Get the free Instructions for Form CT-3-A/BC Member's Detail Report Filed ...

Get, Create, Make and Sign instructions for form ct-3-abc

How to edit instructions for form ct-3-abc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form ct-3-abc

How to fill out instructions for form ct-3-abc

Who needs instructions for form ct-3-abc?

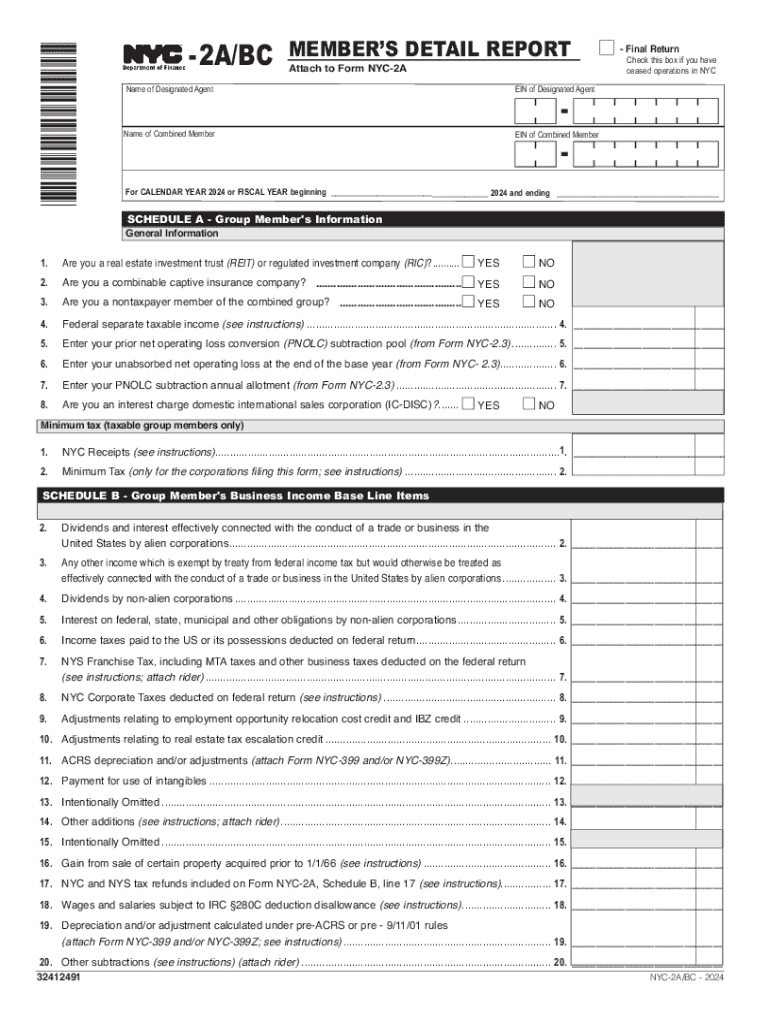

Instructions for Form CT-3-ABC

Understanding Form CT-3-ABC

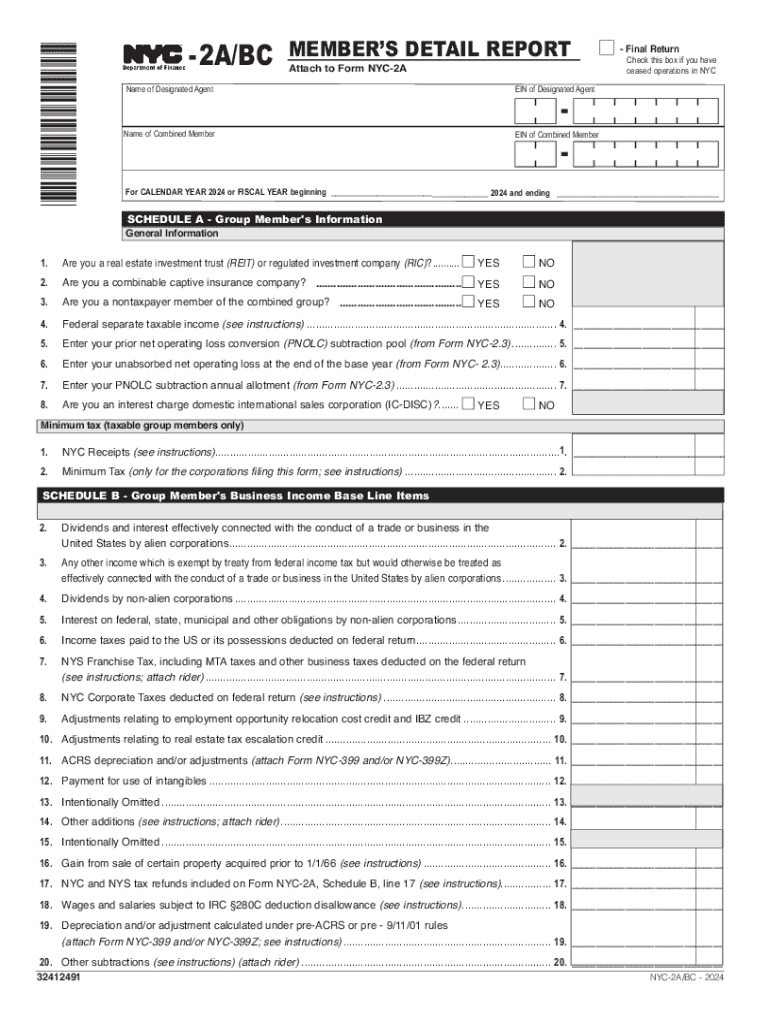

Form CT-3-ABC serves as the New York State corporation franchise tax return tailored for certain businesses, including members of real estate investment trusts. It is essential for corporations operating in New York to file this form to report their earnings and calculate their tax liability correctly.

The primary purpose of Form CT-3-ABC is to ensure compliance with state tax regulations, providing a structured way for businesses to disclose their income, deductions, and credits. Corporations that need to file include those engaging in business activities within New York State; failing to submit could result in penalties or additional tax liabilities.

By utilizing Form CT-3-ABC, corporations can benefit from a streamlined process, enabling them to report taxes accurately while often qualifying for various deductions or credits that reduce their tax burden. It represents an opportunity for businesses to manage their tax responsibilities efficiently.

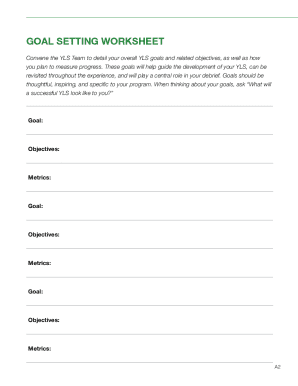

Preparing to fill out Form CT-3-ABC

Preparation is crucial before filling out Form CT-3-ABC. Begin by gathering all required documents to ensure a smooth filing process. This includes financial statements, prior tax returns, and any supporting documentation regarding income and expenses, such as receipts and invoices.

Furthermore, make sure you have vital identification numbers on hand, such as your Employer Identification Number (EIN) and New York State vendor ID. These identifiers are essential to correctly attribute your tax information to your corporation.

Remaining informed about relevant tax regulations is equally important. Key tax law changes or updates can directly affect how you fill out Form CT-3-ABC and the deductions or credits you can claim. Ensuring you are up-to-date with these laws will also help avoid errors in your filing.

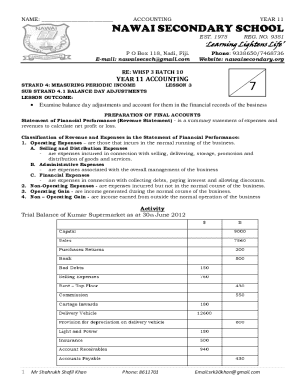

Step-by-step instructions for completing Form CT-3-ABC

Part 1 of Form CT-3-ABC focuses on basic corporation details, including the name and address fields that identify your business. You'll need to provide your Employer Identification Number (EIN) to link your tax responsibilities to your corporation accurately.

Additionally, enter the details of your reporting period. It's vital to ensure that these dates align with your accounting practices, so your income and expenses reflect the correct time frame for tax purposes.

Moving on to Part 2, you will describe the nature of your business operations. This section allows you to articulate your business activities in detail, which helps the New York State Department of Taxation understand your corporate landscape and assess your tax liability accordingly.

Lastly, Part 3 is where you calculate your tax liability. Familiarizing yourself with the applicable tax rates for your reporting year, as well as examples for accuracy, will help you arrive at the correct amount due. This part lets you itemize common deductions and credits available, ensuring you maximize potential tax savings.

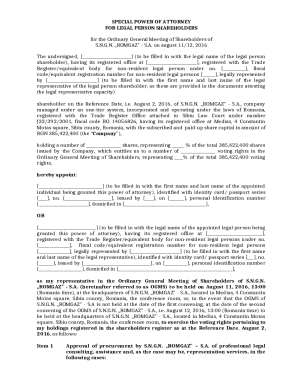

Filing requirements for Form CT-3-ABC

Determining who must file Form CT-3-ABC is an essential step in ensuring compliance. Corporations engaged in business in New York are typically required to file this form. However, certain exemptions exist, including corporations that meet specific thresholds of gross income or those classified under tax law as non-taxable entities.

When it comes to filing methods, corporations can choose between electronic filings and paper submissions. For e-filers, the process is simplified, often allowing for instant confirmations upon submission. If opting for a paper form, ensure you double-check the mailing address, as wrong submissions can lead to delays.

Key considerations after filing

Once you've submitted Form CT-3-ABC, it's essential to know what to expect. Processing timelines vary, but typically, you can anticipate an acknowledgment from the Department of Taxation within a few weeks. Tracking statuses can usually be managed through online portals to maintain awareness of your filing's progress.

In the case of audits or inquiries from the tax department, having organized documentation and being prepared to address any inconsistencies will be crucial. Should there be any mistakes in your submitted forms, correcting them swiftly is imperative to avoid compounding issues during future filings.

Tips and best practices for successful filing

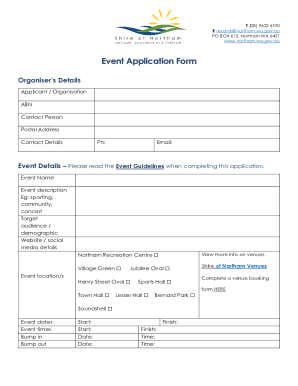

Staying on top of deadlines is vital for corporate tax filings. Effective strategies include maintaining a calendar with all important dates, such as submission deadlines and payment due dates. Early preparation for filing can prevent last-minute stress.

Utilizing pdfFiller for efficient document management streamlines the form completion process. By using this cloud-based platform, you can edit and sign CT-3-ABC efficiently, ensuring all necessary changes are made before submission. Collaborative features allow team members to work jointly on the form, making it easier to gather required information.

Interactive tools for Form CT-3-ABC

Accessing calculators and estimation tools online can simplify your tax preparation process. These tools can help gauge the potential tax liability based on input numbers derived from your income and expenses reported on Form CT-3-ABC.

Additionally, keeping an interactive checklist can ensure that every section of the form is completed accurately. This checklist can facilitate capturing all necessary documentation and information efficiently.

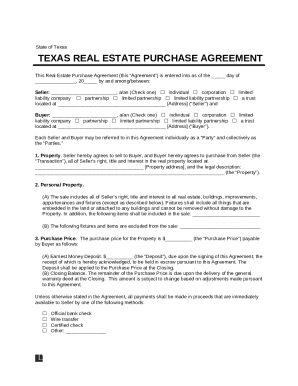

Conclusion: optimizing the filing process with pdfFiller

Utilizing pdfFiller can transform the often tedious tax filing process into a more manageable and collaborative experience. The cloud-based platform enables users to edit documents, eSign promptly, and share forms with team members efficiently, empowering corporations to stay ahead of their filing responsibilities.

By leveraging the features of pdfFiller, businesses can streamline their corporate tax filings through improved document management practices, ensuring they remain compliant while optimizing their tax planning strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my instructions for form ct-3-abc in Gmail?

How do I fill out the instructions for form ct-3-abc form on my smartphone?

How do I edit instructions for form ct-3-abc on an Android device?

What is instructions for form ct-3-abc?

Who is required to file instructions for form ct-3-abc?

How to fill out instructions for form ct-3-abc?

What is the purpose of instructions for form ct-3-abc?

What information must be reported on instructions for form ct-3-abc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.