Get the free site pdffiller com sofi

Get, Create, Make and Sign site pdffiller com sofi

Editing site pdffiller com sofi online

Uncompromising security for your PDF editing and eSignature needs

How to fill out site pdffiller com sofi

How to fill out sec form 144 filed

Who needs sec form 144 filed?

Understanding SEC Form 144: A Comprehensive Guide

Understanding SEC Form 144

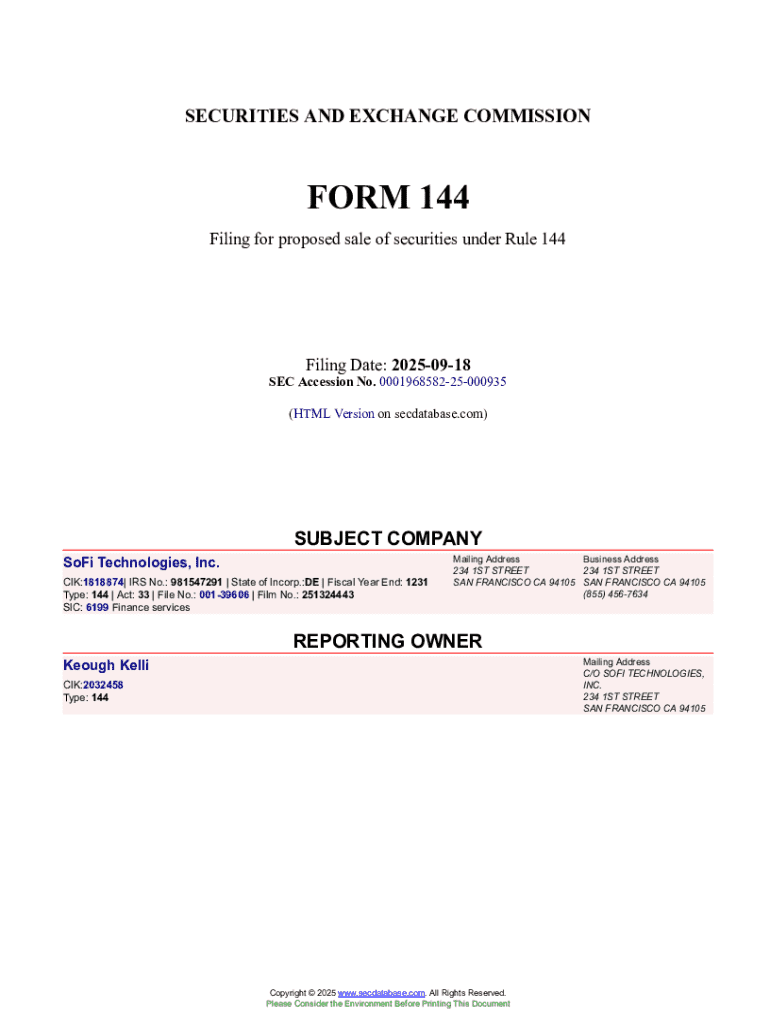

SEC Form 144 is a vital document that insiders of publicly traded companies must file when they intend to sell their shares in the company. Its primary purpose is to provide a transparency mechanism by informing the public about potential sales of securities, ensuring a level playing field for all investors. Insiders, which include executives, directors, and large shareholders, must file this form under certain situations, mainly to comply with SEC regulations.

Filing SEC Form 144 is pivotal because it contributes significantly to market transparency. When insiders sell shares without reporting it, it can lead to misinformation in the market, affecting stock prices. Therefore, timely and accurate filings allow both the market and regulators to monitor insider trading more effectively, ensuring compliance with securities laws and safeguarding investors. Failure to file on time or non-compliance can lead to penalties for the individual and damage the company's reputation.

Key features of SEC Form 144

The form comprises several integral features. First and foremost, it requires detailed information about the insider and the specific securities being sold. Key data include the name of the insider, the relationship to the company, and details of the shares being sold, including the amount and the intended sale price. Understanding these elements is critical for proper compliance with SEC guidelines.

It's crucial to differentiate between public and private sales when filing Form 144. Sales must be reported even if only one shareholder is involved. Furthermore, only specific individuals are required to file this form. Insiders, typically defined as executives, directors, and significant shareholders who own more than 10% of the company's shares, are explicitly outlined by securities laws as those who hold insider knowledge, thus requiring them to disclose their sales activities.

How to file SEC Form 144

Filing SEC Form 144 may seem daunting, but following a step-by-step approach can simplify the process. First, gather necessary information, including your personal details as the insider, the number of securities to be sold, and the type of securities involved. This initial preparation helps streamline the filing process.

Next, access the form online through the SEC's website or other resources like pdfFiller, where it’s readily available for download. Fill out the form accurately, ensuring to pay close attention to required fields, as incomplete information can lead to issues down the line. Submission methods also vary; you can file electronically through the SEC’s EDGAR database or submit a paper version via mail. It’s essential to know the appropriate addresses for submission if opting for the latter.

Filing timeline and deadlines

Understanding when to file SEC Form 144 is vital for compliance. The form must be submitted when insiders plan to sell their shares, which is often tied to specific events such as stock sales or disposals. Each sale requires its own report, thus emphasizing the need for meticulous tracking of such transactions.

Filing deadlines are crucial aspects of the process. Insiders are required to submit the form within a specific number of business days following the sale. Failure to adhere to this timeline can result in penalties, including fines or even more severe repercussions, such as SEC investigations. Consequently, it's advisable to establish a system for monitoring sales and subsequent filings, reducing risks associated with late submissions.

Common FAQs about SEC Form 144

One common question surrounds the consequences of failing to file SEC Form 144. Non-compliance can lead to significant issues, including fines and reputational damage. The SEC emphasizes timely and accurate filings to maintain market integrity.

Another frequent query involves amending the filing post-submission. Yes, insiders can amend their filings if they recognize errors or changes in their sales plans. The process typically involves submitting a new form with the corrections clearly indicated.

Tools for managing SEC Form 144

In today’s fast-paced digital environment, leveraging technology can significantly enhance the management of SEC Form 144 filings. Utilizing document management solutions such as pdfFiller allows users to streamline their filing processes, integrate cloud-based solutions for editing and collaboration, and efficiently manage their compliance responsibilities.

Automated solutions provide additional benefits by enabling tracking of due dates and maintaining accurate records, therefore reducing human error. This is essential in a landscape where regulatory compliance is paramount. With pdfFiller, you can effortlessly edit PDFs, eSign documents, and collaborate with team members, paving the way for seamless document management.

Best practices for filing and compliance

To ensure successful filings, staying informed about regulatory changes is fundamental. Resources like the SEC’s website, relevant news articles, and subscription-based updates can prove invaluable in keeping you and your team aware of new regulations concerning SEC Form 144 and associated filing practices. Knowledge of compliance requirements strengthens corporate governance and fosters investor confidence.

Establishing a compliance checklist is another best practice to implement. This checklist might include key items such as verifying the accuracy of filed documents, adhering to submission timelines, and ensuring that all necessary parties have been informed about their responsibilities regarding SEC filings. This approach not only places an emphasis on diligence but also prepares your team for periodic audits of submitted documents.

Interactive tools and resources

For those navigating SEC Form 144, utilizing interactive tools can greatly enhance the filing experience. Platforms like pdfFiller can guide users through form completion, allowing you to take advantage of features such as electronic signatures, collaborative capabilities, and pre-filled templates that simplify the process.

Having access to templates and examples can also be beneficial. Pre-filled templates provide a reference point, helping individuals better understand the form's structure and required information while ensuring they don’t miss critical details. Such resources facilitate a smoother filing process and bolster compliance efforts.

Understanding the implications of SEC Form 144 filings

Filings of SEC Form 144 carry significant implications for both the securities market and public perception. These declarations influence stock price movements as they signal to investors the likelihood of insider selling, which can affect their buying decisions and overall market sentiment. Transparency in such filings not only affects immediate investor behavior but also shapes long-term trust in the company's governance practices.

Moreover, the correlation between transparency and corporate governance cannot be overstated. By adhering to filing regulations diligently, companies can strengthen investor relations and build confidence among stakeholders. Regulatory compliance showcases a commitment to ethical practices and liability management, enhancing the company's stature in the public domain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the site pdffiller com sofi in Chrome?

How do I edit site pdffiller com sofi on an iOS device?

How do I fill out site pdffiller com sofi on an Android device?

What is sec form 144 filed?

Who is required to file sec form 144 filed?

How to fill out sec form 144 filed?

What is the purpose of sec form 144 filed?

What information must be reported on sec form 144 filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.