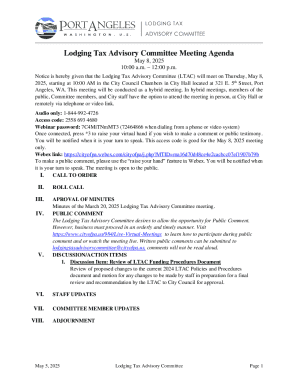

Get the free Appeals from the Tax Equalization and Review Commission. ... - terc nebraska

Get, Create, Make and Sign appeals from form tax

Editing appeals from form tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appeals from form tax

How to fill out appeals from form tax

Who needs appeals from form tax?

Understanding Appeals from Tax Forms: A Comprehensive Guide

Understanding your tax appeal rights

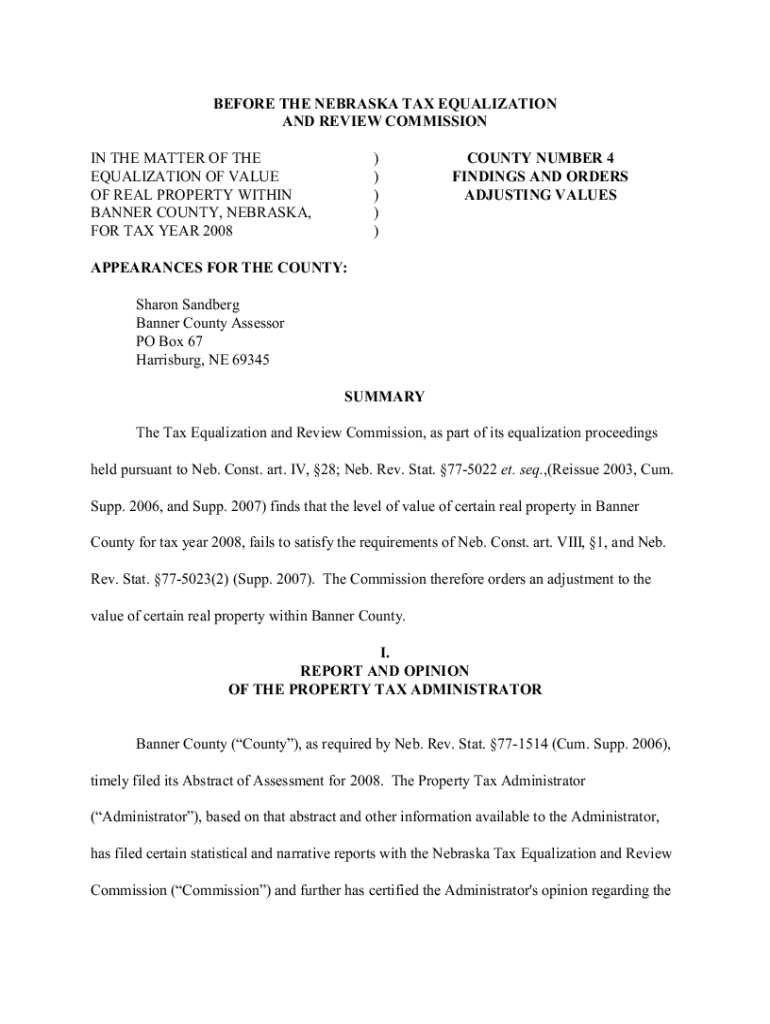

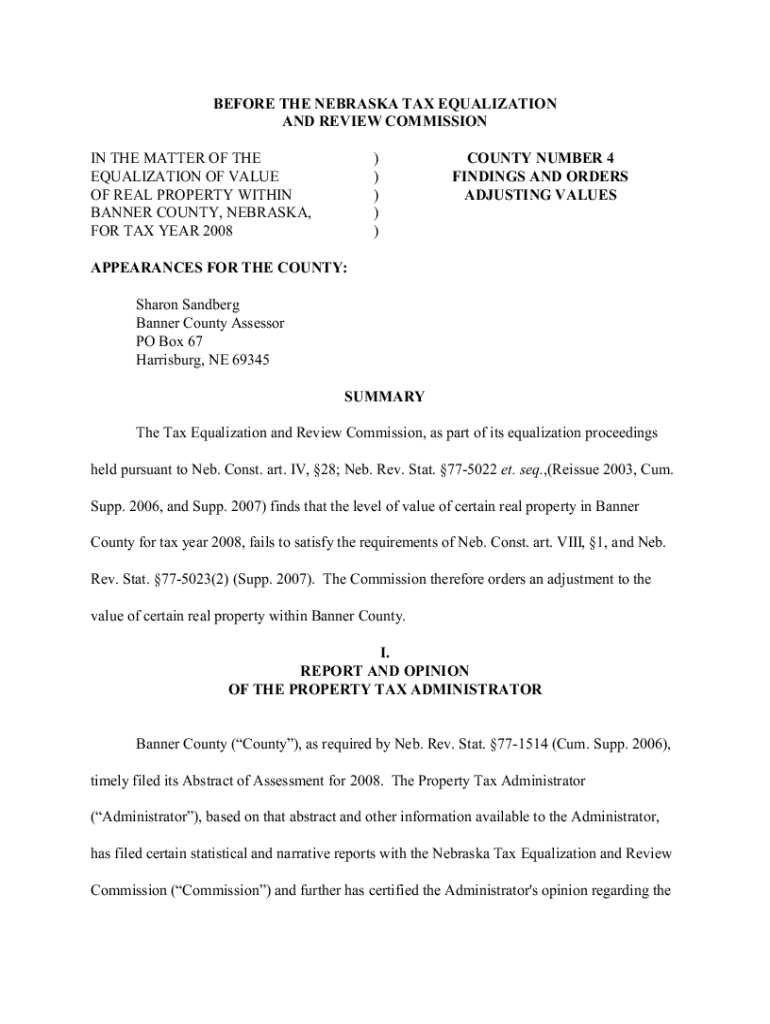

A tax appeal is a formal process that allows taxpayers to dispute decisions related to tax assessments made by the IRS or state tax authorities. This process is significant as it empowers individuals and teams to challenge errors or unfair evaluations that can directly impact their financial obligations. Understanding the tax appeal process requires familiarity with the steps involved, the necessary forms, and deadlines that must be adhered to.

Filing a tax appeal can be crucial when there are discrepancies in property valuations, misinterpretations of tax laws, or inaccuracies regarding income tax assessments. Engaging in this process ensures you access your rights as a taxpayer, enabling you to make necessary corrections and seek fair treatment under the law.

Types of tax appeals

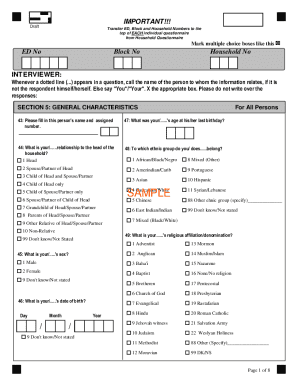

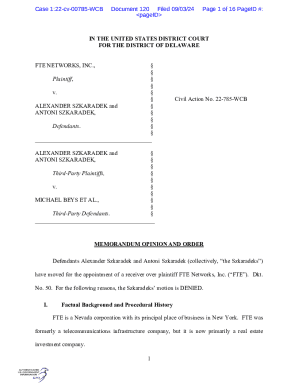

Tax appeals primarily fall into two categories: administrative appeals and Tax Court appeals. An administrative appeal usually begins with a request to the taxing authority's office and follows a defined process involving submissions of evidence and arguments. This process can vary by jurisdiction, with key timeframes often including deadlines for submitting the appeal and responding to requests for additional information.

On the other hand, Tax Court appeals involve initiating a case in a federal or state tax court. Here, the legal proceedings may take longer, and the requirements can be more stringent. Additionally, state and federal tax appeals differ significantly; they follow unique processes and have distinct sets of rules, timelines, and forms to complete, making it essential for individuals to be aware of the specific regulations applicable to their situation.

Preparing for your tax appeal

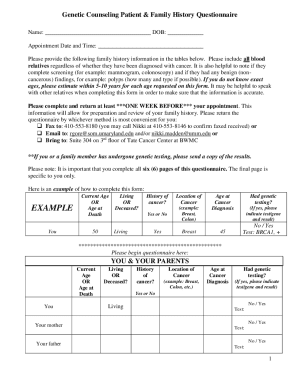

Preparation is a vital step in successfully filing a tax appeal. Assembling all required documentation is crucial. Essential documents generally include the original tax return, any correspondence from tax authorities regarding the assessment, and supporting evidence such as financial records, appraisal reports, or legal interpretations that back your claims. It’s advisable to keep these documents organized in folders segmented by type and year for easy access.

Having a solid understanding of the grounds for appeal is equally important. Common legal bases for appealing include errors in assessment calculations, misinterpretation of tax laws, or a lack of objective valuation related to property taxes. Articulating your reasons effectively requires clarity and precision since each statement must directly support your appeal's validity, making it easier for the reviewing authority to assess your claim.

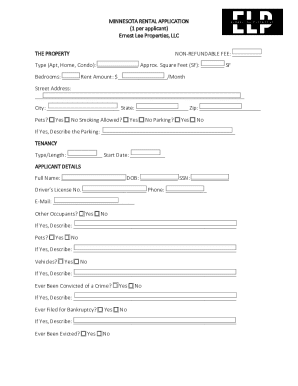

Filling out the tax appeal form

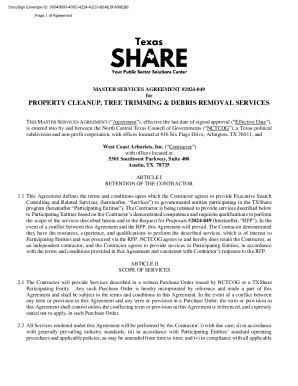

Completing the tax appeal form is a crucial part of the process, requiring attention to detail. Each form usually consists of sections that require specific information, such as personal details, relevant tax years, and the nature of the dispute. When filling out this form, it’s advisable to refer to the instructions provided by tax authorities to ensure compliance with all requirements.

Avoid common pitfalls such as omitting necessary documentation, providing insufficient detail, or missing submission deadlines. To facilitate this process, utilizing pdfFiller can enhance your efficiency by allowing you to edit and sign your forms electronically. With this tool, you can collaborate with others and ensure all relevant parties have access to the required information, significantly speeding up your document management.

Submitting your appeal

The next step is submitting your appeal, which can often be done through various methods, including online submissions, mailing, or even faxing your documents. Each method has its pros and cons; electronic submissions generally offer faster processing and confirmation receipts, while mail submissions provide a tangible record at the expense of time. Whichever method you choose, ensure you meet the specified submission requirements outlined by the tax authorities.

Tracking the status of your appeal provides peace of mind and helps manage expectations. You can frequently check the status through official portals or by directly contacting the relevant authority. Remember to allow adequate time for review, as response timelines can vary based on the complexities of your case.

What to expect after submission

After submitting your tax appeal, there are several possible outcomes. You might receive an approval, which typically results in a revised tax assessment, or a rejection, where your original assessment stands. Understanding what each outcome means is critical. For instance, if approved, ensure to keep a record of the new amounts for potential future disputes, while if denied, you may need to explore your options regarding further appeals or legal recourse.

If your appeal is denied, additional options exist to contest the decision, including further administrative appeals or seeking relief in Tax Court. Each route has distinct procedures and timelines and often involves more complexity. Knowing your rights and how to navigate subsequent steps is imperative for effective resolution.

Additional resources

To assist with your appeal process, numerous resources are available. Websites such as the IRS and your specific state tax agency provide valuable information on forms, deadlines, and procedures. Online calculators and tools can also assist in estimating potential tax liabilities accurately, making it easier to formulate your appeal arguments.

Additionally, communities and forums available on social media or tax assistance sites serve as platforms for sharing experiences and advice. Engaging in these communities allows for knowledge exchange, which can be invaluable in navigating your tax appeal journey.

Tips for successful appeals

For a successful appeal, employing best practices can significantly increase your chances of a favorable outcome. Crafting compelling arguments supported by evidence and clear documentation is paramount. Additionally, when dealing with complex appeals, it might be beneficial to seek professional assistance from tax experts who can provide insights and strategies tailored to your specific situation.

Furthermore, staying organized is crucial throughout the entire process. Utilizing tracking tools to monitor deadlines and ensuring that each piece of correspondence and document is accounted for can make an enormous difference. Not only does this keep your appeal on schedule, but it also enables you to retrieve documents quickly if needed in discussions or further submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my appeals from form tax directly from Gmail?

How do I fill out appeals from form tax using my mobile device?

How do I edit appeals from form tax on an Android device?

What is appeals from form tax?

Who is required to file appeals from form tax?

How to fill out appeals from form tax?

What is the purpose of appeals from form tax?

What information must be reported on appeals from form tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.