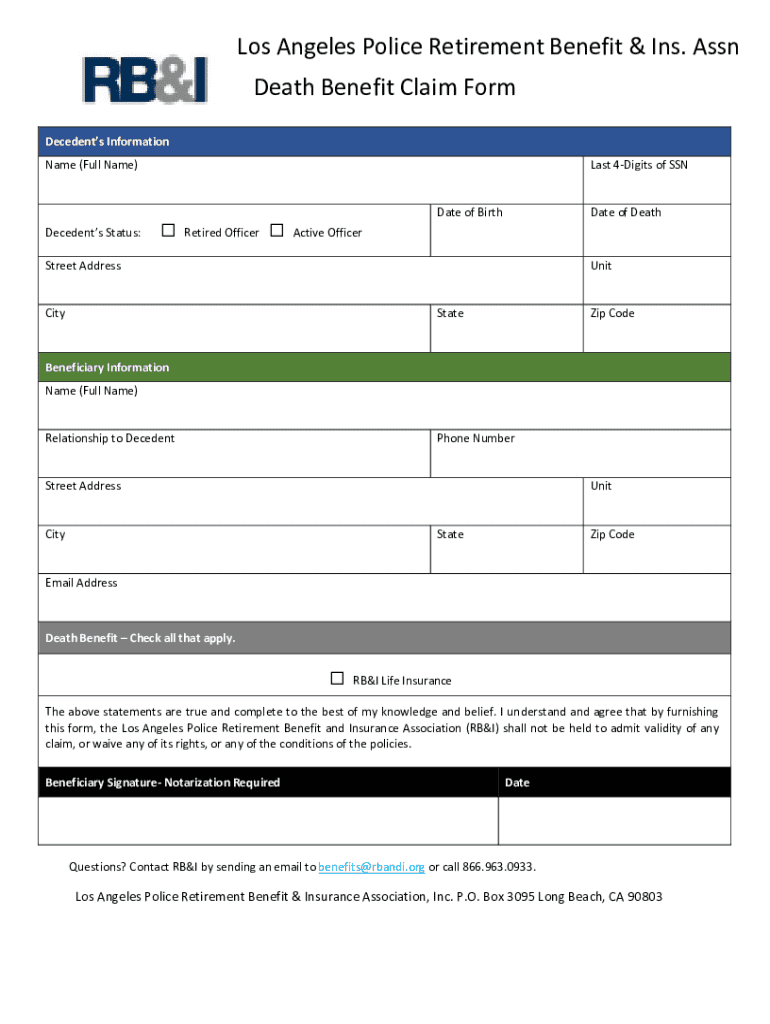

Get the free Death Benefit Claim Form Los Angeles Police Retirement ...

Get, Create, Make and Sign death benefit claim form

Editing death benefit claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out death benefit claim form

How to fill out death benefit claim form

Who needs death benefit claim form?

Death Benefit Claim Form: A Comprehensive How-to Guide

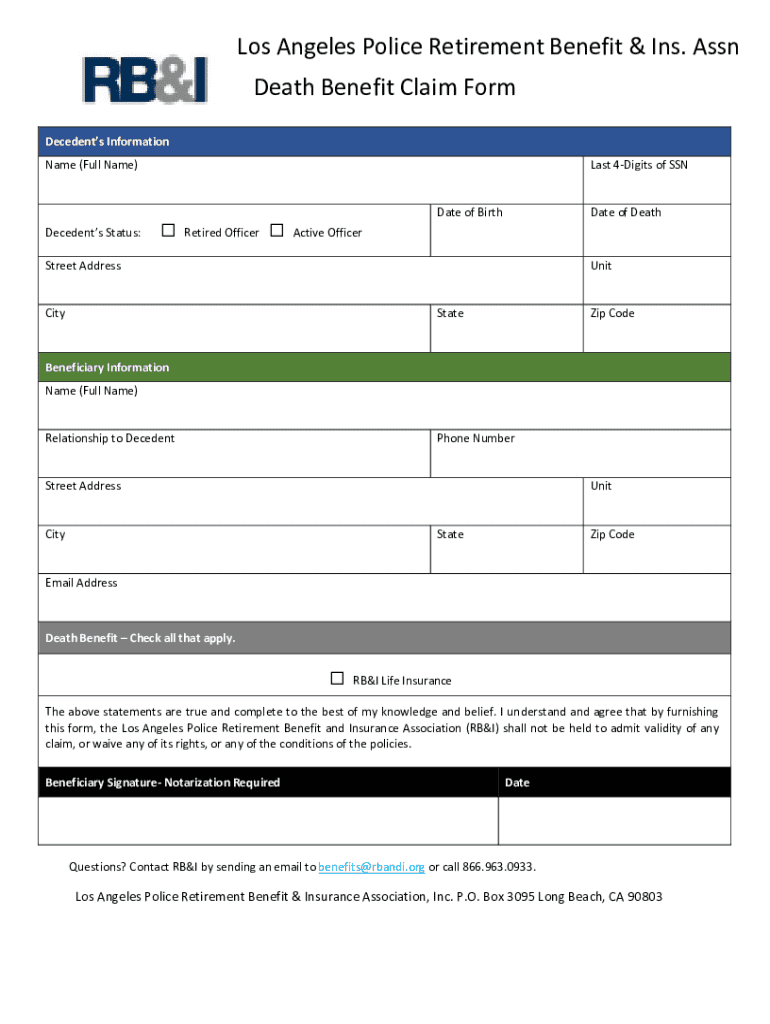

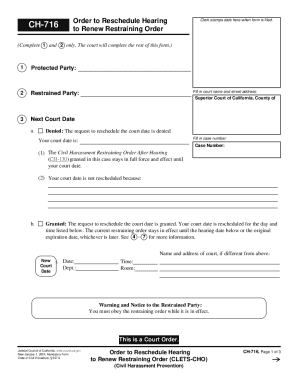

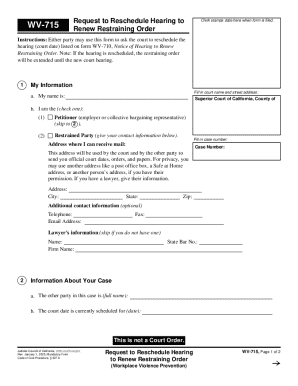

Understanding the death benefit claim form

A death benefit claim form is a key document insurance beneficiaries submit to an insurer to claim payment for a death benefit following the policyholder's demise. This claim typically pertains to life insurance policies and is crucial for ensuring that the financial support the deceased intended for their loved ones is provided.

Filing a death claim is important for several reasons. It initiates the process of receiving funds that can alleviate financial burdens, such as funeral costs, outstanding debts, or help maintain the living standards of surviving family members. The timely submission of this claim can significantly impact how efficiently and promptly beneficiaries receive their funds.

Eligibility requirements for filing a claim

Not everyone can file a death benefit claim; understanding who is eligible is important. Generally, beneficiaries of the policy are the primary individuals allowed to file a claim. This includes family members such as spouses, children, or other relatives expressly named in the policy. In cases where no beneficiaries are listed or designated beneficiaries are deceased, the estate of the deceased might file a claim.

Conditions affecting claim approval include the validity of the insurance policy and the requirements for proving the policyholder's death. The policy must be active, and the claim must be submitted within a stipulated timeframe, which varies by insurer. Additionally, a certified death certificate is generally required to validate the claim.

Preparing to file a death benefit claim

Before submitting the death benefit claim form, prepare necessary documentation to facilitate the process. Chief among these is the death certificate, which proves the passing of the policyholder. Insurers will also require details from the original insurance policy, such as the policy number and coverage specifics. Claimants will typically need to provide a valid identification document, like a driver's license or passport.

Additionally, if applicable, medical records may be needed, particularly if the death was due to health-related issues that could affect the claim process. Gathering all essential information upfront can save time and reduce frustration later on when filing the claim.

Step-by-step instructions for completing the claim form

Accessing the death benefit claim form can usually be done through the insurer’s website or through a document platform like pdfFiller. Depending on the insurer, there may be the option to complete the form online or via a paper format. For ease of use, pdfFiller provides templates that can be filled out, saved, and submitted electronically.

When completing the claim form, ensure to fill out all personal information accurately. This includes the names and contact details of both the claimant and the deceased. Clearly detail the circumstances surrounding the death, including the date and cause, if known. Don't forget to specify beneficiaries and sign and date the form to validate it.

To avoid common mistakes, ensure you do not forget to sign the form, leaving no sections blank, and providing the necessary documentation. Missing or incorrect information can delay the processing of the claim.

Submitting your claim

Submitting the completed death benefit claim form can be done through various methods, depending on the insurer's protocol. One convenient option is online submission through platforms like pdfFiller, which streamlines the process and allows for electronic signatures. Alternatively, you may choose to mail the claim form to the insurer, ensuring that it is sent via a trackable method.

Some insurers allow for in-person submission, providing an opportunity to ask any immediate questions about the claims process. After submission, tracking your claim status is essential. Regularly contact the insurer or use online tools where available to stay updated on the processing of your claim.

Processing timeframes for claims can vary, often taking a few weeks to several months, depending on the complexity of the claim and insurer protocols. Staying proactive in following up can help ensure there are no unnecessary delays.

Frequently asked questions about death benefit claim forms

Common concerns surrounding death benefit claims often lead to questions about what to do if the policy has lapsed. In some cases, insurers may honor a claim if premiums were up to date at the time of death, but this varies widely by company. Knowing the exact timelines and stipulations in your policy can provide clarity.

Another common query revolves around how long individuals have to file a claim. Typically, insurers provide a specific timeframe post-death notification, often ranging from a few months to several years.

Resources for navigating your claim

Navigating a death benefit claim can be complex, but resources abound to assist you. Documentation platforms like pdfFiller provide interactive tools that simplify filling out and submitting forms. They also offer customer support for any questions that may arise. Additionally, participating in community forums and support groups can provide valuable insights from others who have navigated the claims process.

Tips for a smooth claims process

To ensure a smooth claims process, maintain detailed records of all communications with the insurer. Note dates, contact persons, and conversation outcomes. This documentation is invaluable if questions arise or disputes occur. Setting reminders for follow-ups can help keep the claim on track, ensuring you meet deadlines and keep the process moving along.

Utilizing document management tools available through pdfFiller can enhance your claims experience. Organizing important documents in one place, easily editing PDFs, eSigning forms, and collaborating with other stakeholders have never been easier.

Understanding your rights as a claimant

As a claimant, it's crucial to understand your legal rights throughout the claims process. You have the right to receive clear information from the insurer regarding your claim and the processes involved. If you experience undue delay or wrongful denial of your claim, it's advisable to consult a legal professional who specializes in insurance law.

Legal professionals can guide claimants in understanding the complexities of their situation, help navigate appeals, and advocate on their behalf. Being informed about your rights empowers you as you navigate the emotional landscape of losing a loved one and dealing with financial processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete death benefit claim form online?

Can I create an electronic signature for signing my death benefit claim form in Gmail?

Can I edit death benefit claim form on an Android device?

What is death benefit claim form?

Who is required to file death benefit claim form?

How to fill out death benefit claim form?

What is the purpose of death benefit claim form?

What information must be reported on death benefit claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.