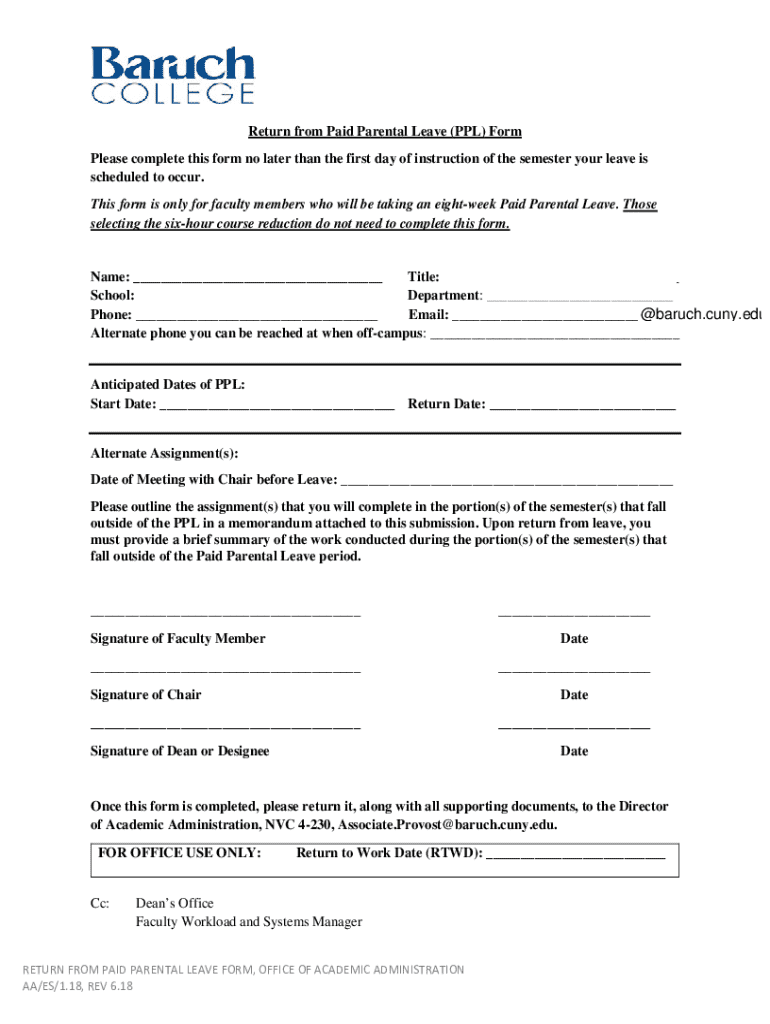

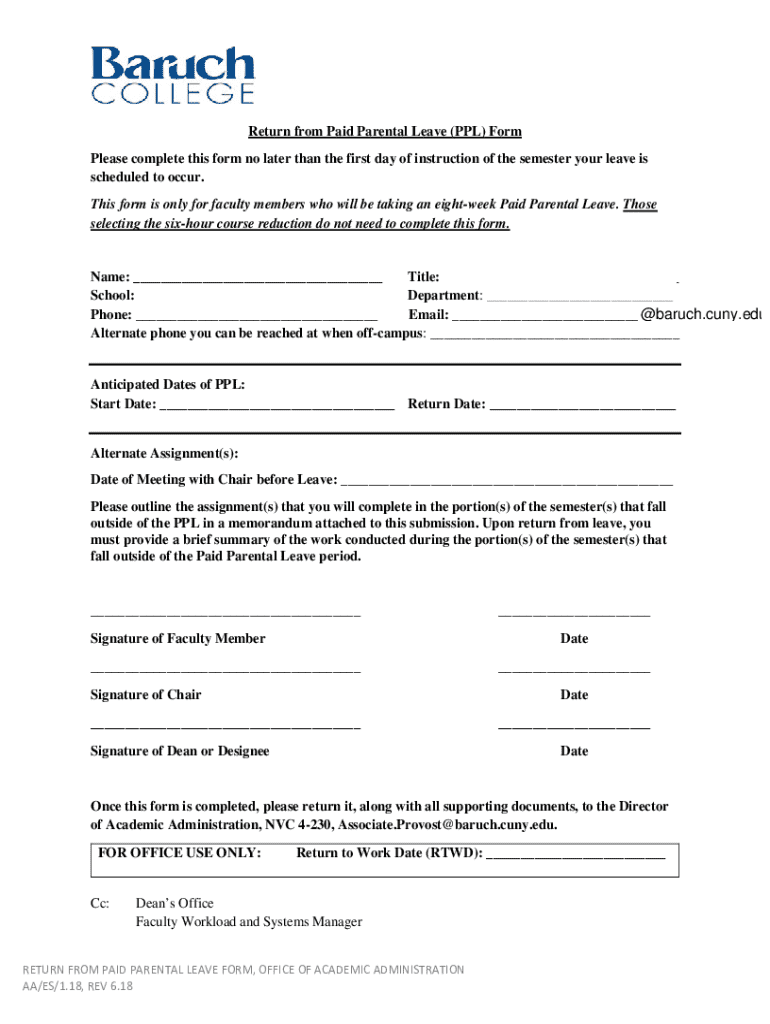

Get the free Return from Paid Parental Leave (PPL) Form

Get, Create, Make and Sign return from paid parental

How to edit return from paid parental online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return from paid parental

How to fill out return from paid parental

Who needs return from paid parental?

Return from Paid Parental Form: A Comprehensive Guide

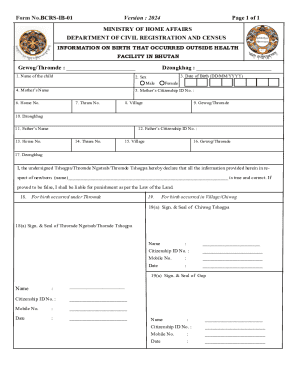

Overview of the return from paid parental form

The return from paid parental form is a crucial document that formalizes an employee's transition back to work following a period of paid parental leave. This form serves multiple purposes: it helps employers manage workforce planning, ensures compliance with legal requirements, and supports employees in resuming their professional responsibilities seamlessly. Understanding when and why this form is needed is essential for both employees and employers to foster a supportive workplace environment.

Understanding paid parental leave

Paid Parental Leave (PPL) is a significant benefit that provides employees with financial support during their bonding period with a new child. Key features of PPL include eligibility criteria, the duration of the leave, and specific benefits that can enhance family well-being. Typically, PPL may extend up to 12 weeks, depending on company policies and local regulations. The eligibility criteria often require employees to have been with the employer for a certain period and to have worked a minimum number of hours.

When comparing paid parental leave with other types of leave, it's essential to recognize the differences. For example, maternity leave is often designated specifically for birth mothers, while family leave can encompass various caregiving scenarios for other family members. Unpaid leave options, although available, do not offer the same financial security, making PPL an invaluable resource for new parents.

Who is eligible for paid parental leave?

Eligibility for paid parental leave is typically governed by specific criteria set forth by employers and federal regulations. Employees must usually have completed a minimum period of service, which may vary by employer and location. Additionally, certain agencies have specific responsibilities for managing employee leave effectively, adhering to the guidelines outlined in regulations such as 5 CFR 630.1201 and 5 CFR 630.1701.

Federal regulations ensure that there are basic rights and protections for employees taking parental leave. However, situations may arise where exceptions or special cases exist, such as for part-time employees or those working under unique contractual agreements. It’s crucial for employees to familiarize themselves with their company’s policies and the stipulations outlined in relevant laws.

Key definitions related to the return from paid parental form

Understanding key terms associated with the return from paid parental form can help demystify the process for employees. For instance, 'Paid Parental Leave' (PPL) refers to time off funded by the employer to allow caregivers to bond with a newborn. The term 'leave year' defines the period in which employees are allowed to take their leave, as delineated by policies. Another critical concept is 'restoration rights', defined under 5 CFR 630.1202 and 5 CFR 630.1702, which ensure that employees can return to their previous positions or comparable roles after their leave period.

Step-by-step guide to completing the return from paid parental form

Completing the return from paid parental form involves several steps to ensure accuracy and compliance. Here’s a detailed guide:

Common questions and answers about the return from paid parental form

Navigating the return from paid parental form can lead to numerous questions. Here are some frequently asked inquiries:

Additional considerations when using the return from paid parental form

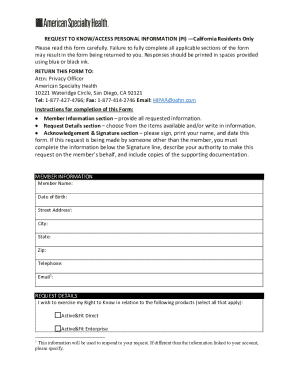

When completing the return from paid parental form, employees should keep several additional considerations in mind. Issues of privacy and confidentiality are paramount, as this form contains personal information that needs to be safeguarded.

Moreover, delays in submitting the return from paid parental form could potentially affect your transition back to work. It is essential to be proactive in understanding your rights and responsibilities during the leave and after returning to your job. Recognizing the organizational policies and how they align with federal guidelines can ease the return process.

pdfFiller's role in managing your parental leave forms

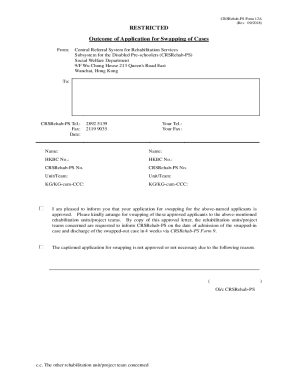

pdfFiller offers a robust platform for managing parental leave forms, providing tools that streamline the process. With features like seamless PDF editing, e-signature capabilities, and document management, pdfFiller empowers users to efficiently handle their documentation.

Using pdfFiller enhances the convenience of accessing and submitting the return from paid parental form. With options for collaboration and sharing, individuals and teams can work together more effectively. The platform ensures that users can manage their parental leave documentation from anywhere, making the ordeal of paperwork far less daunting.

Conclusion

Accurate submission of the return from paid parental form is essential for a smooth transition back to the workplace. Understanding your rights in the context of parental leave fosters a supportive environment for employees and promotes workplace harmony. By leveraging tools like pdfFiller, individuals can navigate the complexities of parental leave documentation with ease, ensuring that their rights are protected and responsibilities are met.

Engage with the community

Sharing personal experiences with parental leave can provide valuable insights for others navigating similar situations. Engaging with fellow users on pdfFiller's platform allows you to exchange tips, support, and encouragement. Together, we can create a community that values parental responsibilities while ensuring professional obligations are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in return from paid parental?

Can I edit return from paid parental on an Android device?

How do I fill out return from paid parental on an Android device?

What is return from paid parental?

Who is required to file return from paid parental?

How to fill out return from paid parental?

What is the purpose of return from paid parental?

What information must be reported on return from paid parental?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.