IRS Publication 6961 2025 free printable template

Get, Create, Make and Sign IRS Publication 6961

How to edit IRS Publication 6961 online

Uncompromising security for your PDF editing and eSignature needs

IRS Publication 6961 Form Versions

How to fill out IRS Publication 6961

How to fill out publication 6961 rev 9-2025

Who needs publication 6961 rev 9-2025?

Understanding the Publication 6961 Rev 9-2025 Form

Overview of Publication 6961 Rev 9-2025 Form

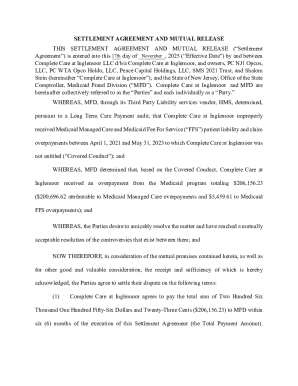

The Publication 6961 Rev 9-2025 Form serves an essential role in capturing specific financial and identification details pertinent to various applications. Designed primarily for use in tax-related submissions and financial reporting, this form facilitates transparency, ensuring that individuals and organizations provide consistent and accurate information to the relevant authorities.

Completing this form accurately is paramount. Errors or omissions can lead to delays, audits, or even penalties, which highlights the importance of diligence in its completion. Understanding its applicability, whether for individuals or businesses, can significantly streamline the process and enhance compliance.

Accessing the Publication 6961 Rev 9-2025 Form

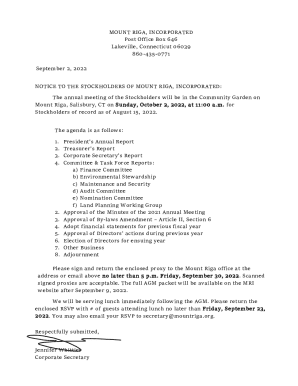

Obtaining the Publication 6961 Rev 9-2025 Form is straightforward. Users can access the form through various channels, which cater to different preferences for document retrieval.

Online, the form is readily available on the IRS website and other official platforms dedicated to tax documentation. Additionally, local tax offices and libraries may carry physical copies for those who prefer traditional methods.

The form is typically available in PDF format, which is ideal for printing, while editable formats may also be accessible to allow for easy online completion and modifications.

Step-by-Step Guide to Filling Out the Form

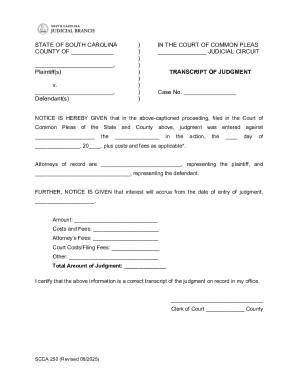

Filling out the Publication 6961 Rev 9-2025 Form can be broken down into three main sections: Identification Information, Financial Details, and Additional Information. Each section requires careful attention to detail to ensure accuracy.

Section 1: Identification Information

This section collects basic identification details. Be prepared to enter full names, addresses, and Social Security numbers or Employer Identification Numbers.

Common mistakes in this section include transposing numbers and failing to use legal names, which can lead to mismatches in records.

Section 2: Financial Details

Here, specific financial information is required. This includes annual income, deductible expenses, and any relevant financial statements. It is crucial to rely on accurate documentation to back every entry.

Examples of acceptable entries are outlined specifically in the form instructions to help avoid errors.

Section 3: Additional Information

This section may contain both optional and required fields. Understanding the necessity of each field can reduce the risk of incomplete submissions. Supplementary documents may strengthen your case, so always consider including them when applicable.

Editing and Customizing the Publication 6961 Form

While paper forms are still in use, digital tools like pdfFiller offer enhanced capabilities for editing the Publication 6961 Form. The first step is uploading the document to the pdfFiller platform.

Once uploaded, you can add text, checkboxes, and signatures easily. It’s recommended to maintain legal compliance by following the guidelines provided within the platform.

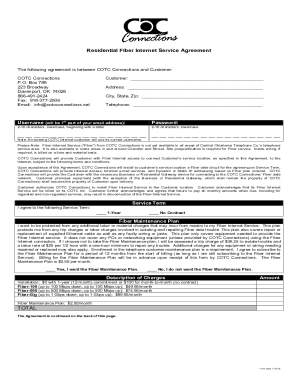

Signing and Submitting the Publication 6961 Form

Electronic signing has gained traction, and the use of eSignatures on platforms like pdfFiller significantly accelerates the submission process. eSignatures are legally binding and, thus, carry the same weight as a handwritten one.

To eSign with pdfFiller, simply click on the signature field located on your form, and follow the prompts. After signing, it's essential to ensure the form is submitted correctly.

Managing Your Publication 6961 Form

Post-submission, maintaining organization is key. Proper tracking of your Publication 6961 Form ensures you always know the status of your application. Utilize digital file management features to keep everything accessible.

If you're working within a team or involved in collaborative processes, consider using pdfFiller's features to invite team members for review and apply comments for revisions.

Troubleshooting Common Issues

As with any form filing process, issues may arise. Frequent errors when completing the Publication 6961 Form often include incorrect figures or missing mandatory information. Identifying these errors prior to submission is critical.

Should submission failures occur, recheck all electronic connections and ensure that you’re adhering to the necessary format requirements. If problems persist, contacting support through pdfFiller can provide immediate assistance, ensuring a smoother resolution.

FAQs about the Publication 6961 Rev 9-2025 Form

Several frequently asked questions can help clarify common concerns regarding the Publication 6961 Form. One common question is, 'What if I make a mistake after submission?' Generally, there are protocols for correcting errors which may involve resubmitting corrected forms.

Users often ask whether they can save a draft of the form. Yes, pdfFiller allows users to save drafts to complete later, accommodating busy schedules.

Case Studies: Successful Applications of the Publication 6961 Form

Real-world usage of the Publication 6961 Form has yielded a variety of lessons learned. For instance, one small business reported encountering issues early in the process due to incomplete financial records, leading to denied applications.

In contrast, another company streamlined its submissions using pdfFiller, resulting in improved efficiency and faster processing times due to careful preparation and review.

Conclusion: Streamlining Your Form Process with pdfFiller

The Publication 6961 Rev 9-2025 Form is a crucial document for various financial applications. Leveraging the pdfFiller platform can significantly enhance your experience with this form.

With features such as editing, eSigning, and document management, pdfFiller empowers users to manage their forms effortlessly. Embrace these tools for the best outcomes when navigating this important document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS Publication 6961 online?

How do I edit IRS Publication 6961 in Chrome?

How do I complete IRS Publication 6961 on an Android device?

What is publication 6961 rev 9-2025?

Who is required to file publication 6961 rev 9-2025?

How to fill out publication 6961 rev 9-2025?

What is the purpose of publication 6961 rev 9-2025?

What information must be reported on publication 6961 rev 9-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.