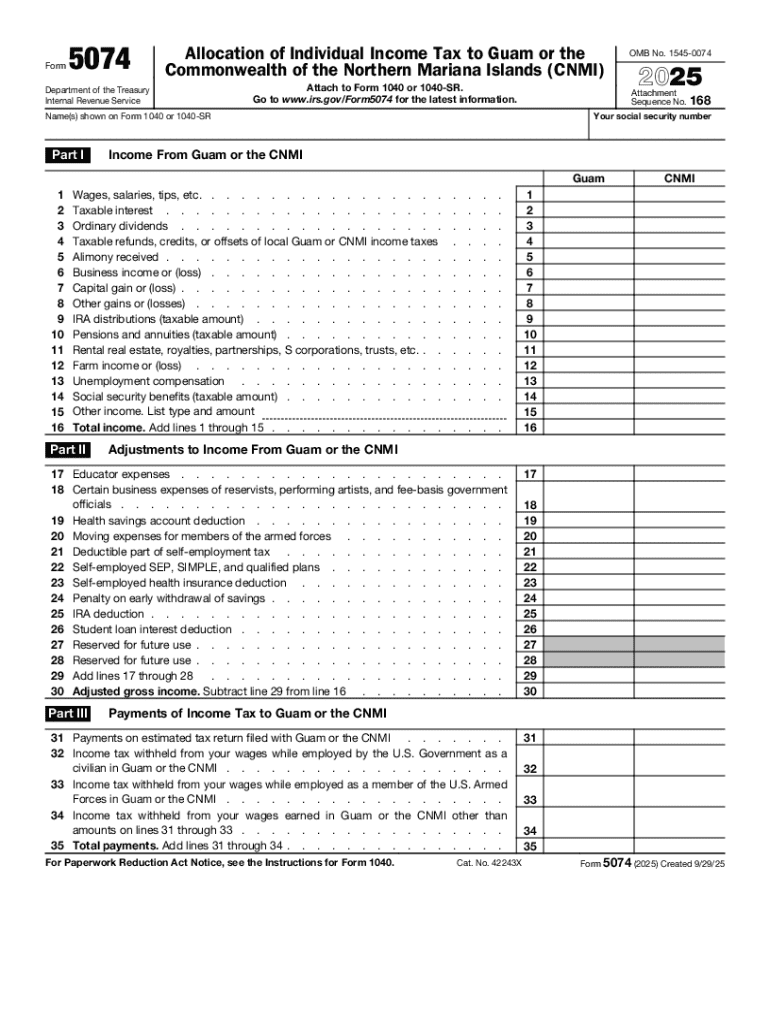

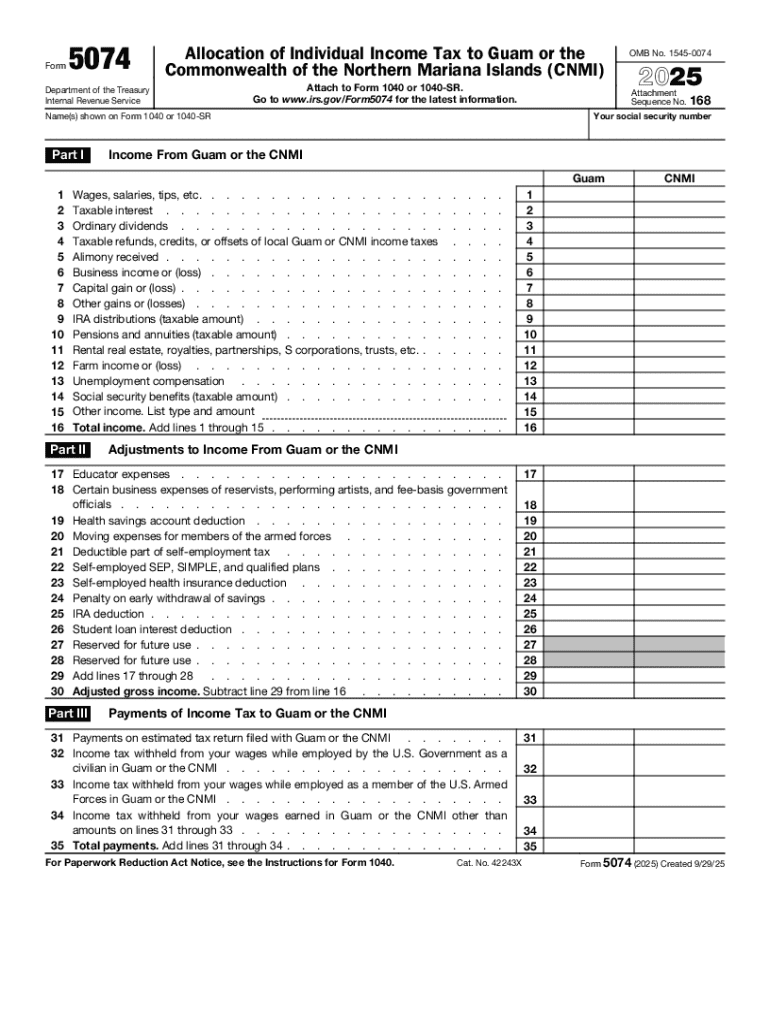

IRS 5074 2025-2026 free printable template

Get, Create, Make and Sign IRS 5074

How to edit IRS 5074 online

Uncompromising security for your PDF editing and eSignature needs

IRS 5074 Form Versions

How to fill out IRS 5074

How to fill out 2025 form 5074

Who needs 2025 form 5074?

2025 Form 5074 Form: A Comprehensive Guide

Understanding Form 5074: What you need to know

Form 5074 is essential for taxpayers claiming eligibility for specific tax benefits related to foreign income or situations requiring particular disclosures. This form helps the IRS assess an individual’s tax situation efficiently, primarily focusing on matters like the change of address and eligibility for certain deductions or credits. Not knowing how to navigate this form can considerably complicate your tax filing process.

Key details regarding Form 5074 include its direct implications on your tax returns, specifically how it integrates with your individual income tax return (Form 1040). Understanding the requirements can help you save money and time. Failing to file Form 5074 might not only result in delayed tax processing but could also trigger penalties or complications with your tax returns.

Importance of filing Form 5074

Filing Form 5074 is crucial for individuals who have a connection to foreign income, especially if you are trying to claim the foreign tax credit or other deductions specific to cross-border situations. Additionally, it becomes imperative if you qualify for status exceptions under tax treaties. Failure to submit this form can lead to unwanted scrutiny from the IRS, incorrect tax calculations, or even audits.

Those required to file often include expatriates, foreign workers, and U.S. citizens residing abroad. Individuals who may also have received renewable diesel fuels credits should certainly pay attention to this form. The consequences of not filing can include increased tax liabilities and potential legal difficulties, thus making awareness and compliance vital.

Step-by-step instructions for completing Form 5074

Completing Form 5074 requires careful consideration and the gathering of specific documentation. Before you begin, organize your financial records, including W-2 forms, 1099s, and any documents related to foreign income or deductions you plan to claim. Verify your eligibility based on residency, employment status, and any relevant treaties.

Once you're prepared, follow these detailed instructions for filling out the form accurately:

Common mistakes to avoid include misstated income figures, as incorrect income declarations can lead to severe tax penalties. Ensure that you include all necessary signatures; omissions might result in your form being returned or marked invalid. Additionally, double-check that all figures match up with your other tax documents.

Editing Form 5074: Making changes efficiently

If you discover an error after submitting Form 5074, editing the form is straightforward utilizing pdfFiller tools. This platform supports you in editing any deficiencies you found in the initial submission, ensuring you stay compliant with IRS regulations. Whether you want to correct income figures or update deductions, pdfFiller allows for seamless adjustments.

To edit your filled Form 5074, carry out the following steps:

Keeping track of changes and utilizing version control is essential when managing tax documents. With pdfFiller, you can monitor the document history, giving you peace of mind that every edit is recorded. If a mistake occurs or you need to revert to a previous version, having a versioning system ensures you can do so without hassle.

eSigning Form 5074: A simple process

Using electronic signatures (eSigning) for Form 5074 speeds up the submission process, allowing for quicker processing by the IRS. eSigning holds legal recognition, effectively validating your identity without the need for physical documents. This not only enhances efficiency but also contributes to an eco-friendly method of handling tax documents.

Follow these steps to eSign your Form 5074 via pdfFiller:

Ensure authenticity by using recognized eSignature platforms, like pdfFiller, that preserve document integrity. This is crucial for any formal submissions to the IRS. Your eSignature should be distinct and verified to avoid issues during the filing process.

Collaborating on Form 5074 with others

Collaborating with tax professionals or team members to resolve queries or validate your claims on Form 5074 can enhance accuracy significantly. Utilizing a platform like pdfFiller allows multiple users to provide input or feedback seamlessly, which is particularly valuable if you're working with complex financial situations requiring expert guidance.

To effectively collaborate using pdfFiller, consider the following methods:

Such collaborative efforts ensure a thorough review process, not only improving the content's accuracy but also creating a more robust submission overall. Working collectively allows for checks and balances, which are paramount when dealing with tax forms.

Submitting Form 5074: A seamless process

Once you've completed and reviewed your Form 5074, the next step is submission. The IRS allows for multiple submission methods, making it convenient for individuals to file tax forms based on their preferences. You can choose to file online or opt for mail-in options based on your comfort level.

To submit your Form 5074 efficiently, follow these options:

Tracking your submission status is equally important. pdfFiller provides tools for monitoring your filings, letting you know when the IRS processes your 5074. Understanding the timelines for responses can help you plan your financial moves accordingly, especially in light of any potential adjustments.

Troubleshooting common issues with Form 5074

It is critical to stay informed about common challenges associated with Form 5074 to prevent complications when submitting your tax forms. One of the primary issues is receiving IRS notifications about discrepancies or information that requires rectification. Understanding the types of notifications you might encounter can help you respond effectively.

Typical notifications may include requests for additional documentation or clarification regarding foreign income reporting. Here’s how to manage these situations effectively:

Accessing help and support is also crucial when navigating form completion and submission. For resources, pdfFiller offers customer support aimed at answering common questions and alleviating concerns, directly enhancing your experience and confidence in managing such documents.

Additional tools and resources for document management

Efficient document management can profoundly affect your tax filing process. Using pdfFiller gives you access to integrate various applications for an organized workflow. Syncing your documents with cloud storage services ensures that everything is accessible and safe from any data loss.

To get the most out of your document management process, consider the following best practices:

By leveraging these tools, you can enhance your overall efficiency and ensure compliance, heading off any issues before they arise. Engaging with the simplest processes fosters familiarity with the necessary forms, facilitating a smoother experience for future submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 5074?

How do I edit IRS 5074 online?

How do I edit IRS 5074 on an iOS device?

What is 2025 form 5074?

Who is required to file 2025 form 5074?

How to fill out 2025 form 5074?

What is the purpose of 2025 form 5074?

What information must be reported on 2025 form 5074?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.