Get the free Tax MapsBangor, ME

Show details

100.68 7.81 22951720139.07135/21 1. 916276. 92+.93.26 0 0 3 R42003A1 115. 07015R5101 88+/190+/0042400616 . 260072418.90190070007B77056237N LINDE11 8. 16PO5A PL173511 5/447+53611.711812 6.241 11389

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax mapsbangor me

Edit your tax mapsbangor me form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax mapsbangor me form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax mapsbangor me online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax mapsbangor me. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax mapsbangor me

How to fill out tax mapsbangor me

01

Gather all necessary documents including your income statements, W-2s, and 1099 forms.

02

Determine your filing status (single, married, head of household, etc.).

03

Access the tax maps for Bangor, ME through the local tax assessor's website or request a hard copy.

04

Locate the appropriate tax map that corresponds to your property address.

05

Fill in the required information, including property description and any exemptions applicable.

06

Review your entries for accuracy and completeness before submission.

07

Submit your tax forms by the deadline, either electronically or by mail.

Who needs tax mapsbangor me?

01

Property owners in Bangor, ME who need to report their property value for tax purposes.

02

Individuals applying for property tax exemptions or abatements.

03

Real estate professionals who require information for transactions.

04

Local government agencies needing accurate property data for planning and assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax mapsbangor me directly from Gmail?

tax mapsbangor me and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in tax mapsbangor me?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your tax mapsbangor me to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit tax mapsbangor me straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing tax mapsbangor me.

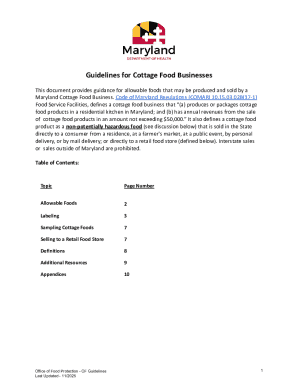

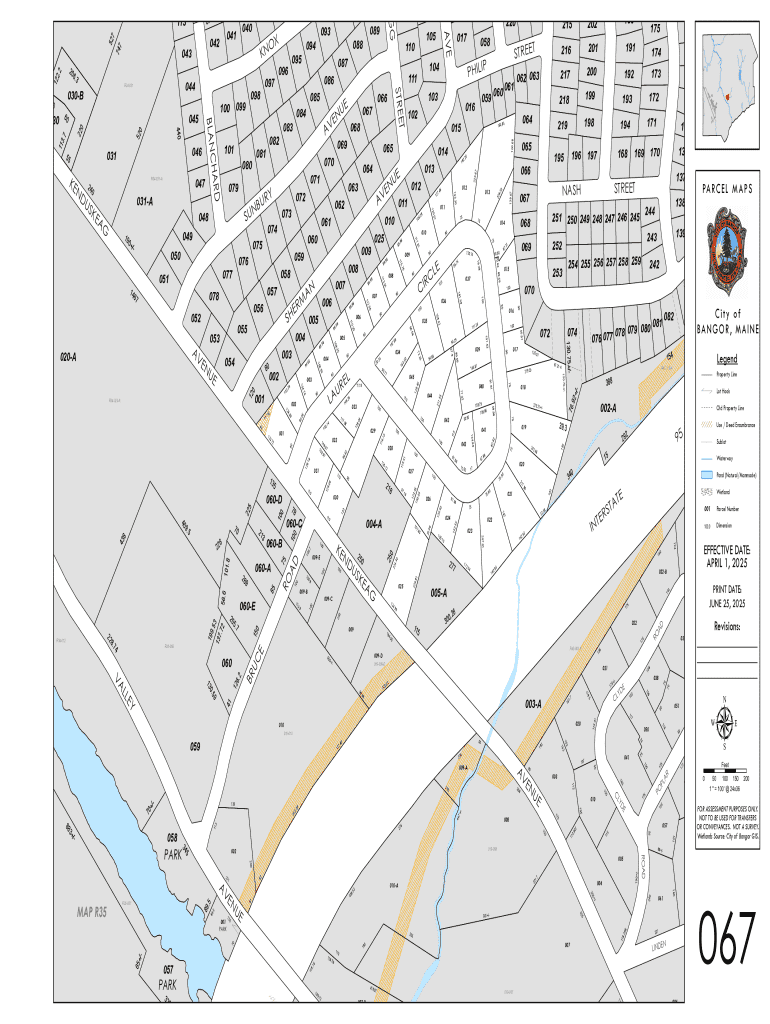

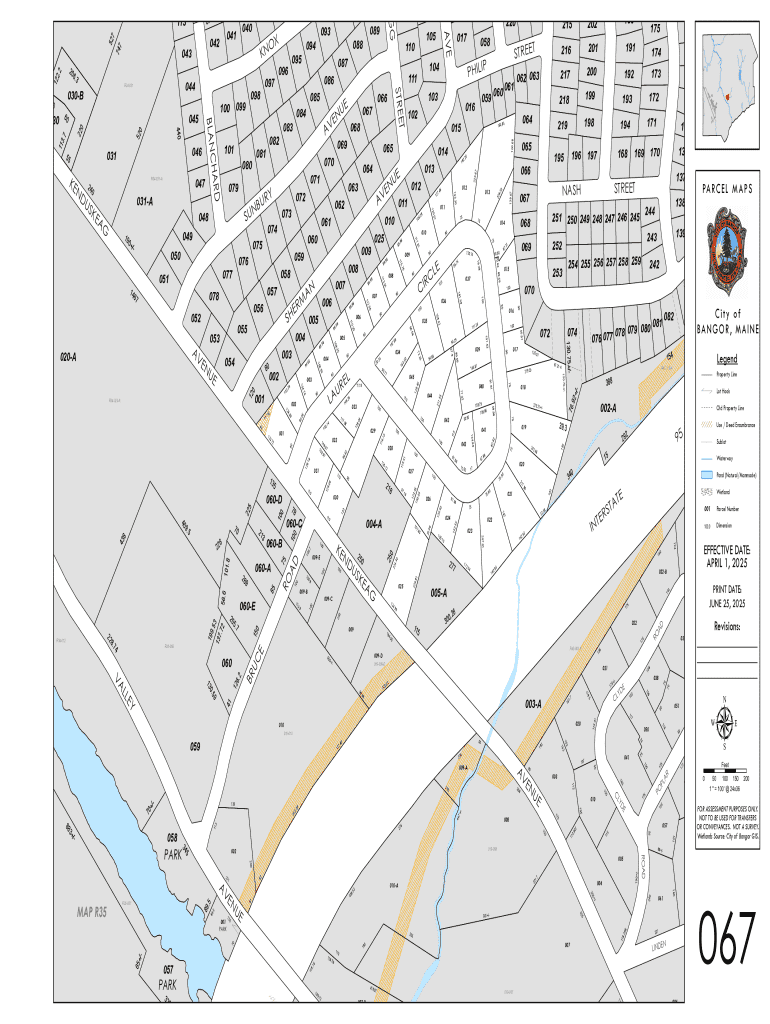

What is tax mapsbangor me?

Tax maps in Bangor, ME are graphical representations of parcels of land that detail property boundaries, ownership, and assessed values for taxation purposes.

Who is required to file tax mapsbangor me?

Property owners in Bangor, ME are required to file tax maps to ensure their property details are accurately recorded for assessment and taxation.

How to fill out tax mapsbangor me?

To fill out tax maps in Bangor, ME, property owners should accurately depict their property boundaries, include identifying information, and submit any required documents to the local tax assessor's office.

What is the purpose of tax mapsbangor me?

The purpose of tax maps in Bangor, ME is to provide a clear and organized way to track property ownership, assess property taxes, and support legal and real estate transactions.

What information must be reported on tax mapsbangor me?

Information that must be reported on tax maps in Bangor, ME includes property boundaries, zoning classifications, ownership details, assessed values, and any easements or restrictions.

Fill out your tax mapsbangor me online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Mapsbangor Me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.