Get the free DeKalb County Tax Commissioner's Office

Get, Create, Make and Sign dekalb county tax commissioner039s

Editing dekalb county tax commissioner039s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dekalb county tax commissioner039s

How to fill out dekalb county tax commissioner039s

Who needs dekalb county tax commissioner039s?

The Complete Guide to Dekalb County Tax Commissioner’s Form

Overview of Dekalb County Tax Commissioner’s Form

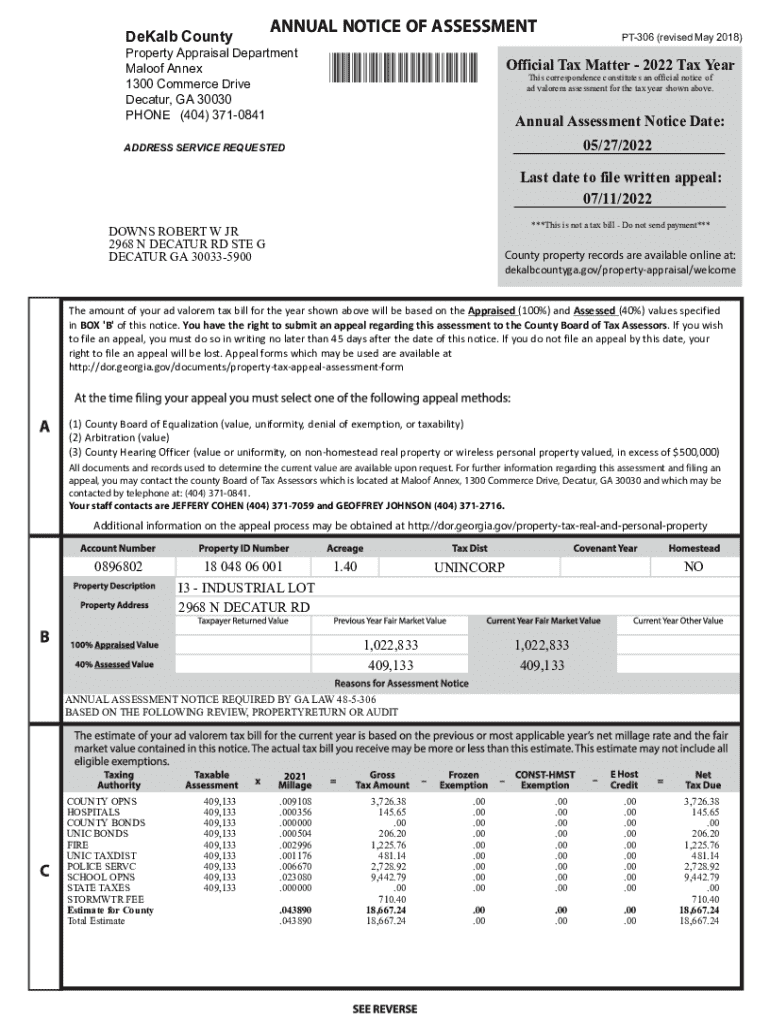

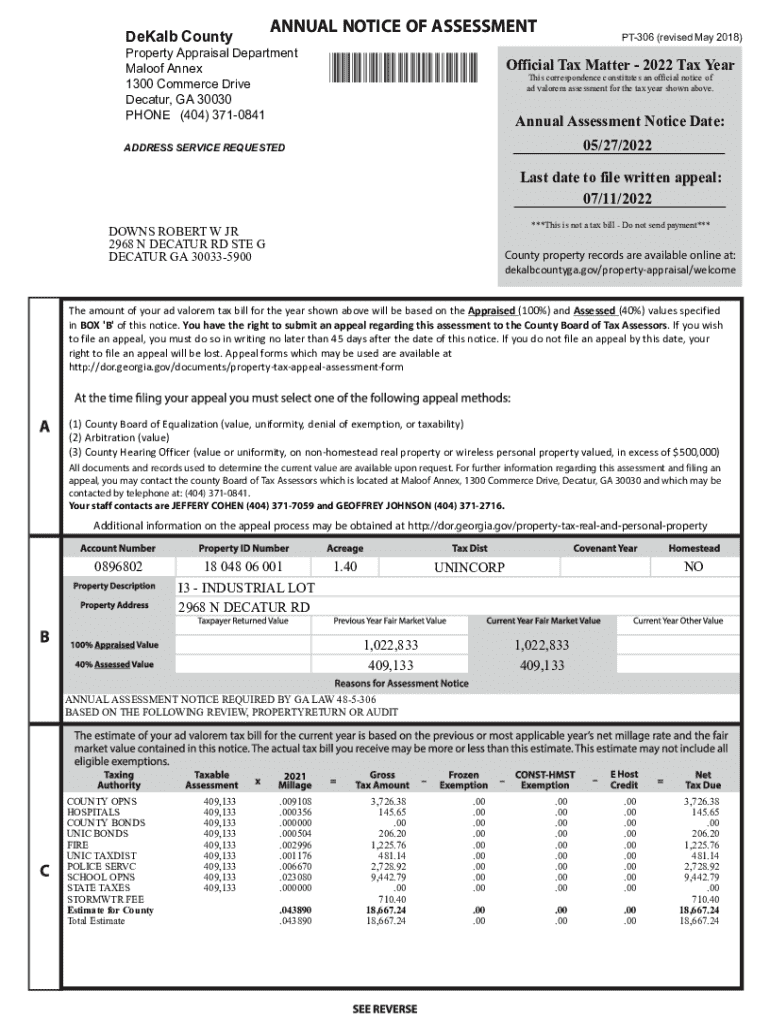

The Dekalb County Tax Commissioner’s Form is integral to managing property taxes within the county. It serves multiple purposes, including application for tax exemptions, reporting property taxes, and requesting payment plans. This form is essential not only for compliance but also for maximizing tax benefits available to homeowners and businesses.

Understanding who needs to utilize the Tax Commissioner’s Form is vital. Homeowners using the form can benefit significantly from property tax exemptions, while businesses may need to report taxes accurately to avoid penalties. Real estate professionals often utilize the form in their dealings to assist clients in claiming exemptions and managing tax obligations.

Understanding the Dekalb County Tax Commissioner’s Responsibilities

The role of the Dekalb County Tax Commissioner is multi-faceted and crucial for the community's financial health. The office handles three main functions: assessing property values for tax purposes, collecting the corresponding taxes, and maintaining accurate tax records. Each of these responsibilities is interconnected with the information provided on the Tax Commissioner’s Form.

By submitting the Tax Commissioner’s Form, individuals and entities contribute to the overarching goal of fair taxation, ensuring that all properties are assessed appropriately. This process not only supports local government operations but also fosters a sense of accountability among property owners.

Typology of Dekalb County Tax Commissioner’s Forms

There are several types of forms managed by the Tax Commissioner’s office, each tailored for specific needs: property tax exemption applications, tax return forms, and payment plans or installment agreements. Understanding the specific function of each form is critical for effective tax management.

For instance, the property tax exemption application enables eligible homeowners to reduce their tax burden significantly, while the tax return form is necessary for reporting accurate figures to the county. Payment plan forms are vital for those who wish to structure their payments over time rather than in a lump sum.

How to Access the Dekalb County Tax Commissioner’s Form

Accessing the Dekalb County Tax Commissioner’s Form online is straightforward. The first step is to navigate to the official Dekalb County Tax Commissioner’s website, where all forms and resources are housed. On the homepage, users can locate the necessary forms through the correct category based on their needs.

Once you find the right section, you can download the desired form in PDF format. This digital access not only saves time but also offers the flexibility of completing and submitting the form online when necessary, especially for tech-savvy users.

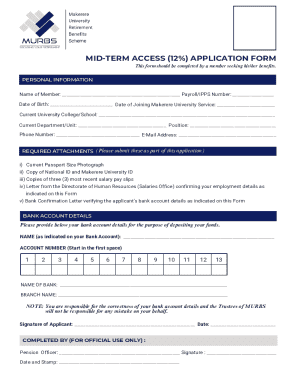

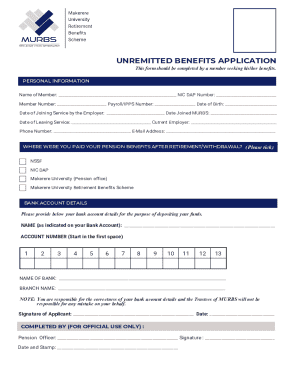

Filling out the Dekalb County Tax Commissioner’s Form

Completing the Dekalb County Tax Commissioner’s Form accurately is crucial for smooth processing. The form typically includes sections such as personal information, property details, and any applicable special exemptions. For the personal information segment, both the homeowner’s details and pertinent financial disclosures need to be provided clearly.

In the property information section, accuracy is key—ensuring that property details such as identification numbers and descriptions are listed correctly can prevent delays or issues. Additionally, identifying eligibility for any special exemptions can significantly impact the overall tax liability.

Common mistakes include leaving fields incomplete, miscalculating figures, and submitting incorrect supporting documents—paying careful attention when filling out the form can mitigate these risks.

Submitting the Dekalb County Tax Commissioner’s Form

Once the form is filled out, it’s time to submit it. There are several submission methods available to residents of Dekalb County. An increasingly popular option is online submission through the pdfFiller platform, which allows for seamless electronic filing of documents.

For those preferring traditional methods, mailing the completed form is also viable. Ensure that the correct mailing address is used and appropriate postage is applied. In-person submissions can also be done at the Tax Commissioner’s office, where it’s essential to bring any necessary documents along with the form.

Tracking the status of your submission

After submission, tracking the status of your Dekalb County Tax Commissioner’s Form is essential to ensure processing has commenced. Many users opt to use tracking tools available on the pdfFiller platform, which offer a reliable way to monitor the status of submissions.

Typical processing times can vary, and it’s advisable to familiarize yourself with these timelines. If any delays occur, knowing how to address these issues promptly can minimize potential complications.

Managing your Dekalb County tax documents

Keeping tax documents organized is an essential practice that can save time and stress. Utilizing pdfFiller to store submissions and receipts ensures that users have easy access to their tax documents at all times. This form of organization facilitates quick retrieval when preparing future submissions or addressing any issues that may arise.

Moreover, it’s critical to know how to amend submitted forms if errors are detected after submission. PdfFiller offers options for editing documents efficiently, along with features that enable collaboration with team members or advisors—streamlining the process even further.

Frequently asked questions (FAQs)

As users navigate the process of filling out the Dekalb County Tax Commissioner’s Form, several common questions arise. One of the most frequent queries involves what to do if there’s a mistake on the form. In such cases, it’s recommended to contact the Tax Commissioner’s office directly for guidance on amending your submission.

Another common concern relates to how one can appeal a tax assessment. Understanding the appeals process is crucial for those who believe their property has been misvalued. Finally, users often inquire about which documents need to be attached when submitting the form, so it’s beneficial to double-check the requirements beforehand.

User testimonials & case studies

Many individuals have successfully navigated the complexities of the Dekalb County Tax Commissioner’s Form with the assistance of pdfFiller. Users have praised the platform for its straightforward interface and effective tools for managing documents. For instance, one homeowner shared how easy it was to apply for a tax exemption using the form's features, while a local business owner noted the efficiency of electronic submission.

Real-life case studies illustrate how pdfFiller has facilitated smoother experiences with document management, demonstrating the platform's ability to enhance user engagement and efficiency while dealing with vital tax-related forms.

Conclusion: maximizing your experience with the Dekalb County Tax Commissioner’s Form

Effectively handling the Dekalb County Tax Commissioner’s Form requires a comprehensive understanding of the form's purpose, types, and submission methods. By leveraging the innovative features of pdfFiller, users can ensure a seamless experience—from filling out to tracking their forms.

This guide serves as an essential resource for individuals and teams looking to optimize their document workflows, reducing the stress associated with tax submissions while maximizing potential benefits. By utilizing these insights, you can approach the Dekalb County Tax Commissioner’s Form with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dekalb county tax commissioner039s to be eSigned by others?

Where do I find dekalb county tax commissioner039s?

Can I sign the dekalb county tax commissioner039s electronically in Chrome?

What is dekalb county tax commissioner039s?

Who is required to file dekalb county tax commissioner039s?

How to fill out dekalb county tax commissioner039s?

What is the purpose of dekalb county tax commissioner039s?

What information must be reported on dekalb county tax commissioner039s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.