Get the free Retail Banking of Bank Alfalah Islamic: Report OnPDF

Get, Create, Make and Sign retail banking of bank

Editing retail banking of bank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retail banking of bank

How to fill out retail banking of bank

Who needs retail banking of bank?

Retail Banking of Bank Form - How-to Guide

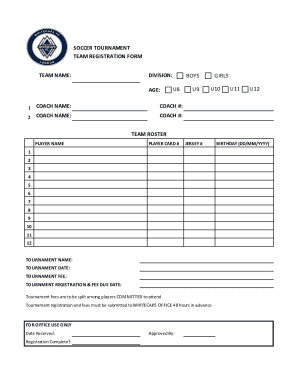

Understanding retail banking forms

Retail banking forms are essential documents used by banks to facilitate various customer transactions and services. They are critical for maintaining secure and efficient banking processes. These forms not only record transactions but also ensure compliance with financial regulations and customer identification procedures.

The forms serve many purposes, including opening an account, applying for loans, and making deposits or withdrawals. Each form has specific requirements and guidelines, which customers need to understand to execute their banking tasks smoothly.

Essential retail banking forms to access

When opening a new retail bank account, completing the appropriate form is the first step. It typically includes personal information such as your name, address, date of birth, and identification details. Banks may require documents such as a Social Security number, proof of address, and government-issued ID.

For existing accounts, various forms are also accessible. Customers may need to update personal information or add authorized signers to their accounts. Knowing how to fill out these forms correctly saves time and assists in maintaining accurate accounts.

Specialty retail banking forms

Certain financial products, like certificates of deposit (CDs) and Individual Retirement Accounts (IRAs), also require specialized forms. These applications necessitate a clear understanding of interest rates, terms, and eligibility criteria. For instance, CD forms will outline the deposit amount, maturity period, and interest arrangements.

As banking evolves, transitioning to online banking has become increasingly popular. Completing forms for switching from traditional to digital banking is becoming more crucial, as users learn how to manage their accounts effectively in an online environment.

Editing and managing your retail banking forms

Utilizing pdfFiller can dramatically streamline your document editing process, whether you're preparing forms for submission or managing existing documents. To start using pdfFiller, upload your forms directly to the platform from your device or cloud storage.

Interactive tools in pdfFiller allow users to edit text, add annotations, and even highlight key information efficiently. Notably, the option to eSign documents helps save time and ensures legal compliance, which is essential in banking transactions.

Collaborative features for team access

Sharing bank forms with team members enhances collaborative efforts, particularly in institutional or corporate banking scenarios. By inviting collaborators using their email addresses, teams can work together to fill out complex forms or review submissions.

Tracking changes is an essential feature for maintaining document integrity. Users can manage revisions, ensuring that everyone is updated with the latest form version. Moreover, cloud storage offers easy access to all forms, fostering an efficient document management process.

Managing form submissions

Understanding the process for submitting retail banking forms is crucial for successful transactions. Each bank may have different submission methods, whether through in-branch services or online platforms.

Best practices for ensuring successful submissions include double-checking all required information and adhering to specific guidelines laid out by the bank. This diligence avoids complications that may delay transactions.

Troubleshooting common issues

Common problems with retail banking forms can arise, such as missing information or incorrect signatures. These issues can lead to delays in processing and customer frustration. It’s essential to be proactive about potential problems.

Solutions often involve thoroughly reviewing documents prior to submission. Should difficulties persist, know how to contact customer support for assistance and clarification. Being informed will empower you to navigate banking transactions more effectively.

Advanced tools for retail banking document management

pdfFiller offers advanced tools specifically designed for banking needs. Features include secure eSigning and customizable templates that enhance user experience. These tools simplify complicated processes such as loan applications and account management.

Enhancing security for sensitive banking documents is critical. Tips for securing your personal information during transactions include using strong passwords and two-factor authentication wherever applicable. Keeping your banking documents secure helps prevent identity theft and fraud.

Future of retail banking forms

Trends in document management suggest a growing reliance on digital solutions. The emergence of mobile banking and fintech innovations is changing the face of retail banking forms, making them more user-friendly and accessible.

Technology is significantly shaping the future of banking forms by enabling customers to complete transactions from their devices. As banks continue to adopt advanced technology, we can expect a more streamlined and efficient banking experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send retail banking of bank to be eSigned by others?

How do I fill out retail banking of bank using my mobile device?

Can I edit retail banking of bank on an iOS device?

What is retail banking of bank?

Who is required to file retail banking of bank?

How to fill out retail banking of bank?

What is the purpose of retail banking of bank?

What information must be reported on retail banking of bank?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.