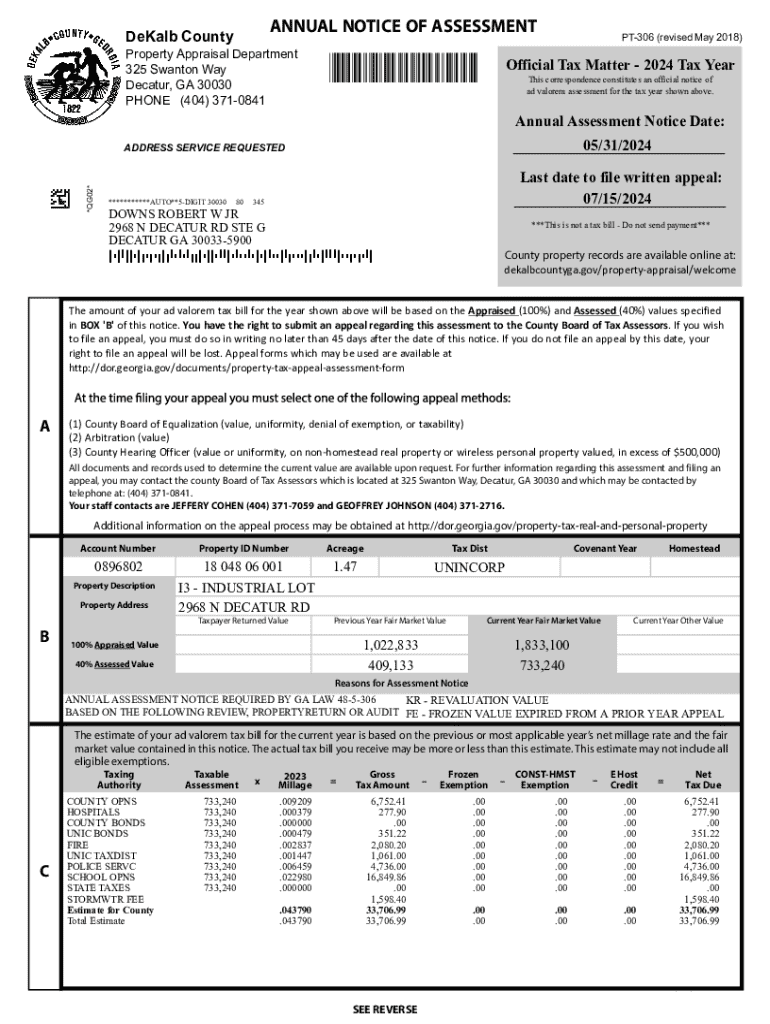

Get the free Official Tax Matter - 2024 Tax Year

Get, Create, Make and Sign official tax matter

How to edit official tax matter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official tax matter

How to fill out official tax matter

Who needs official tax matter?

Official Tax Matter Form: Your Comprehensive Guide for Accurate Filing

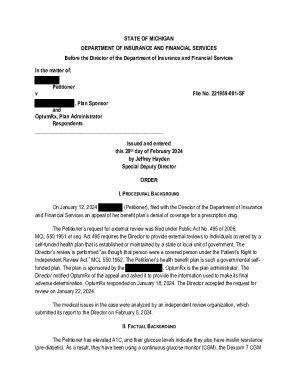

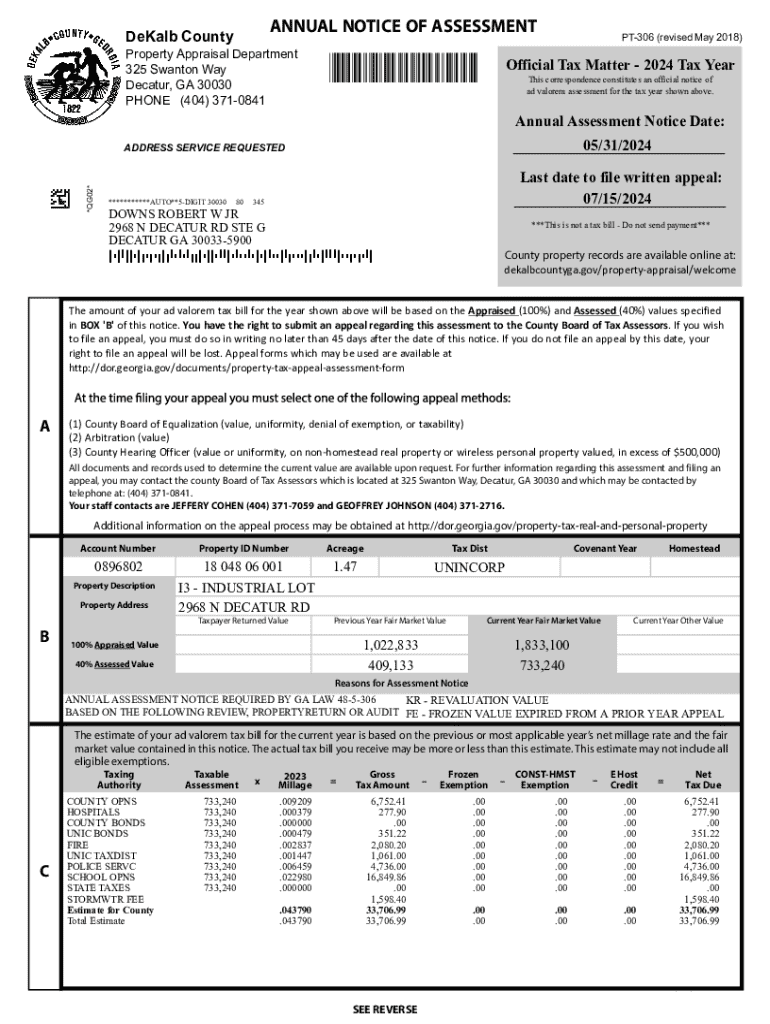

Understanding official tax matter forms

Official tax matter forms are essential documents required by tax authorities to report income, claim deductions, and ensure compliance with tax regulations. Completing these forms accurately is crucial, as it influences your tax liabilities and eligibility for refunds or credits.

The accuracy of these forms can prevent issues with tax authorities, avoiding potential penalties and audits. Whether you're an individual or a business owner, understanding official tax matter forms is a key aspect of financial responsibility. Ignorance or mistakes can lead to significant consequences, making it imperative to grasp the essentials of taxation.

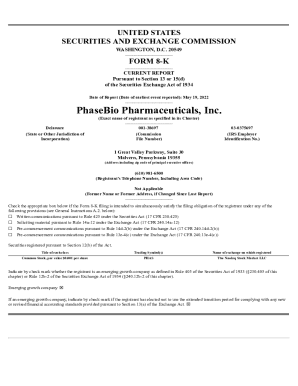

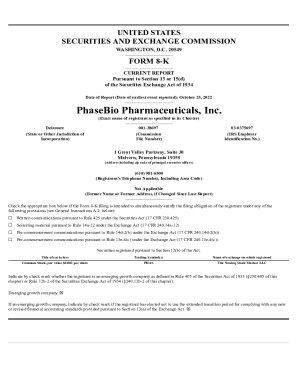

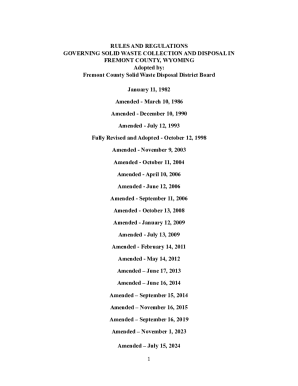

Types of official tax matter forms

There are various types of official tax matter forms, each serving specific purposes. Here’s an overview of the primary categories:

When to use an official tax matter form

Several scenarios may require the use of official tax matter forms. These can include filing status changes, claiming deductions or credits, or resolving disputes regarding property assessments or valuations. It's essential to know the circumstances that necessitate these forms to meet your obligations.

Understanding the associated deadlines is equally important. Missing the deadline for submitting property tax forms or personal property tax returns can lead to penalties, interest charges, or loss of eligibility for exemptions. A proactive approach is vital to ensure compliance and avoid unnecessary costs.

Deadlines and timelines

Each type of tax form has its own deadlines, which vary based on local regulations and the nature of the form. For instance, individual income tax returns are typically due on April 15 each year, while property tax forms may have different submission dates depending on the county. Consult your local tax authority and keep a calendar of critical dates to ensure you're on track with your tax obligations.

How to access official tax matter forms

Accessing official tax matter forms is straightforward, particularly with the resources available today. Most forms can be found on federal and state government websites, allowing users to download them at their convenience.

pdfFiller serves an integral role by providing easy access to various tax forms. Users can search for specific forms and download them directly from the platform, making the process efficient and user-friendly.

Downloading and preparing forms

To download a form, visit the relevant government site or pdfFiller, search for the official tax matter form needed, and click the download link. Be sure to confirm you're downloading the most recent version to avoid using outdated information. Once downloaded, start preparing the form by gathering the necessary information, such as your personal details, financial records, and tax-related documents.

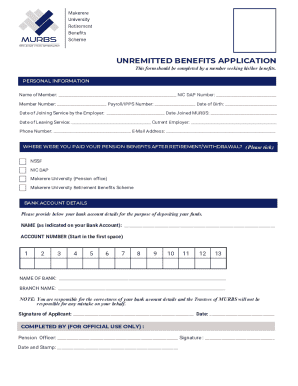

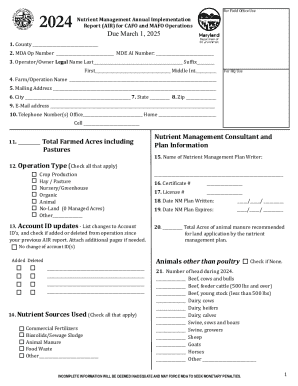

Filling out official tax matter forms

Accurate completion of official tax matter forms is crucial for tax compliance. Typically, the information required includes personal identification, your income details, deductions you wish to claim, and supporting data specific to the form. Ensuring you have all necessary information at hand will streamline the filling process.

Here’s a step-by-step guide on how to fill out a sample form: Start by entering your personal details in the designated sections, including your name, address, and Social Security number. Next, move on to the income section, where you’ll report your earnings. Follow this with any deductions or exemptions, ensuring to reference supporting documentation where necessary. Finally, review the form for inaccuracies or incomplete fields.

Editing features for official tax forms

Editing your official tax forms is key to ensuring that all information is accurate. Mistakes on tax forms can lead to issues with compliance, including audits, penalties, or delays in your tax return process. Therefore, taking advantage of editing features is vital for every taxpayer.

Using pdfFiller, you can easily edit PDFs and make necessary changes. The platform allows users to correct errors directly on the form, which is particularly useful for collaborative efforts where multiple parties may be involved in preparing tax documents. These cloud-based tools offer real-time editing capabilities, enhancing productivity and accuracy.

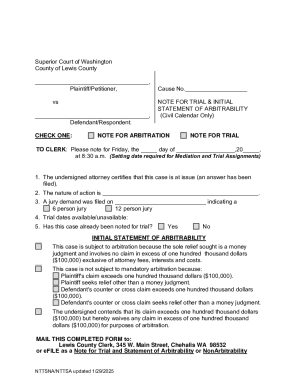

Signing official tax matter forms

Legal implications surround the signing of tax forms. Signatures verify that the information provided is accurate and consistent with your financial history. Inaccuracies can lead to audits, fines, and other repercussions. Therefore, understanding how to properly sign your official tax matter forms is essential.

With pdfFiller, electronically signing forms is quick and straightforward. The platform guides users through eSigning, equipped with security measures such as digital certificates and verification processes. This not only secures your submission but also saves time compared to traditional methods.

Submitting official tax matter forms

Once your official tax matter forms are completed and signed, it's time to submit them. Several delivery methods exist, including online submission, mailing hard copies, or delivering forms in person. The method you choose may depend on the type of form and local regulations.

Tracking the status of your submission is crucial to ensure it has been received by tax authorities. Utilize pdfFiller’s tracking tools, which help monitor the document's status and provide updates on its processing. This feature is invaluable for peace of mind and maintaining organized records.

Common issues and solutions

Many individuals face typical errors when completing official tax matter forms. Understanding these common pitfalls can help you avoid mistakes and ensure compliance. Some frequent issues include missing signatures, incorrect data entries, and failure to include supporting documents.

Before submission, review your completed forms thoroughly. If you identify any issues, use pdfFiller's editing tools to rectify them. If significant mistakes are discovered post-submission, consult a tax professional for guidance on how to amend your returns or address any discrepancies.

FAQs about official tax matter forms

It’s common to have questions regarding official tax matter forms, particularly around filing requirements, deadlines, and the types of information needed. Some frequent queries include how to handle missing documents or unclear tax obligations.

For personalized assistance, consider consulting tax professionals or using helplines provided by tax authorities. Many online resources also offer forums where you can ask questions and receive guidance from experienced users.

pdfFiller's role in managing your official tax forms

pdfFiller is a comprehensive document management platform designed to streamline the process of filing official tax matter forms. With features that enable seamless document creation, editing, eSigning, and collaboration, users gain a powerful tool for handling their tax obligations efficiently.

From accessing official forms to tracking submission status, pdfFiller empowers users to manage all tax-related documents from a single, cloud-based interface. This holistic approach simplifies the tax preparation process and reduces the stress typically associated with tax time.

Benefits of using pdfFiller for tax forms

Leveraging pdfFiller’s capabilities translates to several benefits for taxpayers. The platform not only facilitates error-free form submission through its editing tools but also saves time with features like eSigning. Many users report increased confidence in completing tax forms, knowing that they can easily make corrections and access support as needed.

Enhancing your tax form experience

Beyond just filling out forms, pdfFiller offers additional tools and resources designed to enhance your overall tax form experience. From educational materials that clarify the filing process to interactive support features that assist at any stage, users can access a wealth of information at their fingertips.

Additionally, pdfFiller is continuously evolving, with upcoming features that aim to deliver even greater functionality for users. Staying updated on these enhancements will ensure that you leverage the latest in document management technology for your tax needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute official tax matter online?

Can I edit official tax matter on an Android device?

How do I complete official tax matter on an Android device?

What is official tax matter?

Who is required to file official tax matter?

How to fill out official tax matter?

What is the purpose of official tax matter?

What information must be reported on official tax matter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.