IRS Publication 1321 2025-2026 free printable template

Get, Create, Make and Sign IRS Publication 1321

Editing IRS Publication 1321 online

Uncompromising security for your PDF editing and eSignature needs

IRS Publication 1321 Form Versions

How to fill out IRS Publication 1321

How to fill out publication 1321 rev 10-2025

Who needs publication 1321 rev 10-2025?

Comprehensive Guide to Publication 1321 Rev 10-2025 Form

Overview of Publication 1321 Rev 10-2025 Form

Publication 1321 Rev 10-2025 form serves as a crucial document used for specific regulatory purposes, designed to streamline reporting and compliance requirements. This publication outlines the procedures and standards for completing the form to ensure accuracy in submissions. The key updates introduced in the 10-2025 revision reflect significant changes in reporting protocols, making it essential for individuals and teams to be informed about these adjustments. Accuracy plays a vital role, as a correctly completed form minimizes the risk of errors and potential delays in processing.

Understanding the latest version of the form is critical. Each revision typically incorporates feedback from previous submissions and updates to regulations, ensuring that the form aligns with current best practices. The revision date, October 2025, indicates the validity period of the document, and it’s important to refer to the most current version to avoid issues with compliance.

Understanding the components of the form

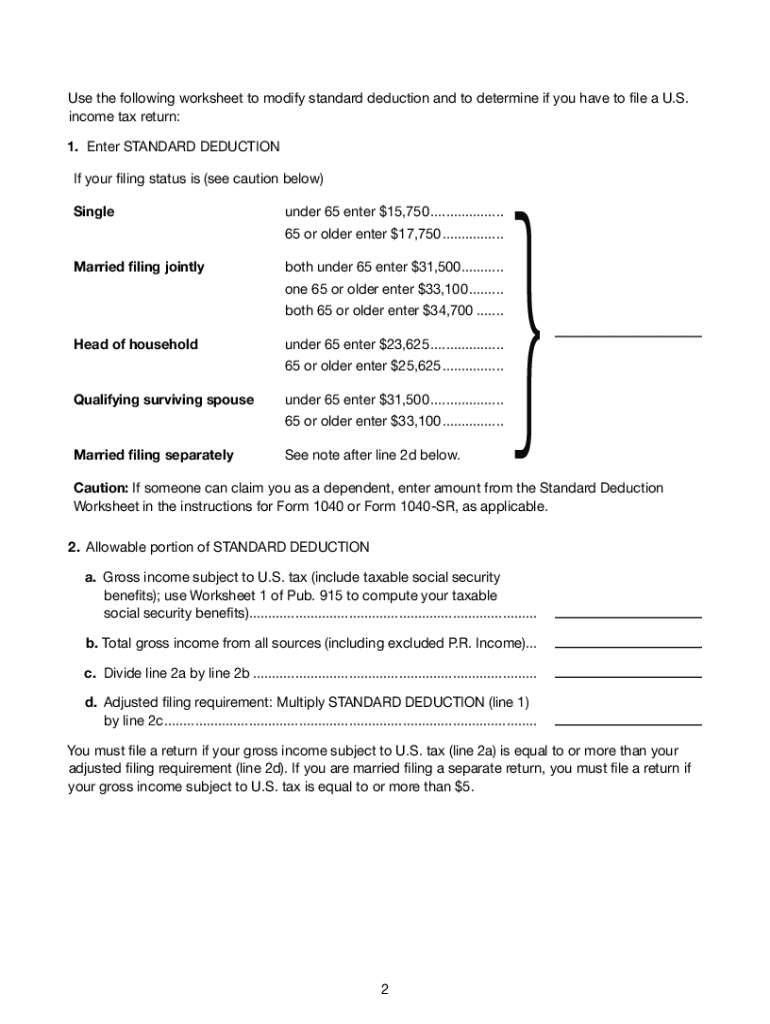

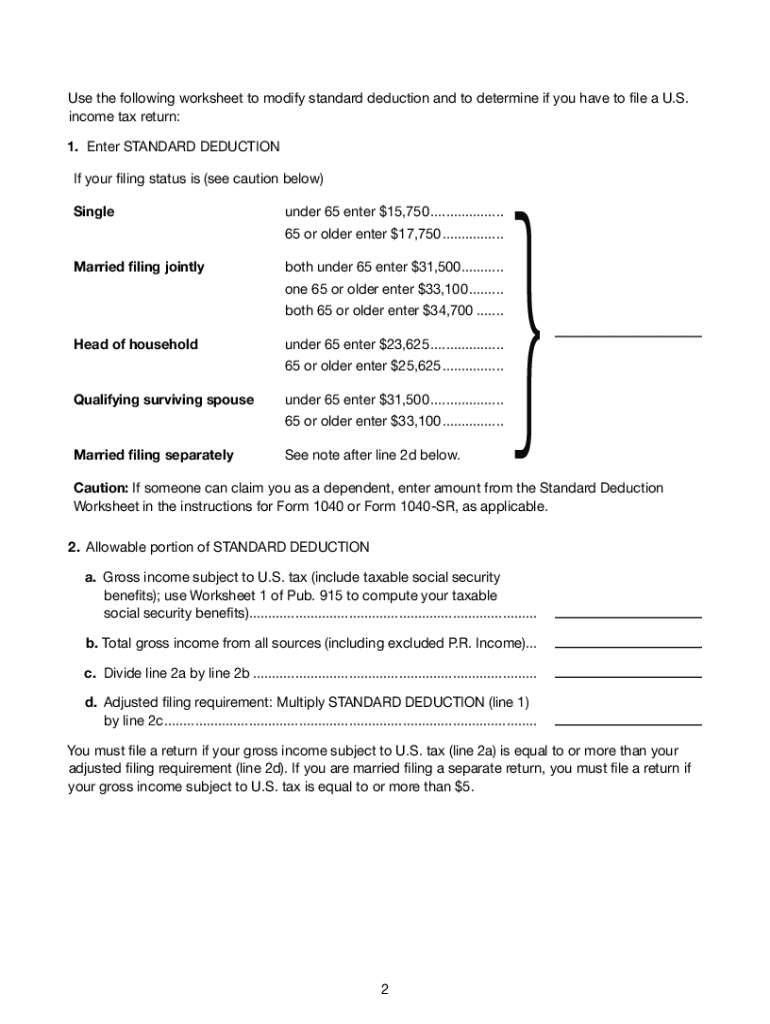

The Publication 1321 Rev 10-2025 form is structured into three main sections, each with distinct purposes designed to simplify the user experience. The first, Section A, focuses on identification and purpose, where users provide their personal information and the context of their submission. This sets the stage for identifying the form’s use and the responsibilities tied to it.

Common terminology associated with the form is essential for users to understand, as terms such as ‘submission’, ‘verification’, and ‘compliance’ frequently appear. Familiarizing oneself with these definitions helps reduce confusion and increases the likelihood of a successful filing.

Steps for completing Publication 1321 Rev 10-2025 Form

Completing the Publication 1321 Rev 10-2025 form may seem daunting at first, but with a structured approach, it can be managed efficiently. Start with **Step 1**: Gather all required information. This typically includes identification documents, previous submissions if available, and any related correspondence. Carefully compiling these documents reduces the chance of errors.

Next, proceed to **Step 2**: filling out the form itself. This step is where attention to detail is critical. Aim for clarity and correctness, avoiding common pitfalls. Double-check spelling, especially for names and identification numbers, as inaccuracies can lead to delays or rejections. In **Step 3**, review the completed form thoroughly. Some useful strategies for reviewing include using a checklist of required sections and supporting documents to ensure nothing is overlooked.

Finally, in **Step 4**, consider submission methods, which may include online portals or traditional mail. It’s crucial to be aware of deadlines and submission timelines, especially if the form relates to time-sensitive issues.

Utilizing pdfFiller for form management

pdfFiller provides an innovative solution for managing the Publication 1321 Rev 10-2025 form, offering users seamless means of accessing, editing, and submitting essential documents. To begin, users can easily locate the publication within pdfFiller’s comprehensive library, allowing for immediate access to the necessary form.

The editing features of pdfFiller empower users to add text, signatures, and annotations directly onto the form. These functionalities not only enhance the organization of the document but also enable collaboration with team members, ensuring everyone is aligned in the submission process.

Moreover, the process of electronically signing the publication is straightforward. Users can follow a few simple steps to add their signature securely, ensuring that all submissions meet legal requirements. Utilizing robust security measures within pdfFiller ensures all eSignatures are protected, maintaining the integrity of the document.

Interactive tools to enhance your experience

To maximize efficiency, pdfFiller also offers customizable templates specifically for the Publication 1321 form. These templates can help users get started quickly, ensuring all necessary sections are included from the outset. Furthermore, integration with other software tools enhances convenience and optimizes workflows for teams, allowing for a more streamlined document management process.

When utilizing pdfFiller, data security and privacy should be a priority. The platform follows best practices to protect user data, reassuring individuals and teams that sensitive information remains confidential throughout the form management process.

Frequently asked questions (FAQs)

As users begin to navigate the intricacies of the Publication 1321 Rev 10-2025 form, several common questions arise. First, what happens if a mistake is made during the filling process? Users should be aware that minor errors can often be corrected with a simple note on the submitted form or through an amendment process, depending on the guidelines given. When it comes to tracking the status of the submitted form, many jurisdictions offer online tracking options, allowing users to stay updated on their document's progress.

In cases where additional information is requested, users typically receive notifications via email or through the submission portal. It’s advisable to respond promptly and provide the requested details to prevent any delays.

Troubleshooting common issues with the form

Even with the best preparation, issues may arise when completing the Publication 1321 Rev 10-2025 form. One common problem is the rejection of a form due to incorrect filing procedures. This necessitates understanding the filing requirements thoroughly. To resolve frequent errors, users should consult the provided guidelines, often included with the publication, and refer to troubleshooting charts available on the pdfFiller site.

Additionally, resources are available for users seeking help and guidance, including customer support services through pdfFiller. Engaging with such resources can provide reassurance and direction during the form submission process.

Additional features of pdfFiller to note

For individuals and teams, pdfFiller offers cost-effective options that cater to a range of document management needs. Users can benefit from a cloud-based solution that enhances accessibility, enabling file retrieval from virtually anywhere. This flexibility is a significant advantage for teams that operate in diverse locations or work remotely.

Support services provided by pdfFiller further enhance the user experience, offering assistance through chat, email, or phone contact. This robust support network can be invaluable for those encountering difficulties while managing their documents, particularly for important forms like the Publication 1321 Rev 10-2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS Publication 1321 without leaving Google Drive?

How do I edit IRS Publication 1321 on an iOS device?

How do I fill out IRS Publication 1321 on an Android device?

What is publication 1321 rev 10-2025?

Who is required to file publication 1321 rev 10-2025?

How to fill out publication 1321 rev 10-2025?

What is the purpose of publication 1321 rev 10-2025?

What information must be reported on publication 1321 rev 10-2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.