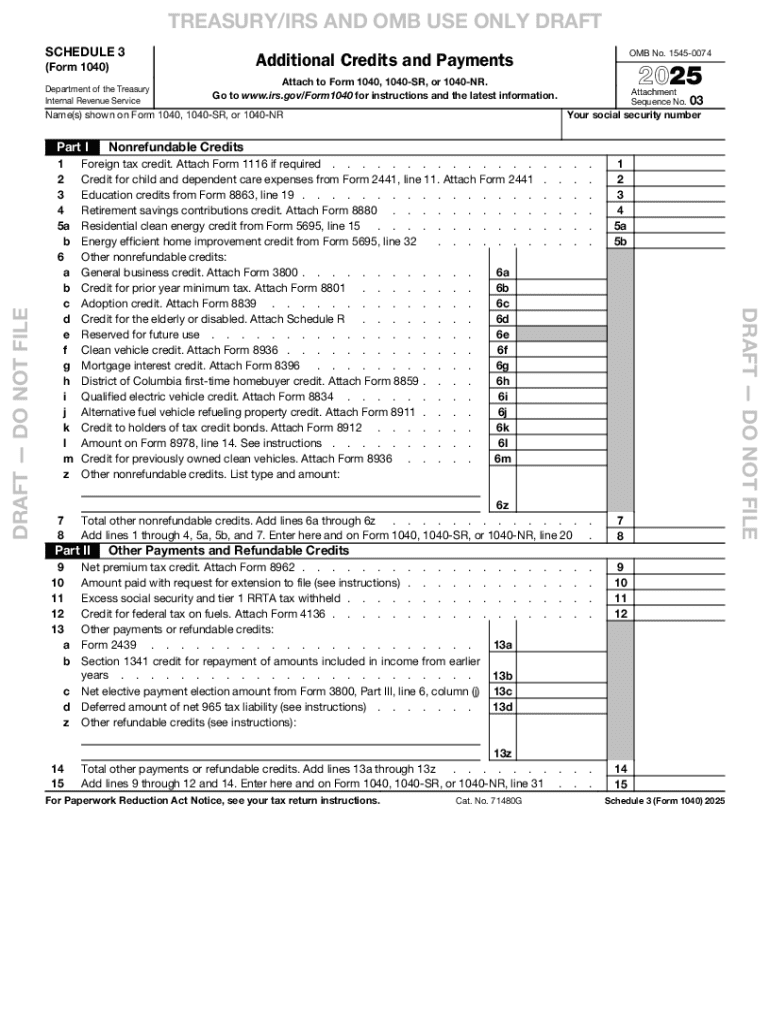

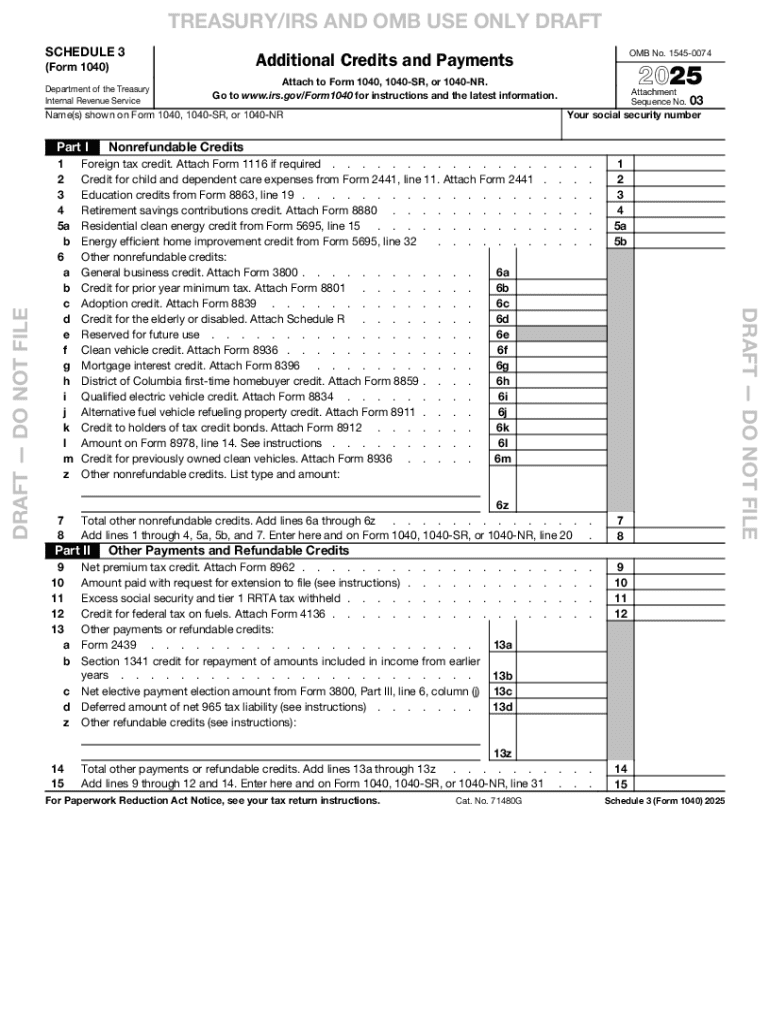

IRS 1040 - Schedule 3 2025-2026 free printable template

Get, Create, Make and Sign irs 2025 draft 1040 form

Editing IRS 1040 - Schedule 3 online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 - Schedule 3 Form Versions

How to fill out IRS 1040 - Schedule 3

How to fill out 2025 schedule 3 form

Who needs 2025 schedule 3 form?

Comprehensive Guide to the 2025 Schedule 3 Form

Understanding the 2025 Schedule 3 Form

The 2025 Schedule 3 Form is a critical document for taxpayers looking to claim nonrefundable credits against their tax liability on their resident income tax return. Understanding its purpose and importance is essential for effective tax planning. This form is vital for ensuring that you capture any available credits that could significantly reduce the amount of tax owed.

Primarily, the 2025 Schedule 3 Form is required for individuals who are filing their federal tax returns, particularly those who qualify for tax credits related to education, adoption, disability, and more. Filing this form accurately can lead to substantial savings, making it necessary for those who might qualify for any of these credits.

Key changes for 2025

Several changes have been implemented in the 2025 Schedule 3 Form compared to previous years, aimed at simplifying the filing process and introducing new credits. This year, the IRS has eliminated some redundancies and clarified instructions, reducing potential confusion for taxpayers. Moreover, adjustments in income thresholds for various credits reflect current economic conditions, making this information particularly relevant for residents of California.

These modifications could impact many individuals, particularly high earners or those recently displaced by changes in the economy. Taxpayers must review these updates carefully to ensure they are maximizing their claim potential for the fiscal year.

Accessing the 2025 Schedule 3 Form

To access the 2025 Schedule 3 Form, taxpayers can visit the official IRS website or utilize alternative resources like PDFfiller, which provides various options for obtaining the form. Downloading the form as a PDF from PDFfiller ensures that individuals can fill it out conveniently and securely online.

The IRS offers the Schedule 3 Form in multiple formats to accommodate different user preferences. Options include a printable PDF version, an online fillable form for ease of use, or eFiling capabilities through authorized eFile partners.

Step-by-step instructions for filling out the 2025 Schedule 3 Form

Filling out the 2025 Schedule 3 Form can be straightforward if you follow these structured steps. This section provides a detailed breakdown of each section of the form, ensuring that you complete it accurately to maximize your claimed credits.

Section Breakdown

1. **Personal Information**: Begin filling out your basic information, including your name, Social Security Number (SSN), and tax filing status. Ensuring this information is accurate is crucial, as any errors can delay processing.

2. **Income Section**: Report your sources of income as required. This section is where you can also gain insight into the credits available by understanding your filing requirements.

3. **Adjustments and Deductions**: Look out for any adjustments on your income tax return. This might include contributions to retirement accounts or certain educational expenses that can lower your taxable income.

4. **Credits and Taxes**: Finally, ensure you detail the specific credits that apply to the 2025 tax year. This could encompass a range of new and existing credits that you may be eligible for.

Common mistakes to avoid

While filling out the 2025 Schedule 3 Form, several common errors can occur, often leading to delays or rejections. One crucial mistake is providing inaccurate personal information that does not match IRS records. This can result in processing holds or requests for further documentation.

Another frequent error is miscalculating credits and deductions. Taxpayers may underestimate their eligibility or incorrectly apply numbers based on out-of-date thresholds. This not only increases the chances of errors during audits but could also lead to missed savings.

Editing and customizing your 2025 Schedule 3 Form

Once you have filled out your 2025 Schedule 3 Form, you might find the need for editing or customization. PDFfiller provides robust tools for editing your documents. Users can easily add text, signatures, and annotations as needed, enhancing the usability of the form.

Additionally, PDFfiller supports features for working with PDFs, such as merging, splitting, and organizing documents. This becomes especially useful for individuals managing multiple forms or needing comprehensive documentation for their tax filings.

Collaborating with team members

If you are part of a team or seeking assistance, PDFfiller offers shared access features, allowing multiple users to collaborate on the document. This can be particularly beneficial when reviewing details or gathering necessary signatures, thus facilitating a smooth workflow.

Managing feedback and revisions seamlessly ensures that all team members are on the same page, reducing confusion and ensuring accuracy in filing.

eSigning the 2025 Schedule 3 Form

Electronic signatures are a convenient way to finalize your 2025 Schedule 3 Form. PDFfiller simplifies this process with its easy eSignature solutions. Users can follow a few straightforward steps to add their electronic signature directly on the form.

After signing, it's essential to verify the authenticity and security features offered by PDFfiller. The platform ensures compliance with legal standards, giving users peace of mind that their documents are securely signed.

Submitting your form

Once the form is signed and complete, there are multiple options for submission. Taxpayers can submit their 2025 Schedule 3 Form online through approved channels, by mailing it directly to the IRS, or delivering it in person at designated tax offices.

Tracking submission confirmation allows you to ensure your form has been received and is being processed without delay.

Managing your document after submission

After submitting your 2025 Schedule 3 Form, it's crucial to have a plan for managing the document. PDFfiller provides secure storage options, enabling users to retain their completed forms safely for future reference.

Accessing your submitted forms anytime, anywhere is a significant benefit, especially if you need to refer back to them for questions or future tax filings. It's also essential to be proactive about tracking the status of your form and responding promptly to any IRS inquiries.

Related forms and publications

When navigating the 2025 Schedule 3 Form, you may also need to familiarize yourself with other related forms and publications. Understanding these can provide additional clarity on how different credits work and how they relate to your overall tax obligations.

Forms such as the 1040 or 1080 series may be relevant depending on your specific situation. Additionally, regularly checking updates and publications from the IRS will help ensure you remain informed about any federal changes impacting tax filings.

Frequently asked questions

Taxpayers often have numerous questions regarding the details of the 2025 Schedule 3 Form. One common query is about eligibility for the different credits and how changes in income affect those claims. Many residents of California may wonder if their specific credits apply under recent changes.

In instances where you encounter issues while filling out forms, troubleshooting tips are readily available through PDFfiller's support resources. This ensures that you have convenient solutions to problems such as miscalculations or issues with submission.

Feedback and continuous improvement

Your feedback is invaluable for improving tax forms like the 2025 Schedule 3 Form. PDFfiller actively encourages users to contribute their insights on the usability and functionality of tax documents, fostering a collaborative environment for enhancement.

Engaging with user suggestions can lead to significant advances in how forms and filing processes are approached in the future, which benefits not only current users but sets a precedent for future improvements.

People Also Ask about

What is line 5a and 5b on 1040?

What goes on line 25d on 1040?

What is Form 8888 for?

What line is other credits on the 1040?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS 1040 - Schedule 3 without leaving Chrome?

How do I edit IRS 1040 - Schedule 3 straight from my smartphone?

How do I fill out the IRS 1040 - Schedule 3 form on my smartphone?

What is 2025 schedule 3 form?

Who is required to file 2025 schedule 3 form?

How to fill out 2025 schedule 3 form?

What is the purpose of 2025 schedule 3 form?

What information must be reported on 2025 schedule 3 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.