Get the free South Carolina Sales and Use Taxes Manual

Get, Create, Make and Sign south carolina sales and

How to edit south carolina sales and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out south carolina sales and

How to fill out south carolina sales and

Who needs south carolina sales and?

South Carolina Sales and Form Guide

Understanding sales forms in South Carolina

Sales forms are essential documents that record important details related to the sale of goods and services between buyers and sellers. Their primary purpose is to provide a clear account of the transaction, serving both legal and accounting functions. In South Carolina, these forms play a pivotal role in ensuring compliance with state laws and tax regulations, enhancing transparency in business dealings.

Different types of sales forms are used across the state, each tailored to specific transactions. Common examples include retail sales receipts, invoices, and bill of sale documents. Awareness of these forms is crucial for both individuals and businesses to ensure records are accurately maintained.

Key features of South Carolina sales forms

Sales forms in South Carolina must contain specific essential elements, which facilitate clarity and accountability. These elements typically include the names and contact information of both the buyer and seller, detailed descriptions of the items sold (including quantity, make, and model), pricing, sales tax, and transaction date.

Moreover, variations exist depending on whether the sale is a business-to-business (B2B) or business-to-consumer (B2C) transaction. For instance, B2B invoices may incorporate additional fields such as payment terms, while B2C receipts focus more on customer-friendly breakdowns of costs, taxes, and totals.

Navigating sales tax regulations in South Carolina

Understanding sales tax is crucial for anyone dealing with sales in South Carolina. The current sales tax rate is set at 6%, but local jurisdictions may impose additional taxes. As such, it's essential to be aware of the total rate applicable to your specific locality. Additionally, certain types of items and services may be exempt from sales tax, including food purchased with food stamps and specific medical equipment.

To ensure compliance, individuals and businesses should accurately determine sales tax amounts. This process involves calculating the gross price of items and applying the sales tax rate. With the right resources, this calculation becomes straightforward.

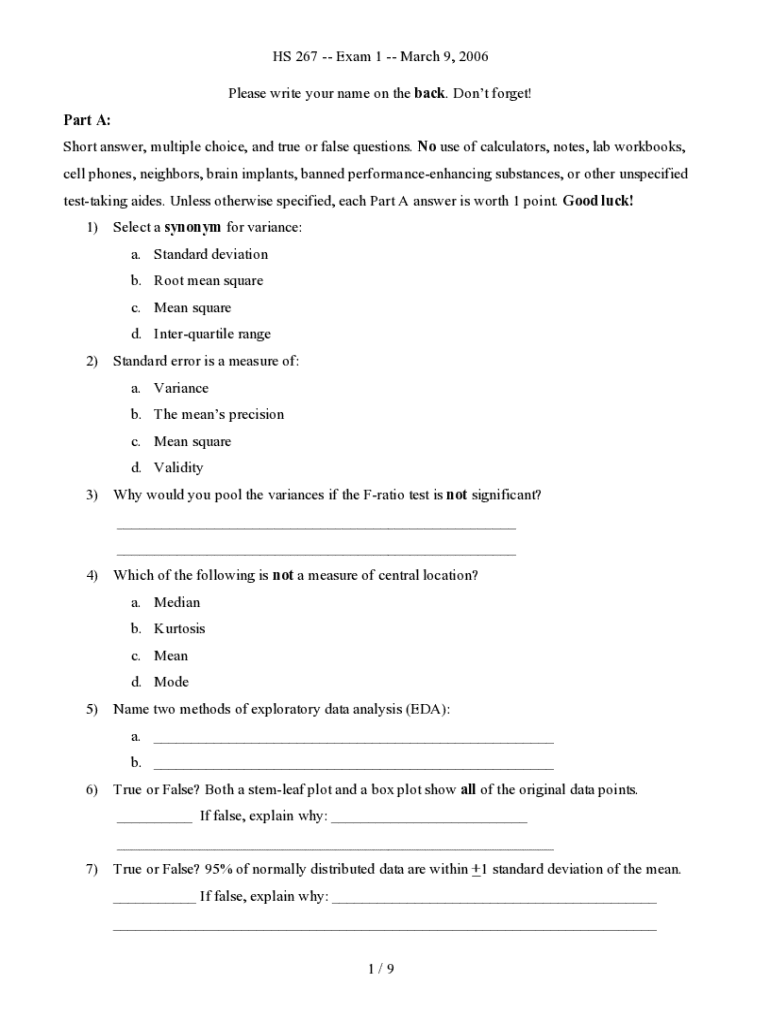

Step-by-step guide to completing sales forms

Completing sales forms accurately is essential for compliance and recordkeeping. Begin by gathering necessary information. This includes all parties’ contact information, product details, and pricing. A well-prepared checklist will streamline the process and prevent delays.

Next, accessing the official sales forms online is straightforward. South Carolina’s Department of Revenue website hosts a variety of templates suitable for different sales. After securing the appropriate form, proceed with filling it out. Pay close attention to each section — accuracy is key.

It’s important to avoid common errors such as incorrect totals or incomplete fields. Once filled out, forms can be submitted either online or via mail; however, ensure that all necessary signatures are obtained to validate the transaction.

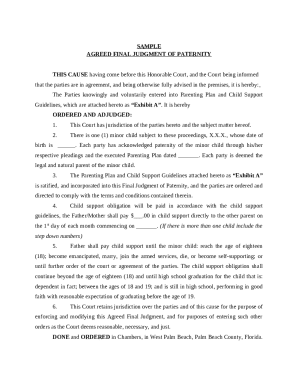

Editing and managing sales forms with pdfFiller

pdfFiller offers powerful features to edit sales forms seamlessly. Users can modify PDFs directly within the platform, making real-time adjustments easy. The plethora of interactive tools allows for adding text, comments, and even images, ensuring that your forms always meet your needs.

Additionally, the eSigning feature enhances transaction credibility by allowing all parties to legally sign documents electronically. Collaboration is made simple; you can invite others to review and approve forms and track changes, making the process more efficient.

Frequently asked questions about sales forms in South Carolina

Many users experience confusion surrounding sales forms, especially regarding errors. If a form is completed incorrectly, it’s crucial to rectify mistakes quickly to prevent complications. Alterations can be made easily with pdfFiller, allowing you to edit necessary details and reissue the form.

Disputes over sales forms may arise, and it's essential to maintain clear records and communication lines. Keep all documentation organized, as this helps in resolving issues promptly. For further assistance, state agencies provide guidance, and reaching out to local office contacts can clarify any doubts.

Staying compliant and informed

Keeping up-to-date with changes to sales tax laws and forms is fundamental for businesses operating in South Carolina. Regularly checking the Department of Revenue’s website or subscribing to their updates can offer insights into amendments that may affect your sales operations.

Routine document management also contributes to compliance. Set reminders for filing business tax returns, and be prompt with license renewals or changes to your tax account to avoid unnecessary interests and penalties.

Exploring additional tools and resources on pdfFiller

pdfFiller hosts a wealth of interactive templates specifically designed for sales forms, enabling users to access customizable versions tailored to their business needs. These templates streamline the process of creating accurate and compliant documents quickly.

User guides and tutorials are readily available on the platform, showcasing detailed instructions for making the most out of pdfFiller’s extensive functions. These resources allow users to navigate forms optimally, ensuring efficacy in document management.

Engaging with community and support

To further enhance your experience with sales forms and pdfFiller, connecting with the community can be beneficial. Follow updates and engage in discussions on platforms where pdfFiller’s updates and tips are shared. This provides valuable insights from fellow users.

For immediate assistance on your sales forms or any related queries, pdfFiller offers various contact options. Utilize these resources to address any pressing issues you may encounter while navigating your document requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my south carolina sales and directly from Gmail?

Can I create an electronic signature for signing my south carolina sales and in Gmail?

How do I fill out south carolina sales and on an Android device?

What is south carolina sales and?

Who is required to file south carolina sales and?

How to fill out south carolina sales and?

What is the purpose of south carolina sales and?

What information must be reported on south carolina sales and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.