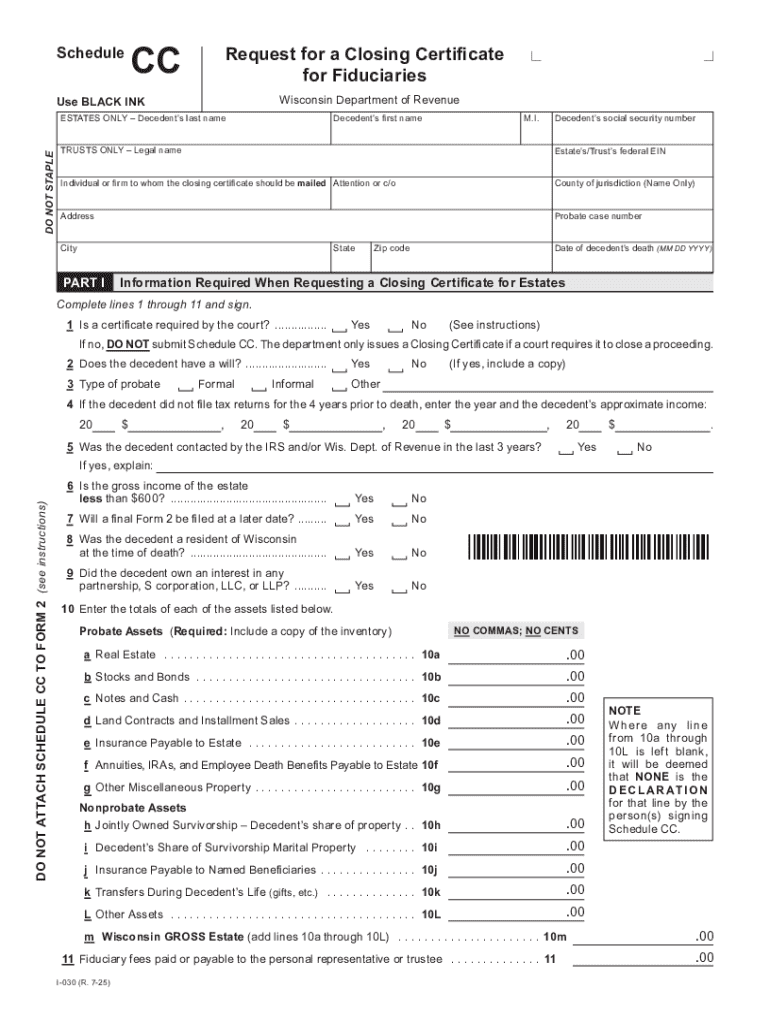

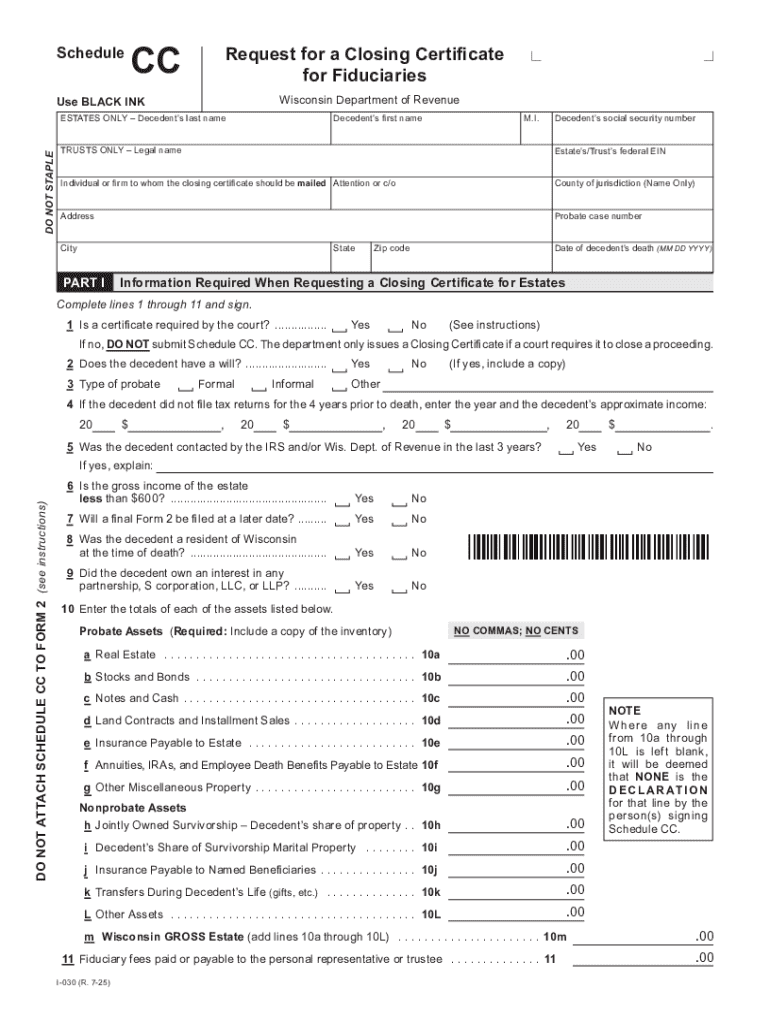

Get the free 2025 I-030 Wisconsin Schedule CC, Request for a Closing Certificate for Fiduciaries ...

Get, Create, Make and Sign 2025 i-030 wisconsin schedule

Editing 2025 i-030 wisconsin schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 i-030 wisconsin schedule

How to fill out 2025 i-030 wisconsin schedule

Who needs 2025 i-030 wisconsin schedule?

Navigating the 2025 -030 Wisconsin Schedule Form: A Complete Guide

Overview of the 2025 -030 Wisconsin Schedule Form

The 2025 i-030 Wisconsin Schedule Form is a crucial document used for reporting taxable income within the state of Wisconsin. This form is particularly relevant for individuals filing their state taxes, as it assists in documenting various sources of income and applicable deductions or credits. Its purpose extends beyond simple compliance; it also serves as a means for taxpayers to ensure that they accurately report their earnings and leverage potential tax benefits.

In essence, the i-030 form acts as a comprehensive outline of an individual's or entity’s fiscal year, allowing an organized view of income and potential tax obligations. Its thorough documentation supports both personal tax filings and the financial transparency required of small businesses and teams. Many find it indispensable for ensuring that they remain compliant while optimizing their tax responsibilities.

Key features of the -030 schedule form

The 2025 i-030 Wisconsin Schedule Form comprises several essential components that facilitate its function as a tax reporting tool. Key segments of the form include:

Unique features of the form include online accessibility and advanced collaboration tools offered by pdfFiller. This adaptability means that users can easily fill out forms from any location and save progress across devices, enhancing their overall experience.

Who should use the 2025 -030 Wisconsin schedule form

The 2025 i-030 Wisconsin Schedule Form is designed for a diverse audience, including:

Common scenarios for utilizing the i-030 form often revolve around accurately filing state taxes to avoid fines and penalties. Moreover, individuals can leverage the document for claiming specific tax deductions or credits, which can lead to significant savings.

Step-by-step instructions for completing the 2025 -030 form

Successfully filling out the 2025 i-030 Wisconsin Schedule Form involves several methodical steps:

Tips for efficiently managing your Wisconsin schedule form

Efficient management of your 2025 i-030 Wisconsin Schedule Form can save time and reduce stress. Here are some effective strategies:

Importance of accurate filing with the -030 schedule form

Filing accurately with the 2025 i-030 Wisconsin Schedule Form is essential for multiple reasons. Errors can have significant consequences, including penalties for late submissions or inaccuracies. Such fines can add unanticipated costs, particularly for those managing tighter budgets.

On the other hand, precise completion of the form ensures that taxpayers maximize their eligible deductions and minimize potential liabilities. By taking care to file correctly, individuals and teams can navigate their tax obligations efficiently while potentially increasing their overall financial outcome.

Resources for additional support

For further assistance while navigating the 2025 i-030 Wisconsin Schedule Form, multiple resources are available:

Keeping up-to-date with tax changes

Staying informed about new tax laws is essential for individuals and teams using the 2025 i-030 Wisconsin Schedule Form. Regular updates can significantly impact how one approaches tax filings.

Utilizing pdfFiller allows users to remain in the loop regarding essential changes that could affect the form. The platform provides consistent updates, ensuring that your paperwork is always aligned with the latest requirements and regulations set by the state of Wisconsin.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 i-030 wisconsin schedule from Google Drive?

Can I create an electronic signature for the 2025 i-030 wisconsin schedule in Chrome?

Can I create an electronic signature for signing my 2025 i-030 wisconsin schedule in Gmail?

What is 2025 i-030 wisconsin schedule?

Who is required to file 2025 i-030 wisconsin schedule?

How to fill out 2025 i-030 wisconsin schedule?

What is the purpose of 2025 i-030 wisconsin schedule?

What information must be reported on 2025 i-030 wisconsin schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.