Get the free Health Savings Account Employee Election and VEBA ...

Get, Create, Make and Sign health savings account employee

How to edit health savings account employee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health savings account employee

How to fill out health savings account employee

Who needs health savings account employee?

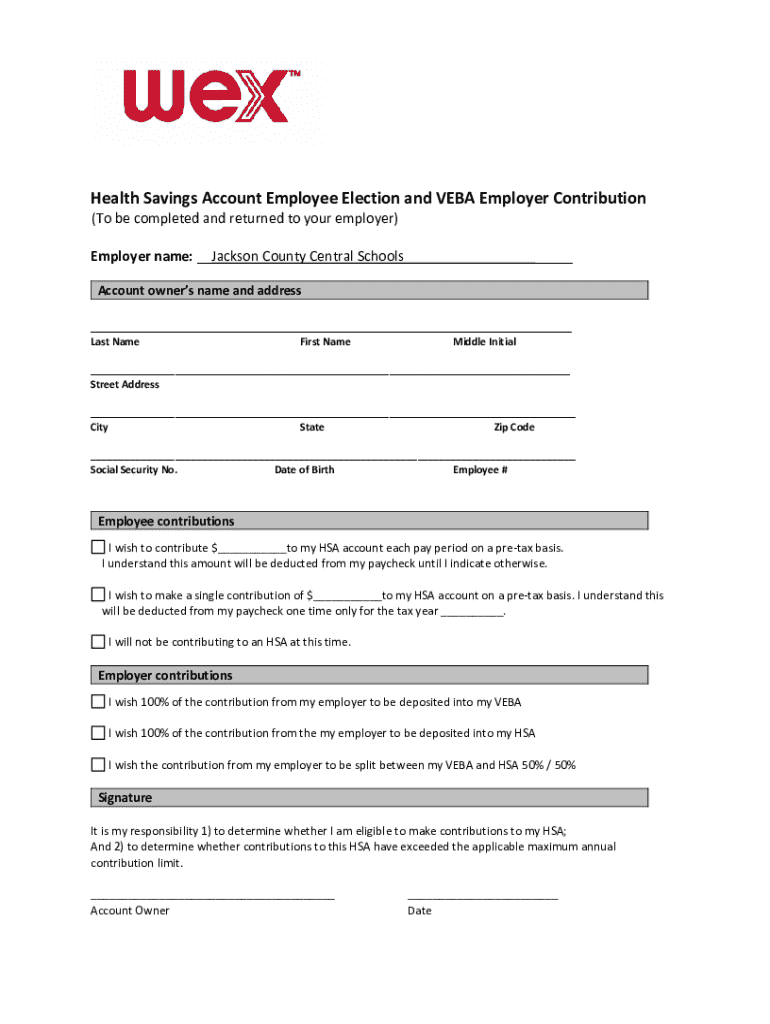

Understanding the Health Savings Account Employee Form

1. Understanding health savings accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals save for medical expenses. Typically paired with high deductible health plans, HSAs allow employees to set aside pre-tax funds that can be used for qualified health care costs. This effective savings tool is essential in managing rising health care expenses without compromising the quality of care.

The importance of HSAs for employees lies not only in their tax benefits but also in their flexibility. Employees can use HSA funds for a wide range of health-related expenses, including copayments, deductibles, and certain over-the-counter medications. Understanding HSAs is crucial for employees who wish to make informed decisions about their health benefits.

Key benefits of utilizing an HSA include tax-deductible contributions, tax-free withdrawals for qualified expenses, and the ability to carry over unused funds from year to year. Employees can proactively manage their health care expenses while saving for future needs, making HSAs an attractive option.

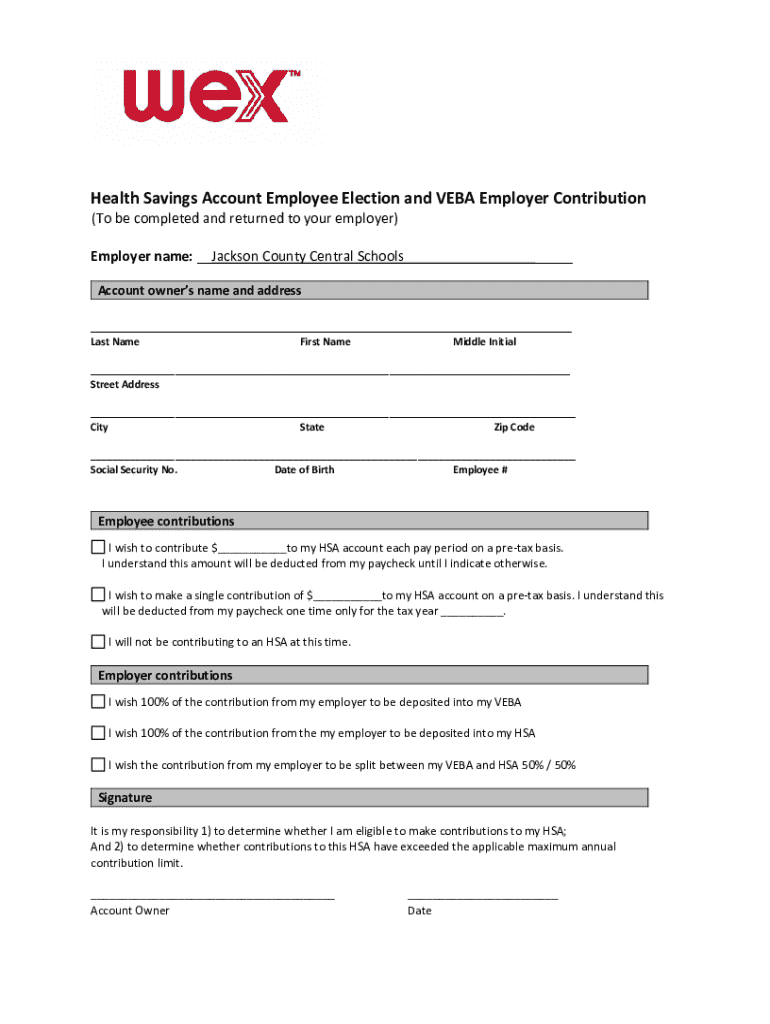

2. What is the health savings account employee form?

The Health Savings Account Employee Form is a crucial document used by employees to establish their HSAs and designate their contribution amounts. This form serves as a formal request to set up the account and provides employers with the necessary information to facilitate the process. Understanding this form is vital for employees aiming to maximize their benefits through an HSA.

The primary purpose of the Health Savings Account Employee Form is to gather information about the employee, their health plan selection, and how much they wish to contribute. This information helps employers manage payroll deductions and ensure that employees are making full use of their HSAs. Importantly, employees who are eligibility-qualified based on their health plan must fill out this form.

In general, anyone who enrolls in a high deductible health plan (HDHP) can fill out the employee form. Furthermore, employees wanting to contribute to their HSAs or adjust their contribution amounts should complete this form annually or whenever changes need to be made.

3. Step-by-step guide to completing the health savings account employee form

Filling out the Health Savings Account Employee Form correctly is essential for ensuring that your HSA is set up properly. The initial step involves preparing to fill out the form. This includes gathering necessary documentation such as personal information, insurance details, and understanding the eligibility criteria associated with your health plan.

Once you’re ready to start filling out the form, follow these detailed instructions for each section:

After completing the form, review it for accuracy. Ensure all sections are filled out and correct. Submission options typically include electronic submission through your employer’s system or mailing a physical copy to the designated department.

4. Interactive tools for managing your HSA

Using pdfFiller, employees can easily customize their Health Savings Account Employee Form. The platform provides essential features such as a PDF editor that allows users to edit forms seamlessly. This ensures that every detail is accurately represented, and it eliminates the hassle of handwritten forms that may contain errors.

Additionally, pdfFiller offers eSignature integration, making it easy for employees to electronically sign their forms without needing to print them. This feature speeds up the submission process and maintains a digital trail of all documents submitted, enhancing accountability.

Collaboration tools are also available on pdfFiller, allowing teams to manage HSAs collectively. Team members can share forms and information securely, making the management of health savings accounts a smoother experience.

5. Overview of health savings account regulations

Health Savings Accounts operate under a framework of strict federal guidelines. These regulations determine who can set up an HSA, contribution limits, and the types of expenses that qualify for tax-free withdrawals. The key point is that only individuals enrolled in a high deductible health plan can open an HSA.

It’s also essential to understand the tax implications of HSAs. Contributions made are tax-deductible, reducing your taxable income. Furthermore, withdrawals for qualified medical expenses are tax-free, making HSAs an excellent strategy for minimizing tax liabilities while covering health-related costs.

Checking for updates on the federal guidelines is crucial, as these can change annually. Keeping informed about the contribution limits and eligible expenses ensures that individuals maximize their HSA benefits effectively.

6. Frequently asked questions about health savings accounts

As you navigate your Health Savings Account, you may have several questions. Understanding what qualifies as a qualified medical expense is fundamental. Generally, these expenses include costs for doctor's visits, hospital stays, prescription medications, and preventive care services.

Another common question is whether HSAs can be carried over year-to-year. The answer is yes; unlike Flexible Spending Accounts (FSAs), HSAs do not have a 'use-it-or-lose-it' rule. This allows you to save the funds for future health expenses without the pressure of spending quickly.

Lastly, understanding the differences between HSAs, Health Reimbursement Arrangements (HRAs), and Flexible Spending Accounts (FSAs) can clarify your options. HSAs are owned by the employee, while HRAs are employer-funded and typically subject to different regulations than FSAs.

7. Customizing your HSA experience with pdfFiller

Customizing your Health Savings Account Employee Form experience is easy with pdfFiller. Utilizing ready-made templates ensures that you have the most current version of the form, avoiding any potential errors associated with outdated documents.

Moreover, pdfFiller’s cloud-based solution allows users to access their forms anytime, anywhere. This flexibility empowers employees to manage their documents and health savings accounts on their own schedule, enhancing productivity.

Security is another vital feature of pdfFiller. With data encryption and secure storage options, you can rest assured that your personal information is protected throughout the entire process.

8. Key takeaways for managing your health savings account

Managing your Health Savings Account effectively requires attention to detail and an understanding of the associated benefits. Ensure that you are knowledgeable about the contribution limits and eligible expenses to fully utilize your HSA.

Staying informed about updates to HSA policies and regulations is critical. By regularly reviewing your information, you can take full advantage of the tax benefits and savings opportunities that come with an HSA.

By using tools like pdfFiller, you can streamline the management process, making it much easier to keep track of your health-related financial planning. Empower yourself today to optimize your health savings account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in health savings account employee without leaving Chrome?

Can I create an electronic signature for signing my health savings account employee in Gmail?

How do I fill out health savings account employee on an Android device?

What is health savings account employee?

Who is required to file health savings account employee?

How to fill out health savings account employee?

What is the purpose of health savings account employee?

What information must be reported on health savings account employee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.