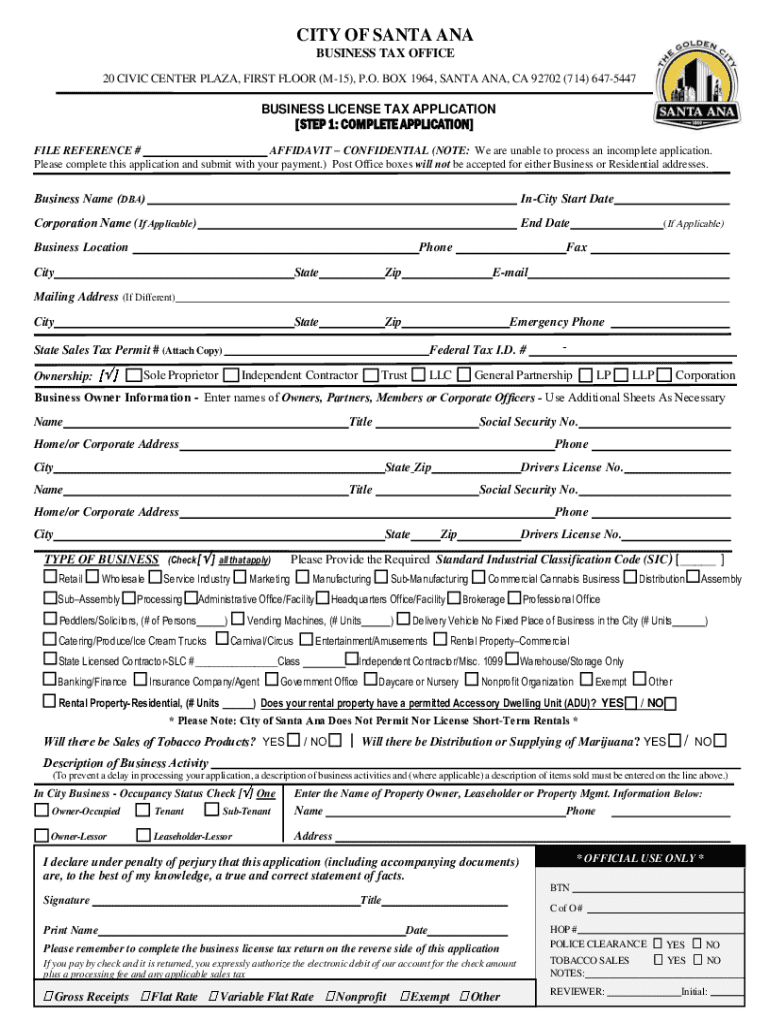

Get the free General Business License Tax Review Form

Get, Create, Make and Sign general business license tax

Editing general business license tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out general business license tax

How to fill out general business license tax

Who needs general business license tax?

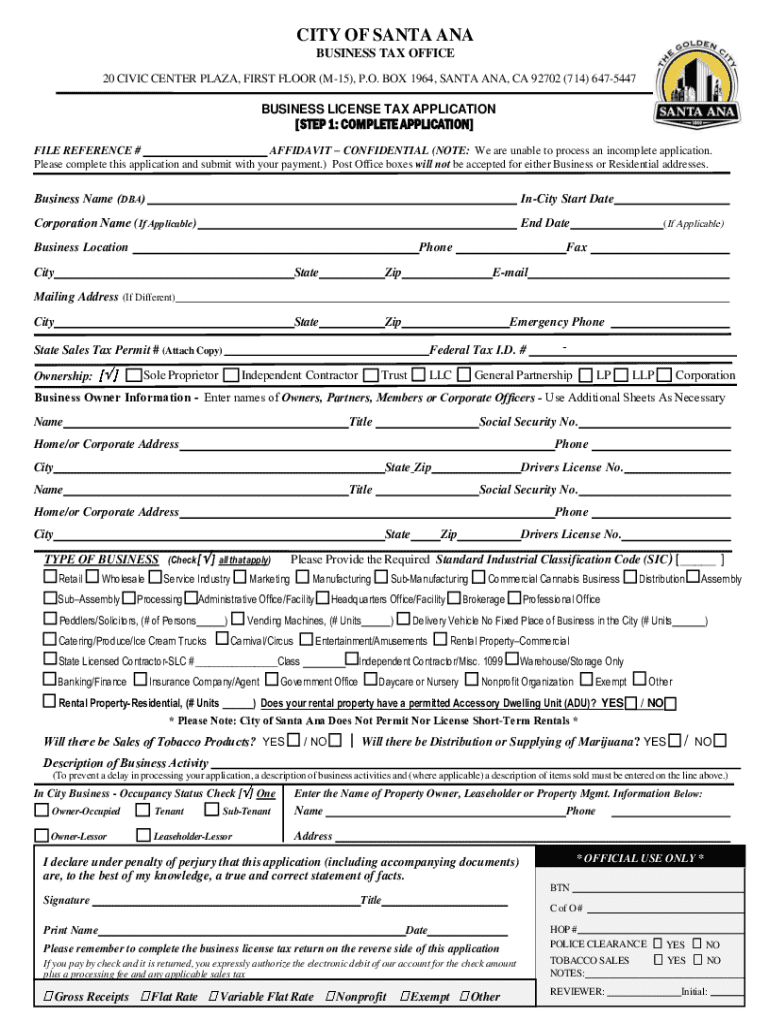

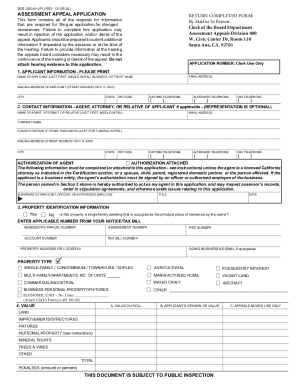

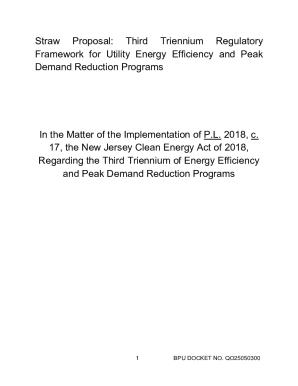

Understanding the General Business License Tax Form

. Understanding the general business license tax form

Every business operating legally is required to file a general business license tax form. This document serves as a declaration of a business's intent to operate within a specific jurisdiction. Each city or county may have different requirements, but the primary aim remains the same: to ensure compliance with local laws, support tax collection, and maintain data on commercial activities.

A business license tax is essentially a fee that a city, county, or state charges to authorize a business to operate legally within its borders. This tax can vary widely based on the business type, size, and jurisdiction, with penalties imposed for failure to comply with local regulations. Understanding tax compliance is crucial for maintaining a good standing and avoiding fines or legal challenges.

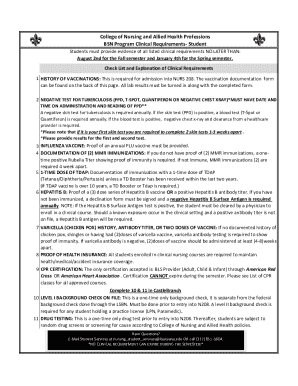

. Key components of the general business license tax form

Filling out the general business license tax form requires specific information tailored to the business entity. Typically, it includes the business name, primary address, and contact information. This initial data is crucial for the local government to process the application and link it to the correct location.

Owner information must also be provided, detailing who is responsible for the business. This includes contact details and potentially personal identification numbers. Furthermore, the form often requires an indication of the business type and structure, which is essential for the accurate assessment of tax obligations.

Some sections of the form can be more intricate, requiring financial disclosures. This includes information about revenue, projected expenses, and any other relevant financial criteria. Careful and accurate completion of this section can significantly affect the assessment of taxes owed.

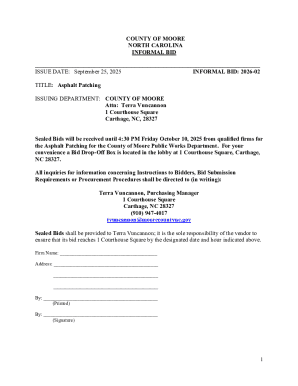

. Step-by-step instructions for filling out the form

To effectively complete your general business license tax form, start by gathering the necessary documentation. This ensures you have all required details at your fingertips when filling out the form. Essential items include your tax identification numbers, which help to link your business with the appropriate tax obligations, and previous year’s tax returns, which may provide necessary financial insight.

Begin the process by accurately filling out Section 1: Business Information. Here, you will provide your business’s basic information including names and addresses. Then move to Section 2: Owner Information, entering details about the business owner(s). Finally, Section 3: Financial Disclosure requires you to outline your revenue and business expenses transparently.

While filling out the form, it’s crucial to avoid common pitfalls that can cause delays or rejections. One frequent mistake is leaving sections incomplete or providing incorrect financial calculations. Double-checking your entries before submission can save time and prevent issues down the line.

. Editing and signing the business license tax form

Once the form is completed, the next step is to edit and finalize it before submission. One of the most efficient tools for this is pdfFiller, a cloud-based solution that allows users to manage their business documents seamlessly. With pdfFiller, you can access your forms from anywhere, ensuring that you can make adjustments as necessary.

Editing the form is straightforward. First, upload your completed document to pdfFiller. The platform offers user-friendly editing tools, allowing you to modify text, add signatures, and include annotations if needed. Simply click on the fields that require changes and input the correct information.

Once edits are made, signing the form digitally also becomes easy. Electronic signatures hold the same legal weight as handwritten ones, streamlining the approval process. pdfFiller provides a smooth eSignature solution, ensuring that your document can be signed quickly and securely.

. Submitting the general business license tax form

After your general business license tax form is complete and signed, the next step is submission. Several methods exist for this purpose, depending on your local regulations. You may choose to submit the form online through your local government’s official site, which is often the quickest and most convenient route.

Alternatively, physical mail submissions are an option for those who prefer not to submit electronically. Many jurisdictions also allow in-person submissions at designated government offices, which can sometimes facilitate immediate feedback or responses regarding your application.

After submission, expect processing times to vary. It’s also not uncommon for local governments to request additional information or clarifications after initial submission. Staying prepared for follow-up inquiries can significantly streamline the licensing process.

. Managing your business license tax information

Once your general business license tax form has been submitted, it’s essential to manage this information effectively. Keeping thorough records of all documents related to your business license can prove invaluable for future reference or compliance checks. For this purpose, pdfFiller’s document management capabilities shine, allowing you to store and organize your paperwork in a secure cloud environment.

Creating a focused filing system will help you locate necessary documents quickly. Regularly reviewing and updating your records ensures that you remain compliant with any changing regulations. Anticipating questions or issues that may arise post-submission can also help in maintaining good standing with local authorities.

For instance, you might wonder how to check the status of your application or how to amend any submitted forms. Staying proactive can alleviate stress and ensure your business operations run smoothly.

. Interactive tools and resources on pdfFiller

pdfFiller offers a wealth of interactive tools that can simplify the process of dealing with the general business license tax form. Users can explore pre-existing templates to streamline form-filling, ensuring that all necessary fields and information are already prepared for quick completion.

Those looking for more customized options can easily create their own forms or documents within the platform, adding personalized fields based on their specific business needs. The collaboration tools available on pdfFiller also empower teams to work together efficiently, enabling multiple users to edit and comment on documents in real time.

Additionally, secure document sharing features allow businesses to send forms privately and safely, maintaining confidentiality while still ensuring all necessary parties have access to important information.

. FAQs about the general business license tax form

Questions often arise after completing the general business license tax form. One common concern deals with mistakes: "What if I make a mistake on my form?" The best course of action is to address any errors promptly by making corrections before submission, or knowing the local process for amendments if necessary.

Another frequent question pertains to fees. Understanding what charges may attach to the business license tax is critical for preparing financially. Checking local guidelines will provide a clearer picture of potential costs associated with obtaining a business license.

. The importance of staying informed on business tax regulations

It’s essential for business owners to stay updated on evolving tax regulations to maintain compliance and avoid penalties. Local tax codes can change frequently, making it crucial to actively seek resources and professional guidance related to business licenses and tax responsibilities.

Engaging with trusted resources, such as industry publications, tax advisory firms, and official government websites, can provide insights into new regulations and changes. Consulting with tax professionals can also yield tailored advice that might mitigate misunderstandings or oversight concerning your business tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit general business license tax from Google Drive?

How do I complete general business license tax on an iOS device?

How do I fill out general business license tax on an Android device?

What is general business license tax?

Who is required to file general business license tax?

How to fill out general business license tax?

What is the purpose of general business license tax?

What information must be reported on general business license tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.