Get the free Year Tax Year

Get, Create, Make and Sign year tax year

Editing year tax year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out year tax year

How to fill out year tax year

Who needs year tax year?

A comprehensive guide to year tax year forms

Understanding year tax year forms

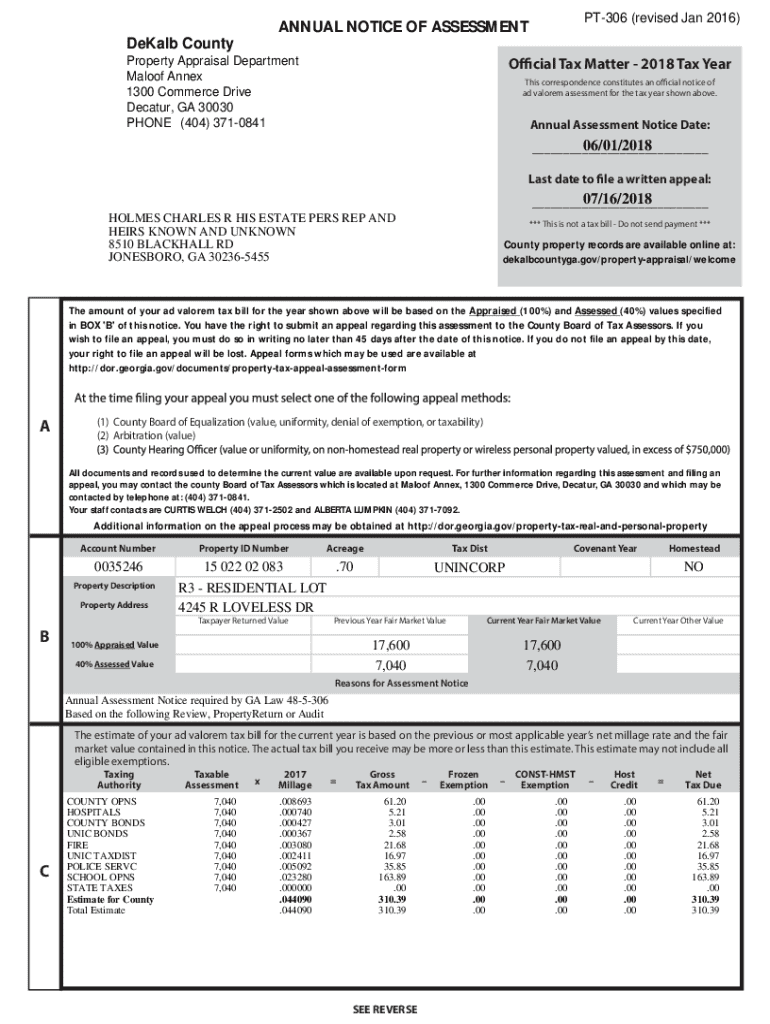

Year tax year forms are essential documents used for reporting income, deductions, and credits to the Internal Revenue Service (IRS) and state tax authorities. These forms serve as a standardized means for individuals and businesses to comply with tax laws and meet their financial obligations. Every taxpayer must understand how to fill these forms accurately to avoid potential legal issues and ensure proper tax payment.

The importance of year tax year forms cannot be overstated. They are not just a legal requirement; they also play a critical role in personal and corporate financial planning. Failure to submit these forms correctly can lead to significant penalties, including tax violations, which might require legal intervention. Understanding what types of forms are needed will help streamline the tax preparation process.

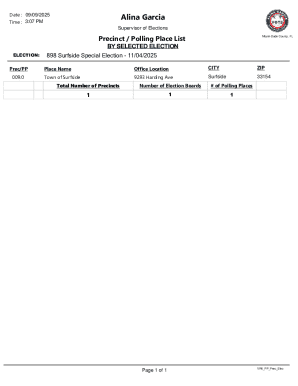

Key dates and deadlines

Each tax year follows a specific timeline for submission. Generally, the tax year aligns with the calendar year, running from January 1 to December 31. Taxpayers must be aware of key submission deadlines to avoid unnecessary stress and penalties. A thorough understanding of these dates is crucial for effective financial planning.

Filing dates for most individuals are set for April 15 of the following year. However, if that date falls on a weekend or holiday, the due date may shift, which can cause confusion. For businesses, deadlines can vary based on the type of entity. Extensions can be filed to allow additional time, but even with extensions, taxes owed must still be paid by the original filing date.

Missing these deadlines can lead to late fees, interest, and potential audits. Understanding these dates enables taxpayers to plan their finances and avoid unwanted complications.

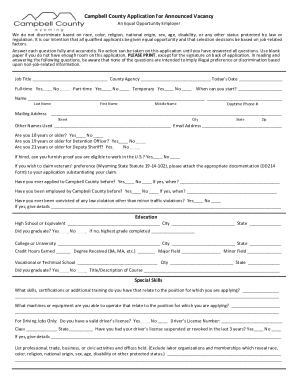

Step-by-step guide to filling out year tax year forms

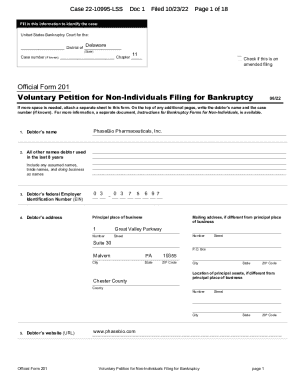

Filling out year tax year forms requires careful preparation and organization. The first step involves gathering necessary information, which is crucial for an accurate and efficient filing process. This includes all personal details, income documentation such as W-2 and 1099 forms, and relevant deductions and credits that apply to your situation. Missing information can lead to significant errors and potential delays or audits.

Next, familiarize yourself with the form layout. Each year tax year form has different sections to fill out, some of which are often overlooked. Understanding how to navigate the form layout is vital to ensure nothing is left incomplete. Reviewing the form systematically is advisable.

When it comes to completing the form accurately, there are several practical tips that can help. Ensure every piece of information is double-checked and be wary of common errors like mismatched Social Security numbers or incorrect income entries. Utilizing technology, such as the tools provided on the pdfFiller platform, can significantly enhance the accuracy of your submissions.

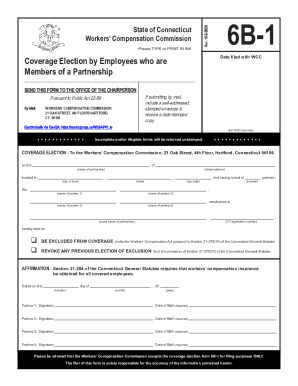

Editing and managing your year tax year forms

Editing year tax year forms can often be a challenge, especially if you are dealing with multiple revisions. pdfFiller offers an array of editing tools that make this process straightforward. To start, you need to upload your document to the pdfFiller platform, where editing becomes intuitive and user-friendly.

One major advantage of the pdfFiller platform is the ability to eSign your year tax year forms securely. eSigning eliminates the need for printing and scanning, offering a fast and efficient way to complete your tax documentation.

Collaboration tools on pdfFiller allow for sharing forms with team members or advisors, making it easy to get real-time feedback and comments. Being able to work on documents together can assist in ensuring accuracy and compliance.

Submitting year tax year forms

Once your year tax year forms are filled and edited, the next step requires understanding the options for submission. Digital submissions have become increasingly popular due to convenience and speed, but some may still prefer paper submissions.

For those opting for paper submissions, it’s always wise to mail forms through certified mail or a similar service to confirm receipt. After submission, you can expect confirmation from the IRS or the state tax authority. Being proactive can help avoid future complications.

Common issues and troubleshooting

Even after diligent preparation, issues can arise when submitting year tax year forms. Common errors may lead to rejections or audits, and knowing how to tackle these problems is crucial. During the review process or post-submission, you may notice discrepancies or receive notices from the IRS or state agencies.

Utilizing resources for assistance, including tax advisors or online communities, can provide valuable insights. Forums can often shed light on common problems and solutions, making them an excellent tool for navigating tax complexities.

Tools and resources for managing year tax year forms

Managing year tax year forms is made simpler with the right tools and resources. pdfFiller offers interactive tools like form templates and calculators that can enhance efficiency dramatically when preparing taxes. Using these tools can streamline the documentation processes significantly.

The accessibility of cloud-based technology allows you to store and retrieve your documents easily, making it easier to maintain organized records year-round. The collaborative features offered by pdfFiller equip individuals and teams to work together more effectively.

Staying organized for future tax years

Organization throughout the year plays a significant role in simplifying the tax preparation process when the next tax season arrives. Maintaining clear records and budgeting appropriately for expected taxes can ease stress and enhance accuracy in filings.

Preparing for the next year’s tax season well in advance ensures that you won’t find yourself scrambling at the last minute. Engage with your advisors or utilize resources available on pdfFiller to stay informed about any changes in tax laws or applicable deductions.

FAQs about year tax year forms

Many individuals have questions when it comes to completing year tax year forms, especially for the first time. A clear understanding of frequently asked questions can alleviate potential stress and confusion as you prepare your forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify year tax year without leaving Google Drive?

How do I fill out the year tax year form on my smartphone?

How do I complete year tax year on an iOS device?

What is year tax year?

Who is required to file year tax year?

How to fill out year tax year?

What is the purpose of year tax year?

What information must be reported on year tax year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.