Get the free Nonprofit State Income & Sales Tax Exemptions

Get, Create, Make and Sign nonprofit state income amp

How to edit nonprofit state income amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit state income amp

How to fill out nonprofit state income amp

Who needs nonprofit state income amp?

Nonprofit state income and form: A comprehensive guide for nonprofits

Understanding nonprofit status and state income requirements

Nonprofit organizations operate primarily to serve the public good rather than to generate profit for shareholders. Common types include charitable organizations, educational institutions, and religious entities. Nonprofit status offers various benefits, such as tax exemptions, eligibility for grants, and improved credibility with the public.

However, maintaining compliance with state income tax requirements is crucial for nonprofits. Each state has its laws governing tax-exempt organizations, and failure to comply can lead to consequences, such as loss of tax-exempt status or legal penalties.

Navigating the state income tax obligations for nonprofits

Nonprofits may qualify for state tax exemptions, allowing them to operate without paying certain taxes. To qualify, organizations typically must meet specific criteria, including being organized for charitable purposes and operating within the community's best interests. It's important to note that these criteria can vary significantly from state to state.

Common state tax forms for nonprofits include variations of the IRS Form 990, which inform the state about the nonprofit’s financial status, activities, and governance. Each state may have its additional forms, so understanding both federal and state filing requirements is essential for compliance.

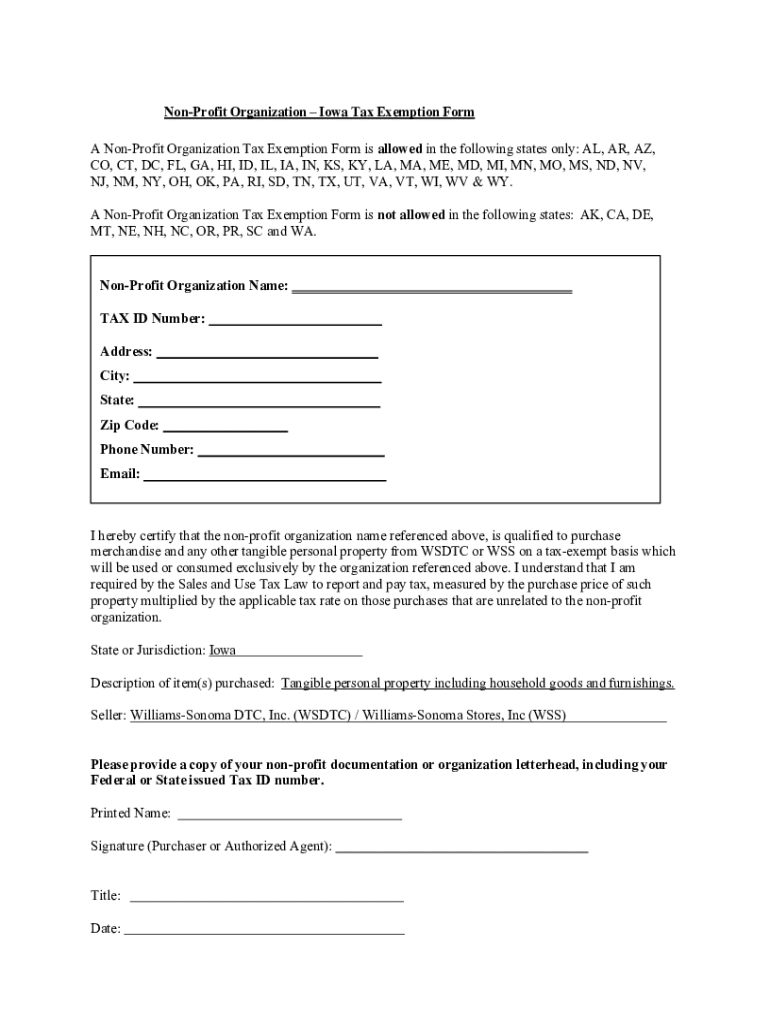

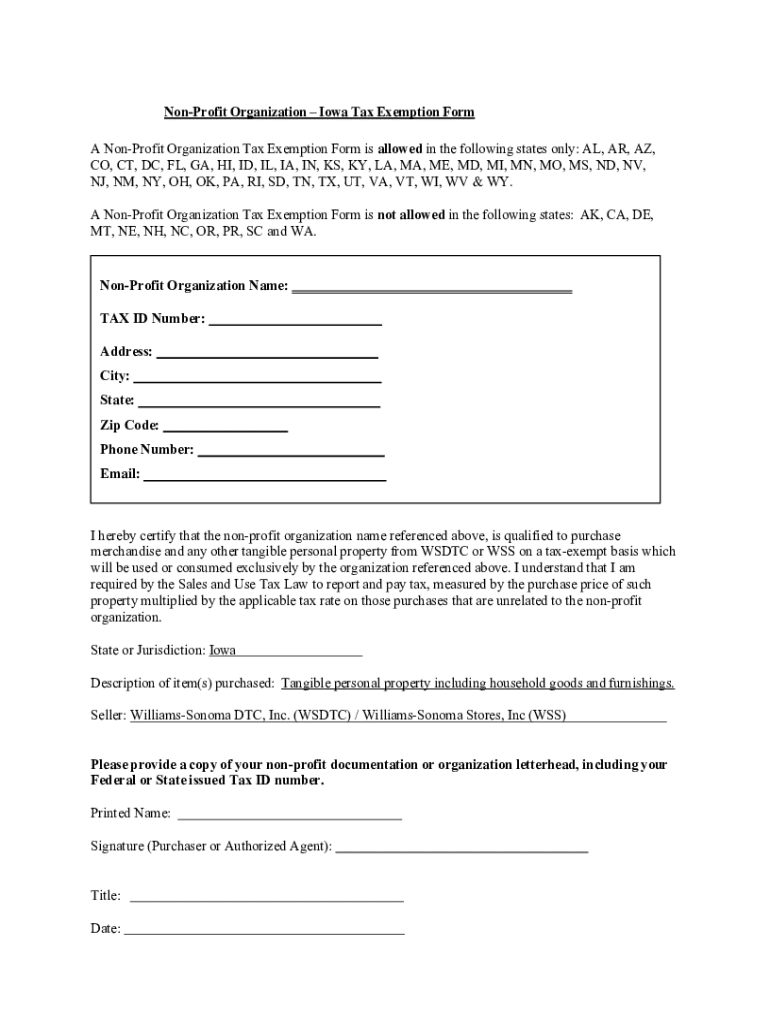

How to complete state income tax forms for nonprofits

Filling out state income tax forms like the state version of IRS Form 990 requires attention to detail. The process begins with gathering all relevant financial documentation, including income statements, balance sheets, and previous tax filings. The forms typically have multiple sections, each designed to capture specific information.

Common mistakes include inaccurate reporting of financial statements or omitting required disclosures. Nonprofits should double-check their information and, if unsure, consider employing a tax professional for assistance.

Electronic filing and document management

Electronic filing of state income forms offers several benefits for nonprofits. The process is often quicker, allowing for immediate submission and confirmation of receipt. Additionally, electronic forms reduce the likelihood of errors that can occur during manual entry and enable better tracking of submissions.

Utilizing platforms like pdfFiller can simplify the electronic filing process. Its features streamline document completion, offering tools for easy editing and eSigning, ensuring that nonprofits can collaborate efficiently. This functionality is critical in ensuring compliance and maintaining updated documentation.

Compliance strategies for nonprofits

Ongoing compliance monitoring is essential for nonprofits to maintain their tax-exempt status. Regular annual reviews and audits can help organizations assess their compliance with both state and federal regulations, identifying potential issues before they escalate.

Nonprofits must also update their information with state agencies when any significant changes occur, such as changes in leadership or organizational structure.

Resources for nonprofits

Various government resources can help nonprofits navigate state income requirements. Most state revenue departments offer detailed guides, FAQs, and downloadable forms on their websites.

Additionally, tools available on platforms like pdfFiller can aid in managing nonprofit forms effectively, with features designed for document storage and streamlined editing.

FAQs on nonprofit state income forms

Common questions arise about the implications of failing to file state forms. Nonprofits that neglect to submit required forms may face penalties, including fines and potential revocation of their tax-exempt status.

Final thoughts on managing state income compliance

Understanding state income forms and compliance is vital for any nonprofit organization aiming to maintain its standing. Awareness of state-specific requirements, deadlines, and filing processes can help avoid costly mistakes.

Leveraging tools such as pdfFiller can greatly enhance efficiency in managing documentation. By simplifying the completion and submission of forms, nonprofits can concentrate more on their mission instead of paperwork, ultimately benefiting those they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nonprofit state income amp from Google Drive?

Can I sign the nonprofit state income amp electronically in Chrome?

How can I fill out nonprofit state income amp on an iOS device?

What is nonprofit state income amp?

Who is required to file nonprofit state income amp?

How to fill out nonprofit state income amp?

What is the purpose of nonprofit state income amp?

What information must be reported on nonprofit state income amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.