Get the free HSA CONTRIBUTION ELECTION FORM Instructions

Get, Create, Make and Sign hsa contribution election form

Editing hsa contribution election form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hsa contribution election form

How to fill out hsa contribution election form

Who needs hsa contribution election form?

HSA Contribution Election Form: A Comprehensive Guide

Understanding HSA contributions

A Health Savings Account (HSA) is a tax-advantaged savings account designed specifically for individuals with high-deductible health plans (HDHPs). This account allows users to save for qualified medical expenses while enjoying a number of tax benefits. Contributions to an HSA are tax-deductible, and the money can grow tax-free as long as it is used for eligible healthcare costs. This makes HSAs a crucial tool for managing healthcare expenses, particularly for those anticipating significant medical needs.

Contributions to an HSA can significantly reduce your taxable income. For the tax year 2023, the contribution limits are $3,850 for individuals and $7,750 for families. Additionally, individuals aged 55 and older can make a catch-up contribution of $1,000. However, eligibility for making HSA contributions hinges on your enrollment in a qualified HDHP, which typically requires a minimum deductible and out-of-pocket maximum.

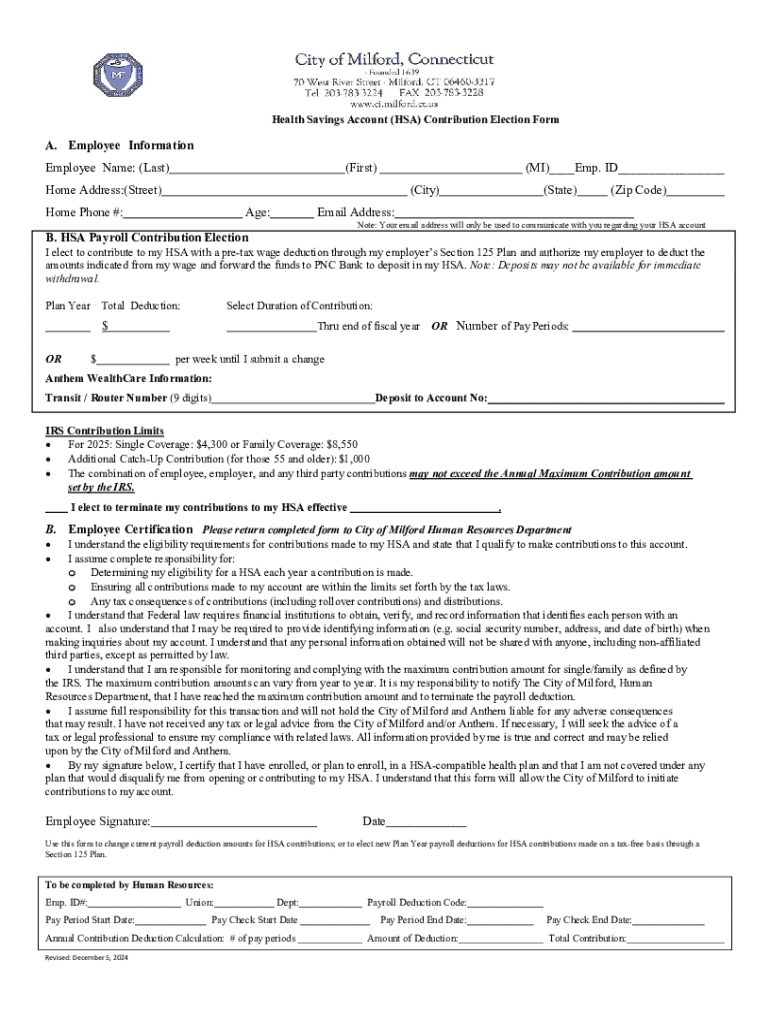

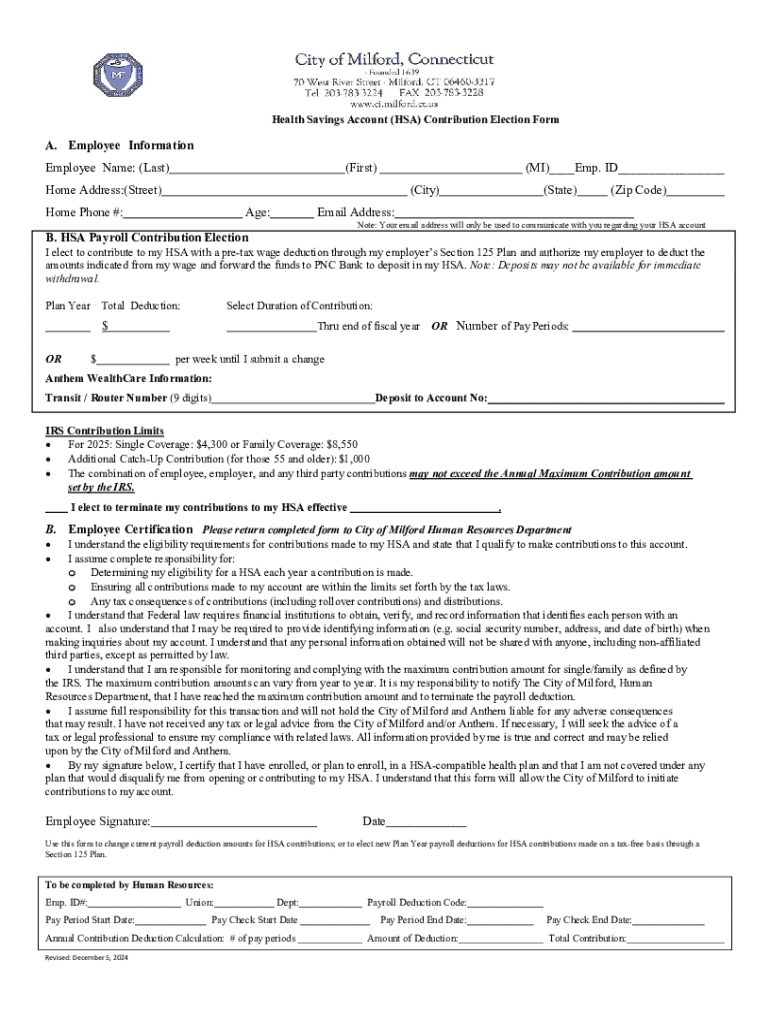

The HSA contribution election form explained

The HSA Contribution Election Form is an essential document that enables individuals to elect how much money they wish to contribute to their Health Savings Account from their paycheck. This form is crucial for both employees and employers to ensure contributions are accurately reported and processed. It allows employees to specify their desired contribution amounts, which facilitates proper withholding from their paychecks.

Key components of the HSA Contribution Election Form include personal information such as the employee’s name and address, the elected contribution amounts, and the choice of whether the contributions are made solely by the employee or include employer contributions as well. Completing this form accurately is vital to ensure that contributions are in line with tax laws and individual financial goals.

Step-by-step guide to completing the HSA contribution election form

Completing the HSA Contribution Election Form can seem complicated at first, but following these steps can simplify the process:

Frequently asked questions (FAQs) about the HSA contribution election form

Navigating the HSA Contribution Election Form often leads to various queries. Here are some common questions and their answers:

Managing your HSA contributions

Monitoring your HSA contributions throughout the year is vital to ensure compliance with IRS regulations and to maximize your tax benefits. Regular tracking enables you to make necessary adjustments timely. Consider setting reminders to review your contributions quarterly. If you have an employer match or contribution, account for that when evaluating how much you should contribute.

Staying within the contribution limits is essential, as exceeding them may lead to tax penalties. It's also important to consider how any contributions made by your employer count toward your annual limit. Make informed decisions so that you derive maximum benefit from your Health Savings Account.

Utilizing pdfFiller for your HSA contribution election form

Having access to intuitive document management tools can greatly simplify the process of completing your HSA Contribution Election Form. pdfFiller offers a seamless platform for users to edit, sign, and store their documents securely. Here’s how you can benefit from using pdfFiller for your HSA documentation needs:

Additional tools and resources for HSA management

To effectively manage your HSA and maximize its potential benefits, consider utilizing various tools and resources. These resources can greatly assist in budgeting and tracking your contributions throughout the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hsa contribution election form in Chrome?

How can I fill out hsa contribution election form on an iOS device?

Can I edit hsa contribution election form on an Android device?

What is hsa contribution election form?

Who is required to file hsa contribution election form?

How to fill out hsa contribution election form?

What is the purpose of hsa contribution election form?

What information must be reported on hsa contribution election form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.