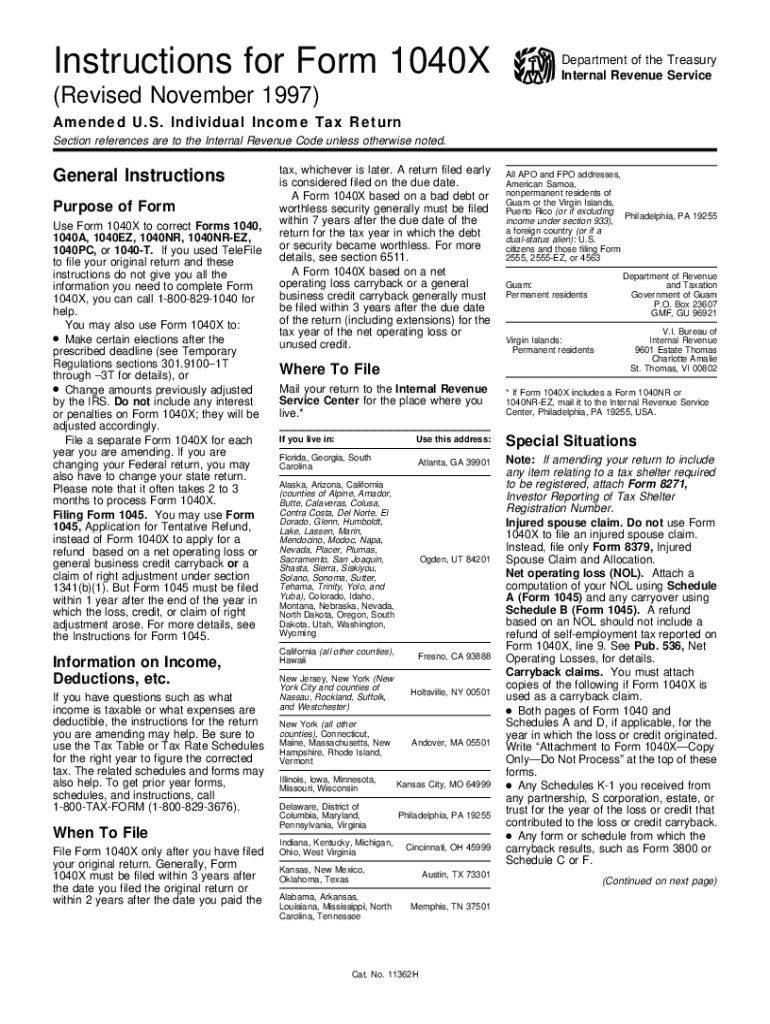

Get the free Instructions for Form 1040 X : amended U.S. individual i...

Get, Create, Make and Sign instructions for form 1040

Editing instructions for form 1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1040

How to fill out instructions for form 1040

Who needs instructions for form 1040?

Instructions for Form 1040: Your Complete Guide to Filing Your Taxes

Understanding Form 1040

Form 1040, commonly referred to as the 'U.S. Individual Income Tax Return', is the standard federal income tax form used by individuals to report their income and calculate their tax liability. This form is essential for both individuals and families as it encompasses everything from salary and wages to other sources of income, allowing taxpayers to detail their financial picture for the year.

The importance of Form 1040 cannot be overstated, as it serves as the basis for understanding an individual's or household's tax obligations, potential refunds, and overall fiscal responsibility. By accurately completing this document, taxpayers ensure compliance with U.S. tax laws, while also maximizing potential deductions and credits.

Who needs to file Form 1040?

Determining the necessity to file Form 1040 depends on various criteria, including your filing status, income level, and age. Generally, individuals earning above a certain income threshold must file. Specific groups, such as self-employed individuals, freelancers, or those receiving 1099 income, not only need to file but may also face additional forms and schedules. Everyone should assess their tax situation annually to ensure compliance and identify any opportunities for deductions or credits.

Navigating the form 1040

Understanding the layout of Form 1040 is crucial for a smooth filing process. The form consists of several sections, including Personal Information, Income, Adjusted Gross Income, Deductions, and Tax and Credits. This structured format helps filers input their data accurately, ensuring fewer errors that could delay processing or lead to penalties.

It's advisable to utilize visual guides or interactive tools that can help demystify the complexity of Form 1040. These resources often include diagrams, sample filled forms, or software that assist in accurately filling forms, which can alleviate common confusion and errors associated with tax preparation.

Common terms and definitions

Tax filing jargon can be overwhelming. Familiarizing yourself with common terms can make the process less intimidating. For instance, 'Adjusted Gross Income (AGI)' represents your total gross income after specific deductions, which is a critical component in determining taxable income. Understanding these key terms can empower filers to make informed decisions regarding their returns.

Step-by-step instructions for completing Form 1040

Step 1: Providing your personal information

Start by entering your name, address, and Social Security Number (SSN) at the top of Form 1040. Accuracy is crucial; errors here can lead to delays in processing or issues with the IRS. Ensure that your Social Security Number matches the one issued by the Social Security Administration.

Common mistakes at this stage include typos and the inclusion of incorrect names or addresses. Always double-check this information before proceeding.

Step 2: Entering your income

The next section requires you to report your various sources of income. Include wages from your W-2 forms, interest, dividends, self-employment income, and any capital gains. Make sure that the figures you're reporting correspond with the documents provided by your employers or financial institutions.

More often than not, many people overlook reporting income from side jobs or freelance work. It's essential to compile all your income for an accurate tax assessment.

Step 3: Calculating your adjusted gross income (AGI)

Your AGI is a vital figure as it influences your eligibility for various deductions and credits. To calculate your AGI, take your total income and subtract any qualified adjustments, such as student loan interest or IRA contributions. Understanding what constitutes AGI is imperative for all taxpayers.

Filing can get complex here, especially if you have multiple income streams. Taking time to ensure accuracy will save you potential headaches down the line.

Step 4: Deductions and credits

This step requires you to consider whether you are opting for standard or itemized deductions. The IRS allows filers to choose whichever method yields a lower tax liability, thus maximizing potential savings.

Credits can further reduce your tax owed and might include child credits, education credits, and even energy-saving credits. Be sure to research the available credits thoroughly to ensure you are not leaving money on the table.

Step 5: Assessing your tax liability

To determine your tax liability, navigate the IRS tax tables based on your taxable income. Consider using tax calculators available on platforms like pdfFiller, which streamline this process and ensure accuracy. Such tools can simplify tax calculations, allowing for a clearer picture of what you owe or whether a refund is due.

The nature of your tax situation can determine whether you owe taxes or can expect a refund, making accurate calculations at this stage incredibly important.

Step 6: Verifying and signing your return

Once you have filled out Form 1040, take the time to verify every entry for accuracy. Even seemingly minor mistakes can lead to significant issues with the IRS. After careful verification, don't forget to sign and date your return, confirming that the information is complete and accurate.

Using electronic solutions such as pdfFiller can facilitate the e-signing process, making submissions easier and faster to manage.

Special cases and additional types of 1040 forms

In certain circumstances, you may find that other types of 1040 forms are more suitable for your tax situation. For instance, Form 1040-A is designed for simpler tax returns, while Form 1040-EZ is even more straightforward, allowing basic income reporting up to specific limits.

Form 1040-SR is specifically tailored for senior citizens, offering an easy-to-follow layout that caters to older filers. Each version of the form varies in complexity and eligibility, so it's crucial to choose the one that aligns with your financial situation.

Filing as a resident vs. non-resident

Additionally, there's a notable distinction in filing based on residency status. Resident aliens generally use Form 1040, whereas non-residents typically use Form 1040-NR. Compliance with these regulations is essential, as misfiling can lead to penalties and complications.

Understanding the appropriate filing form according to your residency can significantly impact your tax responsibilities and the way you benefit from potential deductions.

Tips for managing your taxes effectively

Recordkeeping best practices

Maintaining good records throughout the year is paramount in simplifying the tax preparation process. You should keep receipts for expenses, bank statements, income documentation, and prior year returns organized. This can streamline your tax filings and support any potential audits.

Consider creating a digital folder on your computer or using a cloud-based system like pdfFiller to store essential tax documents securely.

Using technology for tax management

Utilizing technological solutions for tax management brings significant advantages. Software and platforms such as pdfFiller not only allow for easy form filling but also provide e-signature options and real-time collaboration features that can be especially useful for teams managing shared tax documents.

This technology fosters accuracy and efficiency, ensuring that all team members are aligned on filing duties and deadlines.

Common tax filing mistakes to avoid

Frequently asked questions about form 1040

What if make a mistake on my tax return?

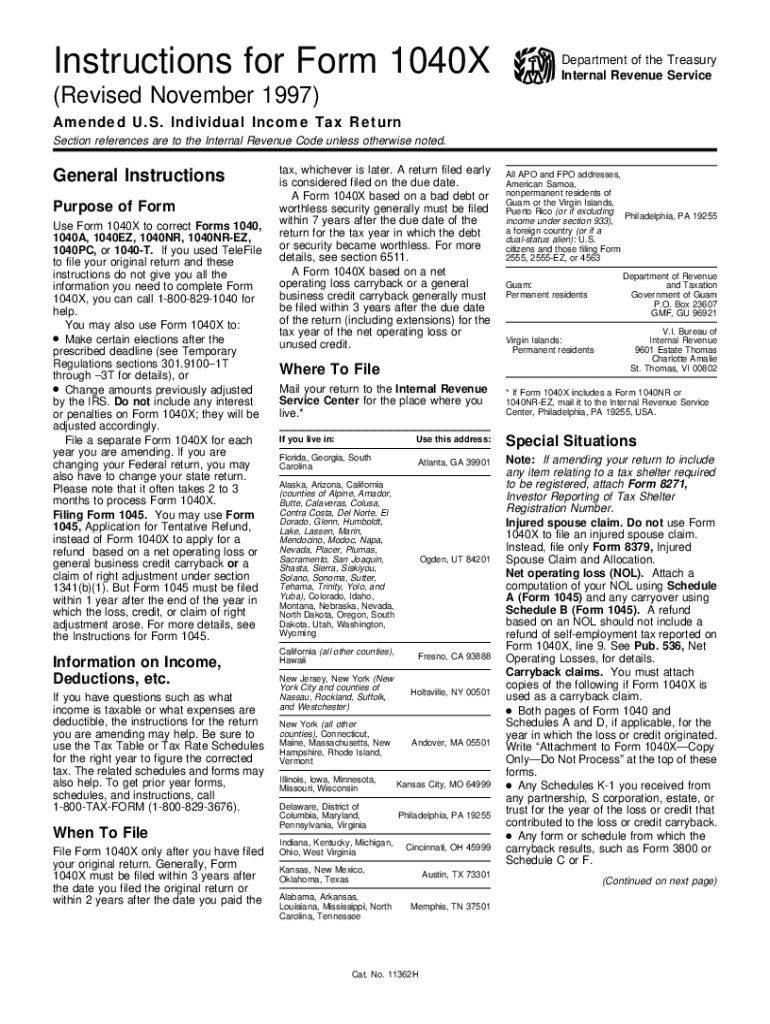

If you've made an error on your tax return, do not panic. You can amend your return by filing Form 1040-X to correct any mistakes. It's important to address errors swiftly to avoid penalties.

How do amend a filed form 1040?

To amend a filed Form 1040, you will need to submit a Form 1040-X and ensure that it's filed after your original Form 1040 has been processed. This form must indicate the corrections and provide a clear explanation of the changes being made.

When is the deadline to file my taxes?

The deadline for filing your taxes is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It's advisable to mark your calendar as Tax Day, to ensure timely submission.

How to track my refund after submitting form 1040?

After submitting your Form 1040, you can track the status of your refund using the IRS 'Where's My Refund?' tool. You'll need to input your Social Security Number, filing status, and the exact amount of the refund to receive current information.

Interactive tools and resources

Utilizing platforms like pdfFiller can greatly assist in filling out Form 1040. The interactive features offered by pdfFiller foster an efficient and accurate filing process. Users can not only fill out their forms seamlessly but also collaborate with team members on tax documents, ensuring that everyone is on the same page.

Engaging with these tools can streamline data collection, significantly reducing the likelihood of errors and omissions, which ultimately leads to a smoother tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify instructions for form 1040 without leaving Google Drive?

Can I create an eSignature for the instructions for form 1040 in Gmail?

How do I fill out the instructions for form 1040 form on my smartphone?

What is instructions for form 1040?

Who is required to file instructions for form 1040?

How to fill out instructions for form 1040?

What is the purpose of instructions for form 1040?

What information must be reported on instructions for form 1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.