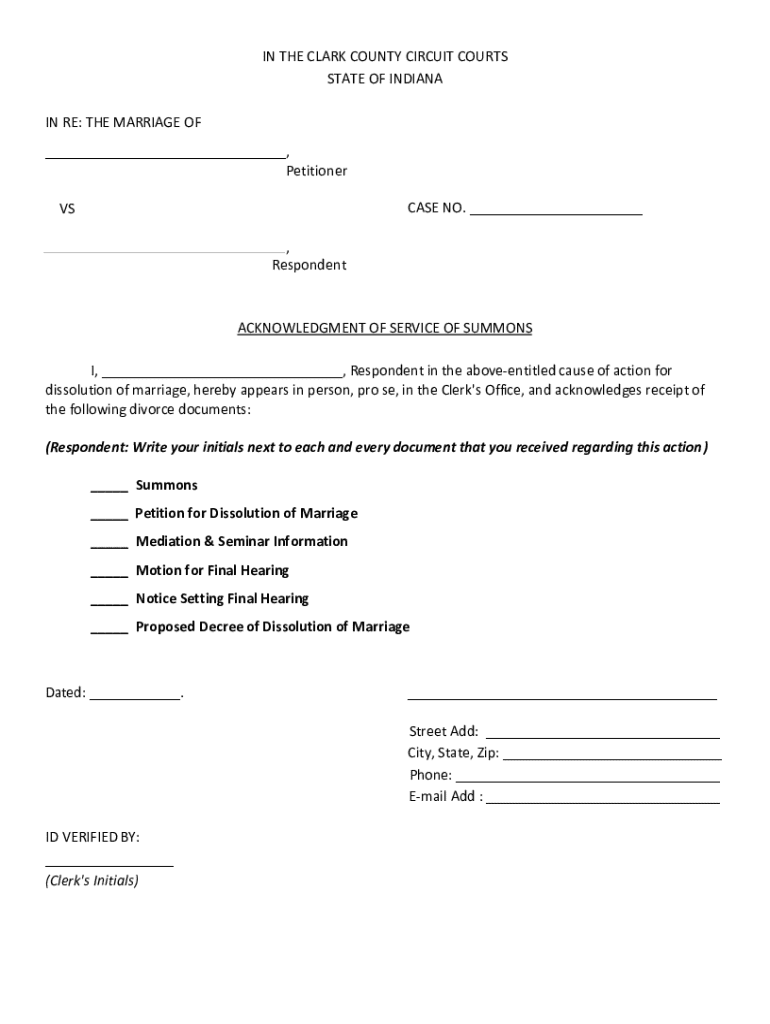

Get the free STATE OF INDIANA IN THE COURT COUNTY OF CASE NO.

Get, Create, Make and Sign state of indiana in

Editing state of indiana in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of indiana in

How to fill out state of indiana in

Who needs state of indiana in?

State of Indiana in Form: A Comprehensive Guide to Navigating State Forms

Overview of Indiana's state forms

Indiana's state forms are essential components of the legal and regulatory framework that residents and businesses must navigate. From tax forms to business licenses, these documents facilitate compliance with state laws, ensuring that individuals and organizations operate within the established guidelines. Understanding the role of these forms not only helps in legal compliance but also enhances operational efficiency.

For individuals and teams, having a clear grasp of specific forms is crucial. As transactions become more digitized and bureaucratic processes evolve, knowing which forms to use and how to fill them correctly can save time and prevent costly mistakes. This guide will explore the landscape of Indiana's forms, providing the resources needed for effective document management.

Navigating the Indiana state forms landscape

Finding the right form in Indiana can be daunting, especially with the plethora of documents available. However, understanding how to identify and select the appropriate form based on your requirements can simplify the process. Start by reviewing resources available on state websites and consult local offices for assistance. Look for common forms utilized by residents, such as those related to taxes, businesses, or vital records.

Finding the right form

When trying to locate the correct form, consider the following strategies:

Key categories of forms

Indiana's forms can broadly be categorized into several key areas which include tax forms, business forms, and personal forms. Each category serves a different purpose but is equally important for efficient governance and compliance.

Detailed insights into popular Indiana forms

Tax forms

In Indiana, both individuals and businesses must file various tax forms, including the commonly known 1040 form for individual income tax and the business tax forms designed for corporate and self-employed entities. Understanding the purpose and requirements of these forms can simplify the tax filing process significantly.

To complete the Indiana income tax return, follow these steps:

Business registration forms

Starting a business in Indiana necessitates the completion of specific registration forms. To operate legally, business owners must understand the requirements, including choosing a business structure and obtaining the necessary permits and licenses.

Consider this checklist for new business owners:

Vital records requests

Requesting vital records like birth, marriage, and death certificates in Indiana requires specific forms. To streamline the process, ensure you have all necessary identification and information ready.

Follow these steps to request vital records:

Interactive tools for form management

Editable PDF templates for Indiana forms

Using pdfFiller, residents and businesses in Indiana can easily access and fill out various forms online. This platform allows you to edit forms directly, adding a level of convenience and efficiency that paper forms simply can't offer.

E-signing options

E-signing documents has become a safe and efficient alternative to traditional signatures. With pdfFiller, you can follow these simple steps to e-sign your documents securely:

Step-by-step instructions for completing forms

Instructions on common state forms

Completing forms correctly is paramount, particularly for state taxes and business licenses. Each form may have unique requirements, but generally, you should follow a format that includes accurate identification, financial information, and necessary signatures.

Common forms like the Indiana tax return require specific sections to be filled out, and improper completion can lead to processing delays or rejections.

Tips for avoiding common mistakes

Preventing errors in form submission starts with awareness. Be mindful of the following frequent mistakes:

Submission and management of Indiana forms

Understanding submission procedures

Indiana provides multiple pathways for submitting forms, including online portals, physical mail, and in-person submissions at relevant offices. Familiarizing yourself with these options can ease the process. Ensure you check existing deadlines, as missing a deadline could lead to penalties or legal complications.

Managing your resubmissions

If your submission is rejected or additional information is requested, don’t panic. Here’s how to handle such scenarios:

Tailoring your document management with pdfFiller

Unified cloud-based solutions

pdfFiller provides a unified cloud-based platform designed for comprehensive form management—from creation and editing to e-signing. This integration simplifies the workflow, allowing users to manage all their Indiana forms in one place, reducing the hassle of handling multiple documents across different platforms.

Collaborating with teams

For teams working together on forms, pdfFiller offers features that enhance collaboration. Teams can share documents, track changes in real-time, and ensure everyone stays updated, ultimately streamlining operations.

Frequently asked questions (FAQ)

As individuals and businesses navigate Indiana state forms, several common inquiries arise. Understanding the nature of these forms, their uses, and submission processes can alleviate concerns.

Common inquiries include:

Clarifications on legal aspects and implications of form accuracy are also pivotal in supporting users’ confidence throughout their documentation processes.

Support and guidance for Indiana form issues

When faced with challenges regarding Indiana state forms, resources are available to guide you through the process. The state offers dedicated helplines, online FAQs, and guidelines to assist residents.

Utilizing state resources such as the Indiana Department of Revenue or the Secretary of State's office can provide clarification on specific form-related inquiries, ensuring you remain well-informed.

User insights and testimonials

Individuals and teams across Indiana have experienced the benefits of utilizing state forms through pdfFiller. From reduced processing times to enhanced collaboration, feedback highlights the platform's usability.

Case studies reveal improved productivity and efficiency in document management, emphasizing how pdfFiller simplifies the complexities involved with state forms. Users appreciate the ability to edit, sign, and manage all documents within a single integrated solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state of indiana in from Google Drive?

How can I edit state of indiana in on a smartphone?

How do I complete state of indiana in on an iOS device?

What is state of indiana in?

Who is required to file state of indiana in?

How to fill out state of indiana in?

What is the purpose of state of indiana in?

What information must be reported on state of indiana in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.