Get the free COMMERCIAL EQUINE LIABILITY APPLICATION (A ...

Get, Create, Make and Sign commercial equine liability application

Editing commercial equine liability application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial equine liability application

How to fill out commercial equine liability application

Who needs commercial equine liability application?

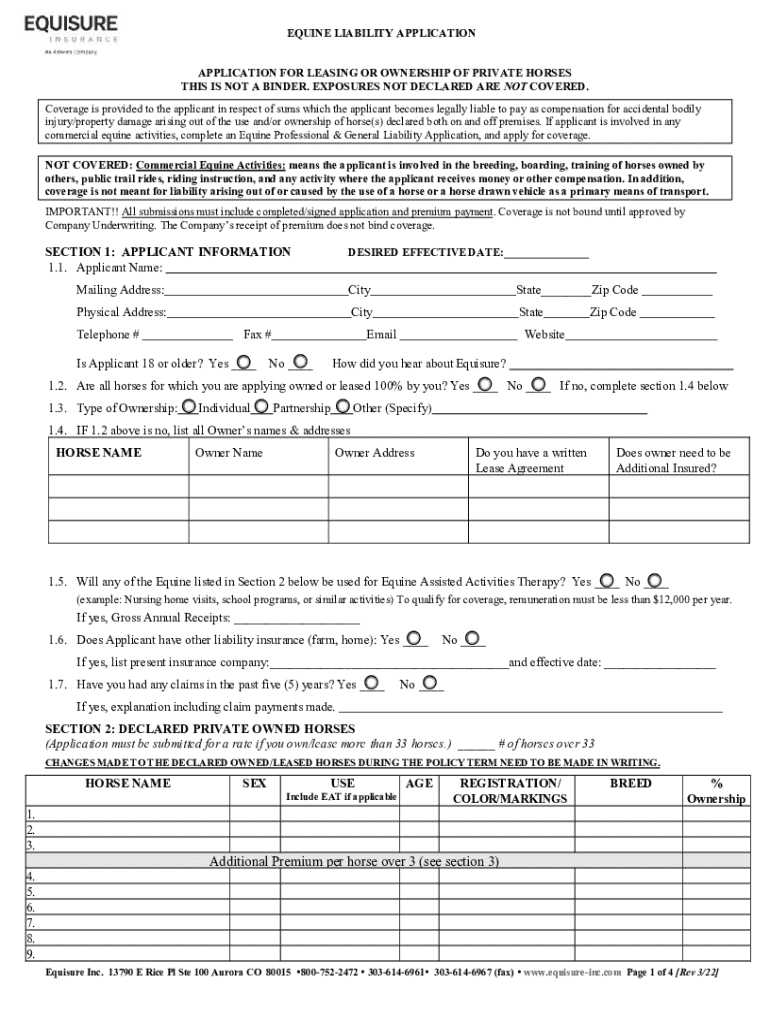

A Comprehensive Guide to the Commercial Equine Liability Application Form

Overview of commercial equine liability insurance

Commercial equine liability insurance is essential for anyone involved in the equine industry, providing protection against a multitude of risks. This specialized insurance is designed to cover claims arising from injury or damage that occurs during horse-related activities. Given the unpredictable nature of equine behavior and interactions, having this insurance is crucial for mitigating financial losses.

The types of risks covered under commercial equine liability insurance often include bodily injury to non-employees, property damage, and legal defense costs. For example, if a horse owned by your riding school injures a visitor, this insurance would cover related expenses. The key stakeholders in the equine industry, from riding schools and boarding facilities to trainers and breeders, all benefit from the reassurance this policy provides.

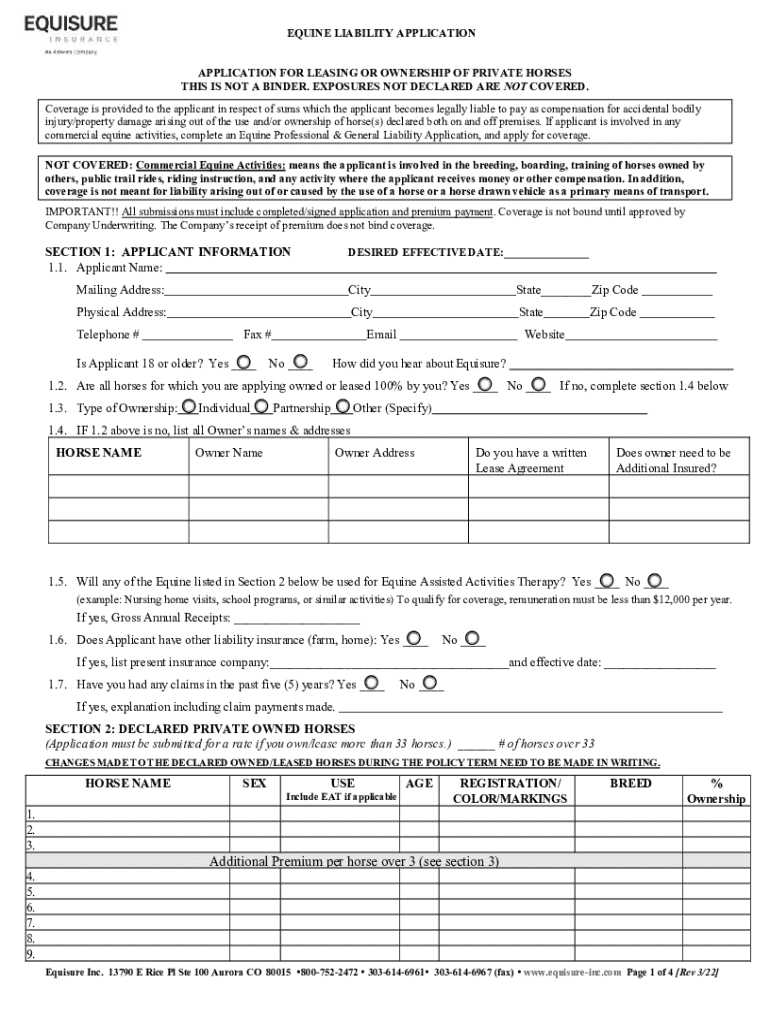

Understanding the commercial equine liability application form

The commercial equine liability application form serves a crucial purpose in the insurance acquisition process. It acts as a detailed questionnaire that helps insurers assess the risk associated with your equine business. Completion of this form is often the first step towards obtaining the right insurance coverage.

Targeting professionals such as riding instructors, stable owners, and equestrian event organizers, the application form is essential for anyone seeking coverage. Utilizing this form not only streamlines the application process but also ensures that you communicate all necessary details to potential insurers, thus maximizing your chances of obtaining suitable coverage.

Sections of the commercial equine liability application form

A well-structured commercial equine liability application form comprises several key sections that collect essential information.

Step-by-step instructions for completing the application form

Completing the commercial equine liability application form can be straightforward if you approach it systematically. Begin by gathering the necessary information that aligns with each section of the form. Create a checklist of required documentation, such as licenses and past insurance policies, to ensure nothing is overlooked.

While filling out the form, pay attention to detail. Clarity and accuracy are imperative, as mistakes can delay processing or even result in denial of coverage. Avoid common pitfalls like omitting information or providing vague responses. It's advisable to review the form multiple times and ensure compliance with all requirements before submission.

Editing and customizing the commercial equine liability application form

Customization can enhance your commercial equine liability application form. Using tools like pdfFiller allows you to edit the document to suit your unique business needs. You can easily modify text, add specific details, or include branding elements, creating a personalized touch that reflects your business identity.

When customizing, focus not just on aesthetics but on clarity and professionalism. pdfFiller offers features that support document customization and ensure your application stands out to insurers while conveying all essential information.

eSigning the application form

The electronic signature process is useful for modern insurance applications. Using eSignatures to sign your commercial equine liability application form simplifies the approval process and increases efficiency. Additionally, electronic signatures are legally recognized in most jurisdictions, making them a secure alternative to traditional signatures.

By adopting eSigning, you also benefit from quicker turnaround times, eliminating the delays associated with printing, signing, and mailing physical documents. This option aids both individuals and teams in managing their applications seamlessly.

Submitting the application form

Once your commercial equine liability application form is complete and signed, it’s time for submission. Depending on your preferences, you can submit the form online, via mail, or in person. Ensure that you follow any specific instructions provided by your insurance company for the submission method.

After submission, you should track the status of your application. Depending on the insurer, you can expect a response within a few days to a few weeks. Understanding the timeline helps you manage your business operations while waiting for coverage confirmation.

Managing your commercial equine liability insurance documents

After securing your commercial equine liability insurance, keeping your insurance documents organized is paramount. Utilizing a tool like pdfFiller can facilitate the management of your documents. This platform allows you to store, organize, and access your policies easily.

Additionally, pdfFiller offers collaborative features, ensuring that your team can work collectively on document management. Regular updates and maintenance of your insurance records ensure that you remain compliant and up-to-date with your insurance coverage.

Frequently asked questions (FAQs)

It’s common for applicants to have questions regarding the commercial equine liability application form. Some typical inquiries revolve around required information and how to rectify errors. It's advisable to consult your insurance agent for clarity on questions specific to your situation.

If you encounter issues, seek guidance through your insurance provider’s customer service resources. They can provide support on troubleshooting potential application challenges and offer additional documentation if needed.

Additional considerations & special scenarios

Navigating the commercial equine liability application process may involve unique circumstances for certain businesses. For example, if your operations involve high-risk equine activities, it's essential to disclose these details in your application. Insurers need comprehensive information to determine appropriate coverage.

As your equine business grows, consider periodically reviewing and adjusting your insurance coverage. Insurance needs can evolve, and maintaining adequate coverage ensures your business remains safeguarded against emerging risks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get commercial equine liability application?

How can I fill out commercial equine liability application on an iOS device?

How do I fill out commercial equine liability application on an Android device?

What is commercial equine liability application?

Who is required to file commercial equine liability application?

How to fill out commercial equine liability application?

What is the purpose of commercial equine liability application?

What information must be reported on commercial equine liability application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.