Get the free RI SOS Filing Number: 202568291720

Get, Create, Make and Sign ri sos filing number

Editing ri sos filing number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ri sos filing number

How to fill out ri sos filing number

Who needs ri sos filing number?

Everything You Need to Know About the RI SOS Filing Number Form

Understanding the RI SOS Filing Number Form

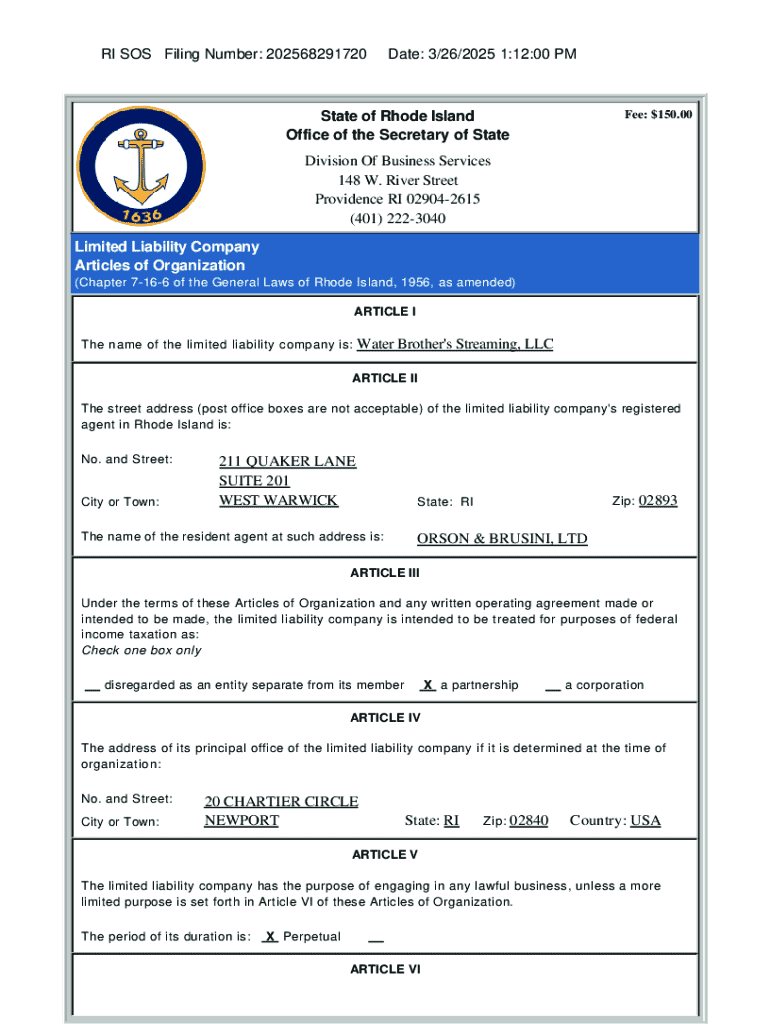

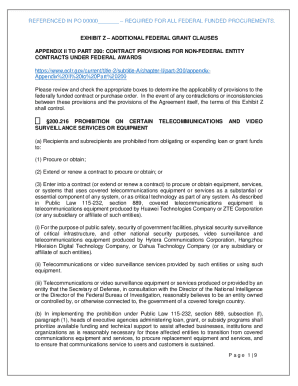

The RI SOS Filing Number Form is a critical document required for businesses operating in Rhode Island. This form assigns a unique filing number to entities registered with the state, functioning as a corporate identifier within the corporate database maintained by the Rhode Island Department of State. Essentially, it serves as proof that your business is legally recognized and compliant with state regulations.

The importance of the filing number cannot be overstated. It allows businesses to maintain good standing with the state, facilitating various operations, including obtaining licenses, filing taxes, and entering contracts. By having a unique identifier, businesses can streamline their interactions with government agencies and establish credibility with clients and partners.

How to access the RI SOS Filing Number Form

Accessing the RI SOS Filing Number Form is straightforward, with the online platform serving as the most efficient method. To begin, visit the official website of the Rhode Island Secretary of State, where the form is housed. Navigate to the business services section, where you'll find links leading directly to the filing number form and other related resources.

If you prefer alternative methods, you can obtain the form by mail or in-person at designated state offices. Simply contact the Department of State’s office to request the form be sent to your address, or you can visit their office, where staff can provide assistance and printed copies of the form.

Components of the RI SOS Filing Number Form

The RI SOS Filing Number Form requires several pieces of essential information. First, businesses must provide their official name as registered with the state. Following that, confirm the business structure, whether it be an LLC, corporation, or nonprofit. Accurate representation of the business name is crucial for ensuring that your entity aligns within the state’s corporate database.

Additionally, the contact information section mandates a valid phone number and mailing address. This allows state officials to reach out to organizations if any clarification is needed. The purpose of the filing should also be succinctly described; this typically includes the type of services your business provides or its mission for nonprofit entities.

While there may be optional sections, these can enhance the context of your submission, providing additional clarity to your filing. Common mistakes to avoid include misspelling the business name, omitting required contact details, and failing to thoroughly review the completeness of forms before submission.

A comprehensive guide to filling out the form

The process of filling out the RI SOS Filing Number Form can seem daunting, but breaking it down into manageable steps will simplify the task significantly. Start by gathering all necessary information, including your business name, address, and the specific purpose of your filing. Accuracy is paramount, as errors can lead to delays or complications.

Once you have the information, move on to the actual filling out of the form. Input the business information carefully, paying attention to any specific formatting requested. Next, fill out the contact section clearly, ensuring that the details are correct. Before submitting the form, make sure to review relevant regulations and requirements outlined by the Rhode Island Secretary of State.

Tips for efficiently managing your filing with pdfFiller

Utilizing pdfFiller can significantly streamline your document management process, especially when handling the RI SOS Filing Number Form. With interactive tools available for editing and collaboration, you can ensure that all necessary information is inputted correctly in an efficient manner. The platform also provides user-friendly functionality, making it easy to review and adjust your submission seamlessly.

eSigning the RI SOS Filing Number Form is made simple with pdfFiller, allowing you to add your signature electronically and submit documents without having to print or mail anything. Furthermore, the cloud-based solution enables you to organize and store your documents securely, allowing for easy access and management of all essential forms.

Submitting your RI SOS Filing Number Form

After you've thoroughly completed the RI SOS Filing Number Form, it's time to submit it. You have options: filing online through the Secretary of State’s site is recommended for its speed and tracking capabilities. Alternatively, you can submit the form by mailing it to the appropriate state office or dropping it off in person. Be aware that certain submission fees may apply depending on your filing type.

When submitting online, ensure you follow the prompts for payment to avoid delays. Additionally, familiarize yourself with the process for tracking your submission status through the official website, which provides peace of mind as you await confirmation of your filing registration.

Next steps after filing

Once your RI SOS Filing Number Form has been submitted and you receive your filing number, it’s crucial to manage your business information proactively. You will need to keep your details up-to-date to maintain compliance, especially if any changes occur within your business structure or address.

If you find yourself in the position of needing to update or correct information on your filing, it’s essential to follow the protocol for such adjustments as mandated by the Rhode Island Secretary of State. Keeping track of renewal dates and requirements is equally important, particularly for businesses that rely on ongoing filings to sustain their operations.

Common questions and troubleshooting

Addressing common concerns regarding the RI SOS Filing Number Form is crucial for a smooth filing experience. Should you make a mistake on the form, the first step is to determine the nature of the error. For minor inaccuracies, you may be able to amend your filing; however, in more complex situations, seeking help from an expert or the Secretary of State's office can provide clarity on the appropriate steps.

In case of any issues during the filing process, ensure you have direct access to support and help resources. The Rhode Island Secretary of State’s website typically has a dedicated contact section where you can find assistance and FAQs to guide you through any challenges.

Exploring additional services offered by pdfFiller

Beyond simply filling out the RI SOS Filing Number Form, pdfFiller offers extensive features designed to enhance your document management experience. From document signing to comprehensive editing capabilities, users can benefit from a streamlined workflow that significantly reduces time and effort. Case studies actively showcase successful filings handled through pdfFiller, illustrating the platform’s impact.

Encouraging efficiencies in your filing process can be transformative for your business. By leveraging pdfFiller's capabilities, you can ensure that your entity remains compliant with state requirements while simultaneously minimizing errors that could disrupt your operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ri sos filing number directly from Gmail?

How can I get ri sos filing number?

Can I create an electronic signature for signing my ri sos filing number in Gmail?

What is ri sos filing number?

Who is required to file ri sos filing number?

How to fill out ri sos filing number?

What is the purpose of ri sos filing number?

What information must be reported on ri sos filing number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.