Get the free ua Y - boe ca

Get, Create, Make and Sign ua y - boe

How to edit ua y - boe online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ua y - boe

How to fill out ua y

Who needs ua y?

UA Y - BOE Form: Comprehensive Guide for Effective Usage

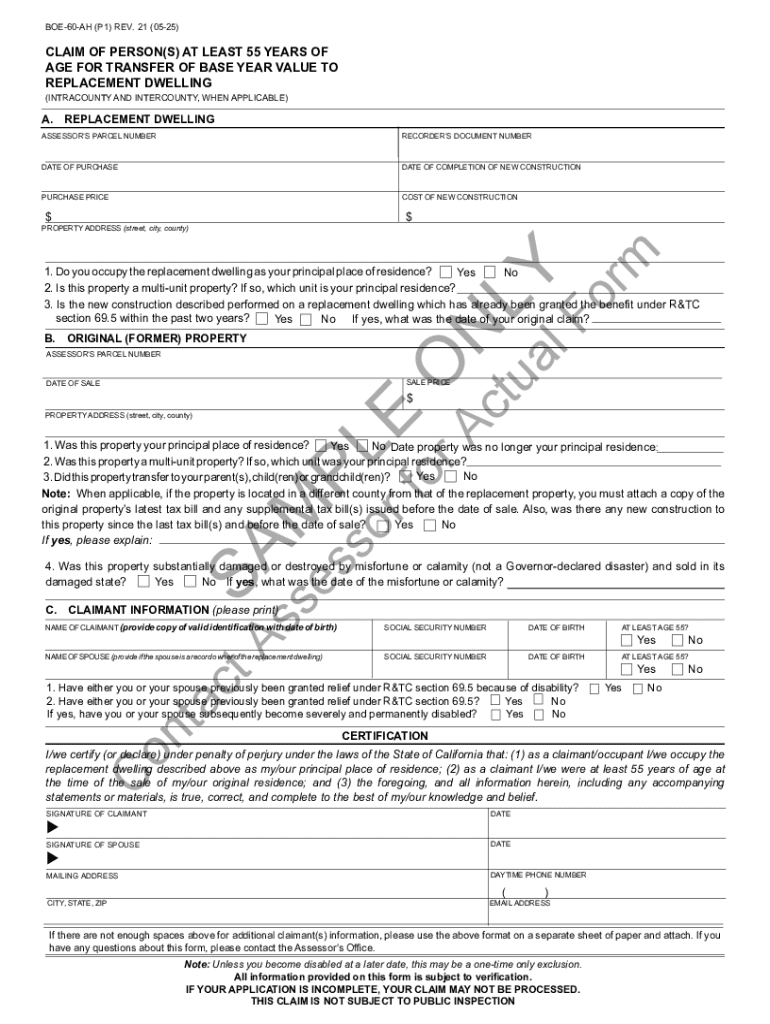

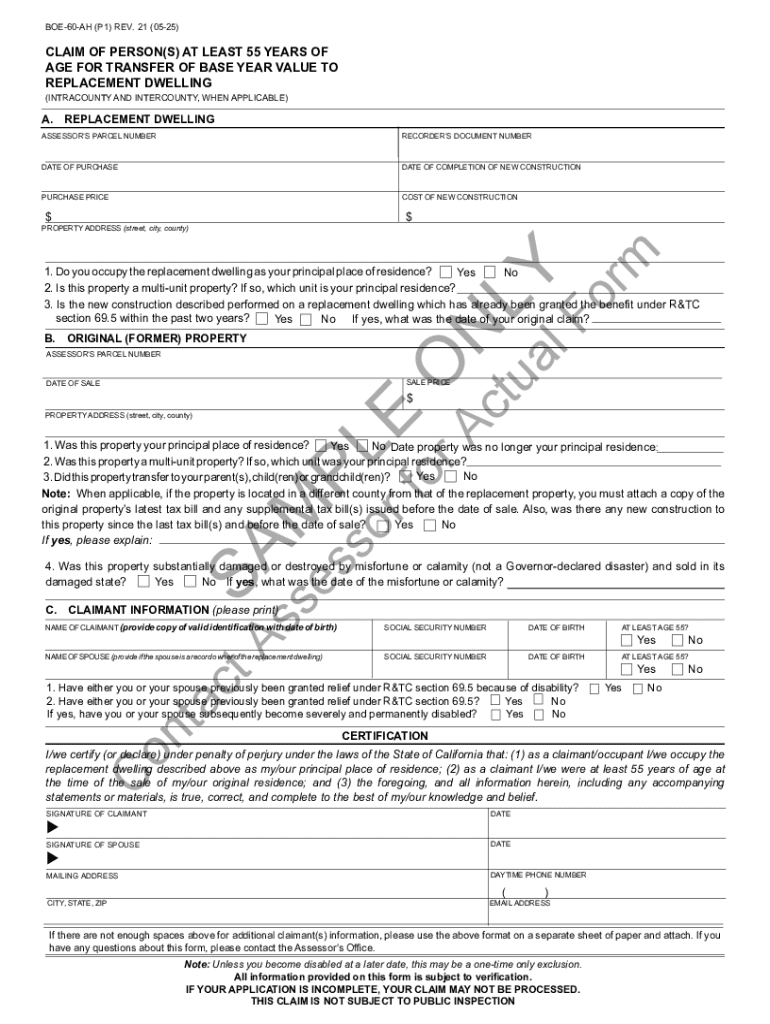

Understanding the UA Y - BOE Form

The UA Y - BOE Form serves as a critical documentation tool, primarily used to facilitate financial transactions and provide vital information for government organizations, particularly within the United States. Its purpose encompasses various applications, including tax filing, business compliance, and reporting financial data to governing bodies. Understanding the nuances of this form can significantly influence the efficiency of both personal and business dealings.

The importance of the UA Y - BOE Form extends beyond mere compliance; it encapsulates a structured approach for transparent reporting. Specifically, it is pivotal for scenarios involving audits, tax obligations, and financial reviews, ensuring that relevant entities have access to accurate and organized data.

Key terminology

Familiarity with key terminology associated with the UA Y - BOE Form plays a crucial role in its effective completion. Terms like "gross revenue," "tax identification number," and "deductions" frequently appear, and understanding these definitions can prevent mistakes that lead to delays or even penalties.

Engaging with these terms not only boosts the likelihood of seamless form submission but fosters a comprehensive understanding of the underlying financial principles, making users more informed participants in their economic dealings.

Who needs the UA Y - BOE Form?

The UA Y - BOE Form caters to a diverse audience, translating its utility across various sectors. Individuals often require this form for personal financial documentation, especially when engaging in activities such as filing taxes or applying for loans. Conversely, teams, particularly in finance and accounting, utilize this form to ensure compliance with regulatory requirements and maintain accurate financial records.

Specific industries, such as banking, accounting, and small business sectors, find significant benefits from utilizing the UA Y - BOE Form. For example, small businesses may use it to articulate gross revenue accurately, thus easing their tax burden and maintaining their status with relevant government organizations.

Common use cases

Preparing to fill out the UA Y - BOE Form

Before initiating the filling process, gathering the required information is vital. Essential documents include prior tax returns, financial statements, and any relevant business licenses. Collecting these resources ensures that the information inputted into the UA Y - BOE Form is not only accurate but also complete.

Additionally, understanding the structure of the UA Y - BOE Form is crucial. This form typically comprises multiple sections, each dedicated to a specific aspect of financial reporting—ranging from identifying personal or business information to providing financial data and supporting documentation.

Understanding the form structure

The structure can generally be broken down into four primary sections: Personal or Business Information, Financial Data, Supporting Documentation, and Signatures. Each segment plays a crucial role and requires careful consideration to complete the form effectively. Visual aids may be beneficial for reference.

Step-by-step instructions for filling out the UA Y - BOE Form

Section 1: Personal or business information

Entering accurate personal or business information is the first step. This section typically asks for the tax identification number and other identifying information. Mistakes in this area may lead to processing delays or inaccuracies in tax filings. Make sure to double-check the spelling of names and other identifiers.

Section 2: Financial data

The next section focuses on financial data. Report the numbers accurately, ensuring consistency in the format. Use decimal points judiciously and avoid common pitfalls such as rounding figures without explanation.

Section 3: Supporting documentation

Supporting documentation may include prior tax returns or other financial records. Ensure these documents are relevant and up to date, as they bolster the integrity of the information provided.

Section 4: Signatures and dated entries

Finally, ensure that all required signatures are included at the bottom of the form. Dates must be accurate and reflect the time of submission, as this can be vital for compliance with government standards.

Editing and finalizing the UA Y - BOE Form

Once the form is filled out, it is crucial to review the entries for any errors or omissions. Utilizing pdfFiller's features, users can edit the document easily via an intuitive interface. Make any necessary adjustments before finalizing the document to avoid unnecessary complications.

Utilizing pdfFiller for edits

Editing the filled UA Y - BOE Form on pdfFiller is straightforward. Firstly, navigate to the desired section, make your changes, and save the updated document. Double-check any alterations, particularly in financial data.

Seamless eSigning process

The eSigning process seamlessly integrates into the pdfFiller platform, allowing for quick and secure signing of the UA Y - BOE Form. Users can invite colleagues to sign, ensuring collaborative efforts are respected. This eliminates the need for physical paperwork, enhancing efficiency.

Managing and storing your UA Y - BOE Form

Effective document management is essential once the UA Y - BOE Form is completed. pdfFiller provides robust tools for saving, organizing, and retrieving forms effortlessly. Users can maintain a structured filing system, categorizing documents based on submission dates or types.

Best practices for record keeping emphasize the importance of securing digital documents. Users should consider options for cloud storage alongside traditional physical filing systems, ensuring redundancy in case of device failure. This approach also promotes compliance with data protection regulations.

Common questions and troubleshooting

Encountering issues with the UA Y - BOE Form is common among users, often stemming from misunderstood terms or incorrect data entries. To mitigate these challenges, access to commonly asked questions or support resources can be extremely beneficial.

Support resources

pdfFiller offers accessible support for users facing specific queries about the UA Y - BOE Form. This support can range from walkthroughs of common mistakes to detailed instructions on completing tricky sections of the form, further enhancing the user experience.

Integrating the UA Y - BOE Form into your workflow

To maximize productivity, integrating the UA Y - BOE Form into your daily workflow is essential. pdfFiller provides features that facilitate collaboration among team members, allowing multiple stakeholders to engage with the document.

Collaboration features in pdfFiller

Using collaboration tools, team members can comment, edit, and approve the UA Y - BOE Form from different locations, reinforcing a paperless environment. This eliminates the drawbacks of traditional document handling, promoting greater efficiency.

Automating document processes

pdfFiller’s automation functionalities, such as templates, simplify repetitive documentation tasks. Teams can create standard forms and customize them as needed, saving time and ensuring consistency across submissions.

Additional features of pdfFiller

Beyond the UA Y - BOE Form, pdfFiller offers various other templates that users may find suitable for their needs. The platform's flexibility extends to numerous document types, making it a complete solution for document management.

Maximizing pdfFiller’s cloud-based solutions

Utilizing pdfFiller’s cloud-based solutions enhances accessibility and mobility. With documents available from any location, users can effortlessly manage forms whether in-office or on the road. This adaptability ensures that critical tasks can be accomplished without geographical constraints.

Real user testimonials and use cases

Numerous success stories illustrate the transformational potential of pdfFiller in document management. Users have shared experiences highlighting how streamlined processes have not only saved time but also mitigated stress during busy filing periods.

Inviting user experiences

We welcome additional user experiences with the UA Y - BOE Form and the platform, inviting others to share their unique insights. Collective experiences can shed light on the form’s practical applications and the versatile tools pdfFiller provides, enriching the community's knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ua y - boe?

Can I create an electronic signature for the ua y - boe in Chrome?

Can I create an electronic signature for signing my ua y - boe in Gmail?

What is ua y?

Who is required to file ua y?

How to fill out ua y?

What is the purpose of ua y?

What information must be reported on ua y?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.