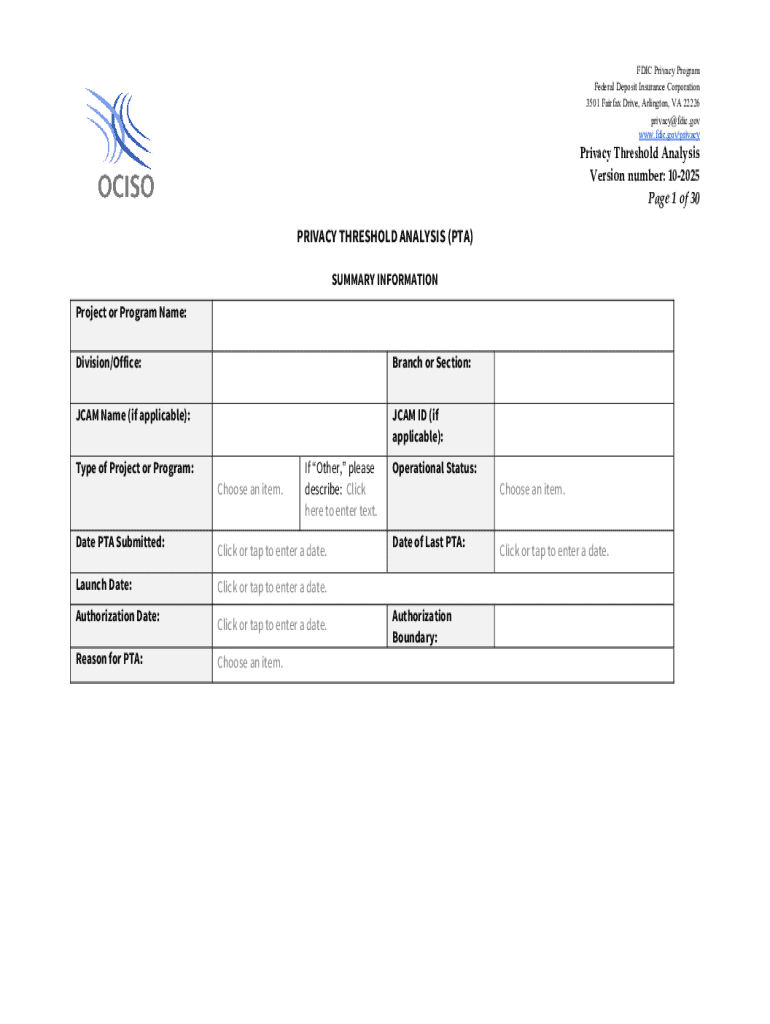

Get the free FDIC Supervisory Approach Regarding the Use of Pre- ...

Get, Create, Make and Sign fdic supervisory approach regarding

Editing fdic supervisory approach regarding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fdic supervisory approach regarding

How to fill out fdic supervisory approach regarding

Who needs fdic supervisory approach regarding?

FDIC supervisory approach regarding forms

Overview of the FDIC supervisory approach

The Federal Deposit Insurance Corporation (FDIC) plays a pivotal role in safeguarding the stability of the nation's banking system. Its supervisory approach encompasses a rigorous assessment of financial institutions to ensure their compliance with federal regulations, specifically concerning the various forms they must complete. Understanding this supervisory approach is essential as it underpins the confidence consumers place in financial institutions and the overall system's stability.

The FDIC's supervisory approach targets several key objectives when it comes to forms: maintaining bank accountability, enhancing consumer protection, and establishing a groundwork for banking safety and soundness. This regulatory context not only reinforces a strong leadership posture within the banking community but also fosters an environment where innovation can thrive without compromising safety.

Understanding the relevance of forms in FDIC supervision

Forms serve as the bedrock of FDIC supervision by capturing essential information needed to assess banks' operations and risks. Common types of forms reviewed include call reports, risk assessment forms, and compliance documentation, all fundamental to the FDIC's regulatory framework. Their primary purpose is to provide regulators with vital insights into a bank's financial health and operational status.

Moreover, forms are a critical tool for compliance and risk management. They facilitate meticulous tracking of data necessary for regulatory adherence and foster effective communication between financial institutions and regulators. Through accurate and timely form submissions, banks can demonstrate their commitment to transparency and public confidence in their operations.

Detailed insights into specific FDIC forms

Among the forms utilized by the FDIC, several play a pivotal role. For instance, **Form 314** pertains to the compliance of banks with the Bank Secrecy Act and Anti-Money Laundering (AML) regulations. Its primary purpose is to gather data on suspicious activities and assist in minimizing risks associated with financial crime.

Another significant document is **Form FR 2056**, which banks use to demonstrate their capital adequacy. This form ensures that banks maintain sufficient capital on hand, which is vital for operational stability and consumer trust. By understanding the requirements of these forms, institutions can better handle regulatory expectations.

Frequently asked questions about these forms often center on submission deadlines and detailed requirements. For instance, how often does a bank need to submit Form 314, and what constitutes a suspicious activity report? Addressing these questions aids banks in maintaining compliance and ensures they meet the expectations set forth by the FDIC.

Interactive tools for form management

In an age of digital innovation, utilizing interactive tools for managing FDIC forms can significantly enhance efficiency. Resource platforms like pdfFiller allow users to easily fill out, edit, and manage forms with a user-friendly interface designed for direct access from anywhere.

Below is a step-by-step guide to utilizing pdfFiller effectively:

Case studies reveal how financial institutions have improved their compliance processes through pdfFiller, resulting in heightened accuracy and reduced turnaround times for submitting vital forms.

Best practices for completing FDIC supervision forms

Accuracy and compliance are critical when filling out FDIC forms. Here are common mistakes to avoid:

To ensure accuracy, take the time to verify all entries. Engage relevant team members in review processes to spot potential errors before submission. Furthermore, it's vital to monitor any updates from the FDIC regarding form changes, enhancing your institution's ability to remain in compliance.

Challenges and solutions in form management

One of the significant challenges faced by institutions in managing FDIC forms is the voluminous data required. Complexity can lead to errors and inefficiencies. Utilizing tools like pdfFiller can help mitigate these challenges by simplifying the filling and submission processes through automation and structured workflows.

For instance, a large regional bank faced difficulties processing hundreds of forms annually, resulting in compliance lapses. By adopting pdfFiller, they streamlined form submissions, reducing processing time by fifty percent and improving accuracy substantially.

Updates and changes in FDIC form requirements

Recently, several developments have led to significant changes in FDIC form requirements, particularly around capital adequacy and consumer protection standards. These changes reflect the evolving landscape of banking regulation aimed at fortifying the nation's financial institutions.

For instance, modifications in the categories of risk assessment have been implemented to provide improved guidelines for banks. Understanding how such changes affect the supervisory process is essential for banks to align their strategies accordingly. Institutions should stay informed on emerging regulations, as proactive adjustments can significantly influence their compliance status.

Related topics in FDIC supervision

The relationship between proper form completion and overall bank health cannot be overstated. Accurate and timely submissions not only reflect compliance but also contribute to the institution's stability and consumer confidence.

Moreover, with advancements in technology, the FDIC's supervisory practices are continuously evolving. The integration of artificial intelligence and data analytics in regulatory processes indicates future trends that may involve more automated assessments and real-time monitoring, changing how forms will be utilized in the coming years.

Engaging with the FDIC and staying compliant

Establishing effective communication channels with the FDIC is paramount for financial institutions. Regular dialogues not only foster relationships with regulators but also provide crucial insights into regulatory expectations and compliance nuances.

Resources like webinars, newsletters, and training sessions offered by the FDIC are excellent for ongoing education. Additionally, networking opportunities within industry associations can help build connections that further support adherence to best practices and regulatory demands.

Contact information for further assistance

Should you have any questions regarding specific forms, reaching out to the FDIC directly through their dedicated helpdesk can provide swift clarification. Additionally, for managing forms effectively, pdfFiller offers comprehensive support to assist users in navigating form requirements.

Contact details for pdfFiller support can be found on their website, ensuring that institutions always have access to the resources they need to manage their form-related tasks efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in fdic supervisory approach regarding without leaving Chrome?

Can I create an electronic signature for the fdic supervisory approach regarding in Chrome?

Can I edit fdic supervisory approach regarding on an Android device?

What is fdic supervisory approach regarding?

Who is required to file fdic supervisory approach regarding?

How to fill out fdic supervisory approach regarding?

What is the purpose of fdic supervisory approach regarding?

What information must be reported on fdic supervisory approach regarding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.