Get the free MTD Revenue Report

Get, Create, Make and Sign mtd revenue report

How to edit mtd revenue report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mtd revenue report

How to fill out mtd revenue report

Who needs mtd revenue report?

MTD revenue report form: A how-to guide for accurate business insights

Understanding the MTD revenue report form

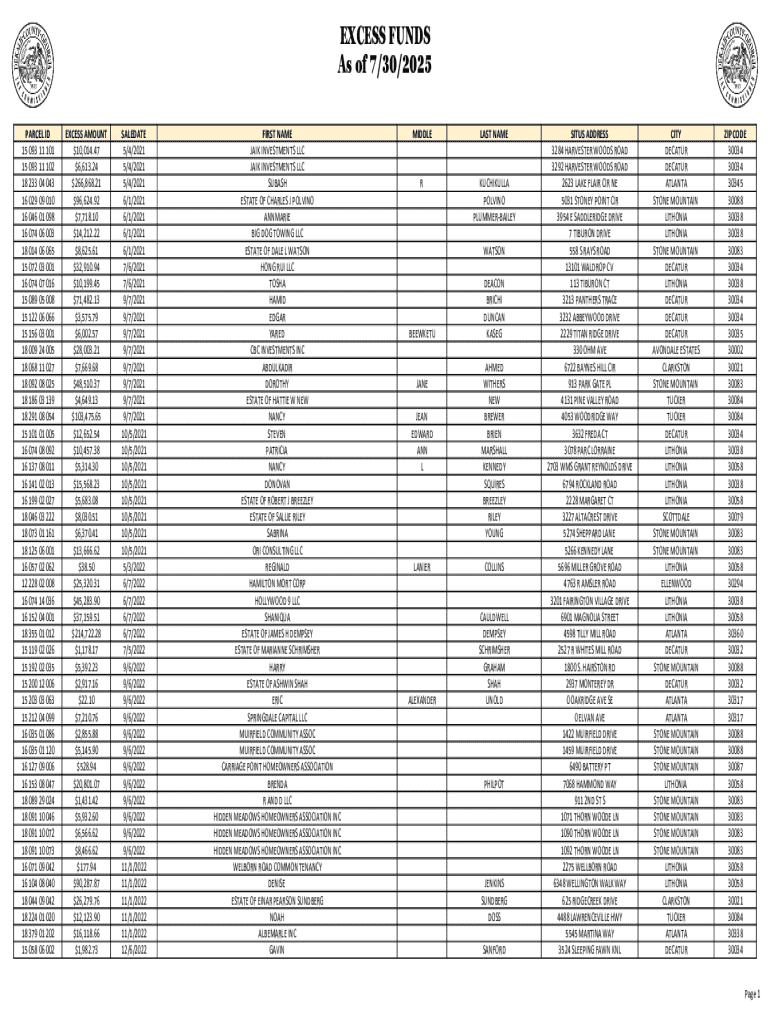

MTD revenue reporting, or Month-to-Date revenue reporting, is a critical tool for businesses that wish to monitor their financial performance throughout a specific month. By focusing on revenue generated from the start of the month until the current date, this report offers a snapshot of a company’s financial health. This approach allows companies to react proactively to changes in their revenue streams, enabling management to make informed decisions swiftly.

The importance of MTD reporting can't be overstated. It allows management to assess current performance against forecasts, pivot strategies in real-time, and identify trends early. MTD reporting differs from QTD (Quarter-to-Date) and YTD (Year-to-Date) in that MTD focuses specifically on the current month, while QTD and YTD encompass longer reporting periods. Understanding these differences helps businesses adopt the most appropriate metrics for their strategic needs.

Key components of the MTD revenue report

An effective MTD revenue report includes several essential data points. The total revenue figure generated for the month is paramount, giving a straightforward view of performance. Additionally, comparing this figure to the previous month's revenue can provide insights into growth or decline. Tracking year-on-year growth also establishes how the current month’s performance fares against the same period in previous years, helping to identify seasonal trends.

Interpreting these components is crucial for deriving actionable business insights. For instance, a sudden spike or decline when compared to the previous month could indicate either a successful sales campaign or potential issues that need addressing. Tools for data visualization, such as charts and graphs, can enhance the interpretation of these figures, allowing stakeholders to quickly grasp important trends.

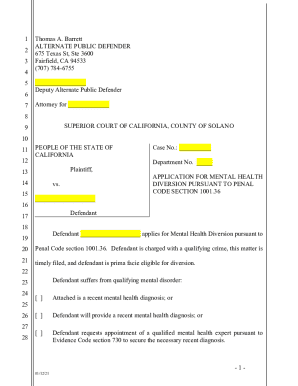

Step-by-step instructions on filling out the MTD revenue report form

Filling out the MTD revenue report form begins with accessing the template available on pdfFiller. Start by gathering all necessary documents and information related to your revenue sources and expenses, such as sales data, invoices, and receipts. Each section of the form is crucial, so let's explore them in detail:

To ensure accuracy, double-check all entries and calculations. Use tools available in pdfFiller to help manage data inputs.

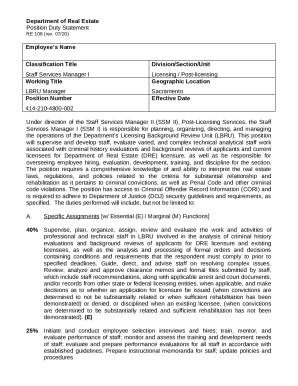

Editing and customizing your MTD revenue report

pdfFiller provides robust editing tools to modify existing MTD revenue report forms. Best practices recommend customizing templates to reflect your company's unique branding and specific reporting needs. This could include logos, fonts, and color schemes.

Moreover, including interactive fields within your report allows for real-time data entry. This ensures that your report remains dynamic and can easily adapt to any new information as it arises throughout the month.

Collaborating on MTD reports

Collaboration is key in preparing MTD reports, and pdfFiller offers tools that facilitate teamwork. You can invite team members into the document for review or edits, ensuring everyone’s input is valued. Real-time commenting and feedback mechanisms allow for an interactive approach to report preparation.

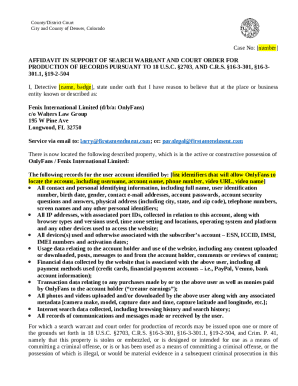

It's crucial to manage document security and permissions effectively. Ensure that sensitive data is protected by restricting access to authorized personnel only, safeguarding the integrity of the information being analyzed.

E-signing and finalizing your MTD revenue report

Using digital signatures for MTD reports streamlines the approval process. electronic signatures verify the authenticity and integrity of the document while also expediting the finalization process. pdfFiller guides users through the eSigning process step-by-step, making it simple to finalize your document.

Ensuring document integrity post-signature is vital. By retaining signed documents in a secure system, businesses can avoid disputes and maintain a clear record of approvals.

Storing and managing your MTD revenue reports

pdfFiller's document management features simplify the storage and retrieval of MTD revenue reports. Organizing reports by month or revenue type can facilitate easier access during audits or planning sessions. Historical analysis becomes simpler when all reports are archived correctly.

Best practices for archiving reports include using systematic naming conventions and maintaining organized folders. This not only helps in compliance but also significantly reduces the time taken to find past reports when required.

The frequency and timing for generating MTD revenue reports

It is generally recommended to generate MTD revenue reports shortly after the month concludes to allow for timely analysis and strategic planning. Utilizing these reports enables businesses to adjust operational strategies as needed, ensuring responsiveness to market dynamics.

MTD data can also play a pivotal role in investor relations and stakeholder reporting. By demonstrating a consistent approach to financial reporting, businesses can bolster trust and transparency, enhancing their reputation in the market.

Common challenges and solutions in MTD reporting

Preparing MTD reports can present several challenges, such as data discrepancies or formula errors. Identifying these pitfalls early on is crucial. Regular audits and checks of the data being used can prevent these issues from escalating.

Solutions may include leveraging built-in templates that minimize manual entries or adopting automated data capture methods from your invoicing systems. This not only streamlines the report creation process but also enhances compliance with financial regulations.

Enhancing your reporting with advanced analytics

Integrating analytics tools alongside your MTD reporting can elevate the depth of insights derived from your data. By investigating trends over time, businesses can gain a clearer understanding of performance drivers.

Incorporating predictive modeling techniques could help forecast revenue performance, allowing companies to plan without relying solely on historical data. This can lead to more strategic decision-making, ensuring sustainable growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mtd revenue report online?

How do I complete mtd revenue report on an iOS device?

How do I complete mtd revenue report on an Android device?

What is mtd revenue report?

Who is required to file mtd revenue report?

How to fill out mtd revenue report?

What is the purpose of mtd revenue report?

What information must be reported on mtd revenue report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.