Get the free fec form 3 instructions

Get, Create, Make and Sign fec form 3 instructions

How to edit fec form 3 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fec form 3 instructions

How to fill out fec form 3 receipts

Who needs fec form 3 receipts?

Understanding the FEC Form 3 Receipts Form: A Comprehensive Guide

Overview of the FEC Form 3

The FEC Form 3 serves as a crucial documentation tool used in the reporting of contributions received by political committees. This form is part of the Federal Election Commission's (FEC) broader campaign finance reporting requirements, designed to ensure transparency in the political funding process. It specifically focuses on tracking receipts, thereby spotlighting how campaign finances are sourced and utilized.

Effective receipts tracking is essential, especially for electoral campaigns, as it helps maintain accountability and fosters trust among voters. These reports allow for accurate accounting of contributions and disbursements, aiding committees in adhering to federal guidelines and avoiding legal ramifications.

Key features of the FEC Form 3

The structure of the FEC Form 3 is comprehensive, requiring detailed information about each contribution received. Features include specific fields for different types of contributions, such as donations from individuals, political committees, and other organizations. Furthermore, the form's requirements help maintain consistency in data submission, which is vital for FEC review.

One of its standout features lies in its cloud-based capabilities, facilitating real-time data access and updates. Users can work on the form from any location, ensuring seamless collaboration among campaign team members. The user-friendly interface promotes efficient document management, making it easier to fill out, edit, and submit the form.

Navigating the FEC Form 3

How to access the form

Accessing the FEC Form 3 is a straightforward process. Individuals can find it available for download on the official FEC website, ensuring that the latest version is used for accurate reporting. The website provides an array of resources, including instructions, to help navigate the complexities of submission.

For added convenience, users can utilize pdfFiller. This tool allows for cloud-based edits, enabling users to fill in the form quickly, save it securely, and access it from any device at any time.

Understanding the layout

The layout of the FEC Form 3 is organized into distinct sections, each tailored to different aspects of contribution reporting. Understanding these sections is crucial; they include vital fields that need to be populated accurately. Each part plays a key role in ensuring the correct flow of data into the federal reporting system.

Filling out the form with meticulous attention to detail significantly reduces the risk of errors that can lead to compliance issues. It's essential to familiarize oneself with the form's layout, allowing for efficient data entry that follows logical sequences.

Step-by-step guide to completing the FEC Form 3 receipts section

Step 1: Gathering required information

Before starting to fill out the FEC Form 3, it’s essential to gather all necessary information. This includes identifying all sources of receipts, which may comprise donations from individuals, political committees, and even transfers from unaffiliated political committees. Organizing this data beforehand streamlines the process and ensures that no key information is overlooked.

Furthermore, understanding the types of contributions is crucial. Contributions can often be categorized into different classifications, such as cash donations, checks, or electronic transfers. Proper classification aids in accurate reporting and compliance with federal regulations.

Step 2: Entering receipt details

When entering receipt details into the FEC Form 3, accuracy is paramount. Each contribution should be listed with its corresponding value and the name of the contributor. The format of these entries is typically standardized, often requiring details such as the date of receipt, the amount contributed, and the recipient's details.

For example, a typical entry might look as follows: 'John Doe, $1,000, July 15, 2023'. Correctly following this format not only eases the review process but also helps to uphold the integrity of the documentation.

Step 3: Reviewing your entries

After populating the form, reviewing entries is a crucial step before submission. Double-check for any discrepancies or typographical errors that may compromise the integrity of the report. Utilizing a checklist can be a useful practice to ensure that all necessary fields are completed correctly.

Many common pitfalls include failing to capture contributions made in different formats or forgetting to include necessary annotations. Ensuring complete transparency in reporting prevents compliance issues and helps build trust within the campaign’s funding environment.

In-depth breakdown of FEC Form 3 schedules related to receipts

Schedule A overview: contributions from individuals

Schedule A is specifically dedicated to recording contributions received from individuals. Required fields in this section include the contributor's name, address, amount contributed, and the date of the contribution. These fields ensure adherence to federal reporting standards and transparency regarding who is funding political activities.

For electronic filing through tools like pdfFiller, it’s important to carefully input each of these details. Utilizing the platform's guided features can significantly simplify this process, ensuring accurate and compliant reporting of Schedule A entries.

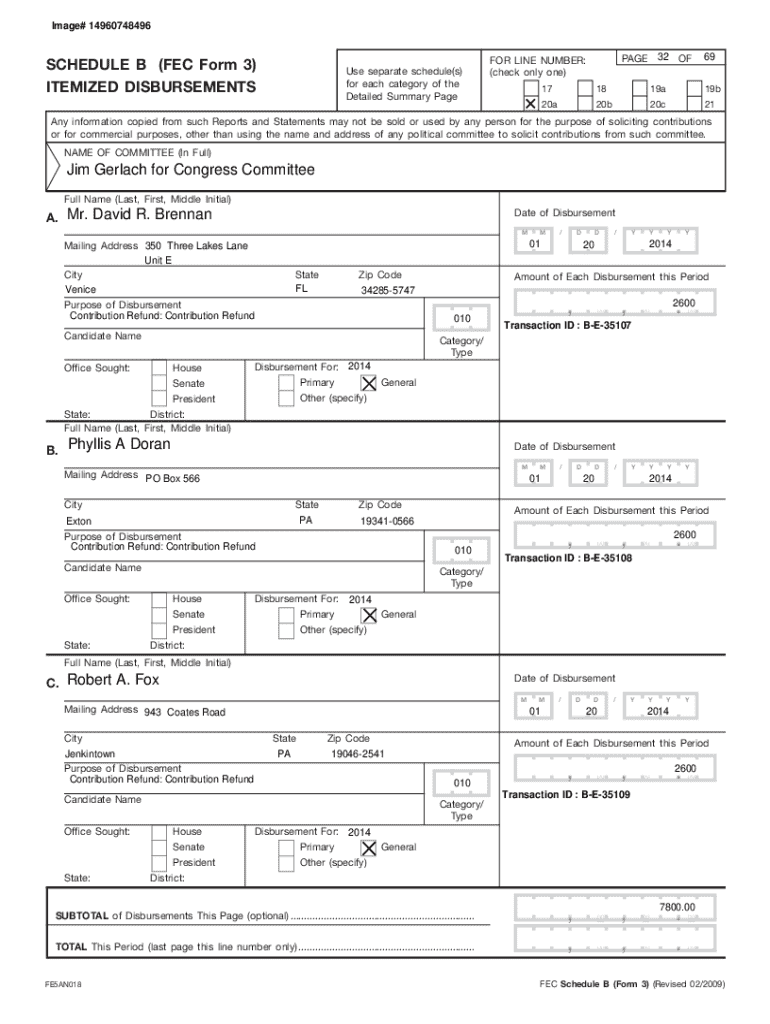

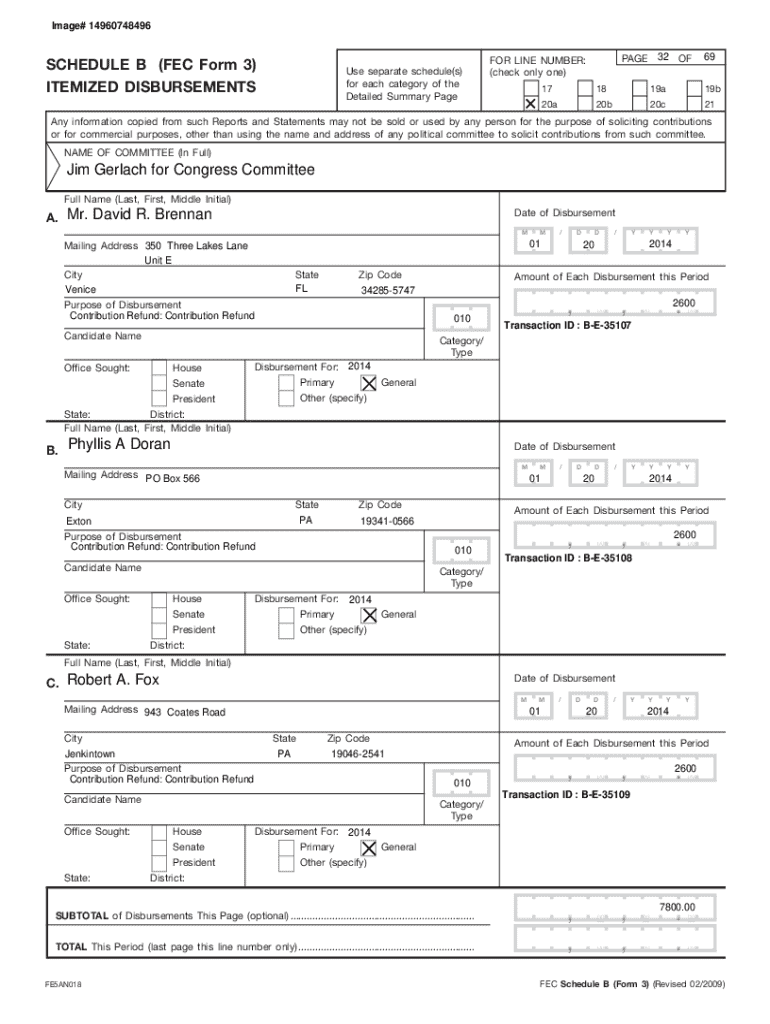

Schedule B overview: contributions from political committees

Schedule B caters to contributions received from political committees. This schedule has notable differences compared to Schedule A, primarily centered around the type and source of the contributions. Specific details required include the name of the committee, the amount, and the date.

For campaign teams, understanding these differences is crucial as accuracy in reporting affects compliance and potential penalties for errors. For example, entries may include contributions reported as 'PAC X, $2,500, August 10, 2023'.

Schedule overview: loans and lines of credit

Schedule C addresses the reporting of loans and lines of credit established by the campaign. This section is essential for distinguishing loans from regular contributions and ensures that debts incurred by the campaign are documented correctly. Required information includes the lender's name, the amount, and the repayment terms.

Getting these details right is critical, as improper reporting can lead to misinterpretations of a campaign’s financial stability and could lead to legal scrutiny.

Filing guidelines for FEC Form 3

Submission process

Submitting the FEC Form 3 electronically is a straightforward but essential process. Once you have thoroughly reviewed and completed the form, you can upload it via the FEC's online submission portal. Deadlines for filing vary depending on the timing of the election cycle, so being attentive to these dates is crucial for compliance.

Regular filing is also necessary; campaigns are often required to submit reports periodically throughout the election cycle. Keeping track of these deadlines aids in maintaining compliance and ensures that the campaign remains transparent in its financial dealings.

Maintaining compliance

Understanding FEC rules regarding contributions is paramount for any campaign team. Compliance not only mitigates the risk of penalties but also enhances the effectiveness and trustworthiness of the political campaign as a whole. Key areas to pay attention to include contribution limits, permissible sources of funding, and detailed documentation requirements.

Failure to adhere to these guidelines can result in severe consequences, including hefty fines or potential legal action. Therefore, teams should prioritize staying informed about changes in regulations and ensuring their reports reflect current practices.

Editing, signing, and managing FEC Form 3 with pdfFiller

Editing your form

With pdfFiller, editing the FEC Form 3 becomes a hassle-free task. The platform provides a range of tools designed for managing PDF documents effectively. Users can make necessary corrections, add annotations, or update data without the need for traditional printing and scanning, which can be time-consuming.

Common edits include correcting entries, adjusting dates, or incorporating signatures. The flexibility to make real-time changes ensures that the final document submitted is correct and reflects the campaign’s actual financial situation.

eSigning the document

Securing compliant electronic signatures on the FEC Form 3 is critical and easily achievable with pdfFiller. Utilizing its eSignature feature not only saves time but also ensures that your document complies with legal standards for electronic submissions.

This capability streamlines the signing process, allowing multiple team members to sign the document without needing in-person meetings. The ease of accessing the form via cloud-based services simplifies the coordination among team members.

Managing versions and access

pdfFiller enhances document security through its version management and access control features. Users can easily track changes made to the FEC Form 3, ensuring that any edits are documented and reviewable. This clarity provides greater confidence when finalizing reports for submission.

Moreover, features for team collaboration allow for streamlined communications, enabling multiple users to work on the document while controlling access. This function is invaluable for campaign teams that require ongoing adjustments to their financial reports.

Common questions and troubleshooting

Filing campaigns often run into issues with form rejection. Common reasons for rejection include incomplete submissions or discrepancies in reported figures. If your form is rejected, it is critical to review the feedback provided by the FEC and address the highlighted issues promptly.

Additionally, troubleshooting common errors on the FEC Form 3 is a proactive way to mitigate problems. Frequent mishaps include incorrect calculations, missing signatures, or failing to include necessary notes detailing transactions. To avoid these issues, establishing a checklist for completion before submission can be useful.

If assistance is required during the filing process, reaching out to the FEC’s help center can provide clarity on specific procedures and guidelines. Utilizing their expertise can help navigate the complexities surrounding campaign finance regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fec form 3 instructions in Gmail?

How do I edit fec form 3 instructions online?

How do I edit fec form 3 instructions on an Android device?

What is fec form 3 receipts?

Who is required to file fec form 3 receipts?

How to fill out fec form 3 receipts?

What is the purpose of fec form 3 receipts?

What information must be reported on fec form 3 receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.