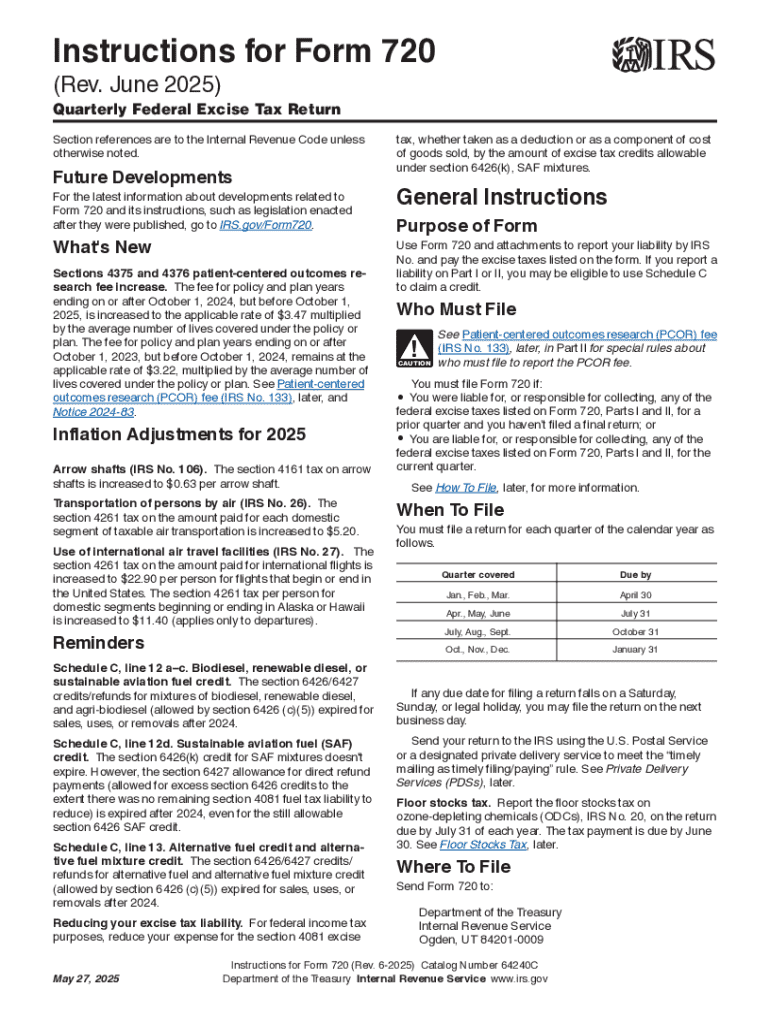

IRS Instructions 720 2025-2026 free printable template

Get, Create, Make and Sign IRS Instructions 720

Editing IRS Instructions 720 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 720 Form Versions

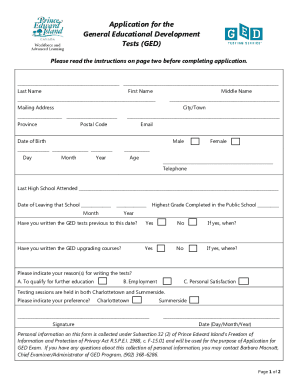

How to fill out IRS Instructions 720

How to fill out form 720-x - form

Who needs form 720-x - form?

Form 720- - How-to Guide

Understanding Form 720-

Form 720-X is an essential document that allows businesses to amend previously submitted Form 720 filings. Its primary purpose is to enable corrections for errors, changes in tax liability, or adjustments related to the federal excise tax. Unlike Form 720, which is used for reporting the original tax amounts, Form 720-X focuses on making amendments. This distinction is crucial for maintaining accurate records and ensuring compliance with IRS regulations.

Filing Form 720-X is vital for taxpayers who wish to understand their tax obligations fully. It provides a clear path to rectifying mistakes, thereby preventing unnecessary penalties or audits. Overall, the importance of Form 720-X in tax reporting cannot be overstated, as it serves as a safety net for ensuring that businesses present accurate tax data to the IRS.

Who should use Form 720-?

Form 720-X is primarily intended for individuals and businesses that have already submitted Form 720 but later identified errors or updates to their tax situations. This form is particularly relevant for various industries such as manufacturing, transportation, and telecommunications, which often engage in transactions subject to federal excise taxes.

Common scenarios for filing Form 720-X include situations where a business realized it had reported incorrect excise tax amounts, or it needs to adjust its credits based on new invoices or transactions. Understanding who should use this form helps streamline the process and ensures compliance across different industry standings.

Detailed instructions for filing Form 720-

Completing Form 720-X requires attention to detail and adherence to IRS guidelines. Here’s a step-by-step guide to ensure your filing is accurate.

Common errors to avoid when filing Form 720-

Filing errors can lead to unnecessary complications and potential fines. Knowing common pitfalls will help you navigate the process smoothly.

Tools and resources for completing Form 720-

Utilizing the right tools is essential for an efficient filing process. Here are some resources specifically designed to assist with Form 720-X.

Supporting documentation for Form 720-

When filing Form 720-X, ensuring proper documentation is key. Keeping comprehensive records mitigates issues in case of an audit.

Frequently asked questions about Form 720-

Many questions arise when navigating the complexities of Form 720-X. Here are some common queries and their answers.

Understanding the benefits of using pdfFiller for your taxes

Utilizing pdfFiller to manage your Form 720-X filing offers numerous advantages. With seamless editing features, you can easily fill out and adjust your forms without paper clutter.

Additionally, pdfFiller provides eSignature options for quicker processing, allowing you to get compliance signatures in real time without hassle. Its cloud-based access ensures that you can manage your documents from anywhere, making tax season much more manageable.

The importance of timeliness in filing Form 720-

Timely filing of Form 720-X is essential to avoid potential penalties. Missing deadlines can lead to unnecessary fines and complications with the IRS.

Enhancing your document management process with pdfFiller

Implementing a cloud-based document solution like pdfFiller transforms how you manage Form 720-X and other tax documents. With the flexibility to access your files from any device, you can collaborate seamlessly with your team or partners.

The all-in-one platform also provides comprehensive editing tools to tailor documents to your needs, whether for individual or business purposes. pdfFiller's solutions cater to unique document requirements for businesses of all sizes.

Case studies: Successful Form 720- filings using pdfFiller

Real-world examples demonstrate the effectiveness of using pdfFiller to file Form 720-X accurately. These case studies highlight how different businesses have simplified their tax filing processes.

For instance, a mid-sized manufacturing company used pdfFiller to amend multiple Form 720 submissions swiftly, reducing the process time significantly. Likewise, a small transportation firm found that using pdfFiller's editing tools allowed them to collaborate effectively with their bookkeeping solutions, resulting in timely and precise filings.

Testimonials from these users reflect a high satisfaction rate with the ease of navigating Form 720-X filings through the platform, showcasing the tangible benefits of adopting cloud-based document management solutions like pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Instructions 720 directly from Gmail?

How can I modify IRS Instructions 720 without leaving Google Drive?

How do I make changes in IRS Instructions 720?

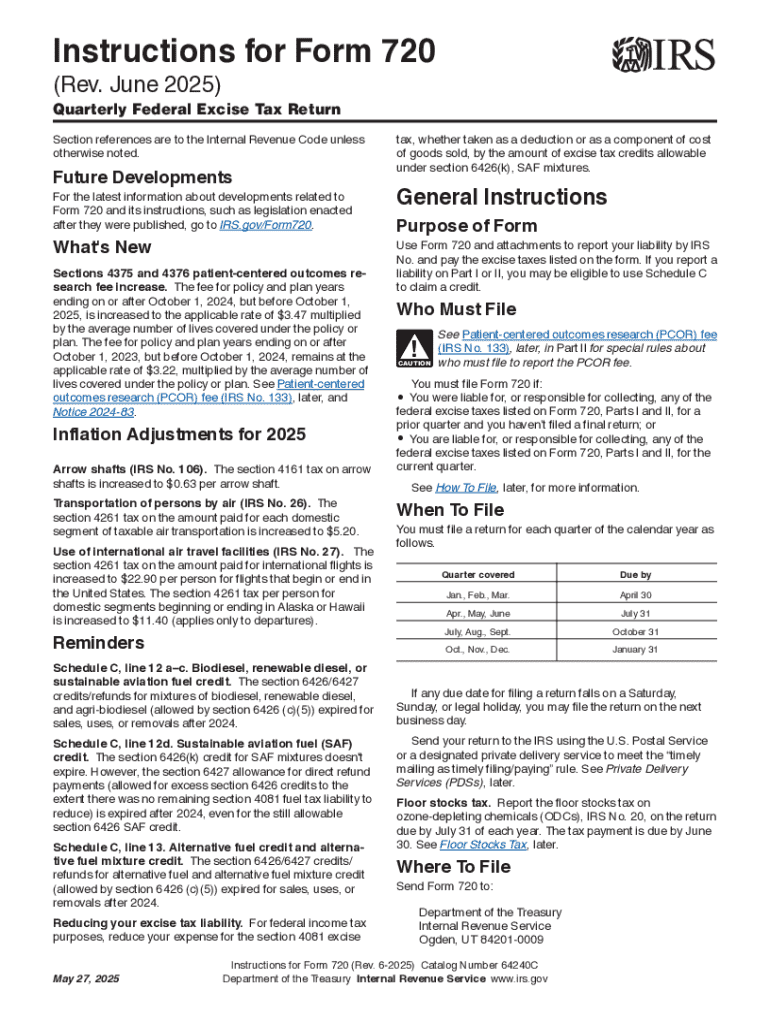

What is instructions for form 720?

Who is required to file instructions for form 720?

How to fill out instructions for form 720?

What is the purpose of instructions for form 720?

What information must be reported on instructions for form 720?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.