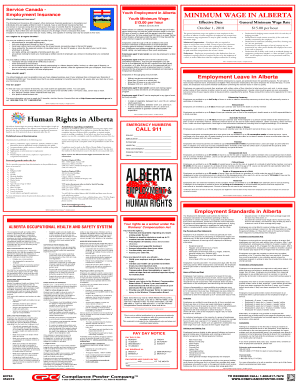

Get the free 2024 Form 987 Application for Ad Valorem Tax Exemption for Religious Entities - asse...

Get, Create, Make and Sign 2024 form 987 application

How to edit 2024 form 987 application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form 987 application

How to fill out 2024 form 987 application

Who needs 2024 form 987 application?

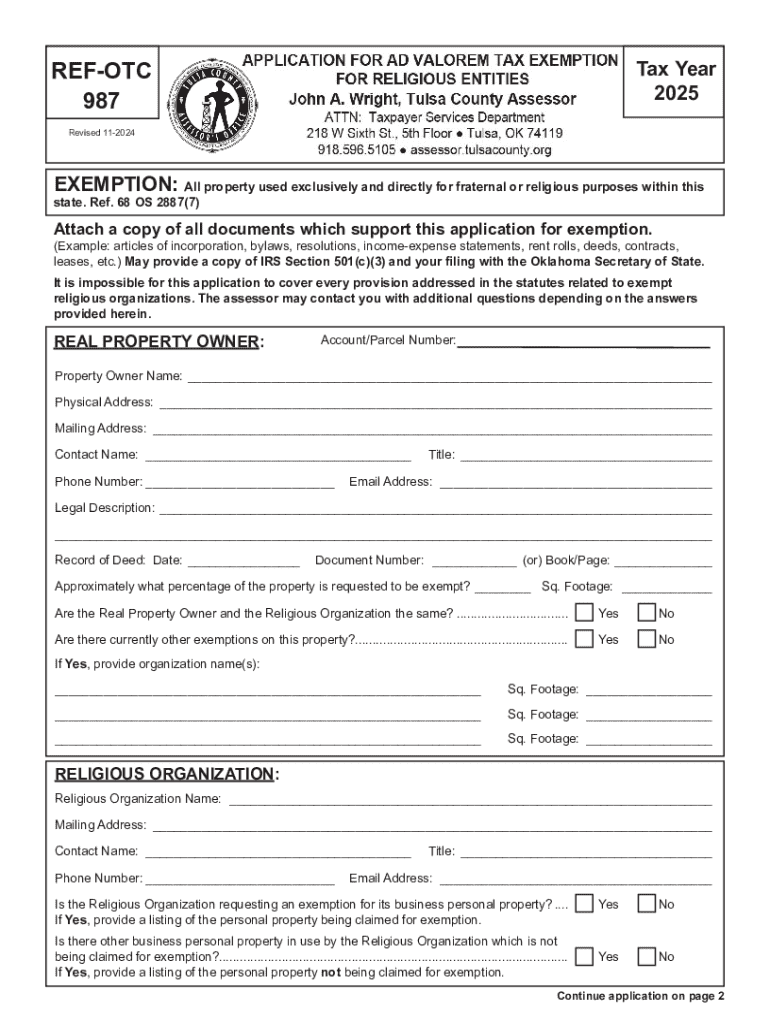

Understanding the 2024 Form 987 Application Form for Tax Exemption

Understanding Form 987

Form 987 is a vital document used by organizations seeking tax exemption under U.S. law. This form allows entities such as nonprofits, churches, and educational institutions to declare their status as tax-exempt organizations, thereby enjoying significant financial benefits. Form 987 assists applicants in affirming that they meet the necessary criteria to receive tax-exempt recognition, which can profoundly impact their fundraising capabilities and overall financial health.

The primary purpose of Form 987 is to streamline the application process for tax exemption. By providing detailed information about the organization and its purpose, the IRS can efficiently evaluate the eligibility of the applicant for exemption under sections 405 and 258 of the Internal Revenue Code. Organizations that fail to file this form may inadvertently jeopardize their tax-exempt status.

Organizations and individuals who need to file Form 987 include various entities seeking tax-exempt status, particularly religious organizations and charitable nonprofits. If your organization aims to operate in the public interest while benefiting from tax exemptions, completing this form accurately and thoughtfully is crucial.

Key features of Form 987

To qualify for tax exemption through Form 987, organizations must meet specific eligibility criteria. Generally, to be eligible, the applying organization must demonstrate that it operates exclusively for charitable, educational, religious, or scientific purposes. This is essential to ensure that the organization aligns with the public interest objectives outlined by tax laws.

The types of organizations qualifying for this exemption include religious entities, charitable associations, educational institutions, and some healthcare organizations. Each category has distinct requirements, but they all share the common goal of benefitting society or the public in significant ways.

The benefits of filing Form 987 are abundant. Approved organizations gain exemption from federal income taxes, allowing them to allocate more resources toward their primary mission. Moreover, donations received by these organizations become tax-deductible for contributors, which can encourage higher donations and financial support.

Navigating the 2024 Form 987

The layout of the 2024 Form 987 is designed with user-friendliness in mind, facilitating an organized process for applicants. It contains multiple sections, each dedicated to collecting specific information essential for the application review.

Interactive tools for completing Form 987

Using interactive tools can significantly simplify the process of completing the 2024 Form 987. For instance, a step-by-step interactive filling guide provides useful prompts to ensure no essential information is overlooked. Leveraging these features leads to a more efficient and accurate application.

pdfFiller offers robust PDF tools that enable individuals to edit and sign Form 987 seamlessly. Users can upload the form online, fill it out, and even eSign directly within the platform. This eliminates the need for physical paperwork, thereby enhancing the application experience for users.

Frequently asked questions about these interactive features generally address concerns regarding security, ease of use, and how to manage your application through the pdfFiller platform.

Best practices for filling out Form 987

Accuracy and completeness are paramount when filling out Form 987. Many first-time applicants make common mistakes such as omitting crucial information or providing incomplete responses. Ensuring that every question is addressed thoroughly can prevent delays or even denials of tax-exempt status.

When preparing documents to submit alongside your Form 987, gather supporting materials. These may include the organization's bylaws, financial statements, and a detailed description of your activities. Such documentation enhances your credibility and strengthens your case for tax exemption.

Submitting the 2024 Form 987

When it's time to submit the 2024 Form 987, applicants have options. Organizations can choose between online filing, which offers immediacy and convenience, or traditional paper filing, which may take longer to process. Ultimately, online submission is generally recommended for an expedited review.

After submitting the application, organizations can expect a processing period, typically ranging from weeks to months. It's crucial to monitor the application status and maintain communication with the IRS. Applicants can address any follow-up requests or queries to expedite their approval.

Common challenges and solutions

First-time filers often encounter challenges while completing Form 987, including understanding complex tax laws and ensuring their organization meets all eligibility criteria. A detailed review of the application guidelines before starting may help mitigate these issues.

In the event of delays or denials, applicants can request a reconsideration or ask for advice from experienced professionals. Resources for assistance, including legal experts specializing in tax exemptions, can be invaluable. don't hesitate to seek help to navigate the intricacies of filing this form.

After filing: Managing your tax exemption

Once your Form 987 is approved, maintaining your tax-exempt status requires diligence. Organizations must be aware of renewal processes and deadlines to ensure that they comply continuously with IRS regulations. Typically, renewals are required every three years, though this may differ based on the organization type.

Additionally, reporting requirements exist to ensure that the organization remains compliant. These often include filing annual reports and financial statements that reflect the organization's activities and financial position. Staying proactive in these areas can prevent unnecessary complications in the future.

Utilizing pdfFiller for Form 987

Adopting pdfFiller to manage your Form 987 application is advantageous for several reasons. This cloud-based platform offers unparalleled convenience, allowing teams to access documents from anywhere. It enables easy collaboration, useful for organizations with multiple stakeholders involved in the application process.

The step-by-step guide to using pdfFiller ensures that users can create, fill, and file their applications without hassle. By leveraging the functionalities of this platform, such as editing templates or collaborating with team members, organizations can streamline their application process.

Real-life success stories

Numerous organizations have successfully leveraged Form 987 to secure their tax-exempt status. Testimonials from users highlight the smooth application experience and the impact of gaining tax exemption on their ability to serve communities effectively. Many report increased donations and expanded outreach as direct results of becoming tax-exempt.

For instance, a local charity that primarily serves underprivileged families secured its tax-exempt status through Form 987. This not only enhanced their credibility but also opened the door for corporate sponsorships and grants. Such cases exemplify the positive ripple effect of tax exemption, reinforcing the importance of filing Form 987 accurately.

Advanced tips and insights

With the 2024 version of Form 987, organizations should be aware of any changes or updates that could affect their applications. Understanding the nuances of the current form ensures that applicants can navigate any new requirements effectively.

Considering legal advice can also be advantageous, as professionals can provide insights tailored to specific organizations. Furthermore, keeping an eye on future considerations, such as shifts in tax policies or community needs, will help ensure organizations remain competitive and relevant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2024 form 987 application?

How do I edit 2024 form 987 application straight from my smartphone?

How do I edit 2024 form 987 application on an iOS device?

What is 2024 form 987 application?

Who is required to file 2024 form 987 application?

How to fill out 2024 form 987 application?

What is the purpose of 2024 form 987 application?

What information must be reported on 2024 form 987 application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.