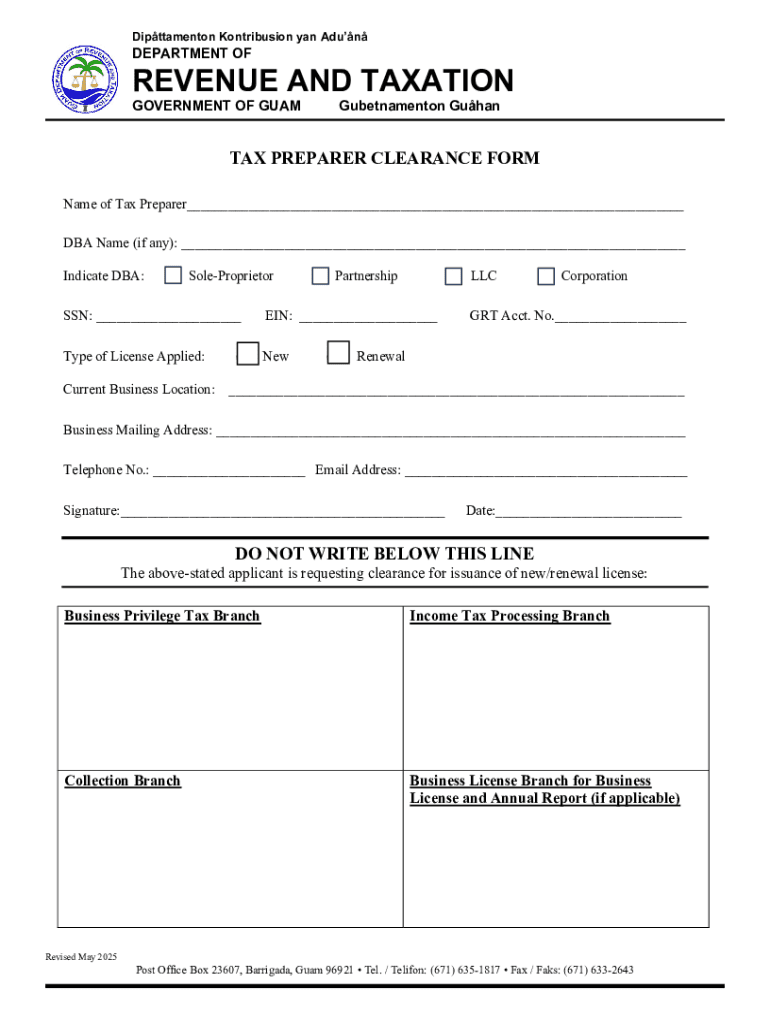

Get the free Tax Clearance Application Form

Get, Create, Make and Sign tax clearance application form

How to edit tax clearance application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax clearance application form

How to fill out tax clearance application form

Who needs tax clearance application form?

Tax Clearance Application Form - How-to Guide

Understanding the importance of the tax clearance application form

A Tax Clearance Certificate (TCC) is an official document provided by tax authorities that indicates an individual's or business's compliance with tax obligations. It signifies that the taxpayer has met all necessary tax filing requirements and is in good standing with government tax requirements. This certification is vital in personal and business finances as it demonstrates financial responsibility and compliance with tax laws, which can be critical when applying for loans, contracts, or even employment.

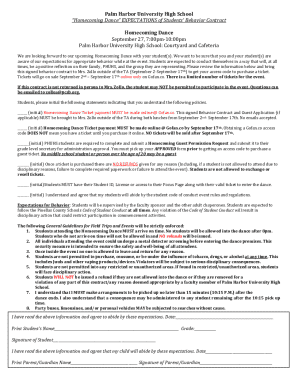

Various scenarios necessitate a Tax Clearance Certificate, notably when individuals or businesses aim to engage in government contracts, apply for work permits, or address issues related to citizenship and residency. The TCC acts as a protective measure, ensuring that the recipient bears no outstanding debts to the government, which can ultimately affect their ability to conduct business or secure financial opportunities.

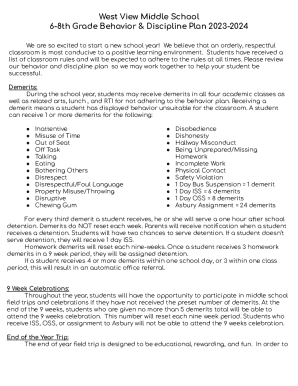

Preparing to fill out the tax clearance application form

Before initiating the tax clearance application, gathering the necessary documents and information is crucial for a smooth process. This typically includes identification documents such as a governmental ID or Tax Identification Number (TIN), which verifies the taxpayer's identity. Additionally, financial records, including accurate income statements and tax returns for the relevant reporting periods, should be collected. For businesses, it's essential to include further documentation like corporate tax filings and proving compliance with employment tax obligations.

Assessing eligibility is also vital, as specific criteria may apply based on individual or business circumstances. Confirming that you have no outstanding tax obligations, are up to date with your filings, and meet all necessary conditions can simplify the application process and enhance your chances of receiving the TCC efficiently.

Accessing the tax clearance application form

Finding the tax clearance application form is typically straightforward. Most tax authorities make the form available on their official websites, which provide downloadable formats of the application. For those preferring physical submissions, visit local tax offices or the Inland Revenue Division of your country or state for access to printed forms.

To ensure you’re working with the latest version of the form, it is recommended to check the official tax authority's website regularly or directly contact the office for updates on form revisions and any changes related to application procedures.

Detailed instructions for filling out the tax clearance application form

Filling out the tax clearance application form requires attention to detail. Here’s a step-by-step guide to help you through the process:

Common mistakes to avoid include inaccurate identification details, omitting significant financial information, or failing to include necessary supporting documentation. Taking time to review these elements prevents applications from being returned or denied.

Editing and reviewing your application

Once your application is completed, utilizing editing tools available through platforms like pdfFiller can significantly enhance accuracy. The platform offers robust editing features, allowing users to modify text, insert additional information, or correct errors seamlessly.

Additionally, confirming that all sections align with specific requirements laid out by the tax authority is essential. A thorough check of the document can prevent any oversights that might lead to delays. If applicable, collaboration features allow team submissions, enhancing the application’s accuracy through multiple points of feedback.

Signing the application

Signature validation stands as a critical component in the tax clearance application process. It asserts the authenticity of the information provided and confirms that the applicant acknowledges their tax responsibilities. E-signature solutions, such as those offered by pdfFiller, make the process of adding your signature effortless. Ensuring the signature is applied correctly can help expedite processing times and reduce the risk of rejection due to formalities.

Submitting the tax clearance application form

Upon completing your application, there are various submission methods available. If applying electronically, follow the online submission process outlined on the tax authority's website, ensuring you attach all required documents. Alternatively, for those who prefer traditional methods, mail-in instructions are typically provided on the application form. Remember to retain copies of all submissions for your records.

Once submitted, processing times can vary based on jurisdiction and complexity. Expect to receive a confirmation of receipt, and be prepared to follow up if there is a delay. Knowing what comes next keeps applicants informed during the waiting period.

Managing your tax clearance application

Tracking the status of your application can often be done through the tax authority's online portal, allowing you to maintain an eye on its progress. If any incorrect information is detected post-submission, contact the tax office immediately to rectify your details without substantial delay to the application. It’s also beneficial to understand the appeal process for denied applications, enabling applicants to address any issues head-on and reapply if necessary.

Frequent questions about the tax clearance application form

Several inquiries commonly arise during the tax clearance application process. For instance, if you lose your Tax Clearance Certificate, promptly contact the issuing authority for a replacement. Renewal is another frequent question; many certificates are valid for a fixed period, so be sure to check how often you need to renew your certificate to remain compliant.

Additionally, can you apply on behalf of someone else? The answer often depends on regulations in your jurisdiction, but generally, an authorized representative (with proper documentation) may submit applications on behalf of individuals or businesses.

Conclusions on the importance of efficient documentation

Efficient management of documentation through platforms like pdfFiller streamlines the application for the tax clearance certificate. By harnessing editing, eSign, and collaborative features, users can ensure their applications are complete and compliant. Proactive management of tax documents will not only ease the application process but further prepare individuals and businesses for future negotiations and compliance instances with governmental authorities.

Additional tips for effective tax management

Maintaining best practices for tax documentation throughout the year can make a significant difference in managing taxes more efficiently. Regularly updating financial records, keeping track of filing deadlines, and understanding governmental tax requirements are all integral components of effective tax management.

Moreover, utilizing resources available through tax authorities or educational platforms can provide further learning about taxes and compliance, ensuring individuals and businesses remain informed and prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax clearance application form directly from Gmail?

How do I edit tax clearance application form straight from my smartphone?

How do I fill out the tax clearance application form form on my smartphone?

What is tax clearance application form?

Who is required to file tax clearance application form?

How to fill out tax clearance application form?

What is the purpose of tax clearance application form?

What information must be reported on tax clearance application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.