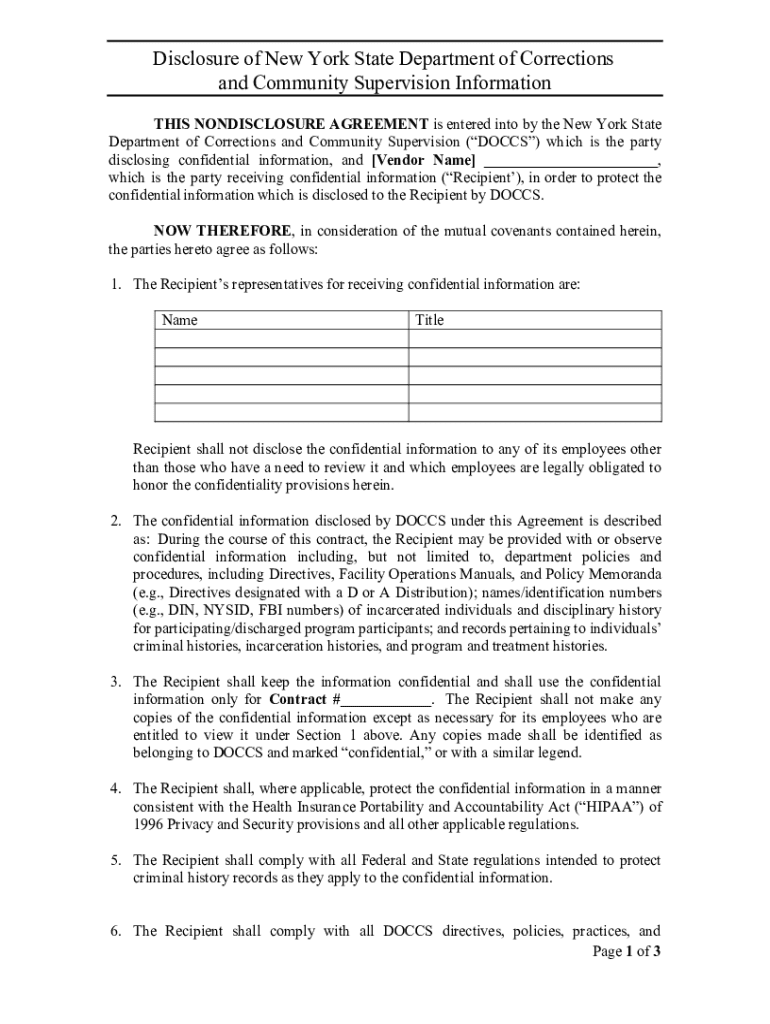

Get the free Disclosure of New York State Department of Corrections and ... - doccs ny

Get, Create, Make and Sign disclosure of new york

Editing disclosure of new york online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosure of new york

How to fill out disclosure of new york

Who needs disclosure of new york?

Understanding the Disclosure of New York Form: A Comprehensive Guide

Understanding the Disclosure of New York Form

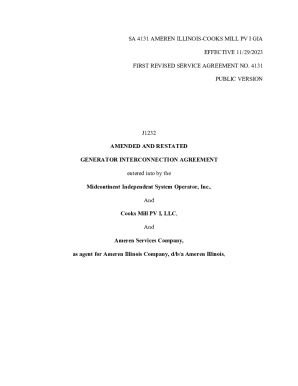

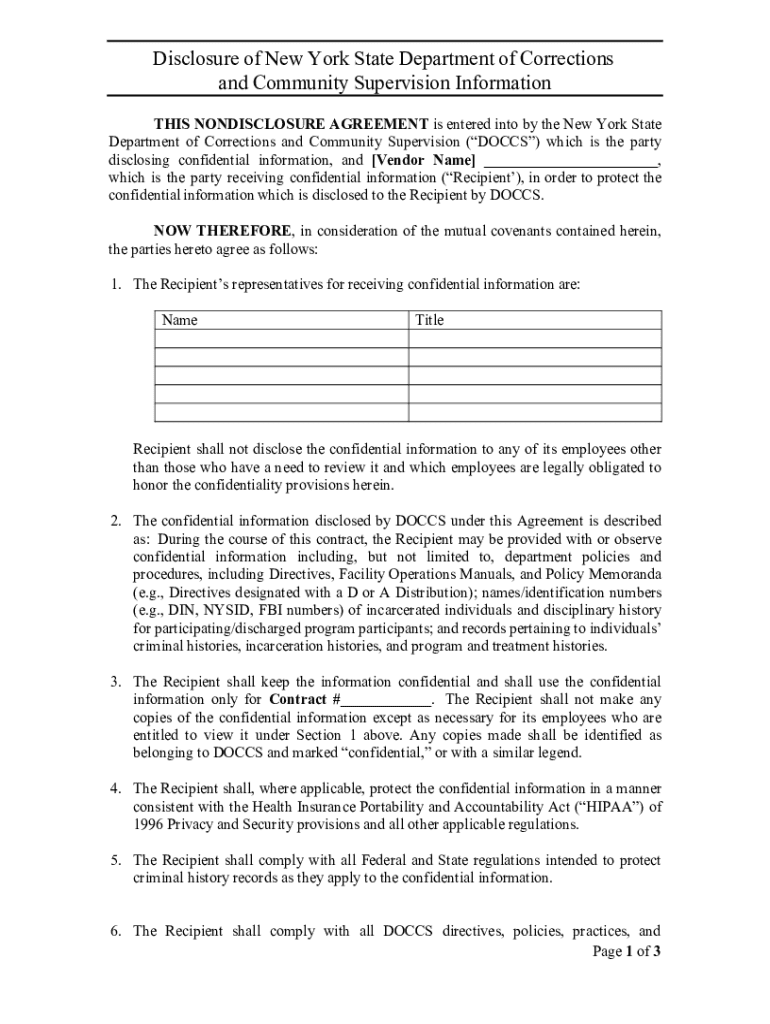

The Disclosure of New York Form is a crucial document designed to promote transparency among various entities operating within the state. Its primary purpose is to disclose financial and ethical obligations, ensuring that stakeholders have access to information that might influence their decisions. This form acts as a safeguard against conflicts of interest and promotes accountability within sectors where public trust is paramount.

The importance of this form extends beyond mere compliance; it ingrains a culture of honesty and integrity within organizations. By requiring detailed disclosures, it mandates that entities maintain a clear record of their financial dealings, affiliations, and any potential conflicts, thereby fostering a transparent business environment.

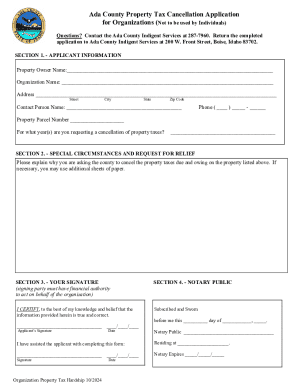

Who needs to file?

Certain individuals and entities are mandated to file the Disclosure of New York Form. This includes public officials, candidates for office, and specific employees in sectors such as education, healthcare, and finance. In addition, consultants and lobbyists are also required to provide disclosures that could impact their work. The goal is to ensure that everyone involved in decision-making processes is held accountable and that all potential conflicts of interest are identified and managed.

Filing this form is crucial in specific scenarios such as when an individual is starting a public service role, participating in lobbying, or interacting with public funds. In essence, anyone in a position where they could influence the public good must be transparent about their interests and affiliations.

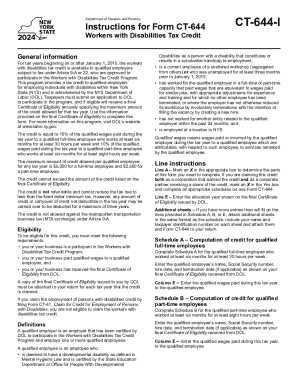

The filing process explained

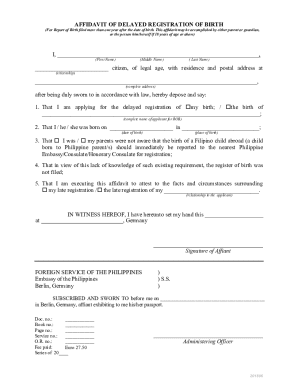

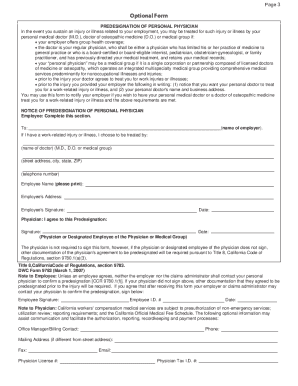

Filing the Disclosure of New York Form might seem daunting, but by following a systematic approach, one can navigate this process effortlessly. A step-by-step guide begins with gathering necessary documentation. This includes financial records, personal information, and any other relevant data that would contribute to a comprehensive disclosure.

Once all necessary documents are ready, start completing the form with accurate and honest information. It's essential to follow specific instructions for each section carefully. When filling out the form, clarity and precision are paramount; any discrepancies could lead to fines or reputational damage.

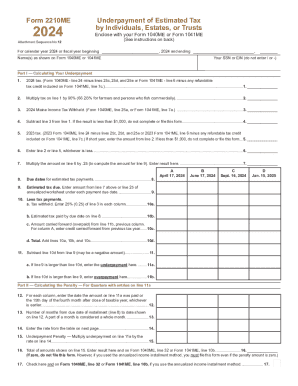

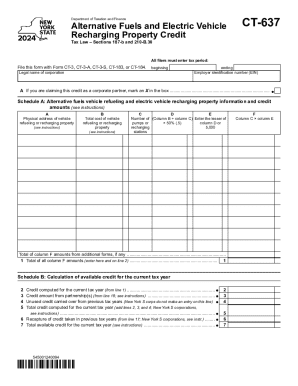

Deadlines and important dates

Filing deadlines for the Disclosure of New York Form can vary depending on the specific role of the filer. Typically, the form must be submitted annually, with most deadlines falling between late January and by the end of April. Familiarizing yourself with these key dates is crucial; late filings can result in penalties or extended review periods, which can complicate compliance efforts.

To ensure compliance, keeping a calendar with critical filing dates can be immensely helpful. Make note of reminder dates leading up to deadlines, as this can aid in avoiding any last-minute rush to gather information or complete the filing.

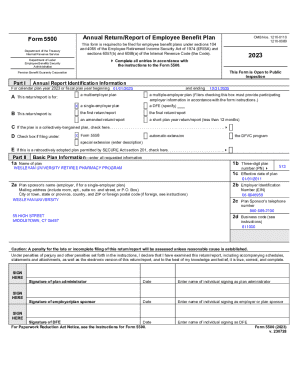

Managing your disclosure form online

Accessing the Disclosure of New York Form online can streamline the filing process. Utilizing platforms like pdfFiller, you can easily locate the form and fill it out digitally. To do this, navigate to the pdfFiller website, search for the 'Disclosure of New York Form,' and download it in an editable format. This process saves time and physical storage space.

Once you have the form, take advantage of the online tools provided to monitor your progress. The platform offers features to track fields that need completion and corrections. This will help avoid any common errors such as missed fields or incorrect information.

Editing the form for accuracy

After downloading the form through pdfFiller, editing it for accuracy is necessary. The platform provides intuitive tools to edit text, add signatures, and adjust fields easily. Key features to look for include spell-check functions, font formatting options, and error highlighting, ensuring your form remains clean and professional.

Collaborating and signing the disclosure form

Collaboration is vital, especially when multiple individuals contribute to a single Disclosure of New York Form. pdfFiller allows users to invite team members to view and edit the document. To do this, simply select the 'Share' option from the platform, and input the email addresses of those you wish to collaborate with. This way, everyone can provide their input in real-time, enhancing the accuracy of your disclosures.

Another advantage of using pdfFiller for your disclosures is the ability to electronically sign the form. Electronic signatures are legally binding in New York, making it easier to finalize documents without needing physical signatures. Ensure that all signatories understand the implications of eSigning, and verify that the platform’s eSignature function adheres to New York laws.

The legal implications of eSigning in New York

eSigning offers a convenient way to complete the filing process, but it’s crucial to comprehend its legal implications. In New York, eSignatures are recognized under the Electronic Signatures and Records Act (ESRA), which grants them the same validity as traditional signatures. However, parties involved should ensure that they are using robust and secure platforms for signing, such as pdfFiller, to ensure compliance and authenticity.

Accessing publicly available filings

Searching for existing Disclosure of New York Filings can prove valuable for various stakeholders. To access public disclosures, visit the appropriate state department website, where filings are regularly updated. By leveraging search functionalities, users can locate specific filings based on names, organizations, or filing years, ensuring they gather accurate data regarding past disclosures.

It's essential to understand the significance of publicly available filings. These disclosures offer insight into the financial activities and affiliations of public officials and entities, promoting a culture of transparency. For anyone evaluating a business or an individual’s potential conflict of interest, the ability to view previous disclosures can guide informed decisions.

Viewing delinquent filings

In addition to accessing regular filings, users can also seek out delinquent filings. This typically involves a process where one can submit specific requests through the state’s transparency portal. Furnishing the necessary details can facilitate a quicker response, allowing anyone to access forms that might have been filed late.

Upon discovering inaccuracies in publicly reported filings, it is critical to report them to the appropriate authorities promptly. Not only does this align with ethical practices, but it also helps maintain the integrity of the disclosure system. Keeping a check on publicly available filings can encourage a more accountable and transparent environment.

Additional support and resources

Many users frequently ask questions regarding the Disclosure of New York Form, underlining common areas of confusion or concern. Questions typically arise around who is required to file, the specifics of completing the form, and consequences for late submissions. Addressing these queries is crucial for compliance and peace of mind.

Specific scenarios that often require further clarification include what constitutes a conflict of interest and how those should be disclosed. pdfFiller addresses these inquiries comprehensively through resources and customer support tailored to equipping users with the knowledge needed for informed compliance and effective filing.

For additional guidance, pdfFiller provides customer support options like live chat, email assistance, and a detailed knowledge base. These resources can help users navigate any complexities involved with the filing process, enhancing users’ ability to comply with the requirements of the Disclosure of New York Form swiftly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete disclosure of new york online?

How do I fill out the disclosure of new york form on my smartphone?

Can I edit disclosure of new york on an iOS device?

What is disclosure of new york?

Who is required to file disclosure of new york?

How to fill out disclosure of new york?

What is the purpose of disclosure of new york?

What information must be reported on disclosure of new york?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.