Get the free virginia sales tax online

Get, Create, Make and Sign virginia sales tax online filing form

How to edit st 9 form virginia online

Uncompromising security for your PDF editing and eSignature needs

How to fill out file va sales tax form

How to fill out va form st-9 virginia

Who needs va form st-9 virginia?

A Comprehensive Guide to VA Form ST-9: Navigating Virginia's Tax Form Essentials

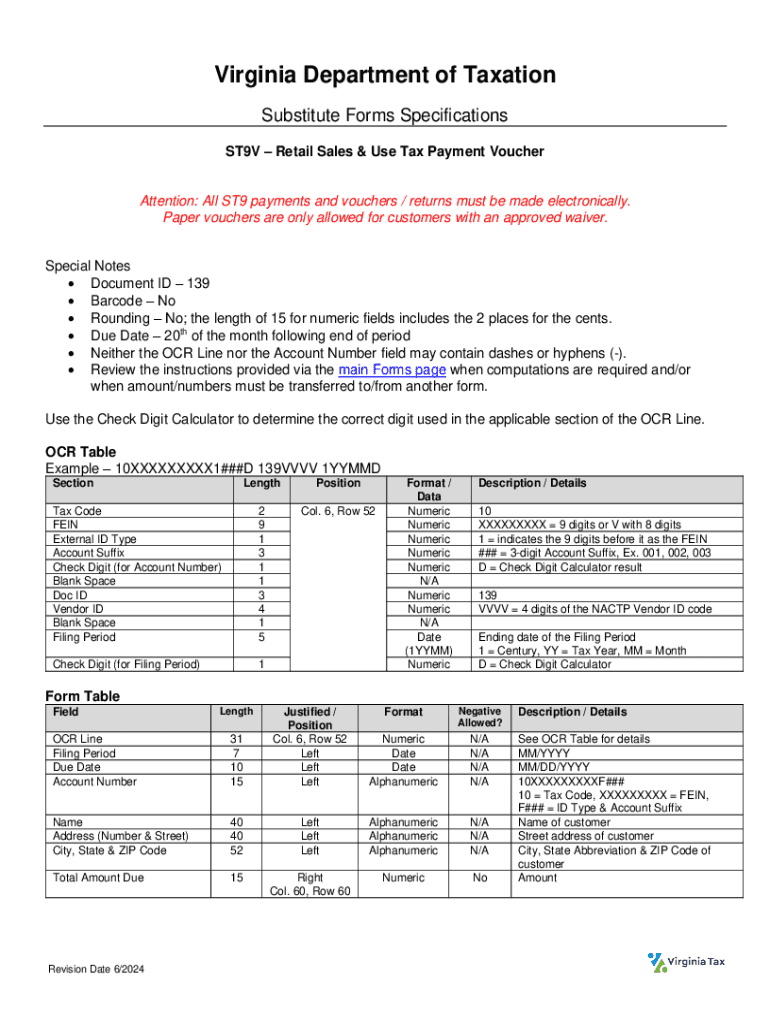

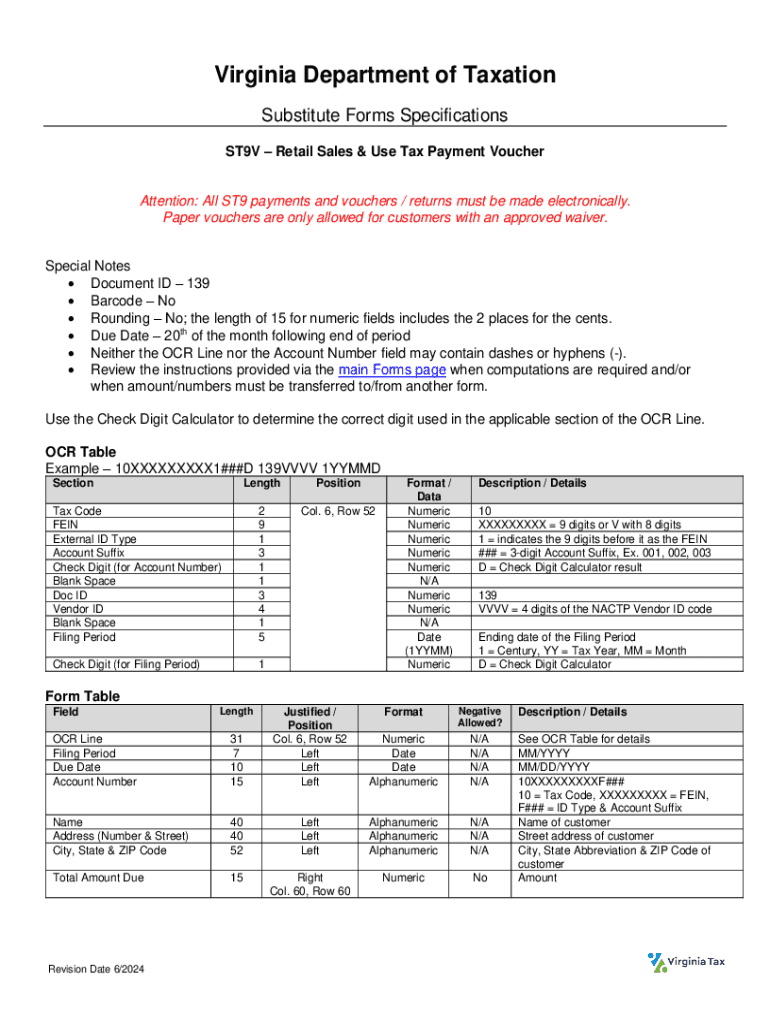

Understanding the VA Form ST-9

VA Form ST-9 is a crucial form utilized within the Virginia tax system, primarily by businesses to report tax-exempt sales. This form allows registered organizations to obtain a certificate of exemption from the Virginia sales tax, enabling them to make purchases for their operations without incurring state sales tax. The significance of this form can't be understated, as it plays a pivotal role in the financial management of various entities, particularly those involved in sales or services exempt from tax. Knowing when and how to use the VA Form ST-9 is essential for compliance and optimizing financial flow.

Generally, businesses and other organizations, such as non-profits and government agencies, are required to file this form. If your organization makes purchases that qualify for sales tax exemption, understanding how to properly complete and submit the VA Form ST-9 is crucial. By filing this form, organizations can help ensure that they adhere to Virginia's tax regulations and avoid unnecessary fees or fines.

Key features of VA Form ST-9

The VA Form ST-9 consists of several key components designed to collect relevant information from the filer. Primarily, this form includes sections that require the organization’s name, address, and identification number, ensuring that the Virginia Department of Taxation can authenticate the eligibility of the claimant. There are also distinctive parts dedicated to the nature of the tax-exempt purchases, making it easier for the state to track the transactions facilitated under this exemption.

The following information is typically required on the form: - The name and address of the purchasing organization - The type of exempt entity (non-profit, government, etc.) - Specific details regarding the items or services being purchased - A declaration of the intent to use the exemption for specific activities as outlined by Virginia tax law. Knowing these details is essential for ensuring complete and correct filings.

Important deadlines for filing this form also exist. Typically, the form should be filed whenever an exempt purchase is intended. While there are no fixed dates like traditional tax filing deadlines, it's crucial to keep records current to avoid complications. Any missteps in filing could result in penalties or the denial of exemption, thus ensuring timely submissions is integral to maintaining compliance with Virginia tax regulations.

Step-by-step guide to filling out VA Form ST-9

To begin the process of filling out the VA Form ST-9, it's essential first to gather all required information. This includes personal identification details of the organization, such as the name of the president or authorized representative, the address, and the appropriate tax identification number. Alongside this, relevant financial data should be compiled to substantiate the tax-exempt status, particularly any supporting documents that describe the organization's mission and activities that qualify for exemption.

When completing the form, pay particular attention to each section, as accuracy is critical. Here are detailed instructions to assist you: - Start with the organizational details: Provide accurate and up-to-date information. - Clearly describe the items or services being purchased under the exemption clause. - Ensure to sign the form where indicated to validate the information provided. Remember that all forms must be completed in ink or electronically for validity, and the use of correct language is essential. Avoid common pitfalls such as incomplete information or incorrect entity classification.

Once your form is completed, it's vital to double-check your work. Here are some tips for ensuring accuracy: - Cross-reference with supporting documentation. - Verify spelling, especially of names and addresses. - Confirm that all logically connected pieces of information agree with each other.

Submission of VA Form ST-9

When it comes to how to file your VA Form ST-9, there are multiple options available. Filers can choose to submit their forms online or via traditional mail. In the digital age, most prefer online submission for its efficiency and tracking capabilities. Virginia has established a streamlined process for electronic submissions, which may involve specific software or online platforms, such as pdfFiller. Users can fill the form digitally, ensuring easy access and swift submissions.

For electronic submission via pdfFiller, make sure to create an account or log in. You’ll be prompted to upload your form, fill out the necessary fields, and utilize the eSignature feature to finalize your submission. This ensures all required signatures are captured, keeping your filings legitimate and prompt. Always confirm you receive a confirmation email after submitting to assure successful processing of your form.

What to expect after submission

After filing your VA Form ST-9, it's essential to understand the form review process. Typically, the submission enters a review phase where the Virginia Department of Taxation verifies the information provided. Expect a processing timeline that may vary; however, it's essential to remain patient as it can take several weeks. If there are any issues or discrepancies found during the review, the state agency will reach out via the contact information provided on the form.

If you encounter errors or issues following your submission, here's how to handle them: - Keep a close watch for notifications regarding issues. - Review any feedback critically and compare it with your submitted form. - Reach out to the Virginia Department of Taxation for clarity if you can't resolve issues independently.

Important notices and updates

Changes to VA Form ST-9 can occur, and it is crucial for filers to stay updated on any recent modifications. Such updates may affect submission processes, reporting requirements, or eligible transactions. Subscribers to Virginia’s tax updates or business newsletters can remain informed about any alterations that might impact their filing. Being proactive about these changes can prevent potential issues or penalties in the future.

For example, organizations might experience shifts in qualifying criteria or required documentation as tax regulations evolve. Monitor the Virginia Department of Taxation's official website or follow them on social media for real-time updates.

Troubleshooting common problems

Filing issues are not uncommon when dealing with forms such as VA Form ST-9. Some common problems include incorrect filings due to human error or technical issues when submitting online. To mitigate such occurrences, stay organized and double-check all inputs as previously discussed. Always have backup copies of your submissions saved on pdfFiller or a secure document management system.

In situations where you face difficulties obtaining necessary information or errors in submission, employ the following strategies: - Review your documents early to identify discrepancies. - Consult with colleagues or use the collaboration features available in pdfFiller for enhanced document oversight. - If persistent issues arise, don't hesitate to reach out for expert assistance or guidance from Virginia tax professionals.

Advanced tips and tools

Using pdfFiller for VA Form ST-9 not only simplifies the filling process but also enhances overall document management. The cloud-based platform provides an array of editing tools that lets users customize their documents according to legal requirements. Every feature from filling out forms to the eSignature function ensures that your submissions are adhered to faster and with fewer errors. It's particularly beneficial for organizations handling multiple tax-exempt purchases.

By leveraging pdfFiller’s collaboration tools, team members can provide input in real-time, allowing for streamlined approval processes and ensuring that all relevant information is included before submission. This not only enhances accuracy but saves valuable time, allowing teams to focus on core business activities.

Monitoring and landscaping your filing journey

Once your VA Form ST-9 is filed, it's vital to have a strategy for monitoring saved data and tracking the progress of your submission via pdfFiller. Establishing a structure for how to handle documentation not only simplifies record-keeping but also aids in future filings. Saving all necessary documents in an organized manner within pdfFiller enables users to quickly reference their submissions when needed and renders future filings more efficient.

Accessing saved forms on the platform is user-friendly; simply log in and navigate to your document management area. Maintaining accurate records not only helps in clarifying past transactions but also provides a robust audit trail for future tax reporting needs. Proper organization preemptively mitigates any complications that may arise in audits or reviews.

Additional considerations

Filing incorrect information on the VA Form ST-9 can have long-term implications on future tax returns. Errors may trigger audits or lead to penalties that can affect an organization's cash flow and operational efficiency. Hence, precision during the initial filing process is paramount. When uncertain, consulting with tax professionals can provide clarity and insight into acceptable practices within Virginia's tax framework.

Should your organization encounter persistent challenges in understanding or filling out the VA Form ST-9, seeking legal assistance might be beneficial. Engaging with tax professionals who understand Virginia’s tax laws can offer tailored solutions and ensure compliance, further deterring potential taxation issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit virginia sales tax online in Chrome?

Can I edit virginia sales tax online on an iOS device?

How do I complete virginia sales tax online on an Android device?

What is va form st-9 virginia?

Who is required to file va form st-9 virginia?

How to fill out va form st-9 virginia?

What is the purpose of va form st-9 virginia?

What information must be reported on va form st-9 virginia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.