Get the free Oil and Gas Tax Conference

Get, Create, Make and Sign oil and gas tax

Editing oil and gas tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oil and gas tax

How to fill out oil and gas tax

Who needs oil and gas tax?

Oil and Gas Tax Form: A Comprehensive Guide

Understanding the oil and gas tax form

An oil and gas tax form serves as a crucial document required by both individual filers and companies operating in the oil and gas sector. This form is pivotal in reporting income derived from oil and gas activities, ensuring compliance with local and federal tax regulations. By properly filling out this form, companies and individuals can accurately report earnings, claim deductions, and pay applicable severance taxes, which contribute significantly to state revenues.

The oil and gas tax form is not just a bureaucratic requirement; it is a vital aspect of the industry's financial ecosystem. Accurate submissions help maintain industry integrity and support tax benefits that can bolster local economies and fund public services.

Types of oil and gas tax forms

There are several types of tax forms relevant to the oil and gas sector, each serving unique purposes under different tax regulations. Understanding these forms is essential for compliance and financial planning.

Who needs to fill out the oil and gas tax form?

A variety of individuals and entities are required to complete the oil and gas tax form. Understanding who specifically needs to file is essential to ensure that everyone complies with the necessary tax laws.

Individual filers

This group includes anyone who receives income from oil and gas interests, such as landowners who earn royalties from oil extraction on their land. They need to report this income accurately on their tax returns, as failure to do so can lead to penalties and interest charges.

Companies and corporations

Oil and gas operators must also complete these forms as part of their operational compliance. This involves detailing revenue, expenses related to extraction, and calculations related to severance tax payments. Partnerships engaged in joint ventures for extracting oil or gas are likewise subject to these requirements, necessitating a clear understanding of how to report income collectively.

Exceptions and special cases

There are special situations where specific entities may be exempt from filing, such as certain non-profit organizations or agreements that stipulate tax exclusions. It's vital to remain informed about these exceptions to avoid unnecessary complications.

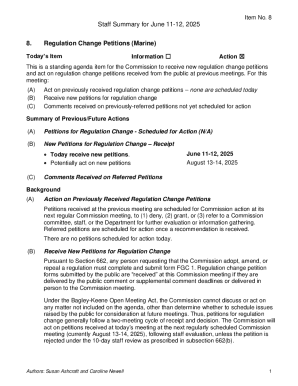

Steps to complete the oil and gas tax form

Completing the oil and gas tax form can seem daunting, but breaking it down into manageable steps can facilitate the process. An organized approach ensures all necessary elements are adequately addressed.

Gathering necessary documents

Before tackling the form, gather all required documentation. Individuals should have their financial statements, prior tax returns, and any relevant royalty agreements available. Corporations will also need to compile similar information, including profit and loss statements and operational reports.

Filling out the form

Each section of the oil and gas tax form should be filled out with precision. Common pitfalls include misreporting income or overlooking deductions. It's critical to cross-check figures against supporting documents to maintain accuracy.

Supporting documentation

Attaching accurate supporting documents is essential. Missing or incorrect documentation can lead to delays or penalties. Typically, required attachments may include operating agreements, well completion reports, and detailed income statements related to oil and gas activities.

Key considerations and tips

Navigating the oil and gas tax form involves more than just filling it out; it requires strategic planning and awareness of deadlines. Missing crucial dates can lead to significant penalties.

Tax deadlines

Filing deadlines for oil and gas tax forms can vary significantly by state. It's important to mark these dates carefully on your calendar to avoid late submissions. Late filing penalties can be steep, reaching up to 25% of the unpaid tax amount.

Keeping records for audits

Maintaining accurate records is vital for both compliance and audits. Generally, it is advisable to keep records for at least three to seven years, depending on your jurisdiction. Organizing documents efficiently also prepares you for unexpected audits, which can occur randomly.

State-specific regulations

Each state has its regulations regarding oil and gas taxes. Colorado, for instance, has unique conditions that could affect tax liability, including local severance tax payments. Familiarize yourself with state-specific requirements to ensure compliance and avoid mistakes.

Utilizing technology for form management

Technology is reshaping how individuals and businesses handle their tax forms. Online tools streamline the entire process, providing valuable resources for effective tax management.

pdfFiller's cloud-based document solutions

One notable resource is pdfFiller, which offers cloud-based document solutions that simplify the oil and gas tax form management process. Features such as seamless editing and collaboration capabilities can significantly enhance efficiency during tax season.

Interactive tools for filling the oil and gas tax form

Interactive tools that include smart templates and auto-fill options can further aid in completing the oil and gas tax form. These tools enhance accuracy and save time, allowing for a more collaborative approach to filling out the form, especially for teams in corporate environments.

Frequently asked questions (FAQs)

While filling out the oil and gas tax form, many filers encounter common issues that can complicate the process. Addressing these queries can alleviate confusion and streamline your filing experience.

Common issues faced by filers

Many filers experience challenges with form errors stemming from incorrect calculations or incomplete sections. Troubleshooting these issues promptly is essential to avoid potential delays in processing.

Resources for additional help

For further assistance, filers can reach out to IRS representatives or consult their state tax authority, which can provide key guidance tailored to specific queries. Many also benefit from the insights of professional tax advisors who can offer valuable strategies for complex situations.

Best practices for filing oil and gas tax forms

To ensure a smooth filing process, adopting best practices will yield the most effective results. Staying informed on tax regulations and engaging with professionals are two key practices that enhance compliance.

Staying informed on changes in tax law

Tax laws are subject to frequent changes, and staying updated is imperative. Subscribing to industry newsletters or joining tax-focused groups can help ensure you remain in the loop regarding critical updates.

Engaging with financial professionals

Timing is essential when deciding to consult a tax professional. If your situation is complex or if there are significant changes in your tax obligations, seeking expert advice can clarify your responsibilities and help you avoid costly mistakes.

Real-life case studies

Understanding real-life scenarios can provide insightful strategies for effectively navigating the oil and gas tax form.

Individual filers' success stories

For example, individuals who have successfully filed their forms emphasized the importance of meticulous preparation. By leveraging technology and maintaining organized records, they were able to maximize their deductions and minimize tax liabilities.

Company experiences

Corporate case studies highlight the benefits of adopting a proactive approach. Companies that implemented solid compliance strategies and utilized document management solutions like pdfFiller reported significantly fewer issues with audits and a smoother filing process.

Final thoughts on oil and gas tax compliance

Achieving compliance with oil and gas tax submissions requires diligence, accuracy, and familiarity with regulatory requirements. Adhering to best practices ensures that submissions are both timely and correct, ultimately minimizing liability and enhancing efficiency.

Utilizing tools such as pdfFiller not only streamlines document management but also enhances collaboration, ensuring users can effectively maneuver through the complexities of tax compliance with ease and confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify oil and gas tax without leaving Google Drive?

How do I execute oil and gas tax online?

How do I edit oil and gas tax on an Android device?

What is oil and gas tax?

Who is required to file oil and gas tax?

How to fill out oil and gas tax?

What is the purpose of oil and gas tax?

What information must be reported on oil and gas tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.