Get the free customer support pdf

Get, Create, Make and Sign customer support pdf form

How to edit customer support pdf form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer support pdf form

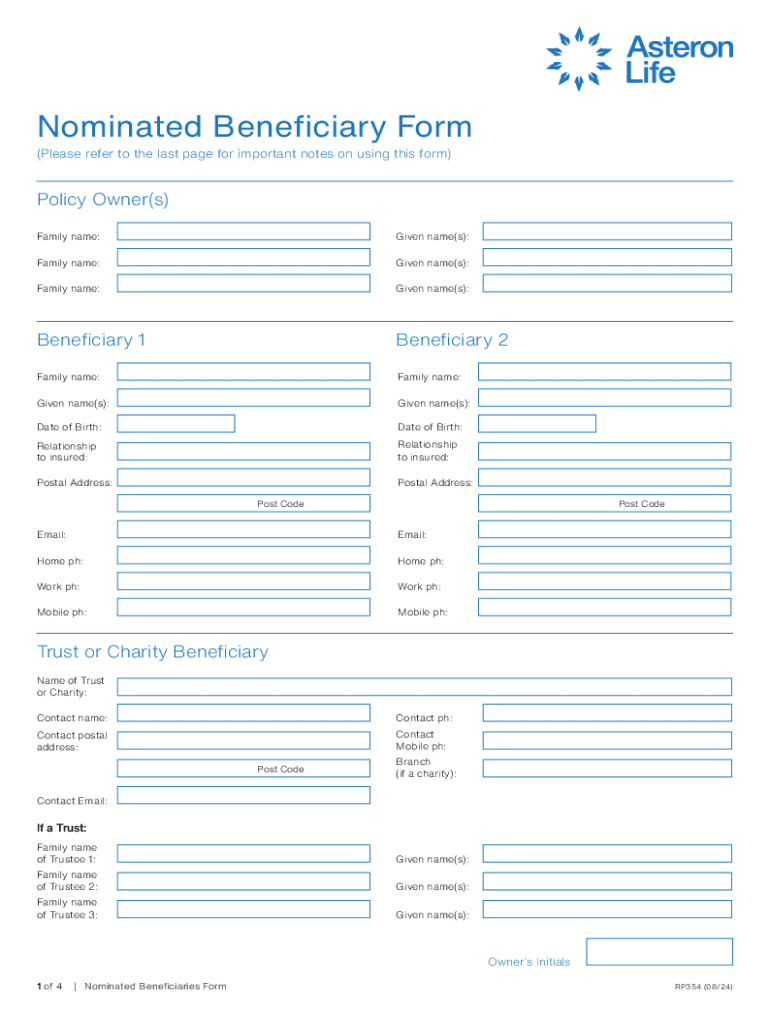

How to fill out aa-life-523-nominated-beneficiaries-form-personalpdf

Who needs aa-life-523-nominated-beneficiaries-form-personalpdf?

Comprehensive Guide to the aa-life-523 Nominated Beneficiaries Form

Understanding the aa-life-523 nominated beneficiaries form

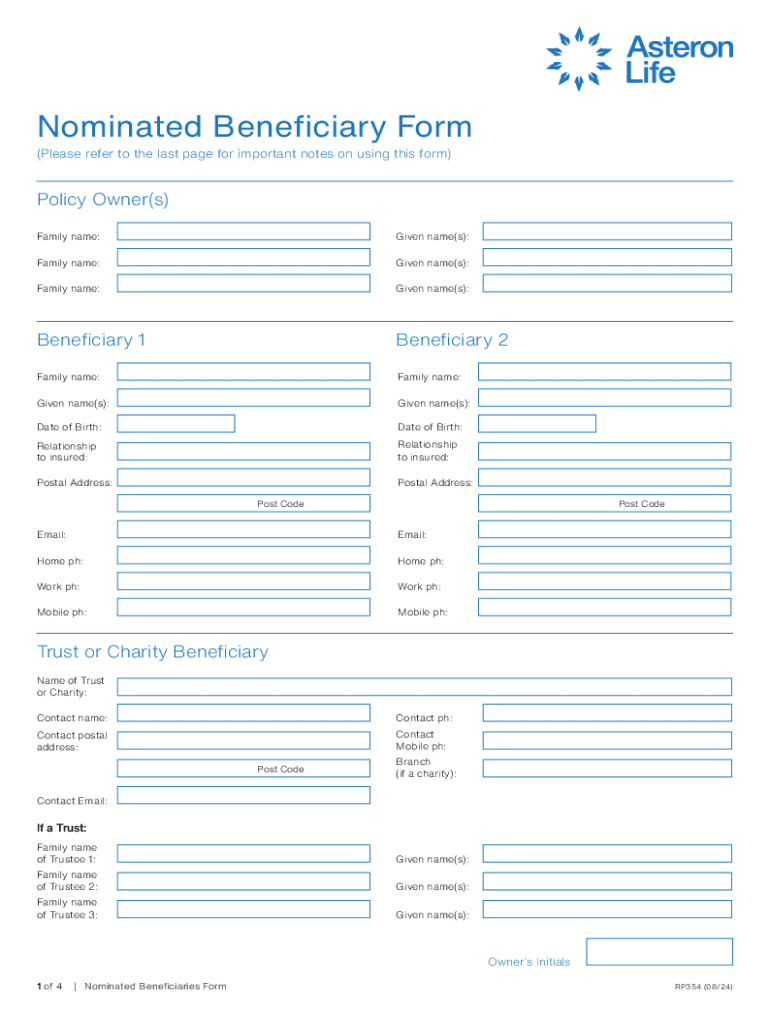

The aa-life-523 form is an essential document used to officially designate beneficiaries for various financial accounts and insurance policies. This form ensures that your assets are distributed according to your wishes upon your demise. Failing to designate beneficiaries can lead to complications, delays, and potentially undesirable outcomes regarding asset distribution.

Nominating beneficiaries is critical as it streamlines the transfer of assets, often bypassing probate, allowing your chosen individuals to inherit with less hassle and quicker access. Among the crucial terms associated with the aa-life-523 form are 'beneficiaries'—the individuals or entities you choose to inherit your assets—and the 'nomination process', which refers to the steps involved in selecting and officially documenting these individuals.

Who needs to use the aa-life-523 form?

The aa-life-523 form is relevant for anyone who has financial assets or insurance policies. Whether you possess a substantial estate or simply a few bank accounts, there are circumstances when you should appoint beneficiaries. Individuals and teams within organizations, such as financial institutions and insurance companies, often find themselves requiring this form to ensure smooth transitions.

Common scenarios that warrant the need for a beneficiary form include life insurance policies, retirement accounts, and bank accounts where you wish to clarify to whom assets will pass after your passing. This form serves not only individuals but also organizations that may need to establish their internal beneficiary designations.

Step-by-step guide to filling out the aa-life-523 form

Filling out the aa-life-523 form is straightforward, but it’s crucial to approach it systematically to avoid errors. Here’s a step-by-step guide.

Editing and customizing the aa-life-523 form

Flexibility is a vital aspect when dealing with documents like the aa-life-523 form. pdfFiller offers fantastic features for editing PDF forms, allowing users to make necessary changes without hassle.

You can easily add additional information or notes to the form, which is helpful for ensuring that the intentions surrounding the beneficiaries are clear. In case you need to change beneficiary information—whether due to life changes such as marriage, divorce, or death—updating the form via pdfFiller is a seamless process.

Signing the aa-life-523 form

Once the aa-life-523 form is filled out, it is essential to formalize it through a signature. Electronic signatures are recognized legally in many jurisdictions, providing an efficient way to authenticate documents.

pdfFiller makes the eSigning process simple, allowing users to sign their forms digitally. The legal validity of electronic signatures means that you don’t need to print the document, making it an efficient choice for modern document management.

Tips for managing your beneficiaries and related documentation

Managing beneficiaries isn’t a one-time task; it requires periodic review and updates. Maintaining up-to-date documentation is pivotal to ensuring that your wishes are accurately reflected.

Frequently asked questions (FAQs) about the aa-life-523 form

There are several common queries regarding the aa-life-523 form that users often encounter. Understanding these can alleviate issues and streamline the process.

Additional features of pdfFiller relevant to the aa-life-523 form

pdfFiller not only simplifies the filling of the aa-life-523 form but also offers numerous additional features that enhance document management.

Collaboration tools enable teams to work together efficiently, providing real-time feedback and sharing options. Plus, accessing documents across different devices means you can manage your forms from anywhere, ensuring you always have the necessary information at your fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute customer support pdf form online?

How do I fill out the customer support pdf form form on my smartphone?

How do I edit customer support pdf form on an iOS device?

What is aa-life-523-nominated-beneficiaries-form-personalpdf?

Who is required to file aa-life-523-nominated-beneficiaries-form-personalpdf?

How to fill out aa-life-523-nominated-beneficiaries-form-personalpdf?

What is the purpose of aa-life-523-nominated-beneficiaries-form-personalpdf?

What information must be reported on aa-life-523-nominated-beneficiaries-form-personalpdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.