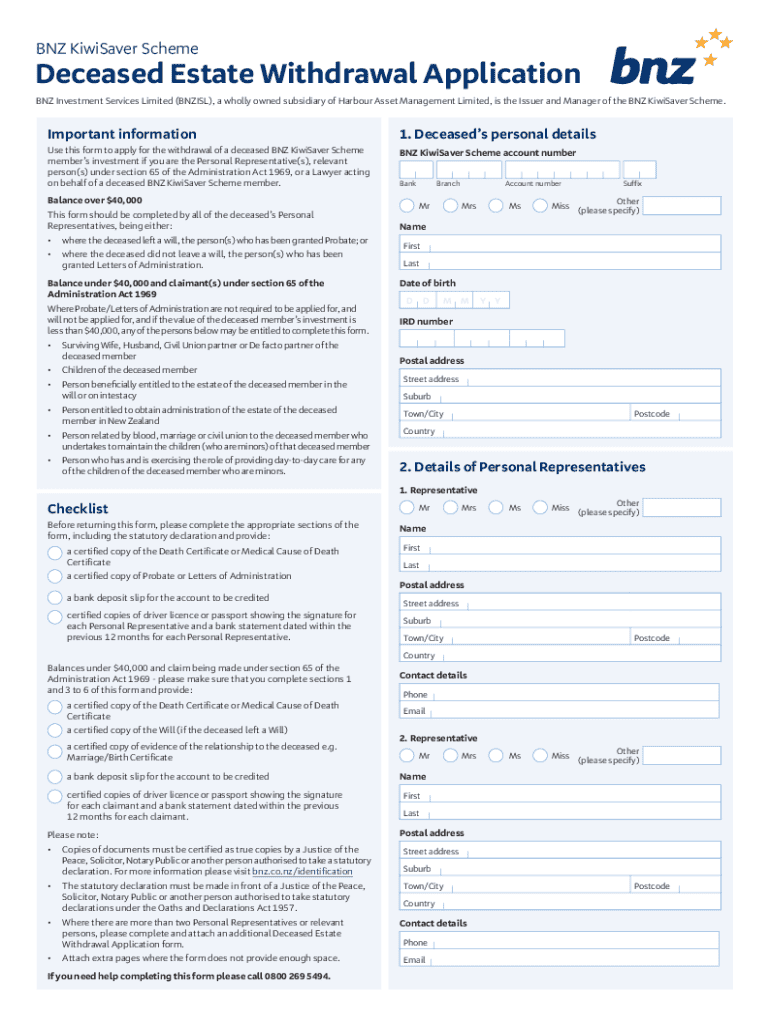

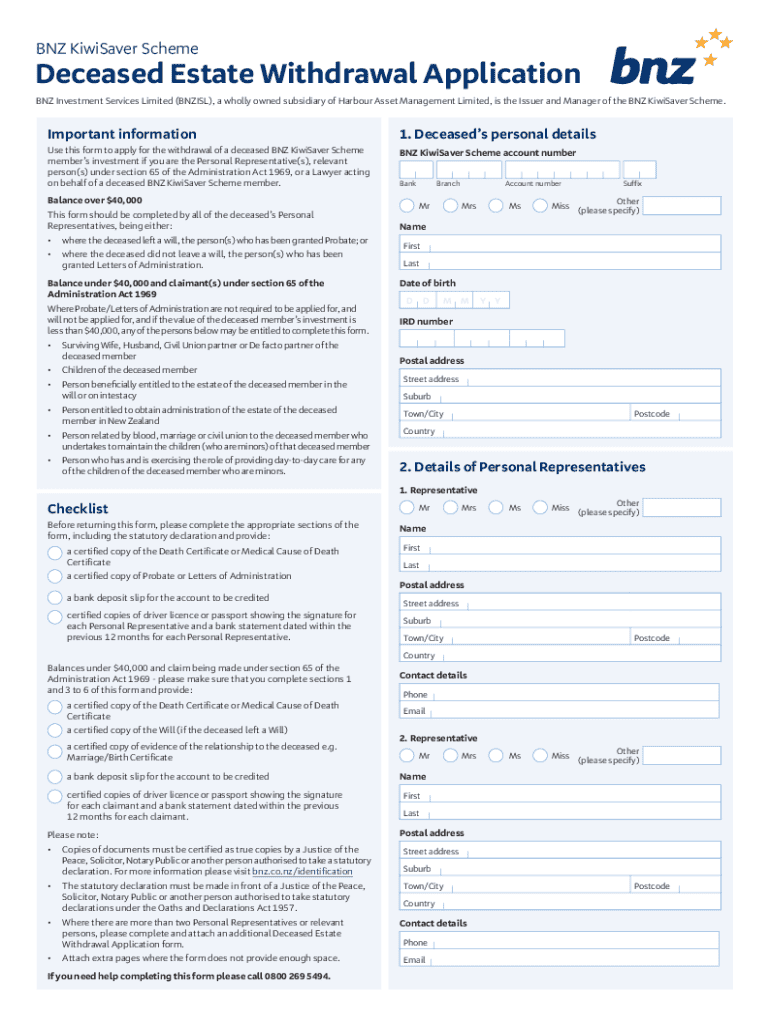

Get the free Deceased Estate Withdrawal Application BNZ KiwiSaver Scheme

Get, Create, Make and Sign deceased estate withdrawal application

How to edit deceased estate withdrawal application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deceased estate withdrawal application

How to fill out deceased estate withdrawal application

Who needs deceased estate withdrawal application?

Deceased estate withdrawal application form: A comprehensive guide

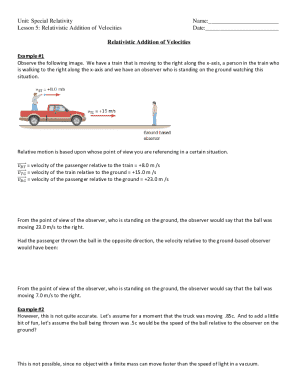

Understanding the deceased estate withdrawal process

A deceased estate refers to the totality of a person’s assets, liabilities, and affairs following their death. This estate can include real property, bank accounts, personal belongings, and any debts incurred by the deceased. Managing a deceased estate is critical to ensuring that assets are distributed according to the deceased's wishes as outlined in their will and that all liabilities are settled before distribution.

The withdrawal application process allows executors and administrators to access and manage these assets formally. This application is often necessary to transfer ownership of the deceased’s property, finalize bank accounts, or claim insurance proceeds. A properly completed deceased estate withdrawal application form is vital for a smooth estate administration process.

Who needs to complete a withdrawal application?

The primary parties involved in completing a withdrawal application are executors and administrators. Executors are individuals named in a will to carry out its provisions, while administrators are appointed by the court when there is no valid will. Both have significant responsibilities to manage the withdrawal application, handle estate assets, and ensure compliance with legal obligations.

Beneficiaries and other interested parties may also have a stake in the withdrawal application process. Beneficiaries are those who are entitled to receive assets from the estate, and they must be informed about the application’s status. Hence, understanding their rights and obligations can help facilitate a smoother transition in the estate management process.

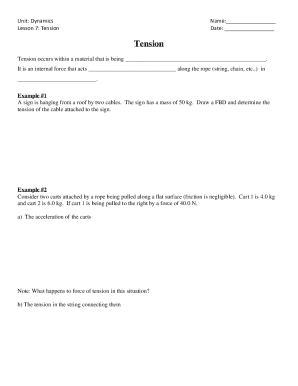

Preparing to fill out the application

Before filling out the deceased estate withdrawal application form, gathering essential documents is crucial. Key documents typically include the death certificate, will, proof of identity of the executor or administrator, and records detailing the estate's assets. Ensuring accuracy and completeness of this information helps to speed up processing and avoids delays from potential inaccuracies.

Knowing the eligibility criteria is equally important. Generally, those named as executors in the will or appointed administrators have the right to apply. However, specific regional or state criteria may vary and should be verified beforehand to ensure compliance with local laws governing deceased estates.

Step-by-step guide to completing the application form

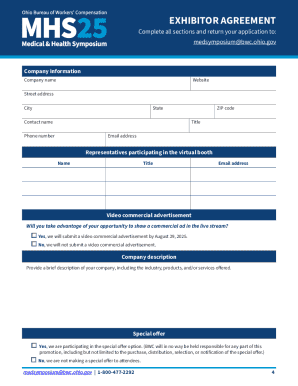

Accessing the deceased estate withdrawal application form is a straightforward process. You can typically find the official form online through legal aid websites or the judiciary's resources in your region. [pdfFiller]() provides an easy access point for obtaining this form.

While filling out the application, each section of the form should be carefully completed. Start by entering all required identification details, followed by information regarding the deceased, such as their full name, date of death, and relevant estate details.

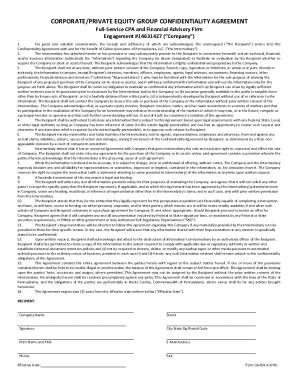

Understanding important legal considerations is key. Misrepresenting any information could lead to legal repercussions, including fines or rejection of the application.

Submitting your application

Once you have completed the deceased estate withdrawal application form, it is crucial to know where to submit it. Applications can often be submitted in several ways: online via an official portal, by mailing the completed form, or by delivering it in-person to the relevant authority such as a probate court.

After submitting your application, tracking its status is essential. Many jurisdictions offer online tools to check the status of your submission, so ensure you save your submission details for follow-up.

What to expect after submission

Upon submission of the application, there are several potential outcomes. Typically, the review process can take several weeks to months depending on the jurisdiction and complexity of the estate. Approval means you can proceed to access and manage the estate's assets following local laws.

However, if an application is denied, common reasons include incomplete forms or discrepancies in the provided information. Knowing how to appeal a denial or what alternative actions to take is vital to ensuring the estate’s affairs are still managed properly.

Using pdfFiller to manage your deceased estate withdrawal application

pdfFiller provides an ideal solution for managing your deceased estate withdrawal application. Users can easily edit and customize their application forms using pdfFiller’s robust tools, empowering them to meet their specific needs and ensure all relevant details are accurately captured.

With pdfFiller, the eSigning feature simplifies the signing process. Executors can collaborate with beneficiaries and other stakeholders seamlessly, which is essential for streamlining communication and ensuring everyone is on the same page during the estate management process.

Frequently asked questions (FAQs)

Addressing common concerns related to the deceased estate withdrawal application process can help alleviate confusion. For instance, many people wonder about the timeline for processing the application, which can vary widely based on jurisdiction and the complexity of the estate.

Should any technical issues arise during form submission, referring to troubleshooting guides or contacting support can be immensely helpful. Accessing relevant helplines for specific estate-related inquiries further ensures the process remains smooth and efficient.

Tips for a smooth withdrawal application process

Best practices for applicants include staying organized, maintaining clear records of submissions, and proactively communicating with relevant parties. Ideally, having a checklist to track essential documents and sections can improve accuracy in application.

Understanding the timeline associated with the deceased estate withdrawal application process is also essential. Patience is often required, as many jurisdictions have defined processing times. Setting realistic expectations can considerably ease the experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my deceased estate withdrawal application in Gmail?

How do I execute deceased estate withdrawal application online?

Can I create an electronic signature for the deceased estate withdrawal application in Chrome?

What is deceased estate withdrawal application?

Who is required to file deceased estate withdrawal application?

How to fill out deceased estate withdrawal application?

What is the purpose of deceased estate withdrawal application?

What information must be reported on deceased estate withdrawal application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.