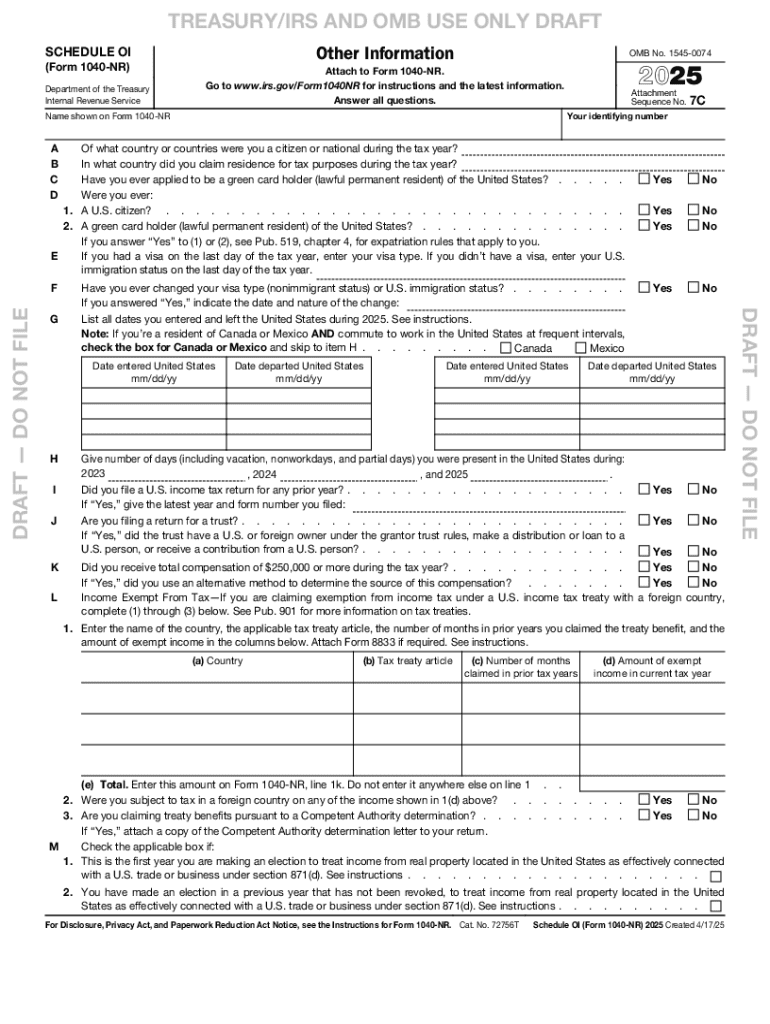

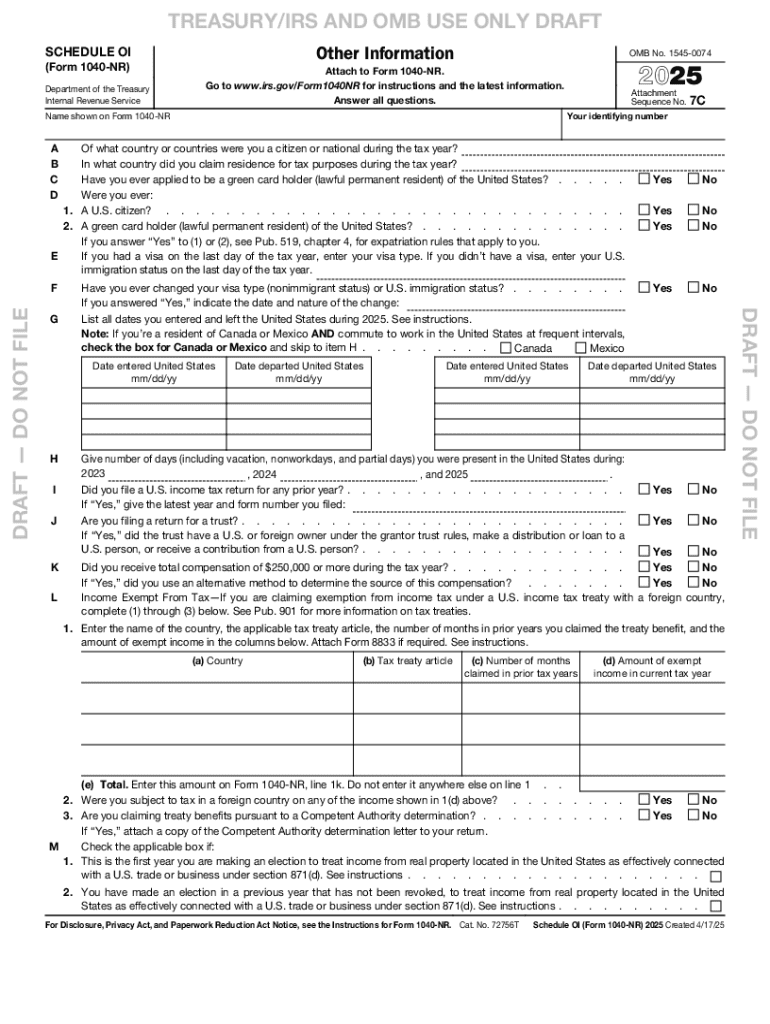

IRS 1040-NR - Schedule OI 2025-2026 free printable template

Get, Create, Make and Sign 793346360 form

Editing IRS 1040-NR - Schedule OI online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040-NR - Schedule OI Form Versions

How to fill out IRS 1040-NR - Schedule OI

How to fill out 2025 schedule oi form

Who needs 2025 schedule oi form?

A comprehensive guide to the 2025 Schedule OI Form

Understanding the 2025 Schedule OI Form

The 2025 Schedule OI Form is an integral part of the U.S. tax filing process, specifically used by taxpayers to report various forms of income that don’t fall under the conventional categories of wages and salaries. Essentially, Schedule OI serves to outline other income, which can include different sources such as interest, dividends, capital gains, and even some unusual income scenarios like lottery winnings. Understanding this form is crucial for accurate tax compliance.

The importance of the 2025 Schedule OI Form cannot be overstated. This form allows the IRS and taxpayers to maintain transparency with income reporting, ensuring that all possible taxable income has been considered in the overall tax return. Failure to report income, even if it arises from non-conventional sources, can lead to consequences ranging from penalties to audit triggers.

Typically, the individuals who need to use the 2025 Schedule OI Form include self-employed workers, freelancers, or anyone who receives income outside of the standard employer-employee wage structures. It can also encompass a wider range of taxpayers, including those who receive different types of income that should be reported separately under the IRS tax laws.

Key features of the 2025 Schedule OI Form

When you dive into the 2025 Schedule OI Form, it’s essential to recognize the various sections it comprises, each served a distinct purpose. Understanding these sections will streamline your process in filling out the form accurately and efficiently. The main sections include Personal Information, Income Information, and Deductions and Credits.

In Section 1, you'll provide your personal information. This includes your full name, Social Security number, and address. Accurate personal details are crucial as they verify your identity and help the IRS link your income to the correct individual or business.

Moving on to Section 2: Income Information, you will be detailing all the income types you have received outside of regular wages. This may include findings from self-employment, business ventures, or other non-traditional income streams. Accurate documentation regarding these income types is essential.

Section 3 covers Deductions and Credits. You can claim eligible deductions here, such as business expenses related to the income you are reporting. Understanding eligible deductions helps to reduce your overall taxable income, thereby potentially lowering your tax liability.

Collectively, these sections support a comprehensive income declaration, which helps maintain compliance with U.S. tax laws.

Preparing to fill out the 2025 Schedule OI Form

Before you begin filling out the 2025 Schedule OI Form, you must gather all essential documents and information required for accurate completion. Potential documents may include 1099 forms for reporting non-employee income, documentation for other income types, and papers that substantiate any deductions or credits you wish to claim. By being organized and prepared, you will reduce the chances of errors on your form.

To streamline this process, create a checklist. This could include:

Once you have gathered the necessary documents, review each form, and note any discrepancies or missing information. This attention to detail will help ensure that the 2025 Schedule OI Form is filled out accurately before submission.

Step-by-step guide to completing the 2025 Schedule OI Form

To facilitate the completion of your 2025 Schedule OI Form, follow this step-by-step guide, ensuring every point is completed with diligence:

Editing and modifying your 2025 Schedule OI Form

Using pdfFiller’s advanced editing tools can simplify the process of modifying your 2025 Schedule OI Form if changes need to be made post-completion. Whether you need to adjust a numerical error in your income report or update personal information, pdfFiller offers various editing options that make such adjustments easy.

When utilizing pdfFiller, keep the following tips in mind for seamless changes:

With these simple strategies, adjusting your form becomes a hassle-free experience.

Signing and submitting the 2025 Schedule OI Form

Once your 2025 Schedule OI Form is thoroughly completed and reviewed, signing and submitting it becomes the next priority. pdfFiller simplifies this process by allowing for electronic signatures directly within its platform, enhancing convenience without the need for printing and physically mailing documents.

For submission, you have two options to consider:

After submission, expect confirmation via email or hard copy, verifying that your 2025 Schedule OI Form was received.

Key deadlines for filing the 2025 Schedule OI Form

Filing your 2025 Schedule OI Form on time is paramount to avoid penalties and ensure compliance with tax laws. Familiarize yourself with important dates as you approach the tax filing season. The primary deadline for filing your individual income tax return, which includes the Schedule OI Form, typically falls on April 15th of the following year.

Remember to also mark these significant dates in your calendar:

Staying organized around these deadlines can save you from unnecessary stress and potential penalties.

Consequences of late or incorrect submission

Failure to submit your 2025 Schedule OI Form by the due date, or inaccuracies in your form, can have serious repercussions. Taxpayers who miss the submission deadline could face penalties that can include interests on unpaid taxes or a flat fee imposed by the IRS for failure to file. Moreover, incorrect reporting might trigger an audit, which can consume considerable time and resources.

Common mistakes to avoid include:

Adhering to best practices in accurate reporting can prevent costly mistakes that complicate the tax filing experience.

FAQs about the 2025 Schedule OI Form

As you navigate the completion of your 2025 Schedule OI Form, you may find yourself with questions about the process. Here are some common queries and their answers to help clarify any uncertainties you might face.

Leveraging pdfFiller for enhanced document management

pdfFiller not only simplifies the completion of the 2025 Schedule OI Form but also offers sophisticated document management solutions. By using pdfFiller, users can leverage cloud-based storage, obtain electronic signatures, and access forms from anywhere, making it an invaluable resource for individuals and teams.

The collaborative features of pdfFiller enable team members to work together on documents conveniently. Additional benefits include:

By leveraging pdfFiller’s features, you can streamline the document creation, editing, and submission process, ensuring that your 2025 Schedule OI Form is managed with utmost efficiency.

People Also Ask about

What is Schedule NEC for?

Who must file Schedule NEC?

What is deductible on schedule A?

Who needs to file form 1040NR?

Do I need to file Schedule?

What is Schedule A on 1040NR?

Who should fill schedule?

Who needs to file a schedule A?

What is schedule OI used for?

Is Schedule 1 always required?

What is schedule OI for?

Who should file schedule oi?

Do I need to fill schedule Oi?

What is tax schedule A?

What is Schedule A form 1040NR?

Who fills out Schedule 1?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1040-NR - Schedule OI from Google Drive?

How do I edit IRS 1040-NR - Schedule OI straight from my smartphone?

How do I edit IRS 1040-NR - Schedule OI on an Android device?

What is 2025 schedule oi form?

Who is required to file 2025 schedule oi form?

How to fill out 2025 schedule oi form?

What is the purpose of 2025 schedule oi form?

What information must be reported on 2025 schedule oi form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.