Get the free PROPERTY FINANCE ADVISORY SERVICES

Get, Create, Make and Sign property finance advisory services

How to edit property finance advisory services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property finance advisory services

How to fill out property finance advisory services

Who needs property finance advisory services?

Understanding and Utilizing the Property Finance Advisory Services Form

Understanding the property finance advisory services form

The Property Finance Advisory Services Form is a crucial document designed to facilitate the financing process for property investments. It serves as a structured format that allows individuals and teams to provide detailed information to financial advisors regarding their property financing needs. This form is essential as it helps advisors tailor their services to meet specific client requirements, ensuring an effective advisory relationship.

Understanding key terms such as 'advisory needs,' 'financial overview,' and 'property details' is vital. These terms define the scope of the advisory services and help in aligning the client’s objectives with available financing options.

Components of the property finance advisory services form

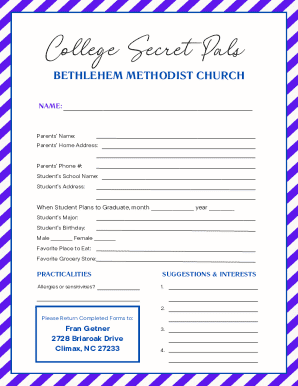

The Property Finance Advisory Services Form consists of several key components that gather essential information needed for effective advisory services. This breakdown includes:

Clients should also prepare commonly required documents such as proof of income, credit reports, and property appraisals to accompany the form for a seamless advisory experience.

Purpose of each section in the form

Each section of the Property Finance Advisory Services Form plays a crucial role in facilitating an effective advisory process. Starting with Personal Information, this section is mandatory as it establishes the client's identity and contact details, forging a connection between the client and the advisory team.

The Financial Overview is equally critical as it provides insights into the client's financial health. By assessing income, existing debts, and assets, advisors can recommend suitable financing options that align with the client's capabilities and goals. Moving on, Property Details are indispensable, as they influence the types of financing solutions available and the risk assessments made by financial professionals.

Lastly, the Advisory Needs and Goals section empowers clients to shape the advisory relationship. Clearly outlining their objectives informs advisors on how best to serve their interests, be it securing funds for a new investment or refinancing an existing property.

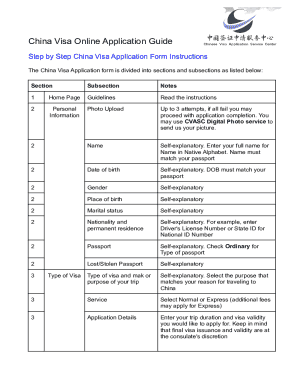

How to fill out the property finance advisory services form

Filling out the Property Finance Advisory Services Form can seem daunting, but it can be a straightforward process by following a step-by-step approach. Here’s how to efficiently complete the form:

To ensure accuracy and completeness, double-check all entries and consider consulting with a financial professional if uncertain about any details.

Editing and modifying the form

Once the Property Finance Advisory Services Form is filled out, you may find the need to edit or adjust information. Whether it’s correcting an error or updating financial details, here’s how to go about it efficiently.

Using cloud-based tools like pdfFiller is advantageous not only for editing but for retaining a well-organized archive of your property finance documents as well.

Signing and submitting the property finance advisory services form

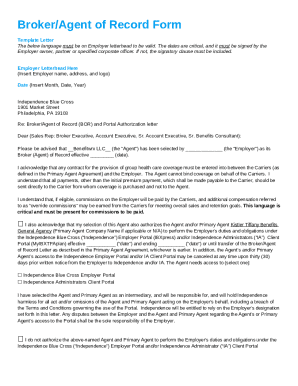

Once the form is accurately completed, the signing and submission process is the final step before engaging with your financial advisor. Here’s a concise overview of what to keep in mind during this phase.

Selecting the appropriate submission method is crucial as it influences the efficiency of initiating the advisory relationship.

Managing your property finance advisory documents

Once submitted, managing your Property Finance Advisory Services Form and related documents becomes vital to maintaining an organized advisory relationship. Here’s how to efficiently manage those documents.

Effective document management fosters smoother communication with financial advisors and enhances the overall advisory experience.

Common challenges and solutions

Filling out the Property Finance Advisory Services Form can present various challenges that may hinder the completion process. Here are some common issues clients encounter and their solutions.

By being proactive in addressing these challenges, clients can better prepare themselves for effective use of the advisory services.

Real-life examples and case studies

The practical impact of properly utilizing the Property Finance Advisory Services Form can be illustrated through real-life examples and case studies. These stories exemplify how efficient use of the form leads to enhanced financial outcomes.

These examples underscore the value of careful preparation and communication in property finance advisory.

FAQs: Your questions about the property finance advisory services form answered

As with any financial document, users often have questions surrounding the Property Finance Advisory Services Form. Here are some frequently asked questions that may help clarify any concerns.

Engaging with your financial advisor regarding these questions can facilitate a more productive advisory experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit property finance advisory services online?

Can I sign the property finance advisory services electronically in Chrome?

Can I edit property finance advisory services on an Android device?

What is property finance advisory services?

Who is required to file property finance advisory services?

How to fill out property finance advisory services?

What is the purpose of property finance advisory services?

What information must be reported on property finance advisory services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.