Get the free Tax Information and Assistance: Tax Forms

Get, Create, Make and Sign tax information and assistance

Editing tax information and assistance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax information and assistance

How to fill out tax information and assistance

Who needs tax information and assistance?

Tax Information and Assistance Form: A Comprehensive How-to Guide

Understanding the tax information and assistance form

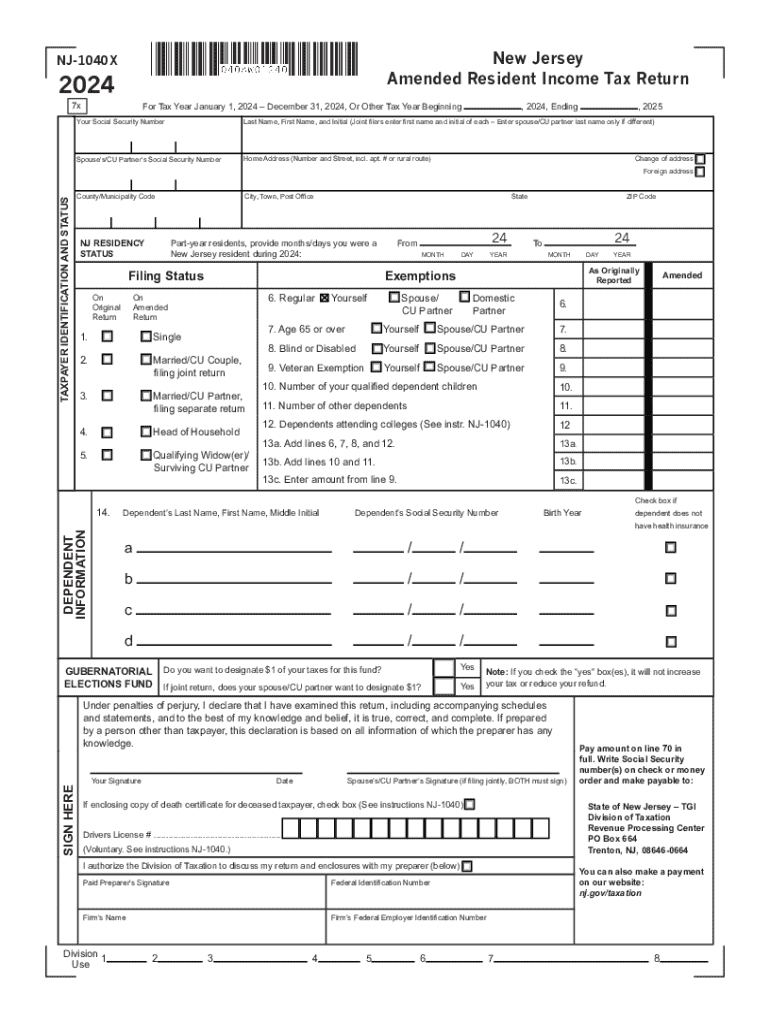

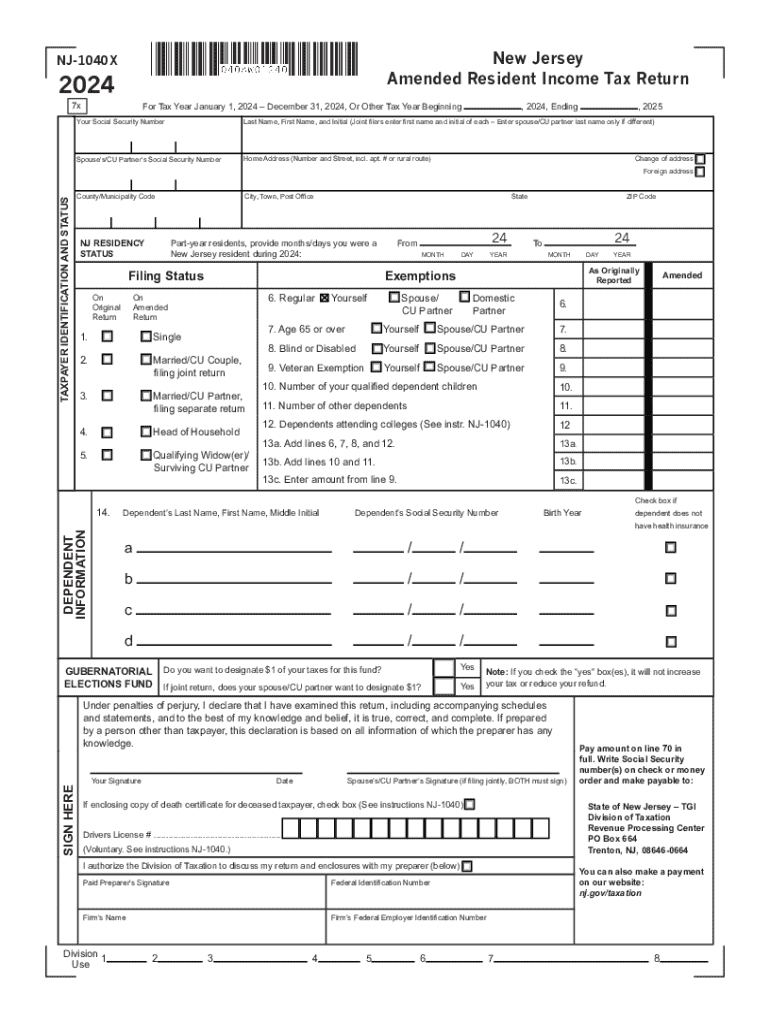

The Tax Information and Assistance Form is a crucial document designed to collect relevant information from individuals and teams seeking tax assistance. Its primary purpose is to provide tax authorities or assistance programs with necessary details to facilitate accurate processing of tax-related queries or claims. Accurate tax information is vital not only for ensuring compliance with local, state, and federal regulations but also for optimizing potential tax benefits for applicants.

This form is essential for a wide range of users. Individuals who may need assistance with their taxes, whether due to complicating factors like disability status or simply due to a lack of experience in navigating complex tax laws, must submit this form. Likewise, teams or organizations may also find themselves in situations where tax assistance is directly relevant, particularly when they are dealing with multiple employees or have specific projects that incur significant tax implications.

Key components of the tax information and assistance form

Understanding the structure of the Tax Information and Assistance Form is fundamental for successful completion. The form typically breaks down into several sections, each focusing on different categories of information. The Personal Information section collects basic identity data, ensuring that the tax assistance is linked correctly to the applicant. Next comes the Income Details section, where applicants must accurately report their income from various sources, such as wages, self-employment, or government benefits.

Another critical component is the Deductions and Credits section, where applicants can identify potential tax benefits they may qualify for, thus reducing their overall tax burden. To support these claims, specific attachments like proof of income, disability applications, and relevant county office documentation should accompany the form. Common mistakes to avoid in this section include failing to double-check figures and omitting attachments, both of which can lead to delays or denials in assistance.

Step-by-step guide to completing the form

Completing the Tax Information and Assistance Form requires an organized approach. The first step is gathering all required information and documentation, which may include recent tax returns, W-2 forms, or disability status documentation. Having everything on hand will streamline the process and reduce the risk of oversight.

Step two involves filling out each section meticulously. Start with the Personal Information section; it’s vital to check that your name and identification numbers are correct. For income reporting, ensure that you capture all relevant sources accurately, and when claiming deductions, be thorough in documenting eligibility and attaching necessary proofs. Finally, reviewing the form is crucial—cross-check information against your documents to ensure consistency and accuracy.

Tips for editing and improving your submission

Utilizing pdfFiller tools can significantly enhance the quality of your form submission. Before finalizing the document, take advantage of its editing features to enhance clarity and ensure all information is presented neatly. This includes adjusting text alignment, font size, and using annotations to highlight important details.

Collaboration features within pdfFiller are also beneficial. You can invite team members to review the form, allowing for collective input and feedback. This step not only improves the accuracy of your submission but also ensures that different perspectives help refine the final document before submission. Engaging multiple team members can uncover errors or improve content clarity.

eSigning the tax information and assistance form

eSigning the Tax Information and Assistance Form is essential for ensuring its legal validity. Electronic signatures hold the same legal standing as traditional handwritten signatures, streamlining the submission process. By using pdfFiller for this step, users can securely sign their documents digitally, which expedites the overall process.

To eSign using pdfFiller, follow a straightforward step-by-step process: open the document, navigate to the eSignature tool, and apply your signature as prompted. Make sure that the form complies with all local regulations and is encrypted for security purposes. Each of these measures reinforces the integrity of your submission and protects personal data.

Frequently asked questions (FAQs)

After submitting your Tax Information and Assistance Form, you might encounter questions or issues. One common concern is what to do if a mistake is discovered post-submission. Most tax authorities allow corrections to be made, but prompt action is essential to mitigate any potential penalties. Additionally, tracking the status of your form can typically be done via online portals or by contacting the relevant office.

Common issues applicants face include missing information or late submissions. If you find yourself in such situations, there are troubleshooting steps available, such as checking the status online or reaching out for additional assistance through the appropriate channels. Familiarizing yourself with these aspects can save time and reduce anxiety during tax season.

Managing your documents on pdfFiller

Organizing your completed forms in pdfFiller is crucial for efficient document management. Best practices for digital file management include creating well-labeled folders for different types of forms, using clear naming conventions, and regularly backing up documents in a secure location. Having this structure in place can make accessing your forms much easier during tax season.

The cloud-based benefits of pdfFiller further enhance this experience. Being able to access documents from anywhere eliminates worries about losing paper files. You can also collaborate effectively with team members, ensuring that all necessary stakeholders have input and access to vital tax-related information.

Seeking further assistance

When further assistance is needed, various resources are available. pdfFiller provides customer support avenues including chat and email for any document-related inquiries. Additionally, community forums can offer peer support and answers to frequently encountered problems, thus fostering a collaborative environment for users.

If situations become complex, considering the option of hiring a tax professional may be prudent, particularly for those with complicated financial circumstances or who have questions about specific deductions related to disability status or multifaceted tax liabilities. This professional guidance can ensure you receive the maximum benefits available through tax assistance programs.

Conclusion: Simplifying your tax process with pdfFiller

The Tax Information and Assistance Form is a pivotal part of the tax process for many individuals and teams, and utilizing a platform like pdfFiller significantly simplifies the workflow. From initial information gathering to eSigning and managing submissions digitally, pdfFiller presents a comprehensive solution that streamlines every step.

As tax season approaches, empowering yourself with the tools and methods outlined in this guide can enhance your efficiency and accuracy. Leveraging pdfFiller not only aids in completing the Tax Information and Assistance Form but also promotes a more organized and less stressful approach to tax management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my tax information and assistance in Gmail?

How do I edit tax information and assistance straight from my smartphone?

How do I complete tax information and assistance on an Android device?

What is tax information and assistance?

Who is required to file tax information and assistance?

How to fill out tax information and assistance?

What is the purpose of tax information and assistance?

What information must be reported on tax information and assistance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.