Get the free Presentation on PCI Rules. Presentation on PCI Rules - doh wa

Get, Create, Make and Sign presentation on pci rules

Editing presentation on pci rules online

Uncompromising security for your PDF editing and eSignature needs

How to fill out presentation on pci rules

How to fill out presentation on pci rules

Who needs presentation on pci rules?

Comprehensive Guide to the PCI Rules Form Presentation

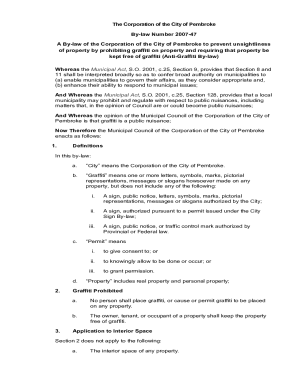

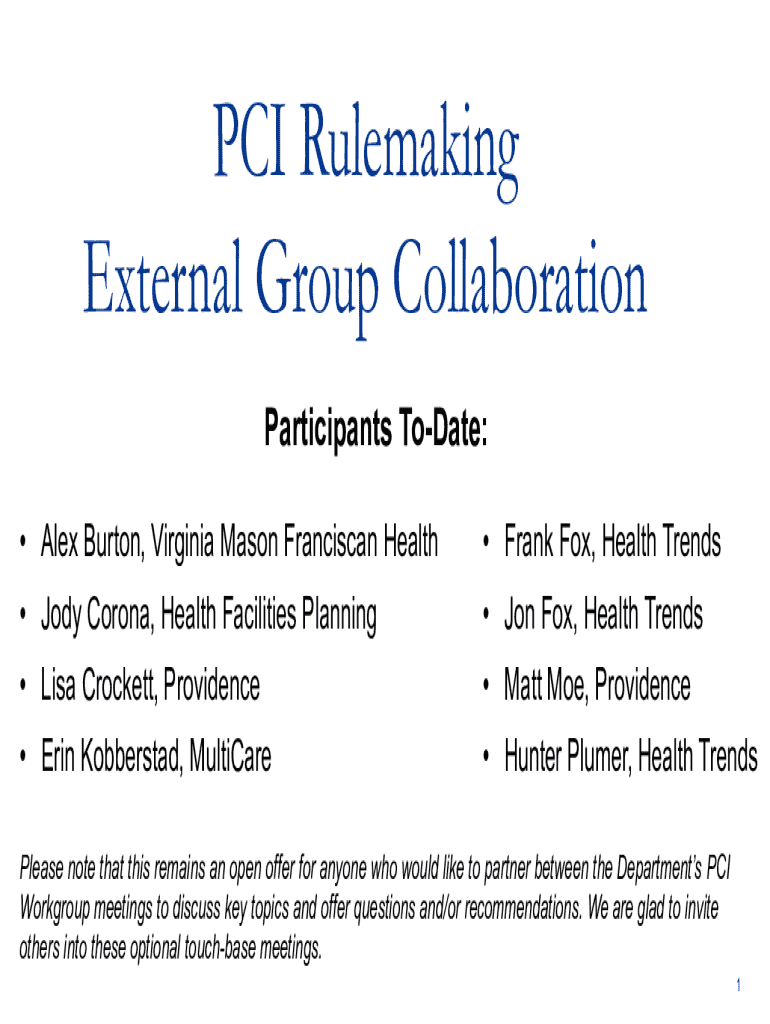

Understanding PCI compliance

PCI compliance refers to the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to ensure that businesses that process credit card transactions maintain a secure environment. These standards are established by the Payment Card Industry Security Standards Council to protect cardholder data. The importance of PCI compliance cannot be overstated, as it significantly reduces the risk of data breaches, enhances customer trust, and, importantly, helps businesses avoid costly fines associated with non-compliance.

The key components of PCI compliance include various security measures that organizations must implement. These can broadly be categorized into six requirements that focus on security management, policies, procedures, network architecture, and software design. Fundamental aspects include encryption, secure storage of sensitive data, and regular system testing. By adhering to these guidelines, businesses can create a more secure environment for their customers and protect against data theft.

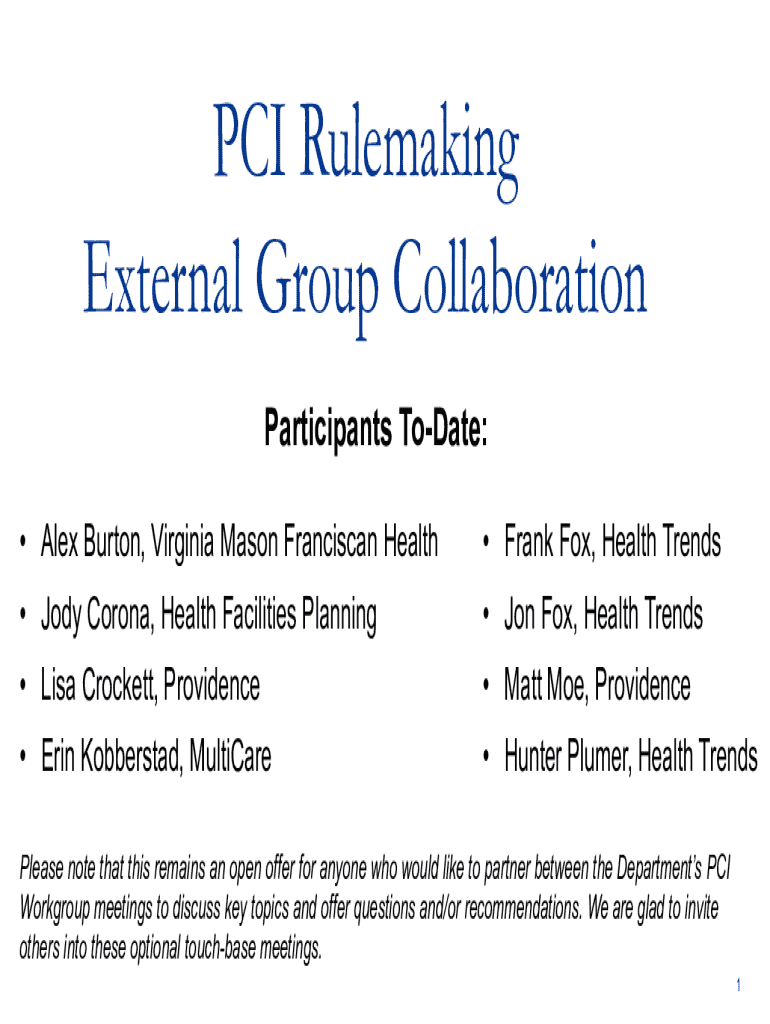

Overview of the PCI Rules Form

The PCI Rules Form plays a crucial role in helping businesses comply with PCI DSS. It provides a structured way to collect and record necessary information pertaining to payment card processing and security measures in place within an organization. This form not only serves as a checklist for compliance but also aids businesses in identifying areas that may require improvement in their information security practices.

Eligibility to fill out the PCI Rules Form varies by organization size and type. Generally, any business that processes, stores, or transmits cardholder information is required to complete this form. Small businesses may have simpler requirements compared to larger enterprises, making it essential for each organization to understand its obligations under PCI DSS. Consequently, different sectors, including retail, e-commerce, and hospitality, may have unique considerations when completing the form.

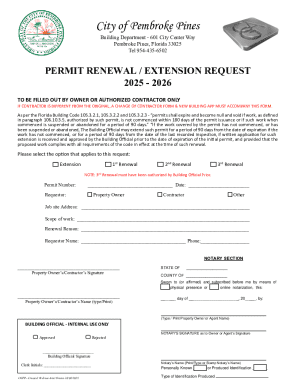

Steps to complete the PCI Rules Form

Completing the PCI Rules Form begins with gathering the required information. Businesses must collate relevant data such as their legal name, business address, payment processing details, and specifics regarding payment card handling. Accurate and thorough documentation of all processes related to card transactions is critical.

It is crucial to be mindful of common mistakes during this process. One major pitfall includes neglecting to keep documentation up to date or misrepresenting information. To avoid these issues, businesses should double-check all entries and ensure that they provide complete and accurate responses. After filling out the form, review each section thoroughly before final submission to ensure compliance accuracy.

Editing and managing the PCI Rules Form

Utilizing pdfFiller for editing the PCI Rules Form can streamline the compliance journey significantly. With its cloud-based platform, users can access and edit their forms anytime, anywhere. To begin editing, simply upload the filled-out PDF form to pdfFiller, where you can make changes to any section as needed. The cloud-based nature of pdfFiller allows for real-time updates, beneficial for teams working collaboratively on compliance.

The collaborative features of pdfFiller allow you to share the form with relevant team members, facilitating collaborative input and feedback. Create an effective feedback loop by soliciting insight from key stakeholders, which not only enhances the quality of the submission but also increases the overall security understanding of your team.

Signing and submitting the PCI Rules Form

Once the PCI Rules Form has been completed and reviewed, the next step involves signing it digitally. pdfFiller offers an eSigning capability that ensures signatures are both secure and legally binding. This functionality simplifies the signing process, allowing signatories to affix their signatures electronically with ease, which is particularly advantageous for remote teams.

The submission process for the completed form typically involves following specific guidelines set forth by your acquiring bank or payment processor. Ensure you understand what documentation is needed post-submission, as this varies by organization. Following submission, maintain records of the submitted documentation as proof of compliance.

Monitoring compliance status

Maintaining PCI compliance is not a one-time endeavor but rather an ongoing commitment involving regular reviews and updates of all security measures. Best practices include conducting routine audits of your payment card processing systems and ensuring staff are educated on the latest compliance standards. Regular assessments can pinpoint vulnerabilities before they become significant security risks.

Using pdfFiller allows organizations to track document history and manage compliance checks effectively. Furthermore, it can serve as a repository for maintaining all compliance-related documents, making it easier to reference updates and access educational materials related to PCI DSS.

Educational resources on PCI compliance

Continuous learning is vital in the ever-evolving realm of PCI compliance. Various training courses and webinars offer insights into PCI DSS requirements and how to implement them effectively. Engaging with such educational resources not only increases awareness but also empowers teams to maintain high standards of security.

Communities and support networks play a significant role in keeping compliance practitioners informed. Engaging in forums allows individuals to ask questions, share experiences, and seek clarifications about complex compliance issues, creating a collaborative culture around PCI adherence.

FAQs regarding the PCI Rules Form

Addressing common questions can demystify the PCI Rules Form process. Many organizations wonder who to contact for assistance while filling out the PCI Rules Form. Resources like the PCI Security Standards Council can provide guidance and direct answers. Additionally, understanding the ramifications of non-compliance is critical; consequences may include hefty fines, increased transaction fees, or even losing the ability to process card transactions altogether.

Updating the PCI Rules Form is typically recommended on an annual basis or whenever significant changes occur within your payment processing environment.

Interactive tools

Interactive tools can greatly enhance the experience of filling out the PCI Rules Form. pdfFiller offers various form completion assistance tools, which help users navigate the complexities of each section efficiently. These tools can guide users through the required fields, ensuring accuracy while maintaining compliance with PCI standards.

By incorporating these tools, businesses can foster a more effective compliance process, ensuring they meet all regulatory requirements efficiently and accurately. Leveraging pdfFiller's capabilities not only simplifies form management but also empowers teams to maintain robust compliance throughout their payment processing operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find presentation on pci rules?

How do I make edits in presentation on pci rules without leaving Chrome?

Can I create an electronic signature for signing my presentation on pci rules in Gmail?

What is presentation on pci rules?

Who is required to file presentation on pci rules?

How to fill out presentation on pci rules?

What is the purpose of presentation on pci rules?

What information must be reported on presentation on pci rules?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.