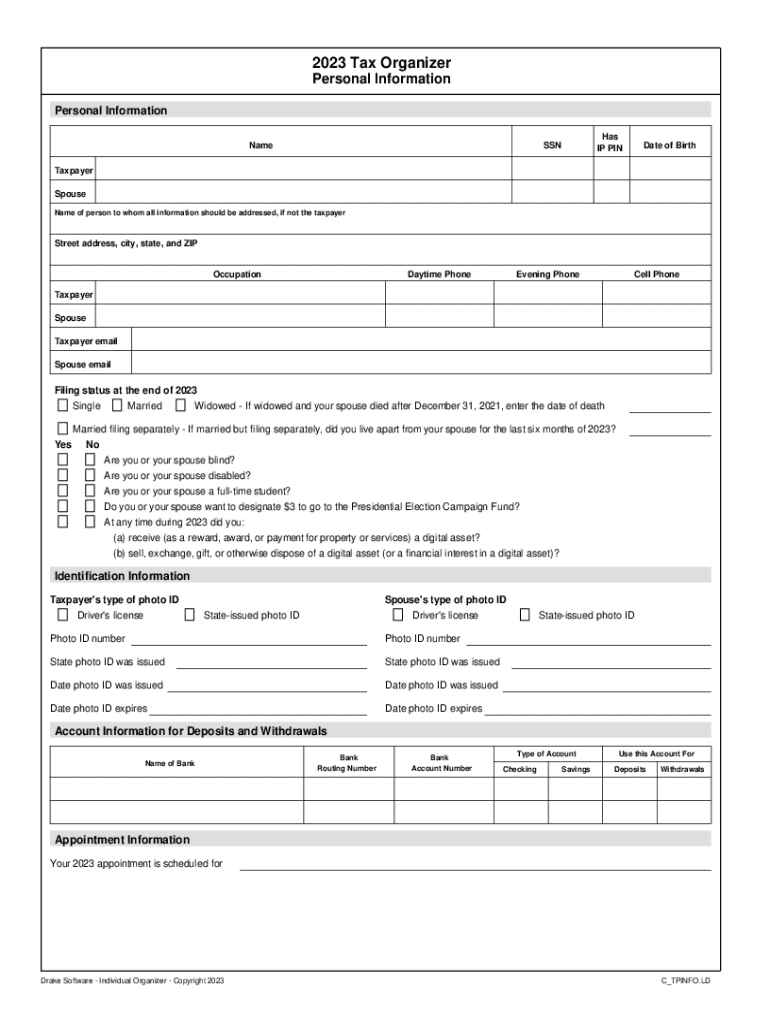

Start by entering your personal information, such as name, address, and Social Security number. Next, document all sources of income including salaries, freelance work, dividends, or any additional streams. Be diligent in noting all possible deductions and tax credits. Understand the distinction between opting for standard vs. itemized deductions, as this choice can have significant consequences on your tax liability.

PdfFiller's organizer allows users to edit and customize fields easily. This feature is particularly useful for tailoring the document according to your specific circumstances. Adding custom notes can help you remember important details and ensure thorough documentation.

Once your documents are ready to be finalized, you can eSign them securely within the tax organizer. This feature not only simplifies the signing process but also enhances collaboration as accountants and financial advisors can easily access and sign documents—streamlining communication.

As you complete your tax organizer and related forms, it’s crucial to have a robust strategy for document management. Utilize pdfFiller's storage solutions to keep your completed tax organizers secure. Sharing documents with relevant parties can be done through secure links, ensuring compliance while managing your sensitive information.

Tips for a successful tax filing experience

To ensure a smooth tax season in 2023, keeping track of tax updates and deadlines is essential. Setting reminders on your calendar can prevent last-minute scrambles as due dates approach. A proactive approach to organizing documents throughout the year is recommended, as it significantly reduces stress during tax time.

Moreover, taking advantage of pdfFiller’s additional tools for tax preparation can enhance your overall experience. Whether it's calculating estimates or learning about new credits, using the right tools can make a difference.

Common mistakes to avoid when using a tax organizer

Mistakes during tax filing can be costly and time-consuming to correct. Some typical errors include entering incorrect information, missing deductions, or failing to keep necessary documentation. To prevent these issues, always review your information for accuracy before submission. Cross-reference entries with supporting documents to ensure consistency and completeness.

Maintaining open lines of communication with your accountant or financial advisor can also help catch potential mistakes before they happen. A team approach to tax preparation can often identify discrepancies and enhance the final outcome.

FAQs about the 2023 tax organizer

As you prepare your taxes using the tax organizer, you may have several questions. Common inquiries often revolve around how to effectively report freelance income or how to navigate available tax credits. For instance, for freelancers, it's important to keep detailed records of all income sources and related expenses to maximize your deductions.

Understanding the necessary documentation will make the filing process smoother. For instance, if you qualify for credits like the Earned Income Tax Credit or Child Tax Credit, ensuring you have the correct form completed can save time and enhance your chances of receiving the proper refund.

Success stories: How users have benefitted from the tax organizer

Users of the pdfFiller tax organizer have reported significant improvements in their tax preparation experience. Many have provided testimonials highlighting how organizing their documents effectively not only saved time but also reduced stress during the traditionally hectic tax season.

One case study involves a small business owner who utilized the organizer to consolidate various income streams and track deductions accurately. This proactive approach led to identifying previously overlooked deductions, resulting in a substantial reduction in their tax bill, demonstrating the organizer’s powerful impact.

Integrating your tax organizer with other tools

The pdfFiller tax organizer is designed with compatibility in mind, facilitating seamless integration with various accounting software and financial tools. This integration simplifies the tax filing process by allowing users to export data directly, minimizing manual entry and reducing the risk of errors.

Ensure you examine the software options that sync well with pdfFiller to leverage the full benefits of automation and efficient document management. Utilizing these compatible solutions can streamline your entire tax preparation experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax organizer for 2023 online?

How do I edit tax organizer for 2023 on an Android device?

How do I fill out tax organizer for 2023 on an Android device?

What is tax organizer for 2023?

Who is required to file tax organizer for 2023?

How to fill out tax organizer for 2023?

What is the purpose of tax organizer for 2023?

What information must be reported on tax organizer for 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.