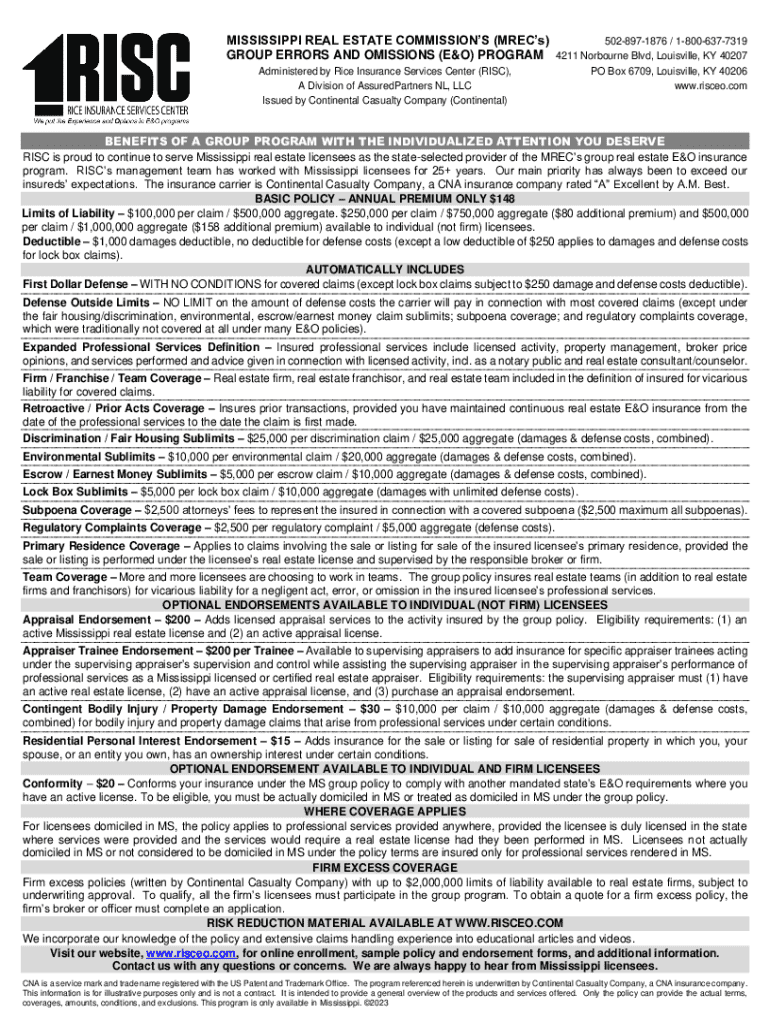

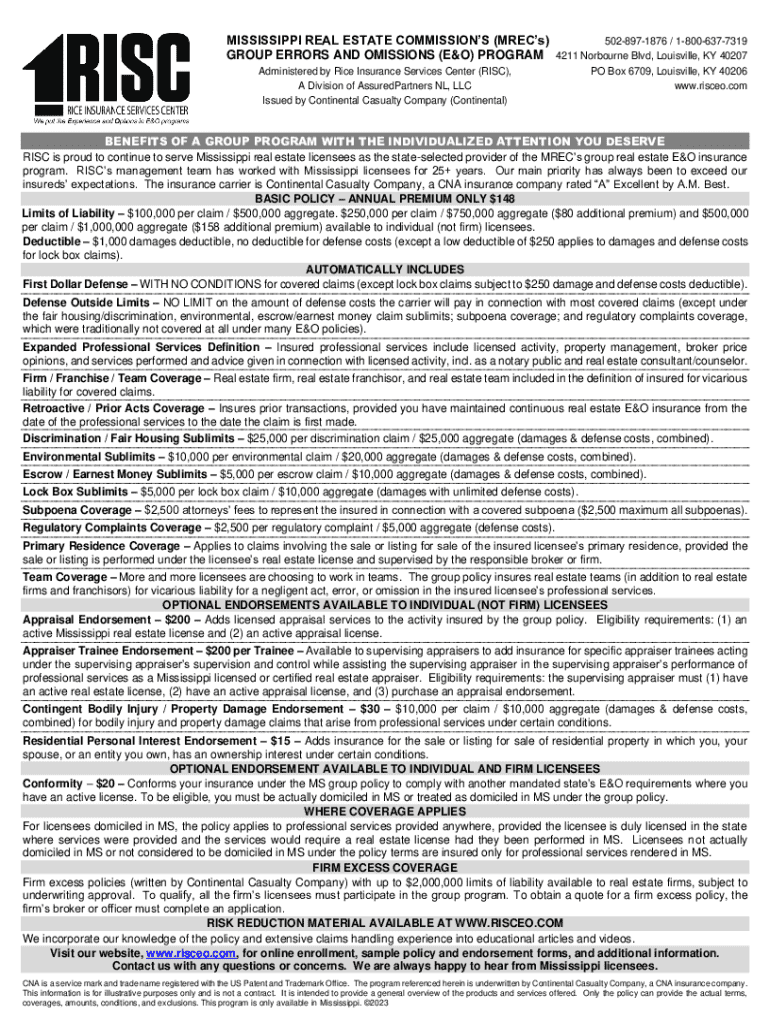

Get the free GROUP ERRORS AND OMISSIONS (E&O) PROGRAM 4211 Norbourne Blvd, Louisville, KY 40207

Get, Create, Make and Sign group errors and omissions

How to edit group errors and omissions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group errors and omissions

How to fill out group errors and omissions

Who needs group errors and omissions?

A comprehensive guide to group errors and omissions forms

Understanding group errors and omissions forms

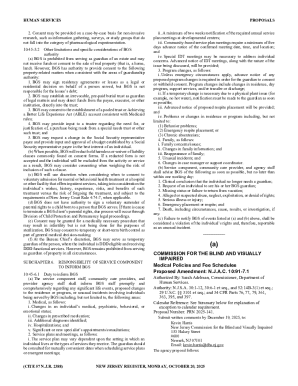

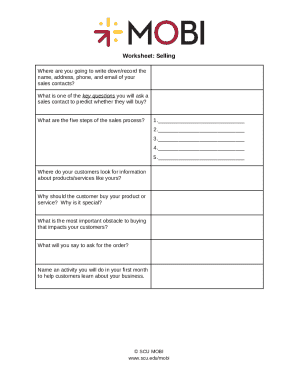

Errors and Omissions (E&O) insurance is a type of professional liability insurance that protects businesses and professionals from claims of inadequate work or negligent actions. This type of coverage is essential across various fields including accounting, legal, real estate, and design, as it safeguards against potential lawsuits resulting from mistakes or oversights during the provision of professional services.

Group errors and omissions forms serve as a structured framework for organizations and teams to secure collective coverage under a single E&O policy. By pooling resources and risks, groups can often access more favorable premium rates and broader coverage while ensuring that all members receive the necessary protection against liability issues.

Who should use group errors and omissions forms?

The primary users of group errors and omissions forms encompass professionals in sectors like accounting, legal, real estate, and design, where collective practices are common. Moreover, businesses with multiple employees or teams performing similar services may find group coverage attractive as it streamlines the process of securing adequate protection.

Key stakeholders include team leaders, administrators, and individual professionals who have a vested interest in ensuring their organization is adequately covered. Understanding the dynamics between individuals and the organization can enhance the effectiveness of the coverage sought.

Key components of the group errors and omissions form

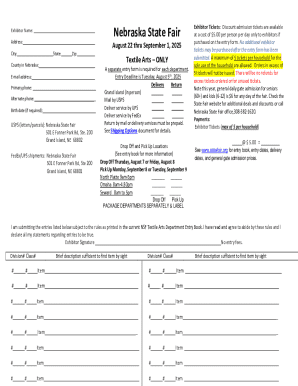

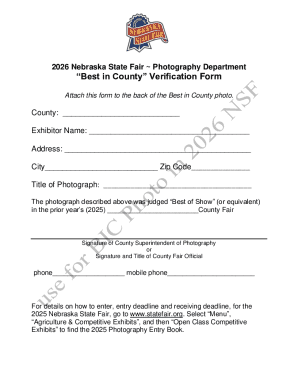

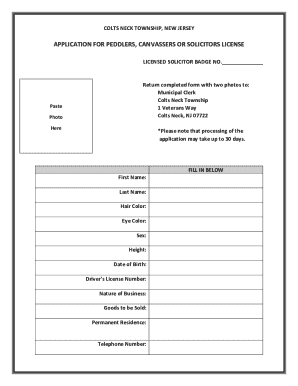

When it comes to completing a group errors and omissions form, the information required is crucial for accurate processing. Essential fields typically involve the organization's name, addresses, professional licenses, and policy details. Each profession may have specific entries, such as license numbers for legal practitioners or certification details for architects.

Moreover, the form comprises sections that detail coverage parameters, including effective dates and the length of the insurance term. This ensures that all parties involved are aware of the duration of the protection they are securing. Additionally, signature and acknowledgment sections signify consent and commitment to the terms provided.

Step-by-step instructions for completing the group errors and omissions form

Completing the group errors and omissions form can appear daunting, but with the right approach, it becomes manageable. Begin by gathering necessary documentation, which may include previous insurance policies, employee details, and relevant certifications that align with your organization's activities.

The actual process of filling out the form involves a series of steps: First, enter your organization's information accurately. Next, specify the types of coverage and limits required based on the needs of your team. Including details for all team members is essential for ensuring everyone is adequately covered. Once all necessary information is inputted, thoroughly review and verify each section to avoid errors.

Unique considerations may apply to different professions. For instance, accounting professionals might require specifics around audit liability, while legal teams may need to address malpractice concerns in their entries. Real estate agents, on the other hand, may focus on coverage related to transaction errors or disclosure issues.

Editing and modifying your group errors and omissions form

There are several scenarios that may necessitate editing the group errors and omissions form, such as changes in team structure (like the addition or removal of members) or adjustments to coverage needs based on evolving business demands. Regularly reviewing and updating the form is essential to maintaining accurate protection.

Using tools like pdfFiller can simplify this process. pdfFiller offers interactive tools that allow users to edit forms effortlessly. With features like version control, you can keep track of previous iterations of the document, ensuring that all updates are accurately captured and easily retrievable.

Signing the group errors and omissions form

The signature section of the group errors and omissions form holds significant importance. Legally, submitting a signed form implies that the organization agrees to the terms and conditions outlined, committing to uphold the responsibilities entailed by the insurance policy. Therefore, it's crucial not to overlook this part of the process.

Utilizing services like pdfFiller, organizations can seamlessly eSign documents. This process not only streamlines the submission but also ensures compliance with eSignature laws, making the entire procedure more efficient and legally sound.

Managing your group errors and omissions form post-submission

Post-submission, managing your group errors and omissions form is vital to ensure that all records are accurately tracked. Best practices include employing cloud storage solutions like those offered by pdfFiller to securely store your document. This makes it easy to access your form whenever needed, significantly improving your document management strategy.

Furthermore, staying on top of coverage renewals is crucial. Be aware of timelines and prepare to take necessary actions to ensure that policy coverage remains uninterrupted. Keeping updated records facilitates this process and helps organizations maintain continuous protection.

Effective collaboration with team members is another critical aspect of managing your form. Sharing access enables all relevant stakeholders to contribute insights and updates, ensuring that everyone is informed about the group's insurance status.

Troubleshooting common issues

As with any form, common errors can arise when filling out the group errors and omissions form. Common pitfalls include omitting required fields, misrepresenting the coverage amounts, or failing to update critical information. Taking time to double-check the entries before finalizing the form can help avoid these mistakes.

If issues occur during submission, such as technical glitches or discrepancies in the information provided, follow specific resolution steps. Contact support through pdfFiller or consult with your insurance provider if immediate solutions are required.

Frequently asked questions about group errors and omissions forms

Users often have queries regarding group errors and omissions forms, ranging from the specific inclusions of coverage to the intricacies of the submission process. Common concerns might include how to accurately list all team members and their respective roles, optimal coverage limits for various professions, and any compliance requirements associated with the form.

Additionally, it's crucial to clarify aspects related to policy terms and obligations. Providing clear, comprehensive answers can alleviate many uncertainties users face when navigating this essential documentation.

Leveraging pdfFiller for your document needs

pdfFiller presents comprehensive document creation and management solutions that greatly enhance the usage of group errors and omissions forms. The platform’s features, including its intuitive interface and robust editing tools, enable users to fill and manage forms easily.

The cloud-based nature of pdfFiller ensures that documents are accessible from anywhere, empowering teams and individuals to work collaboratively and efficiently, regardless of location. Choosing pdfFiller simplifies the entire documentation process, providing a streamlined experience to meet all your document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send group errors and omissions to be eSigned by others?

How do I execute group errors and omissions online?

How do I complete group errors and omissions on an Android device?

What is group errors and omissions?

Who is required to file group errors and omissions?

How to fill out group errors and omissions?

What is the purpose of group errors and omissions?

What information must be reported on group errors and omissions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.