Get the free E 9 ST

Get, Create, Make and Sign e 9 st

Editing e 9 st online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e 9 st

How to fill out e 9 st

Who needs e 9 st?

E 9 ST Form: A Comprehensive How-to Guide

Understanding the E 9 ST Form

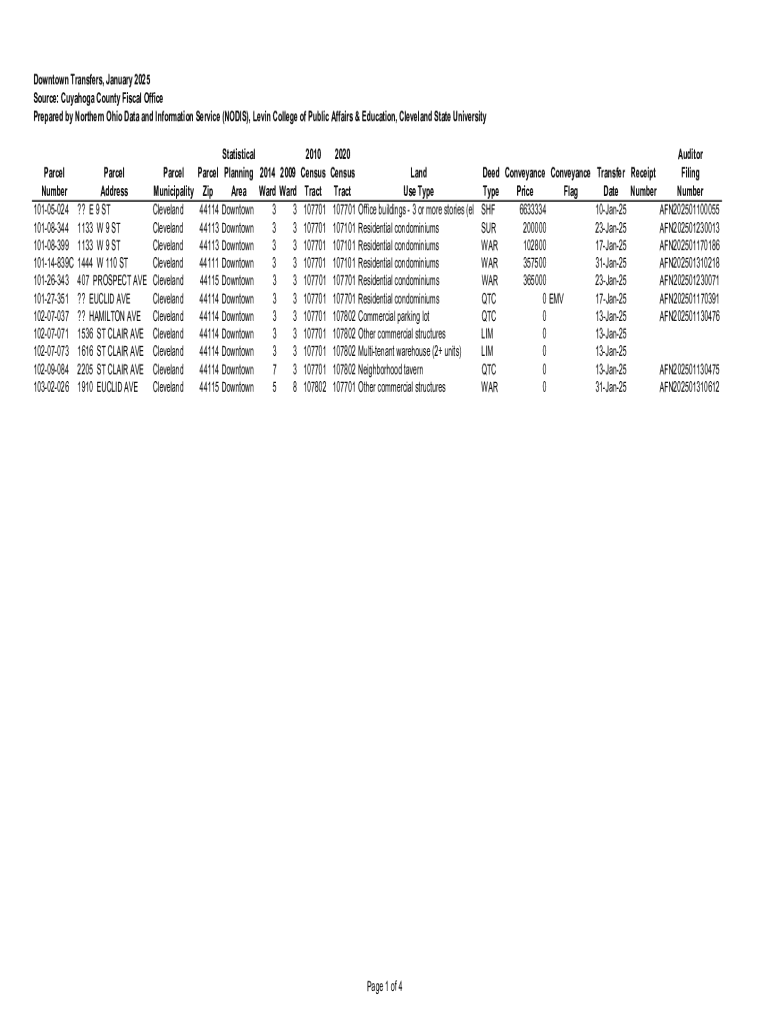

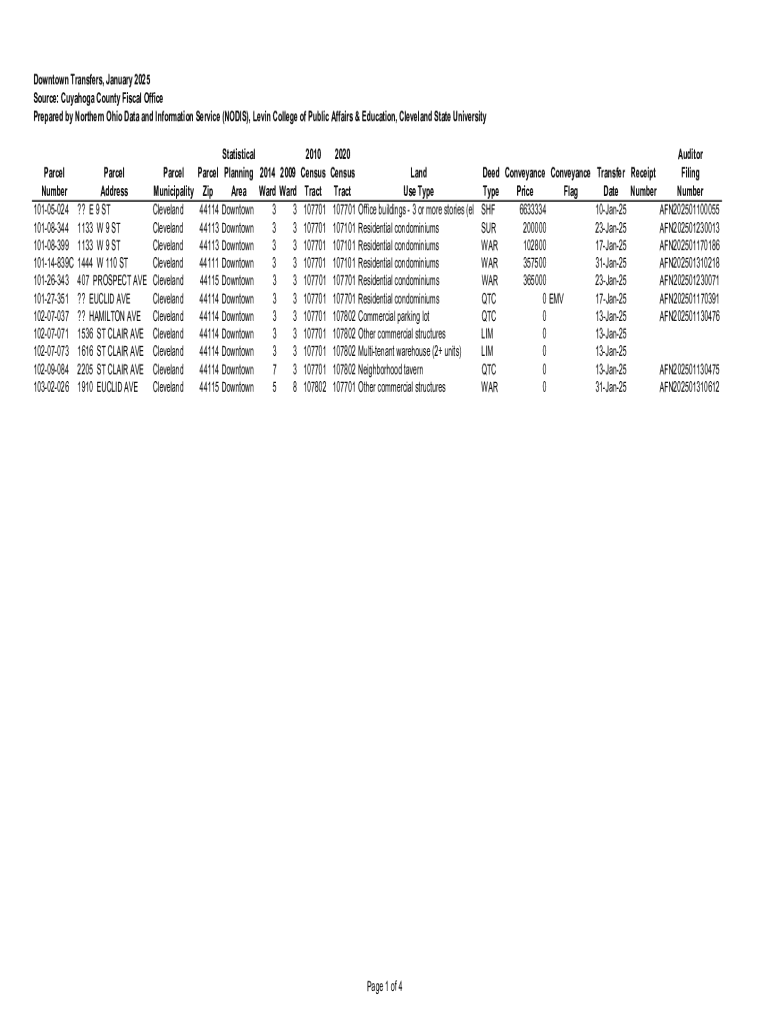

The E 9 ST Form is a vital document used predominantly in the financial and tax reporting sectors. Its primary purpose is to collect and report essential taxpayer information, especially in cases concerning tax exemption claims. Understanding this form is crucial for individuals and businesses seeking to comply with tax regulations and optimize their tax obligations.

The E 9 ST Form is typically required in situations revolving around tax-exempt transactions, such as sales of goods and services to qualified entities. Without this form, businesses risk inaccurate reporting and potential tax liabilities. Therefore, knowing when and how to file the E 9 ST Form is integral to reliable financial management.

Key features of the E 9 ST Form

This form includes several essential fields that capture necessary information, including the taxpayer's name, address, identification number, and the nature of the exemption. It’s vital to fill out each section meticulously, ensuring that all data is accurate and complete. Missing or incorrect fields can lead to processing delays and compliance issues.

One of the common mistakes people make is neglecting to double-check their information before submission. Errors in the identification number or misinterpretation of exemption criteria can cause significant headaches. Familiarizing oneself with the form's requirements can significantly reduce these issues.

Interactive tools for E 9 ST Form completion

Utilizing an online fillable E 9 ST Form can enhance your experience and ensure greater accuracy. Accessing the form online allows users to input their information directly, making it easier to spot errors and make adjustments in real-time. A straightforward search on pdfFiller will guide you to the interactive form.

The benefits of using such tools are manifold. They not only simplify document management but also offer instant saving features, preventing loss of data. Additionally, online tools often come equipped with prompts and tips to help guide users through each section.

PDF editing capabilities

For those who prefer to edit the document in PDF format, pdfFiller provides excellent capabilities to customize your E 9 ST Form. Editing with pdfFiller is intuitive; users can modify existing information, add comments, and annotate important sections without complicated procedures.

To enhance clarity, consider using pdfFiller’s tools to highlight essential sections or to add explanations if you're sharing the document with others. Clear communication is vital, especially when dealing with complex forms like the E 9 ST Form.

Filling out the E 9 ST Form

Filling out the E 9 ST Form is straightforward when you break it into sections. Begin with the personal information section by providing your name, address, and identification number. Ensure that this data matches other official documents to avoid inconsistencies.

Next, delve into the financial information segment, which may require details on your income, expenses, and exemptions claimed. It's critical to remember that accurate financial reporting can have a direct impact on the approval of your exemptions. Keep documentation handy to validate your claims if necessary.

Before submission, follow a checklist to ensure completeness and accuracy. Confirm that every required field is filled correctly, and that your form complies with any local regulations.

Signing and submitting the E 9 ST Form

eSigning the E 9 ST Form can be easily accomplished through pdfFiller's simple interface. Creating a digital signature is hassle-free; users can draw, type, or upload their signature and place it directly on the document. This digital approach offers convenience without sacrificing the legality of the document.

The legal validity of eSignatures is recognized in many jurisdictions, allowing you to submit your form confidently. When it comes to submission methods, users can opt for electronic submission or physical mailing. Each method comes with its timelines and potential notifications regarding processing, so choose what best suits your needs.

Managing your E 9 ST Form

Once you've completed and submitted the E 9 ST Form, maintaining version control is imperative. Tracking changes made to your form ensures that you can refer back to previous versions if needed. pdfFiller’s platform allows users to retain a record of modifications, providing peace of mind in document management.

Cloud-based storage solutions, like those provided by pdfFiller, offer tremendous benefits as well. Not only does storing your document in the cloud prevent data loss, but it also grants you access from any device, enabling flexibility and mobility. Your important files are just a click away, no matter where you are.

Troubleshooting common issues

Users frequently encounter issues when entering incorrect information or failing to follow submission guidelines. If there's a discrepancy with your E 9 ST Form, here are a few tips to troubleshoot: always verify your data and consult the guidelines provided on pdfFiller's platform.

Submission failures can also occur; if your form doesn't upload or processes incorrectly, check your internet connection and ensure the file is not corrupted. If problems persist, reaching out to support is advisable. pdfFiller’s customer service can assist you in resolving issues that remain unresolved.

Enhancing document management with pdfFiller

pdfFiller includes various collaborative features, making it ideal for teams working on the E 9 ST Form. Real-time editing ensures that everyone involved can contribute simultaneously and provide immediate feedback. This functionality streamlines the process and enhances overall productivity.

Additionally, group signing options allow multiple stakeholders to sign the document without physical meetings, thus saving time and resources. Tracking document progress through notifications means you can monitor your form's status and ensure timely completion of all tasks involved.

Legal considerations and compliance

Understanding the legal framework surrounding the E 9 ST Form is essential for ensuring compliance. Familiarizing yourself with federal regulations that govern tax exemption is an important step in the process. This understanding can protect you from potential legal troubles and ensure proper reporting.

Privacy and security measures are also key aspects when handling sensitive documents like the E 9 ST Form. pdfFiller adheres to stringent standards to secure your information, making it a reliable choice for document management. Compliance with federal regulations not only fosters trust but also safeguards your data from unauthorized access.

User experiences and testimonials

Feedback from users indicates that navigating the E 9 ST Form process is significantly easier when using pdfFiller. Many users highlight how the platform simplifies not only the completion of forms but also makes the submission process straightforward and efficient.

Case studies reveal that teams utilizing pdfFiller for document management have achieved smoother workflows and significantly reduced processing times. Users appreciate the ability to collaborate in real-time and the transparency it provides in tracking document progress.

Staying updated with changes

Monitoring for alerts and announcements regarding updates to the E 9 ST Form is crucial for compliance. Staying informed about regulatory changes means you can adapt your approach quickly, ensuring that your submissions meet any new requirements without delay.

Sign up for notifications through pdfFiller to receive updates directly related to the E 9 ST Form. This proactive approach allows users to remain ahead of any changes, enhancing their compliance readiness.

How to provide feedback and help improve this guide

User engagement is crucial for improving the quality of resources like this guide. If you have additional insights or suggestions based on your experience with the E 9 ST Form, consider reaching out to us. Feedback not only helps enhance this document but also benefits future users.

Your input can drive continuous improvement in the coverage of content related to important documents like the E 9 ST Form. We invite you to share any ideas for further resource enhancements, ensuring everyone has access to the most effective information possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my e 9 st in Gmail?

Can I sign the e 9 st electronically in Chrome?

How can I edit e 9 st on a smartphone?

What is e 9 st?

Who is required to file e 9 st?

How to fill out e 9 st?

What is the purpose of e 9 st?

What information must be reported on e 9 st?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.