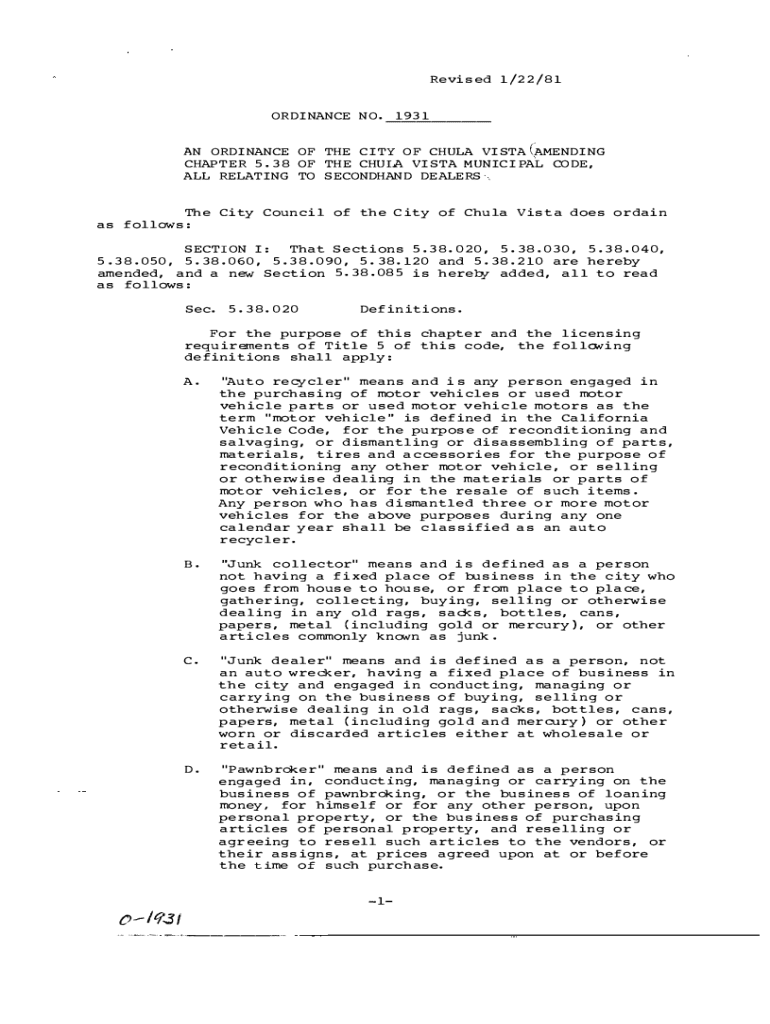

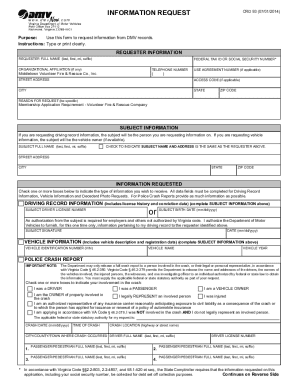

Get the free Ch. 5.38 Pawnbrokers, Secondhand and Junk Store Dealers

Get, Create, Make and Sign ch 538 pawnbrokers secondhand

How to edit ch 538 pawnbrokers secondhand online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ch 538 pawnbrokers secondhand

How to fill out ch 538 pawnbrokers secondhand

Who needs ch 538 pawnbrokers secondhand?

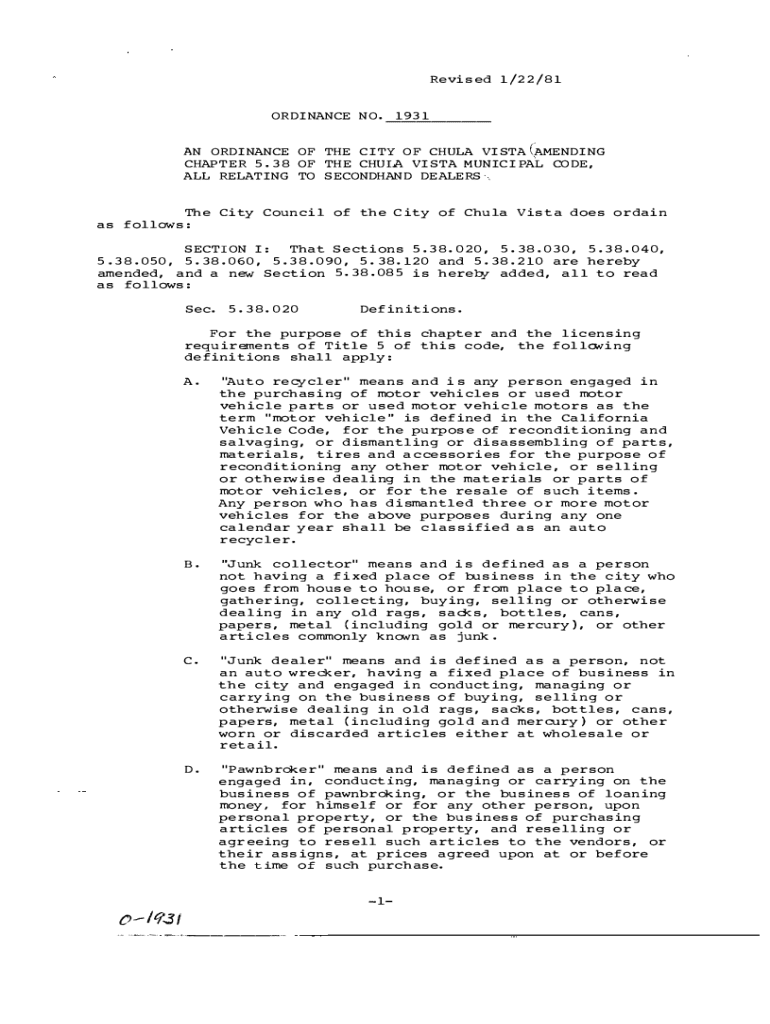

Understanding the CH 538 Pawnbrokers Secondhand Form

Overview of Chapter 538: Understanding Pawnbrokers and Secondhand Dealers

Chapter 538 establishes a regulatory framework concerning the activities of pawnbrokers and secondhand dealers. These entities play a significant role in facilitating consumer transactions involving used goods and cash lending against property. Essentially, pawnbrokers provide immediate financial assistance by offering loans backed by collateral, which are often valuable items. Secondhand dealers, on the other hand, buy and sell previously owned goods, creating a marketplace for items ranging from electronics to jewelry.

The significance of Chapter 538 lies in its capacity to provide consumer protection, ensuring that transactions between pawnbrokers, secondhand dealers, and consumers are conducted fairly and transparently. Compliance with local laws and regulations outlined in this chapter is crucial for maintaining a trustworthy environment that fosters confidence in these transactions.

Key objectives of Chapter 538

The primary objectives of Chapter 538 center on three crucial pillars: consumer protection, regulatory oversight, and transparency in transactions. Firstly, this legislation aims to safeguard consumer rights, ensuring that they are treated fairly during every stage of the transaction process. Pawnbrokers and secondhand dealers must uphold these rights to maintain the integrity of their businesses.

The role of the secondhand form in the pawnbroking process

The secondhand form is crucial in documenting transactions between pawnbrokers, secondhand dealers, and consumers. This form serves as a legal record that outlines the details of each transaction, providing clarity and accountability. The importance of this documentation cannot be overstated, as it protects both the consumer and the dealer by offering an organized method to track and resolve any potential disputes.

The secondhand form typically requires disclosures such as the seller's details, a thorough description of the items being pawned or sold, and the transaction values. By ensuring that all relevant information is accurately captured, the chances of misunderstandings and legal complications are significantly reduced.

Steps to complete the secondhand form accurately

Completing the secondhand form accurately is vital for compliance with Chapter 538 and ensuring smooth transactions. Here are the essential steps to achieve this:

Interactive tools for managing pawnbroker transactions

Leveraging interactive tools can enhance the efficiency with which pawnbrokers manage their documentation processes. Certain platforms provide customizable templates based on Chapter 538 that assist in the swift generation of required forms, including the secondhand form.

Common mistakes when using the secondhand form

Even with clear guidelines, many users can make mistakes when completing the secondhand form. Recognizing these common pitfalls can help avoid delays and complications. One significant error is providing incomplete information, which can lead to processing backlogs or legal ramifications.

Best practices for pawnbrokers and dealers

To navigate the complexities associated with Chapter 538 successfully, pawnbrokers and secondhand dealers should adopt best practices that ensure legal compliance and operational efficiency. Regular training on regulations will keep stakeholders informed about any changes to the law, allowing proactive adjustments within their operations.

Case studies: Successful compliance with Chapter 538

Case studies of pawnbrokers who successfully comply with Chapter 538 can shed light on practical strategies and methodologies. For instance, a local pawnbroker noted a significant reduction in disputes by adopting a comprehensive training program for staff on compliance requirements. Additionally, implementing a robust digital documentation system improved their accuracy in form submissions, resulting in increased customer satisfaction.

These successes highlight the effectiveness of adherence to regulatory guidelines as well as the implementation of best practices in ensuring compliance.

Additional considerations for pawnbrokers

Pawnbrokers must be aware of the potential legal consequences that can arise from non-compliance with Chapter 538. Penalties may include fines or even the revocation of licenses for habitual offenders. Being proactive about understanding not only the current laws but also any upcoming changes in the legislative framework affecting Chapter 538 will serve to protect their interests and maintain operational integrity.

Frequently asked questions (FAQ)

Many individuals have questions regarding the secondhand form and compliance with Chapter 538. Common queries often pertain to the information required, the process for completing the form accurately, and how to remedy any mistakes once submitted. Addressing these frequently asked questions ensures clearer understanding and promotes smoother transaction experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ch 538 pawnbrokers secondhand without leaving Google Drive?

How do I execute ch 538 pawnbrokers secondhand online?

Can I create an electronic signature for signing my ch 538 pawnbrokers secondhand in Gmail?

What is ch 538 pawnbrokers secondhand?

Who is required to file ch 538 pawnbrokers secondhand?

How to fill out ch 538 pawnbrokers secondhand?

What is the purpose of ch 538 pawnbrokers secondhand?

What information must be reported on ch 538 pawnbrokers secondhand?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.