Get the free official form 106j

Get, Create, Make and Sign official form 106j

How to edit official form 106j online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 106j

How to fill out official form 106j schedule

Who needs official form 106j schedule?

Understanding Official Form 106J Schedule Form: A Comprehensive How-To Guide

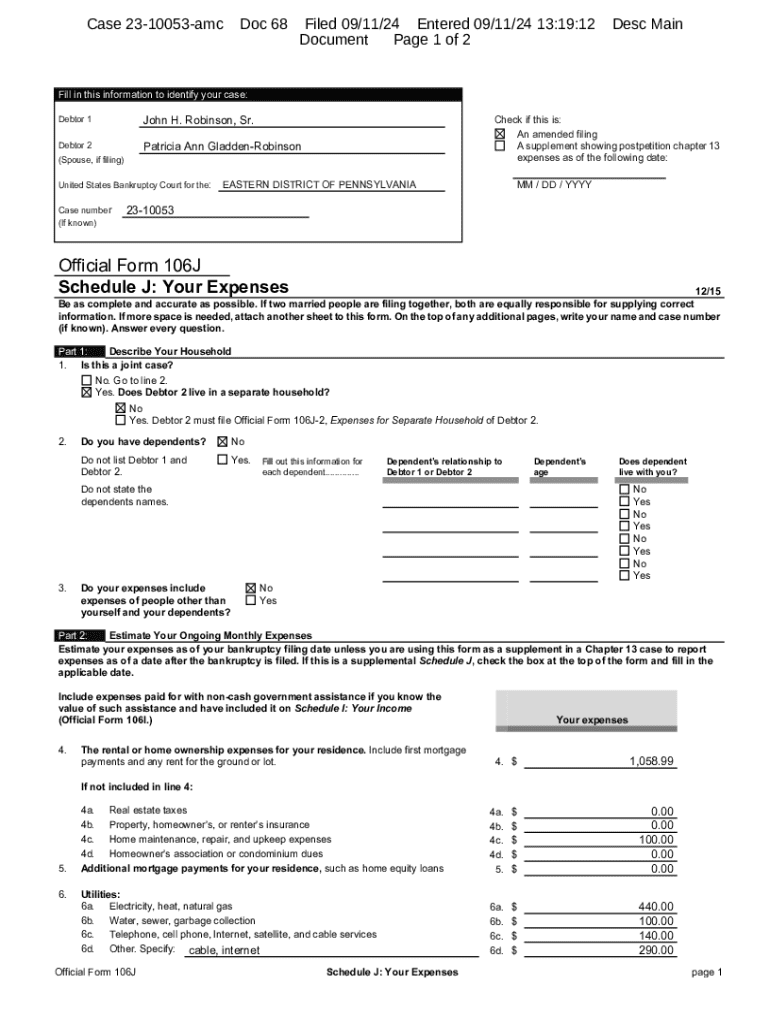

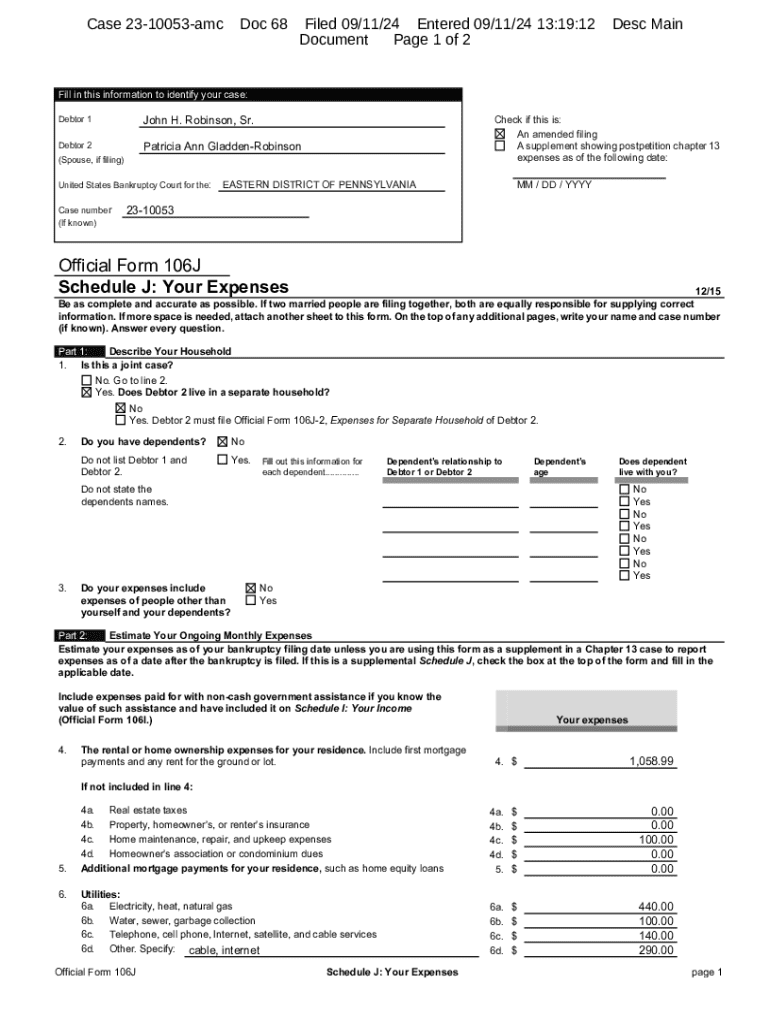

Understanding Official Form 106J Schedule

Official Form 106J is a crucial document within the bankruptcy process, specifically designed to report monthly expenses that can affect a debtor's financial obligations during bankruptcy proceedings. This form is integral to illustrating a debtor's financial situation accurately to the bankruptcy court, helping to ensure that the court understands the necessity of the expenses incurred monthly against the income available, which can aid in determining the path to financial recovery.

The purpose of Form 106J is clear: it aids in financial disclosures required for bankruptcy petitions, giving insight into necessary and discretionary spending. Understanding this form is vital not only for potential filers but also for representatives assisting them, highlighting the key differences from other forms such as Official Form 106I (Income) and Official Form 106A/B (Assets) that focus more on income sources and assets.

Who needs to use Official Form 106J?

Individuals planning to file for bankruptcy are the primary users of Official Form 106J. It is essential for these individuals to detail their living expenses accurately, as this information plays a pivotal role in bankruptcy proceedings. In addition, financial advisors and legal representatives must also be familiar with this form, as they frequently assist clients in completing it accurately and ensuring compliance with filing guidelines.

Specific life situations, such as encountering unforeseen medical expenses, job loss, or other financial hardships, require the use of Form 106J. Moreover, anyone undergoing significant changes in their financial standing or facing challenges in managing family expenses would benefit from accurately filling out this document to reflect their current financial obligations.

Breakdown of Official Form 106J Schedule

Official Form 106J consists of multiple sections that play a vital role in capturing an accurate financial portrait of the debtor’s monthly obligations. The first section asks for a description of monthly expenses, which includes vital areas such as housing, utilities, transportation, food, and health care. Proper categorization of these expenses is key to showing the bankruptcy court an accurate picture of ongoing financial commitments.

The second section differentiates between necessary and discretionary expenses, providing definitions and examples to aid filers in knowing what to include. Necessary expenses are essentials that must be paid, like rent and groceries, while discretionary expenses include non-essential items, such as dining out or luxury entertainment. This distinction is crucial because it affects repayment plans and the debtor’s financial recovery.

Finally, the total monthly expenses calculation section helps debtors sum their expenses comprehensively. This section often includes commonly made mistakes, such as miscalculating totals or omitting certain types of expenses. Debtors need to be meticulous in their calculations to present an accurate financial picture.

Step-by-step instructions for completing Official Form 106J

Before completing Official Form 106J, it is essential to prepare adequately. Start by gathering all necessary financial documents, including tax returns, pay stubs, bills, and any statements reflecting ongoing expenses. Understanding your monthly income sources also lays a good foundation for accurately detailing your expenses and ensuring they're aligned.

Filling out the form begins with entering your personal details accurately, followed by listing essential living expenses methodically. Itemize additional expenses next, including transportation and medical expenses. Finally, calculate your totals carefully. Double-check to ensure that all expenses have been accounted for, and ensure legitimacy and thoroughness in your review process before submission.

Tips for maximizing accuracy and efficiency

Ensuring all relevant expenses are included on Official Form 106J can save time and reduce the risk of delays in the bankruptcy process. One tip is to maintain a detailed record of your expenses for at least several months in advance before filing. This habit makes it easier to compile a comprehensive list of family expenses and necessary cash outflows when completing the form.

Additionally, utilizing digital tools can greatly enhance the completion process, especially platforms like pdfFiller, which streamline editing and organizing expenses. Features such as interactive elements for tracking expenditures and templates specifically designed for Official Form 106J provide ease and precision, allowing users to focus on accuracy without the tedious task of manual calculations.

Common mistakes to avoid with Official Form 106J

Common pitfalls in completing Official Form 106J often include ineffective documentation, where expenses are not adequately verified or substantiated with supporting documents. This lack of documentation can raise red flags during bankruptcy proceedings, potentially leading to penalties or complications in the process.

Another mistake is misclassifying expenses by failing to distinguish between necessary and discretionary costs adequately. This misclassification can skew total expense calculations, which impact the overall assessment by the bankruptcy court. Lastly, neglecting to update the form as financial situations change can severely hinder the accuracy of the information presented and might lead to difficulties later in the bankruptcy process.

FAQs about Official Form 106J

A common question about Official Form 106J focuses on the implications of reporting expenses that exceed income. In situations like these, it’s essential to clearly communicate the rationale for these expenses. The court may require a thorough justification for continued financial distress.

Filers also wonder if the form can be amended after submission. The answer is yes; adjustments can be made as needed, particularly if there are changes in financial circumstances post-filing. Finally, understanding how Official Form 106J influences the overall bankruptcy process is vital. The accurate completion of this form can significantly impact discharge eligibility and repayment plans.

Linked topics and related documents

Understanding how Official Form 106J interacts with other forms can provide perspective on comprehensive financial disclosures. For instance, Official Form 106I focuses on documenting income, while Official Form 106A/B deals with assets and the overall financial picture. Each plays an integral role and should be referenced accordingly during the filing process.

Moreover, additional resources for bankruptcy filers include legal aid organizations and financial planning tools that can provide practical help during the process. Familiarity with these support options can greatly ease the journey through bankruptcy and ensure financially responsible decisions moving forward.

Leveraging pdfFiller for document management

Using cloud-based solutions like pdfFiller enables users to edit forms such as Official Form 106J easily and accurately. The platform’s features support seamless editing, eSigning, and collaboration, making it more efficient to manage documents under one roof. Accessibility from anywhere simplifies the process for users who may need to reference or complete documents on the go.

Additionally, pdfFiller offers secure ways to manage and store completed forms. With robust security measures in place, users can rest assured that their information remains confidential while still allowing easy access for necessary consultations with financial advisors or legal representatives.

Additional considerations for filing bankruptcy

Finalizing your finances requires an understanding of the implications your disclosed expenses may have on the bankruptcy process. Reported expenses, particularly those that are necessary for day-to-day living, play a significant role in determining eligibility for discharge and repayment plans. Careful reporting can lay the groundwork for a successful recovery.

It is essential to be thorough and truthful in filling out Official Form 106J, as accuracy directly impacts your future financial choices. Keeping track of changes in financial conditions and updating relevant forms as needed ensures that you remain compliant with court orders and can build a solid foundation for financial recovery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my official form 106j directly from Gmail?

How do I edit official form 106j straight from my smartphone?

How do I complete official form 106j on an iOS device?

What is official form 106j schedule?

Who is required to file official form 106j schedule?

How to fill out official form 106j schedule?

What is the purpose of official form 106j schedule?

What information must be reported on official form 106j schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.