Get the free Mass Appraisal PlanGaines CAD

Get, Create, Make and Sign mass appraisal plangaines cad

How to edit mass appraisal plangaines cad online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mass appraisal plangaines cad

How to fill out mass appraisal plangaines cad

Who needs mass appraisal plangaines cad?

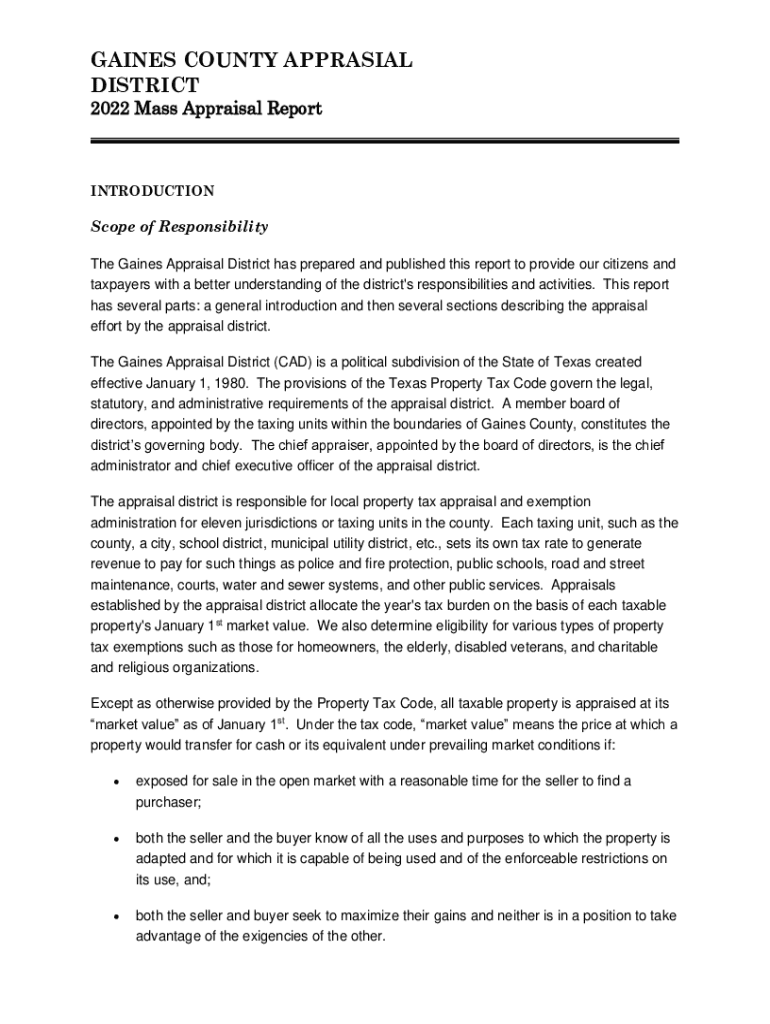

Mass appraisal plan: GAINES CAD form explained

Understanding the mass appraisal process

Mass appraisal is a systematic approach used to value a group of properties as of a specific date, primarily for property tax assessment purposes. Unlike individual appraisals, which focus on single properties, mass appraisals leverage statistical methods to determine the value of numerous properties efficiently. Accurate valuation within this framework is essential, as it significantly impacts local government revenues and ensures a fair tax burden across property owners.

Key stakeholders in the mass appraisal process include municipalities, property owners, and appraisers. Municipalities rely on property valuations to determine tax rates and budgets, while property owners need accurate assessments to ensure they are fairly taxed. Appraisers employ varied techniques and data analysis tools, including GIS data, to generate valuations that comply with the rules set forth by the Texas legislature and local governance.

The GAINES CAD form: An overview

The GAINES CAD form, developed by Cadastre, stands for 'Governing Authority for Inclusive and Non-Exclusive Systems for Commercial Appraisal Data.' This form is designed for local appraisal districts, particularly in Texas, to submit and manage property data utilized in mass appraisal processes. The purpose of the GAINES CAD form is to standardize property information collection to ensure consistency and accuracy across assessments.

Typically, this form is used by tax attorneys and municipalities alike to manage property tax assessments effectively. By integrating comprehensive data into a singular document, the GAINES CAD form plays a crucial role in facilitating accurate valuation and assessment in a manner that complies with state guidelines.

Key components of the GAINES CAD form

The GAINES CAD form comprises several essential sections crucial for providing the necessary property details. Section 1 focuses on Property Identification, where users must enter information such as property address, owner details, and property type. Accurate data entry in this section is pivotal since any discrepancies can lead to valuation inaccuracies.

Section 2 addresses Valuation Methods, where users can select from various appraisal approaches such as the cost, sales comparison, or income approach. Choosing the suitable method based on property type and market conditions is essential for effective valuation. Section 3 provides metrics on Tax Assessment Information, detailing how property taxes are calculated and reported accurately on the form.

Step-by-step instructions for filling out the GAINES CAD form

Filling out the GAINES CAD form requires careful attention to detail. Here's a structured guide to help you navigate the process efficiently.

Managing your completed GAINES CAD form

After completing the GAINES CAD form, managing and editing submissions is straightforward. If changes are necessary, users can edit submitted forms, making updates as required. It's essential to track any modifications closely, ensuring that all stakeholders, including teams and tax attorneys, have access to the latest version of the document.

Utilizing collaboration tools within pdfFiller can facilitate real-time input from team members. This streamlined process enhances communication and ensures that everyone involved can contribute effectively. Best practices for team input include setting clear deadlines and utilizing version control for tracking changes accurately.

Common challenges and solutions in using the GAINES CAD form

Various challenges may arise while using the GAINES CAD form, particularly in navigating complex valuation scenarios or addressing forms that may be rejected. To effectively deal with these issues, understanding potential rejection reasons is crucial. Common reasons include lack of required data or discrepancies between reported and actual property characteristics.

Resolving issues promptly requires a proactive approach, whether seeking clarification from local appraisal districts or collaborating with team members to provide the required data swiftly.

Helpful resources and tools

Accessing valuable resources related to the GAINES CAD form can facilitate a smoother filing process. pdfFiller provides numerous tools such as how-to videos that guide users through form completion, as well as FAQs designed to address common inquiries about the GAINES CAD form.

Contact and support information

If users encounter issues while filling out the GAINES CAD form or require assistance, pdfFiller provides direct contact channels for support. Community forums also serve as excellent platforms for networking with other users and sharing experiences or solutions. Engaging with community feedback encourages a culture of continuous improvement within the tool and can provide insights on unexpected challenges.

Utilizing these resources effectively ensures a comprehensive approach to managing the GAINES CAD form, fostering an environment where property owners confidently navigate the appraisal process with knowledge and support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mass appraisal plangaines cad?

How do I edit mass appraisal plangaines cad in Chrome?

How do I fill out mass appraisal plangaines cad using my mobile device?

What is mass appraisal plangaines cad?

Who is required to file mass appraisal plangaines cad?

How to fill out mass appraisal plangaines cad?

What is the purpose of mass appraisal plangaines cad?

What information must be reported on mass appraisal plangaines cad?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.