Get the free Published January 1, 2026

Get, Create, Make and Sign published january 1 2026

Editing published january 1 2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out published january 1 2026

How to fill out published january 1 2026

Who needs published january 1 2026?

Published January 1, 2026 Form: Your Ultimate Guide

Overview of the 2026 form

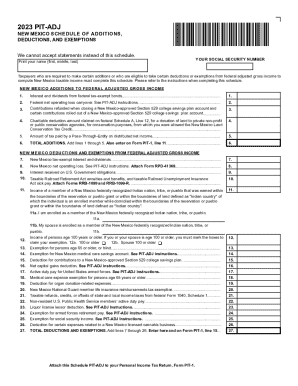

The published January 1, 2026 form introduces a series of vital updates that significantly enhance the experience for users navigating regulatory submissions. Notably, this new version includes refined guidelines that adapt to the evolving needs of individuals, workers, and tax filers, ensuring compliance with the latest tax regulations, particularly concerning income limits and tax credits.

With the emphasis on clarity and ease of use, the form's design is user-friendly. Key features include improved document handling processes, making it easier for couples and individuals to gather the necessary information quickly and accurately. Navigating the new guidelines is essential in successfully claiming provisions such as retirement account contributions and tax credits, which are integral for maximizing potential benefits.

Navigating the new 2026 form

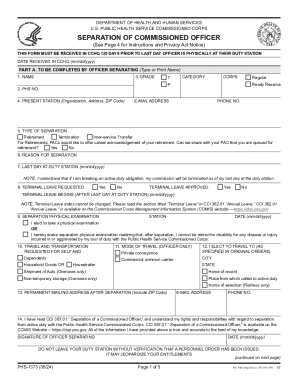

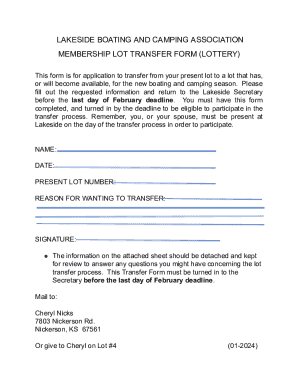

Understanding the intricacies of the 2026 form is crucial for successful completion. The form includes various sections, each designed to collect specific information relevant to your financial situation. Key sections range from personal information to compliance details, which ensure all necessary data is provided for accurate processing.

An essential feature of the form is its breakdown into required and optional segments. Knowing which fields are mandatory can prevent delays in processing your submission. Optional sections may allow tax filers to provide additional information that could bolster their claims for tax credits and retirement savings contributions, thus maximizing their financial benefits.

Step-by-step instructions for filling out the form

Before diving into the form, it’s crucial to gather all necessary documents including tax returns, income statements, and any relevant account information. This preparatory step streamlines the form completion process and minimizes errors that could lead to delays. With these documents on hand, users can confidently navigate through each section.

Starting with Section 1, personal information must be entered accurately. It's vital to cross-check details such as names and social security numbers to avoid unnecessary corrections later on. Section 2 tackles financial information where individuals need to provide insights into income levels and potential tax credits available, emphasizing the importance of being thorough to ensure all applicable provisions are claimed.

Finally, in Section 3, compliance and verification details must be meticulously filled out. This section often requires corroboration of the information provided in earlier sections and may involve documentation of retirement account contributions or verification of income limits. Here are some handy tips for avoiding common pitfalls:

Editing and customizing your form

Once the initial form is filled out, making edits is straightforward with pdfFiller’s robust tools. Users can easily modify text, adjust fields, and enhance the form's appearance to suit their needs. This flexibility allows for customized submissions tailored to individual circumstances, which can be especially beneficial when claiming specific tax credits or submitting information for retirement account contributions.

Moreover, pdfFiller supports collaboration by enabling users to invite team members or partners to review and edit the document. This interactive feature ensures that all input from relevant parties is accounted for, leading to a more comprehensive submission. Valuing team feedback can contribute to clearer documentation, which can be pivotal when meeting compliance standards.

eSigning the 2026 form

The signing process is an integral part of submitting the 2026 form and pdfFiller offers a secure eSigning solution that simplifies this final step. Understanding the importance of secure eSigning is key as it ensures the legitimacy of your submission and protects your personal information. The platform's signature functionality allows for quick, authenticated eSigning without the need for physical paperwork.

To complete your signature, simply follow these easy steps: access the eSignature feature within pdfFiller, select your preferred signing method, and apply your signature. Additionally, if applicable, you may also need to accommodate witness signatures, which can be managed directly through the platform, ensuring all compliance requirements are met seamlessly.

Managing your completed form

Once the form is completed and signed, managing it effectively is the next crucial step. Saving and storing your form securely can prevent loss and unauthorized access. pdfFiller provides built-in cloud storage features, allowing users to safely keep documents organized for easy retrieval in the future. This is particularly important for maintaining access to essential documentation for tax purposes.

Furthermore, sharing your completed form with relevant stakeholders or agencies is effortless. The platform allows users to email documents directly or export them in various formats, including PDF, Excel, or Word. This versatility ensures that you can distribute the document in a manner that suits the needs of the recipients, making it easier to facilitate discussions or clarify details if required.

Frequently asked questions about the 2026 form

As with any regulatory update, the release of the 2026 form has generated numerous inquiries from users seeking clarity. Common questions often focus on submission deadlines, the implications of missed submissions, and the best methods to ensure compliance when using tools like pdfFiller. It's essential to stay informed about these elements to prevent uncertainty and guarantee that all regulations are adhered to.

Additionally, technical questions about pdfFiller's platform capabilities frequently arise. Users may wonder how to access support, troubleshoot technical issues, or utilize specific features that enhance their document management experience. Addressing these inquiries is vital for empowering users to fully leverage the platform and effectively manage their 2026 form.

Future trends in form management for 2026 and beyond

Looking ahead, the landscape of form management is poised for significant transformation. Anticipated legislative adjustments may implement new requirements for documents like the 2026 form, thereby affecting how tax credits, retirement savings contributions, and compliance are handled. Staying abreast of these potential changes is essential for individuals and teams who wish to navigate new regulations effectively.

Additionally, the role of technology in streamlining document management cannot be overstated. Innovations in cloud-based platforms like pdfFiller will likely continue to evolve, providing users with increasingly sophisticated tools for editing, signing, and managing forms. This evolution is not just about efficiency; it signifies a broader shift toward embracing digital solutions that enhance compliance and ease of use in form submissions.

User experiences and testimonials

The real value of document management tools often lies in user experiences. Case studies have illustrated how pdfFiller has revolutionized document handling for many individuals and teams. Users report success stories where seamless collaboration on forms has led to quicker resolutions of financial matters and improved compliance with regulatory standards.

By sharing their experiences with pdfFiller, users shed light on the platform’s capabilities in promoting an efficient workflow. Testimonials reveal that features such as real-time collaboration, easy editing, and secure eSigning have not only simplified the process of completing forms but have also empowered users to take control of their document management needs.

Leveraging pdfFiller for all document needs

pdfFiller stands out as a comprehensive suite for all document creation and management activities. Users can access a wide range of features, ensuring a seamless workflow from filling out the published January 1, 2026 form to managing various other documents. Its cloud-based accessibility means that individuals and teams can collaborate and edit from anywhere, significantly enhancing productivity.

With features that offer detailed insights into document status, customization options for forms, and collaborative tools, pdfFiller is equipped to meet diverse user needs. This positions it as an essential tool for anyone aiming for a streamlined document handling experience, marking it as an invaluable resource for modern document management challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit published january 1 2026 from Google Drive?

How do I fill out published january 1 2026 using my mobile device?

How do I complete published january 1 2026 on an iOS device?

What is published January 1, 2026?

Who is required to file published January 1, 2026?

How to fill out published January 1, 2026?

What is the purpose of published January 1, 2026?

What information must be reported on published January 1, 2026?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.