Get the free CERTIFICATE OF DISSOLUTION OF A LIMITED LIABILITY ...

Get, Create, Make and Sign certificate of dissolution of

Editing certificate of dissolution of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of dissolution of

How to fill out certificate of dissolution of

Who needs certificate of dissolution of?

Understanding the Certificate of Dissolution of Form

Understanding the Certificate of Dissolution

A Certificate of Dissolution is a formal legal document that signifies the end of a business entity's existence. This certificate serves to notify state authorities that a corporation or limited liability company (LLC) has officially ceased operations and is dissolving. Filing this certificate is crucial as it protects business owners from future liability and obligations that may arise after the business shuts down.

The importance of dissolution extends beyond mere formalities; it signifies a responsible approach to ending business dealings. Validating the cessation of business through proper channels helps in maintaining the integrity of the corporate world. Without this step, owners may face unwanted financial liabilities or legal ramifications.

Businesses dissolve for various reasons, including financial setbacks, changes in market demand, or strategic realignment. Voluntary dissolution occurs when owners decide to close their business due to internal factors, whereas involuntary dissolution is enforced by state authorities, often due to non-compliance with regulatory requirements. Understanding these differences is critical for any business owner contemplating the end of their enterprise.

Eligibility criteria for filing a certificate of dissolution

Not every entity can file a Certificate of Dissolution; the process is strictly regulated. Typically, only directors or authorized individuals of a corporation or LLC can initiate this filing. It’s essential to verify that those filing the dissolution have the mandated authority in place, often outlined in the entity’s organizational documents.

Another key component is the necessary approval from directors and shareholders. Many states require a vote for dissolution to ensure that stakeholders agree with the decision. Compliance with state regulations is a must, as differing states may impose specific rules governing the dissolution process.

Additionally, before proceeding with dissolution, examining the business’s financial situation is crucial. Outstanding debts or other financial obligations should ideally be settled to avoid complications during the process. This makes financial clarity a critical part of the decision-making process.

Preparing to file the certificate of dissolution

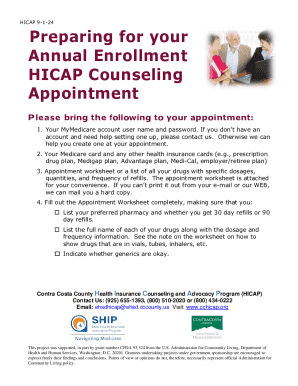

Preparation plays a pivotal role in the successful filing of a Certificate of Dissolution. To start, gather all necessary documents. This includes business identification and registration documents, your latest financial statements, and any certificates of compliance if applicable. These documents provide the legal and financial background required to support your application.

Stakeholders must be notified before filing, which includes informing employees, creditors, and customers. Clear communication keeps essential parties in the loop and allows for a smooth transition. This transparency can significantly affect relationships and reputation moving forward.

Lastly, prior to dissolution, tax considerations must be addressed. Obtaining clearance from tax authorities ensures there are no encumbrances. Settling outstanding debts and obligations is also crucial to avoid potential legal issues post-dissolution. The objective is to leave no loose ends that could tie the owners to the company financially.

Step-by-step filing process

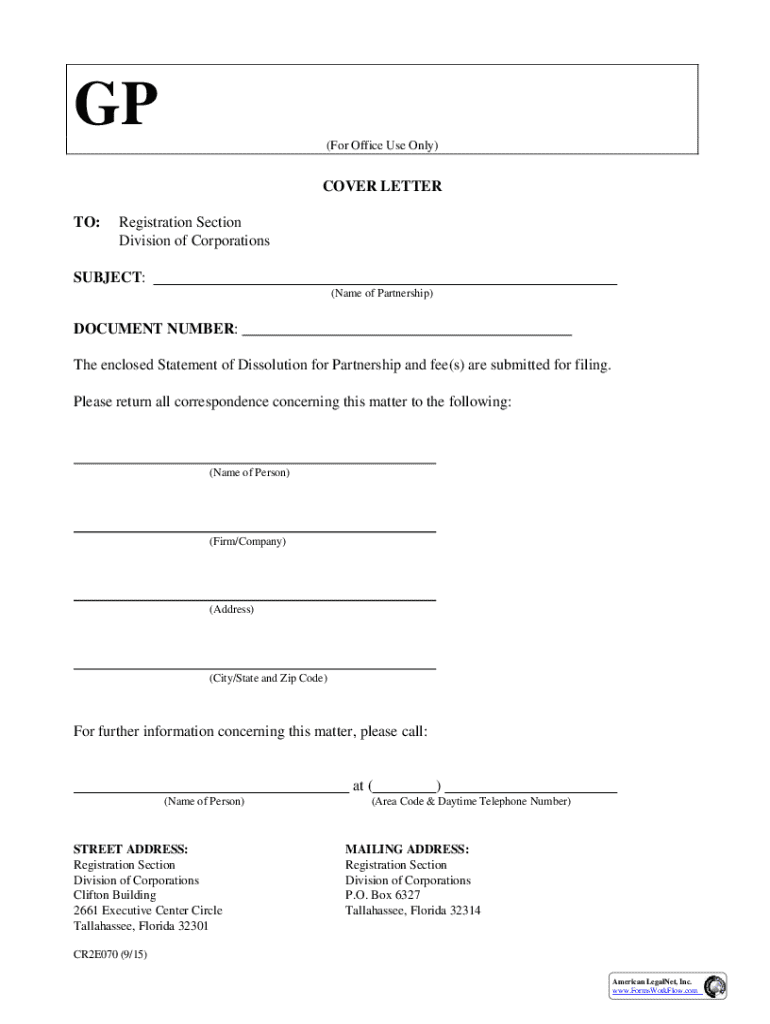

Completing the Certificate of Dissolution form involves several steps. You can typically obtain the form from your state’s Secretary of State website or office. Upon receiving the form, carefully read the instructions specific to your situation, as these will guide you through each section of the form, from company details to consent requirements.

While filling out the form, accuracy is paramount. Ensure all entries are correct, especially the date of incorporation and names of key personnel. Common mistakes include incorrect signatures, missing dates, or failure to provide specific details required in the filing. Review your form multiple times before submission.

Submission of certificate of dissolution

After completing the form, it's time to submit it. Generally, you can choose between online and offline submission. Online filing through your state’s website often expedites the process. However, if you choose to send it via mail or in-person, ensure that you include any filing fees required. These fees vary by state, so double-check to avoid potential delays.

It's essential to track your application after submission. Most states provide a tracking mechanism, allowing you to check the status of your dissolution. Processing times can vary, often taking anywhere from a few days to several weeks, depending on the state and workload of the office.

After filing the certificate of dissolution

Once the Certificate of Dissolution has been filed, businesses must proceed with key next steps. This includes effectively communicating the dissolution to stakeholders, such as employees and clients. Clarity during this phase can aid in mitigating any residual confusion or mistrust.

Additionally, asset liquidation may be necessary. This means selling off any remaining company assets to settle debts or distribute proceeds according to ownership interests. Completing final tax returns is essential as well; businesses must report and resolve any tax liabilities to ensure a clean break from operations.

Keeping records post-dissolution is also essential. States typically require the retention of documents related to the business for a certain period, often ranging from several years to indefinitely. Handling any pending legal matters is crucial to prevent them from impacting your personal liability in the future.

Resources and tools for managing the certificate of dissolution

Utilizing tools like pdfFiller can significantly streamline the process of creating and managing your Certificate of Dissolution. With features that facilitate easy filling and signing of the document, pdfFiller offers a user-friendly interface tailored for document management. This allows individuals and teams to access, edit and collaborate effectively from any location.

Additionally, frequent FAQs about the dissolution process can provide clarity and address common concerns. By leveraging resources available through pdfFiller, users can navigate the complexities of the dissolution process with confidence, ensuring they have covered all necessary steps.

Additional information and considerations

The impact of dissolution on future business ventures is significant. It’s crucial for owners to understand that unresolved dissolution obligations can complicate their ability to start new endeavors. Legal implications may arise if proper procedures are not followed, such as continued liabilities or penalties due to non-compliance with state laws.

Furthermore, a comparative analysis of state-specific regulations regarding dissolution highlights the necessity of understanding local statutes. Each state may have unique guidelines and registries to follow. Leveraging available resources to find state-specific regulations can ensure compliance and a smoother dissolution process.

Conclusion on the importance of proper dissolution

In summary, navigating the Certificate of Dissolution of Form requires a thorough understanding of the steps involved and the implications of each decision made. It's not merely a checklist but a critical aspect of ending business responsibly and legally. Ensuring compliance can have long-term benefits, impacting personal liability and the overall reputation of the owners.

Using professional services wherever necessary can ease the process significantly. Taking the time to adequately address all concerns during the dissolution process will provide business owners with peace of mind, allowing them to focus on their future endeavors without lingering obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute certificate of dissolution of online?

How do I edit certificate of dissolution of online?

How do I fill out certificate of dissolution of on an Android device?

What is certificate of dissolution of?

Who is required to file certificate of dissolution of?

How to fill out certificate of dissolution of?

What is the purpose of certificate of dissolution of?

What information must be reported on certificate of dissolution of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.