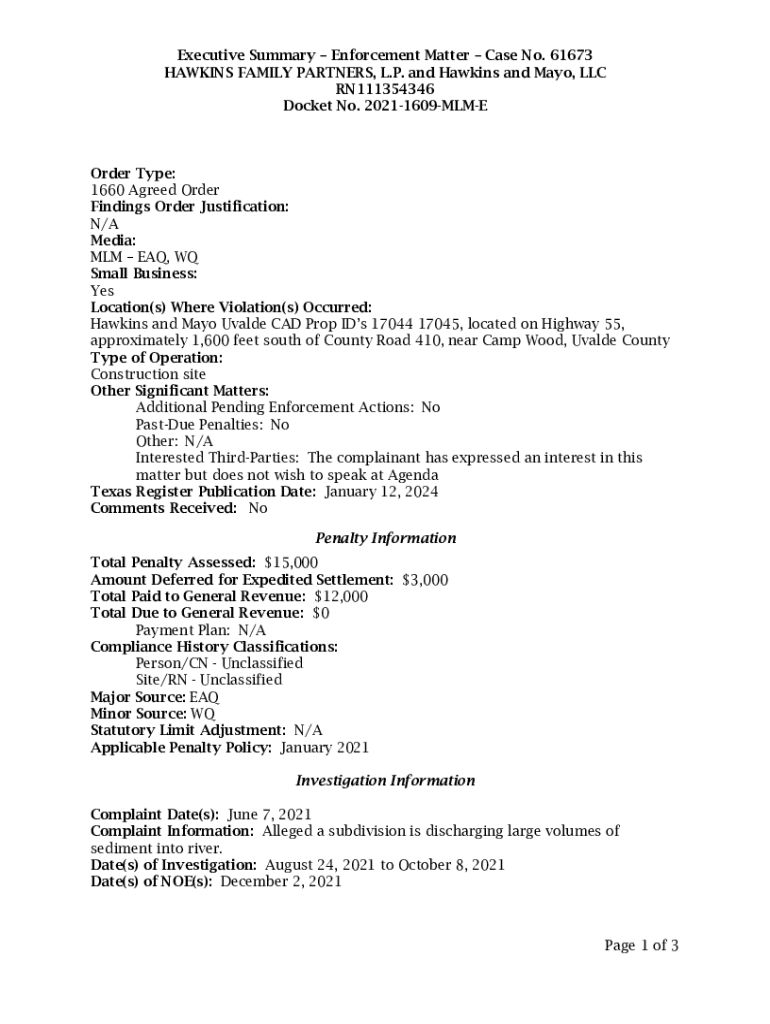

Get the free HAWKINS FAMILY PARTNERS, L.P. and Hawkins and Mayo, LLC

Get, Create, Make and Sign hawkins family partners lp

Editing hawkins family partners lp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hawkins family partners lp

How to fill out hawkins family partners lp

Who needs hawkins family partners lp?

Hawkins Family Partners LP Form: A Comprehensive Guide

Understanding the Hawkins Family Partners LP Form

The Hawkins Family Partners LP Form is a crucial document used in establishing a limited partnership structure for family-owned businesses or investment entities. This form serves to outline the relationship between partners and the operational framework of the partnership, ensuring clarity and legal compliance.

Accurate completion of this form is essential. It not only affects the legal standing of the partnership but also impacts tax positions and liability issues. Inaccuracies or omissions can lead to misunderstandings and potential legal disputes in the future.

Overview of the Hawkins Family Partners LP Structure

The Hawkins Family Partners LP utilizes a limited partnership structure, which includes both general partners and limited partners. General partners manage the partnership affairs and take on more significant liabilities, while limited partners enjoy limited liability up to their capital contributions without being involved in day-to-day operations.

This structure is particularly advantageous in terms of tax implications, allowing for pass-through taxation. This means that profits and losses are reported on the partners’ individual tax returns, potentially leading to tax efficiency. However, understanding state-specific tax laws is critical to leverage these benefits effectively.

Detailed breakdown of the form sections

The Hawkins Family Partners LP Form comprises several key sections that partners must fill out meticulously to ensure accurate representation of the partnership agreement.

Each section is designed to capture specific information crucial for legal, financial, and operational purposes.

Section 1: Basic Information

This section requires basic identification information for all partners. It includes names, addresses, and contact details. Accurate data here ensures all partners are legally recognized and can be contacted for operational matters.

Section 2: Partnership Details

Key information about partnership operations is outlined here, including the partnership’s purpose, operational timeline, and any special provisions that might apply.

Section 3: Financial Contributions

This critical section addresses capital contributions from each partner. Documenting each partner’s investment is essential for financial planning and profit-sharing calculations.

Section 4: Distribution of Profits and Losses

Effective allocation of profits and losses requires careful consideration of each partner's contribution and agreement terms. Standard formulas or customized agreements can be applied based on the partnership's goals.

Step-by-step instructions for completing the form

Completing the Hawkins Family Partners LP Form involves a structured approach, ensuring no details are overlooked.

Step 1: Gather necessary documentation

Compile the following required documents to assist in accurate completion:

Step 2: Complete each section thoroughly

When filling out each section, ensure accurate information to avoid common mistakes, such as incorrect partner details or misclassifications of contributions.

Step 3: Review and edit the completed form

After completion, thorough review is essential. A self-review checklist can guide partners through verifying each section.

Step 4: eSigning the document

Utilize pdfFiller’s eSignature capabilities to securely sign the form. This process includes verification steps to ensure document integrity.

Step 5: Submit and manage your form

For effective management and submission, follow best practices, including tracking the form’s status online.

Utilizing pdfFiller for Hawkins Family Partners LP Form management

pdfFiller offers a robust set of features tailored for managing the Hawkins Family Partners LP Form and ensuring seamless collaboration on documents.

Users can edit PDFs directly, add annotations, and highlight key information efficiently.

Troubleshooting common issues

Completing the Hawkins Family Partners LP Form can sometimes lead to common errors. Awareness and preparedness can help you avoid these challenges.

Common errors users face

Taking the time to double-check entries can prevent these issues from arising, ensuring a smoother path to partnership establishment.

Utilizing customer support options through pdfFiller can greatly assist in addressing these hurdles efficiently.

Frequently asked questions (FAQs)

When dealing with the Hawkins Family Partners LP Form, several questions frequently arise among users.

Additional considerations for family partnerships

When setting up a family partnership, it’s essential to consider various legal and operational dynamics.

Legal considerations include ensuring compliance with local laws that govern partnerships and recognizing the importance of drafting a comprehensive partnership agreement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out hawkins family partners lp using my mobile device?

How do I complete hawkins family partners lp on an iOS device?

Can I edit hawkins family partners lp on an Android device?

What is hawkins family partners lp?

Who is required to file hawkins family partners lp?

How to fill out hawkins family partners lp?

What is the purpose of hawkins family partners lp?

What information must be reported on hawkins family partners lp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.