Get the free Need help with financial aid? We're here for you!Call ...

Get, Create, Make and Sign need help with financial

Editing need help with financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out need help with financial

How to fill out need help with financial

Who needs need help with financial?

Need help with financial form? Here's a comprehensive guide

Understanding financial forms

Financial forms serve as essential documents for both individuals and businesses, encapsulating crucial economic data to be used for a variety of purposes. These forms can range from tax submission documents, loan applications, to expense reports and budgeting templates. Understanding these forms is pivotal to effective financial management and compliance.

Accurate completion of financial forms is non-negotiable. Mistakes can lead to financial loss, delays in loans, and even legal ramifications for businesses and individuals. Errors in financial records not only compromise the integrity of the submitted information but can also cause significant headaches down the line, affecting the financial standing and compliance of taxpayers.

Common financial forms and their purposes

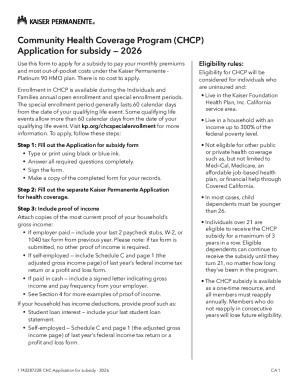

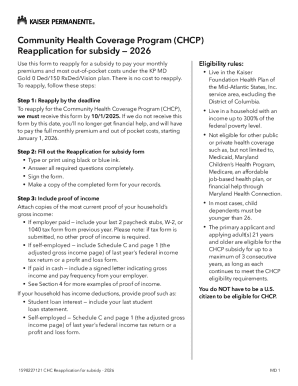

Certain financial forms are ubiquitous in everyday financial dealings. Tax forms, for instance, play a critical role in reporting your income to federal and state governments. Common tax forms include W-2 for employees and 1099 for contractors, each having its specific requirements and uses.

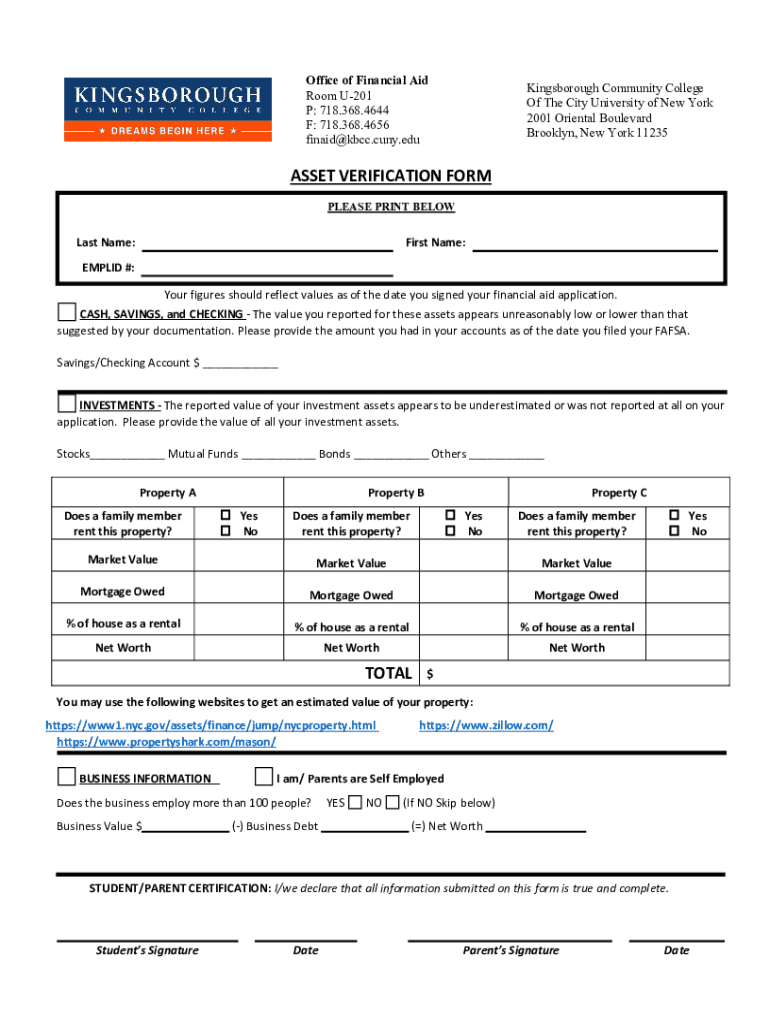

Loan applications, whether for mortgages or personal loans, require detailed financial histories, credit scores, and income verification. Completing these forms accurately is vital as they can determine loan approval and interest rates.

Expense reports reflect the costs incurred for business-related activities and typically require supporting documentation, such as receipts or invoices. Accurately reporting expenses ensures reimbursement and provides a clear picture of financial health.

Finally, budgeting templates help individuals and organizations manage their finances effectively. These simple tools allow users to track income and expenses, providing insight into spending patterns and helping to set future budgetary goals.

Step-by-step instructions for filling out financial forms

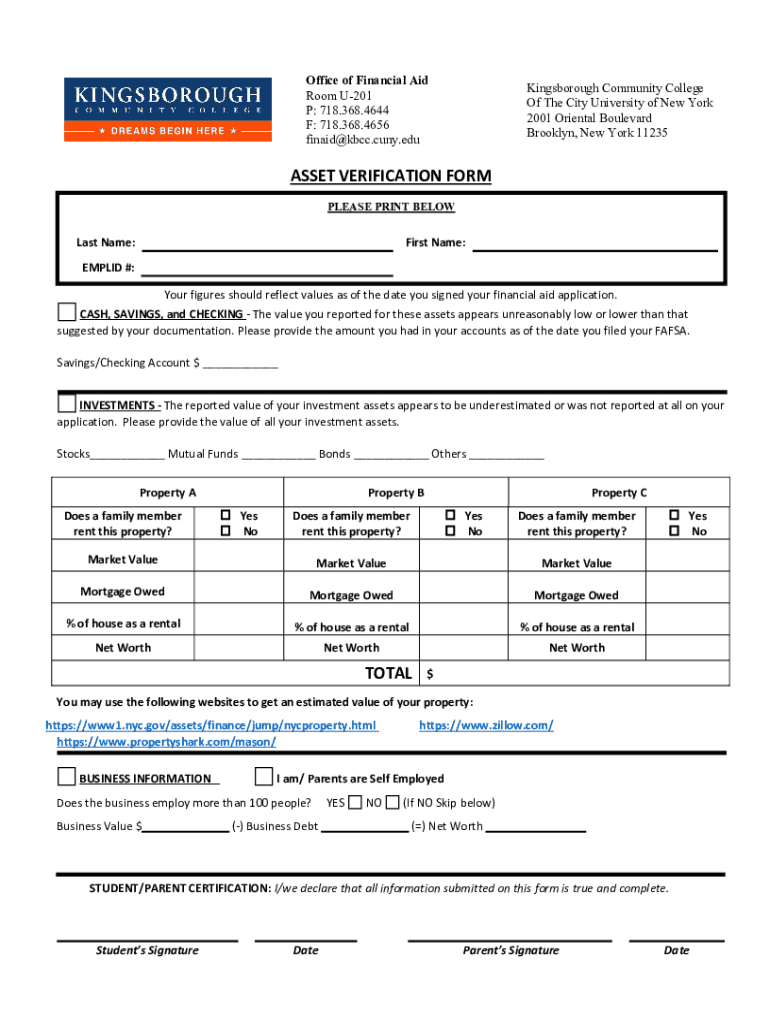

Filling out financial forms can appear daunting, but breaking the process down into manageable steps can simplify it significantly. Start by gathering all the necessary documents, which may include income statements, previous tax filings, loan proposals, and personal identification.

Next, carefully read each section of the form. Understanding what information is required is crucial; for example, tax forms typically ask for personal details, income data, and any deductions that might apply. Pay particular attention to special considerations for self-employed individuals, who may need to provide additional documentation regarding earnings and expenses.

If discrepancies arise from prior documents—such as conflicting income data—it's essential to clarify these issues before submission. Knocking out any inconsistencies can save time and avoid problems with authorities.

Editing and managing financial forms

Managing financial documents meticulously is vital for maintaining effective oversight of personal or business finances. Having a robust system in place for filing, storing, and tracking these documents can tremendously streamline your financial processes. Utilize structured organizational strategies, such as categorizing documents by type or date, to simplify retrieval and minimize confusion.

pdfFiller emerges as an excellent tool for editing financial forms. With features that allow editing PDFs and forms on a cloud-based platform, users can access their documents from anywhere, anytime. Collaborative tools enable multiple users to interact with documents, enhancing productivity and ensuring that forms are completed accurately.

Moreover, digital signatures are becoming increasingly important across various sectors. pdfFiller supports secure signing, ensuring compliance with e-signature laws. The ability to sign and submit forms electronically promotes efficiency and security, eliminating the risk of lost documents.

Interactive tools to simplify financial form management

The beauty of using platforms like pdfFiller lies in the interactive tools at users’ disposal. Template libraries offer pre-filled forms tailored for different purposes, which can help safeguard against common errors that might arise from completing them from scratch.

In addition to templates, calculators and estimators found on pdfFiller allow users to make informed financial decisions. From tax calculators that help gauge possible liabilities to budget calculators, these tools give users real-time data for better financial planning.

Customization options within pdfFiller enable users to modify forms as per their personal or organizational needs. This kind of flexibility ensures that all requirements are met without unnecessary hassle.

Troubleshooting common issues with financial forms

Mistakes with financial forms can range from minor to serious, and being aware of common pitfalls to avoid is crucial. Common errors include misreporting income, failing to include necessary documentation, or misunderstanding the instructions provided.

If you do encounter an error after submission, knowing how to amend your forms is vital. Contact the relevant authorities, such as the IRS for tax issues, and follow their prescribed steps for amending documents. It's essential to act swiftly, as inaction can lead to complications and even financial harm.

Employ proactive measures, such as regular audits of your financial submissions, to minimize discrepancies and ensure accuracy moving forward.

Legal considerations and compliance

Understanding the legal framework surrounding financial forms is paramount for compliance and avoiding potential legal troubles. Financial regulations at both federal and state levels outline how transactions and personal information must be handled, ensuring fairness and accountability within financial systems.

Additionally, safeguarding personal privacy and ensuring data protection on financial forms is a critical responsibility. Best practices for maintaining confidentiality include using reputable platforms like pdfFiller, which comply with stringent data protection standards to assure users that their financial information is secure.

Best practices for managing financial documentation

Keeping records current is essential for effective financial management. Regularly reviewing your financial information helps maintain accurate data and ensures compliance with legal standards. If any changes arise within your personal or business financial landscape, update your records accordingly.

Establishing document retention guidelines is also advisable. Different categories of financial documents should be retained for varying lengths of time, depending on regulatory requirements and personal needs. Generally, retaining tax documents for at least seven years is a prudent practice, while receipts and minor documents may need a shorter retention period.

Conclusion: Streamlining your financial processes

The landscape of financial document management is evolving, and leveraging comprehensive document solutions like pdfFiller can dramatically streamline your processes. By employing effective tools and methodologies, individuals and teams can enhance their efficiency and actively manage financial obligations.

Explore the interactive features available on pdfFiller today. Whether you seek to edit, sign, or manage your financial forms, this platform empowers users to organize their financial documentation with ease and confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my need help with financial directly from Gmail?

Can I create an electronic signature for signing my need help with financial in Gmail?

How do I fill out need help with financial on an Android device?

What is need help with financial?

Who is required to file need help with financial?

How to fill out need help with financial?

What is the purpose of need help with financial?

What information must be reported on need help with financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.